The challenge for asset allocators is to balance overweight positions in risk assets with effective diversifiers to hedge against both growth and inflation risks in the year ahead.

2024 has been a remarkable year in financial markets. Global equities have reached new highs, driven by the strength of U.S. mega-cap stocks, while credit spreads are near historic lows due to robust corporate performance. Meanwhile, 10-year government bond yields are set to end the year higher, despite a global easing cycle by central banks.

Looking into 2025, the challenge in allocating across risk assets lies in the high starting point and the limitations that elevated valuations impose on expected returns, further complicated by economic uncertainty due to the change in U.S. government leadership.

However, our base case remains a steady expansion of the global economy, which should benefit risk assets like equities and credit. As such, the preference is to overweight equities compared to bonds and cash1, and credit over government bonds within fixed income.

The challenge for asset allocators is to balance overweight positions in risk assets with effective diversifiers to hedge against both growth and inflation risks in the year ahead.

The rise in government bond yields means core government bonds can present a stronger buffer to downside portfolio risks, and we believe core government bonds will act as a credible hedge against a sharp economic growth shock.

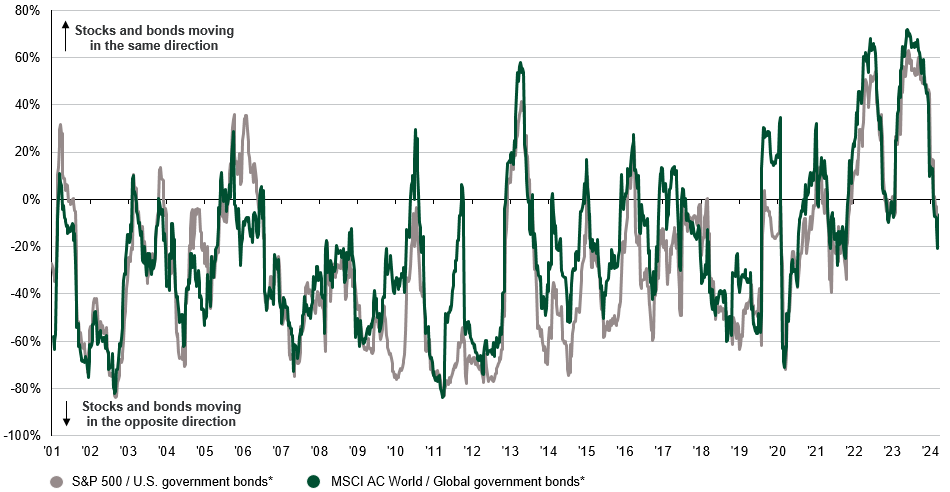

The bigger concern may be that inflation starts to rise on U.S. fiscal policies and the impact of higher tariffs, leading to a repeat of 2022’s “wrong way” correlation in markets. However, a negative correlation is not necessary for bonds to add diversification. Even bonds with zero correlation present benefits, though a more negative correlation provides stronger advantages.

The rise in gold prices indicates investors are seeking assets to hedge against inflation and geopolitical risks or anticipating a decline in real yields due to central bank easing. Although gold is seen as a defensive asset, it is more effective for hedging against extreme events rather than general macroeconomic risks. Additionally, should the Fed opt for a shallower rate-cutting cycle, the carrying cost of holding gold could increase.

Building a resilient portfolio requires diverse assets and broader geographical diversification. Significant differences in sector returns and valuations across global equity markets support active management and stock selection.

The same applies to fixed income and adding duration to portfolios. Central bank policy paths, shaped by domestic conditions, create opportunities in government bond markets where growth is weaker, rate cuts are more substantial and yields may fall further on a relative basis.

Investors are increasingly allocating to alternative assets, particularly real assets like real estate, infrastructure and transport, to find income not available in public markets and to gain diversification due to their low correlation with public market assets. Recently, the inflation-hedging characteristics of real assets have been an additional draw. These assets are not only uncorrelated with public markets but also often uncorrelated with the economic cycle, with returns driven by steady income streams rather than capital gains.

The stock/bond correlation has been moving in the “right” direction but this trend will only persist if inflation falls.

Exhibit 9: Bonds can diversify growth shocks as stock and bond correlation becomes negative, but not inflation shock.

Correlations between stocks and sovereign bonds

Weekly rolling six-month correlation of equities and sovereign bond prices*