If China’s economic momentum improves in 2025, we see value opportunities in Chinese equities, especially for private sector companies that have enhanced their profit margins and corporate fundamentals. Improved market sentiment toward China could also attract more capital flows back into Asian markets.

Growth in most Asian economies slowed in 3Q 2024, notably in Hong Kong, South Korea and Taiwan. This slowdown aligns with the recent decline in export momentum across Asia, which is driven by cyclical weaknesses in the global manufacturing sector and a gradual moderation in semiconductor export growth.

However, semiconductor exports from North Asia are expected to increase in the near to medium term, supported by ongoing structural strength in AI-related products and high-performance computing (HPC) demand. AI-driven technology upgrades broadening to mobile phones, personal computers and other consumer tech products could also sustain this cycle.

Inflation in Asia has generally remained weak, even though India’s inflation surprisingly rose recently, driven by higher-than-expected food prices. However, India’s core inflation remains soft. Asian central banks are likely to maintain their easing bias, but the pace and timing may be limited if tariff risks create currency pressures. Additionally, changes in U.S. rates may also prompt Asian central banks to focus on defending their currencies rather than cutting rates to support their domestic economies.

In late September 2024, China announced a series of coordinated monetary, fiscal and property easing measures to support its economy. Early signs of improvement are starting to emerge. However, recovery of the real estate market will be slow because of excess inventory and cautious buyer expectations. With the new U.S. administration, investors may worry about potential higher tariffs and geopolitical uncertainties.

The U.S. viewing China as a competitive rival isn’t new, and trade concerns are well known and likely already priced in. Most Chinese companies listed in the A-share market generate revenue domestically, and so local demand is crucial. While severe U.S. tariffs may impact China's exports, domestic policy measures to support the economy are likely to be a more significant driver for Chinese equities. In a slow growth environment, high-dividend and defensive stocks like banks, energy and state-owned enterprises have performed well.

However, if China’s economic momentum improves in 2025, we see value opportunities in Chinese equities, especially for private sector companies that have enhanced their profit margins and corporate fundamentals. Improved market sentiment toward China could also attract more capital flows back into Asian markets.

In India, the recent moderation in growth momentum should improve as (1) consumer demand picks up during the upcoming festive season; (2) government spending picks up; (3) private capital expenditure moves from announcements to actual investments; and (4) the central bank starts easing.

Government and regulatory policies are aimed at sustaining growth through incentives for new sectors while curbing excesses. This will likely expand India’s economic growth beyond traditional sectors, like financials, information technology and consumer staples, to other sectors, such as consumer discretionary and new-age disruptive businesses tailored for the local market.

Additionally, the ongoing supply chain reorganization suggests growing demand for infrastructure as India develops into another global manufacturing hub, competing with China and ASEAN. This will likely benefit transport and infrastructure assets. India’s long-term strengths, such as demographics and growth potential, remain robust. It is no surprise that Indian equity market valuations are high, reflecting strong earnings expectations. However, with time and continued profitability growth, this optimism should be justified.

Besides India, ASEAN markets are also likely to gain from the ongoing shift in supply chains. Like India, earnings growth in ASEAN should be supported in the medium term by structural factors such as favorable demographics, a growing middle class and increasing consumption. However, with ASEAN valuations at 13.7x in mid-November, matching their 15-year average, they are more attractive compared to India. Active bottom-up selection is crucial due to the wide variation in macroeconomic and stock fundamentals across ASEAN. The regional grouping’s higher dividend payout ratios make it appealing for income-seeking investors, further enhancing its long-term investment appeal.

Growth in most Asian economies slowed in 3Q 2024, aligning with the recent decline in export momentum across Asia.

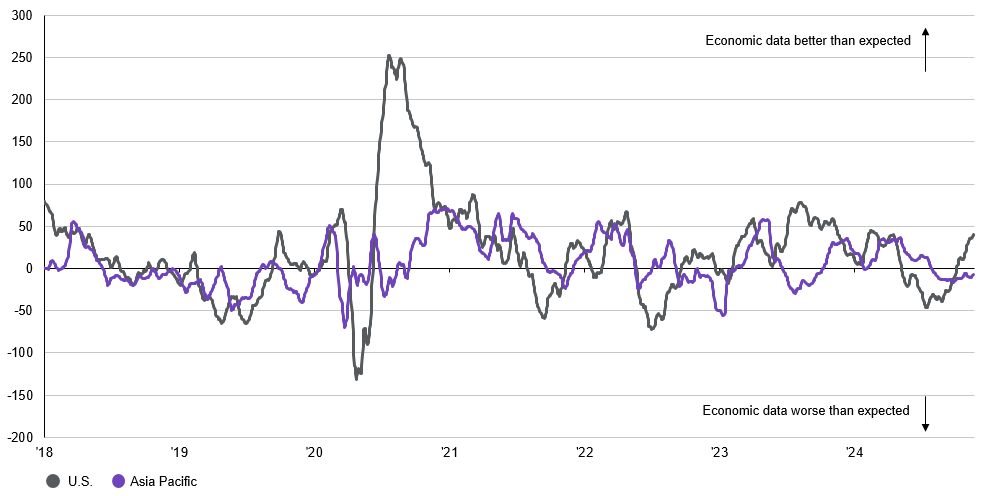

Exhibit 6: Citi Economic Surprise Indices

Index, 7-day moving average