The capex boom is broadening the range of AI beneficiaries, presenting investors with diverse opportunities to invest in AI.

The rise of AI has been a major theme in global stock markets. In the U.S., where tech leadership has been most pronounced, stock markets have rallied a stellar 60% over the past two years. Most of these gains have been concentrated in the stocks of seven mega-cap tech or tech-related companies, which collectively have risen by 113% during this period1.

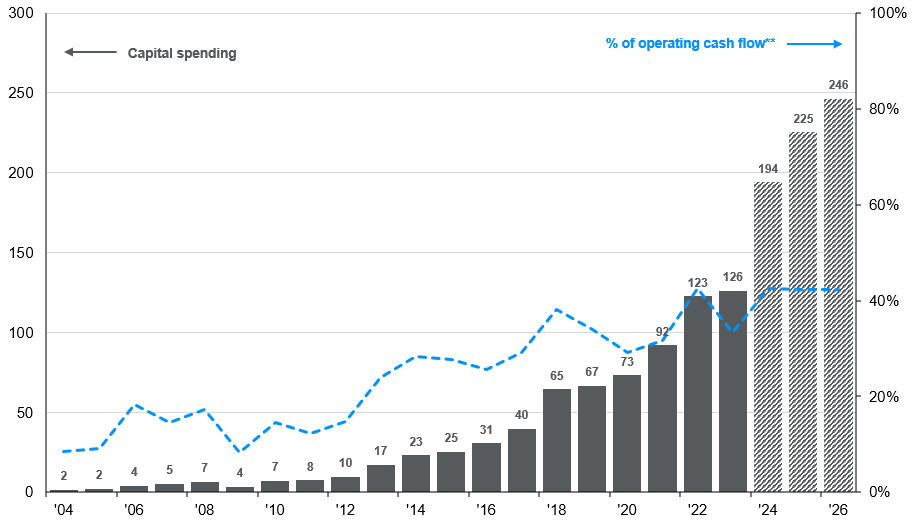

Interestingly, despite the rise in stock prices, valuations have actually declined and are lower today than they were during the 2020-2021 market rally. This is partly because, unlike previous tech booms, the AI wave has been driven by highly profitable tech incumbents. Take the hyperscalers2, for example; these large-scale cloud service companies are uniquely positioned to manage and host AI workloads. They are ramping up capital expenditures3 (capex) by over 50% in 2024 to around USD 200billion, with continued growth expected in the next few years (see Exhibit 7). While the return-on-investment may take several quarters or even years to materialize, this spending is backed by significant cash flow generation.

As such, the elevated valuations of mega-cap U.S. tech companies should be supported by their quality, cash flow generation and growth potential. However, significant spending increases the risk of capital misallocation and overly optimistic growth expectations, which investors will scrutinize more closely as monetization becomes a greater focus. With substantial returns, investors have ended up with large allocations into just a few tech names, warranting careful attention to the competitive and regulatory risks that could curb growth expectations.

The capex boom is broadening the range of AI beneficiaries, presenting investors with diverse opportunities to invest in AI. One company’s capex becomes another company’s revenue, and the AI infrastructure value chain has revealed beneficiaries across both value and growth sectors, spanning small, mid and large-cap companies globally.

In the U.S., spending is expected to benefit market sectors like data center real estate, engineering and construction, nuclear and renewable power, energy transmission, gas-powered electricity, cooling technologies and the electrical components that connect these systems.

In Northeast Asian markets, the dominance in the AI semiconductor supply chain continues to benefit manufacturing powerhouses in South Korea and Taiwan. Japan, which has an edge in semiconductor manufacturing equipment, also stands to benefit. While many Asian exporters may be affected by escalating U.S.-China tensions, it is unlikely the U.S. can completely reduce its reliance on Asian chipmakers anytime soon. Demand for chips is expected to remain robust from both the U.S. and China.

Overall, we continue to view AI as a long-term investment opportunity that is still in its early stages. However, the heavy emphasis of mega-cap U.S. tech stocks in portfolios suggests a need for more diversification. This can be achieved by broadening investments to include a wider range of AI-related opportunities across various markets.

The major AI infrastructure companies are significantly increasing their investment spending, and they have the cash flows to support this expansion.

Exhibit 7: Capex from the major AI hyperscalers*

USD billions; Alphabet, Amazon (AWS), Meta, Microsoft, Oracle