Conditions and fundamentals for positive developed market equities outperformance are still in place.

A concern for the U.S. market is that performance is focused in just a few companies. Over the past two years, the seven mega-cap tech or tech-related companies have been major drivers of the U.S. equity market. In 2024, their earnings are projected to grow by 36.2%, compared to just 3.1% for the rest of the index. However, the focus isn’t solely on their earnings. These companies are heavily investing in AI and research & development, suggesting the tech sector and tech-related companies will likely stay prominent.

Still, there are signs of diversification into other areas. The contribution of the seven mega-cap tech-related companies to S&P 500 earnings per share (EPS) growth is decreasing, and their earnings growth rate is slowing, while it is accelerating for the rest of the index. Analysts expect the rest of the index will play a bigger role in 2024 and 2025. The rate-cutting cycle and resolution of election-related uncertainties should support a cyclical recovery in areas such as manufacturing, allowing less-favored sectors to benefit from tech-driven growth. This should help reduce concentration and valuation risks at the index level.

In Japan, corporate governance reforms have bolstered Japanese equities over the past year. However, this is a long-term structural theme that will contribute steadily over time. The current question for investors is whether there are other supportive factors. Japan’s ruling coalition lost its majority in recent elections, complicating political governance and adding uncertainty. Despite this, the outlook for the Japanese equity market remains positive, driven by wage growth and relatively attractive valuations. The economic outlook in the U.S. and the USD/Japanese yen (JPY) exchange rate are crucial for Japanese equities. A soft landing in the U.S. could keep the JPY weak and boost stocks.

In Europe, the anticipated recovery has fallen short of expectations. Still, there are positive aspects for the region, and the modest rebound should persist. Faster interest rate cuts from the ECB, prompted by easing inflationary pressures and slower-than-expected growth should offer relief to manufacturers and support consumer spending. While challenges like potential new tariffs and trade tensions persist, ongoing real income growth is expected to gradually boost consumer confidence and consumption.

Conditions and fundamentals for positive DM outperformance are still in place.

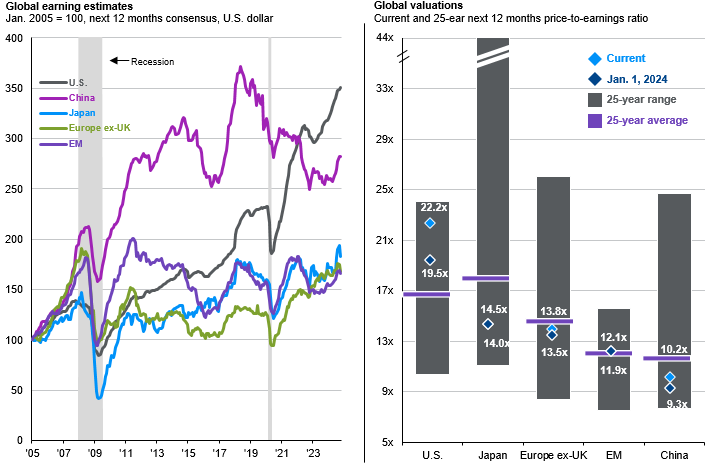

Exhibit 8: Global equity earnings and valuations