While the steepening curve has created opportunities for positive carry on long U.S. duration, the expected increase in Treasuries supply and the Fed’s continued reduction of its Treasury holdings suggest that long-term yields could stay high for some time.

After an eventful close to 2024, U.S. Treasury yields have risen back to July levels, with a steepened curve. On the short end, even though the Fed has started lowering interest rates, initially with a surprise 50 basis points (bps) cut, the pace of future cuts is expected to slow substantially as the next U.S. administration’s pro-growth focus could keep inflation elevated.

While markets are still pricing in just over 50 bps of cuts for 2025, it is a sharp contrast from the Fed’s recent projection of 100 bps. On the long end, an increased risk of a worsening fiscal deficit has also pushed yields higher. While the steepening curve has created opportunities for positive carry on long U.S. duration, the expected increase in Treasuries supply and the Fed’s continued reduction of its Treasury holdings suggest that long-term yields could stay high for some time.

Duration in other DMs such as Europe appears more attractive. The ECB has been cautious with rate cuts, but incoming economic data suggesting weaker domestic growth and softer inflation could lead to more aggressive monetary easing. With growth risks leaning downward, Europe is likely to surprise with dovish policies, making European bonds potentially more favorable than U.S. bonds as their yields may drift lower.

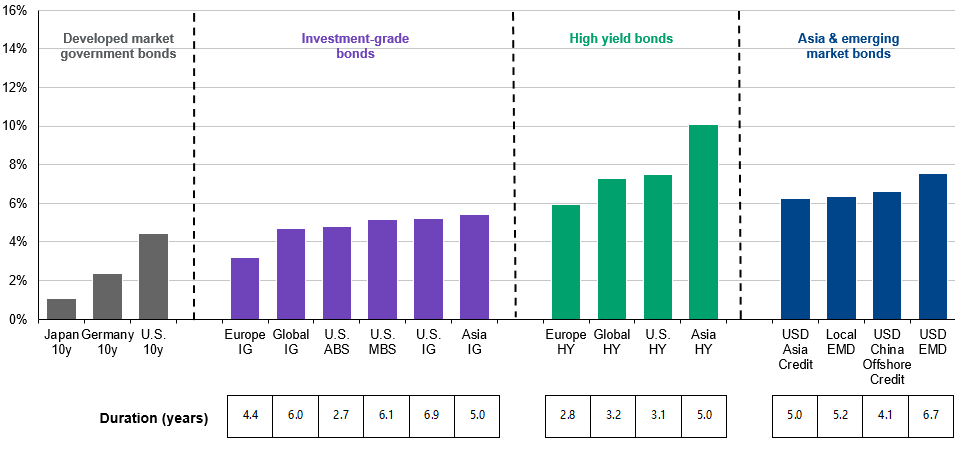

Beyond duration, credit spreads for both U.S. investment-grade (IG) and high-yield (HY) bonds are currently on the tighter side compared to historical norms. In similar previous situations, where the U.S. economy experienced a soft landing and credit fundamentals were strong, credit spreads have stayed tight for an extended period. While there is limited room for spreads to tighten further, the risk of them widening significantly is low, especially with a proposed pro-growth tax cut on the horizon. Overall, all-in yields remain attractive, and corporate bonds are likely to benefit from stable spread returns and changes in short-term rates.

For Asian EMs, the Fed's easing cycle has temporarily reduced pressure on domestic currencies, enabling some central banks to start lowering interest rates. However, renewed expectations for U.S. reflation and higher rates could stall this progress, keeping domestic currencies under pressure. Despite this, a more disciplined fiscal approach in certain markets, especially those with stronger fundamentals, should provide better support for local bonds compared with U.S. Treasuries, presenting a boost to Asian fixed income.

All-in yields for U.S. IG, HY and EM bonds appear more attractive compared to U.S. Treasuries.

Exhibit 4: Fixed Income yields

Yield to maturity