At its April FOMC meeting, the Fed reiterated their unwillingness to reduce the federal funds rate until they have greater confidence that inflation is moving sustainably towards 2%.

In brief

- Despite the recent rebound in U.S. inflation, we still see signs of cooling inflation in the months ahead as consumers are becoming more price sensitive, and shelter inflation should be easing.

- The job market is also going from great to good, with a modest drop in job openings and slower wage growth.

- The Federal Reserve (Fed) may not have the needed conditions to ease policy in the short term, but the trend is still for the next move to be a cut, instead of hike. This would remain supportive to risk assets, such as global equities and high yield corporate debt.

The Fed’s monetary policy outlook will likely continue to be a focus for markets in the months ahead. So far, in 2024, market interest rate expectations have whip-sawed from 6-7 cuts at the start of the year to just 1-2 cuts in April, following a string of hot inflation data. Here, we shine a light on the broader outlook for inflation and the labor market, following the April jobs report.

The last mile of disinflation has proven to be the hardest

Consumer price index (CPI) inflation has been accelerating. Core personal consumption expenditures (PCE) inflation surprisingly rose in 1Q24, and the Employment Cost Index (ECI) climbed a stronger-than-expected 1.2%—its largest gain in a year. Even the trimmed mean PCE, which strips out the most volatile components in the basket, was higher in March than any month in 4Q23. This has raised questions about whether the path to 2% inflation is still encountering “bumps” along the road, or a more problematic trend higher.

Sticky price pressures pose a challenge for the data-dependent Fed, casting doubts on the possibility of any rate cuts this year. Indeed, it would likely take an extraordinary change in the data to bring a June cut back on the table, but the Fed’s path thereafter is still to be determined, and remains reliant on how inflation progresses from here onwards.

Fortunately, a look across the drivers of inflation offer several reasons why a significant reacceleration of inflation is unlikely:

- Wages may be sticky, but a labor market cool down is underway. Labor supply has seen a welcome improvement with the recent migrant surge, building labor force participation and steadying job turnover (i.e. quits rate). Moreover, business surveys (National Federation of Independent Business and Purchasing Managers’ Index) indicate cooling labor demand, and consumer surveys show workers are more concerned about job security.

- Consumers are more price sensitive now. The inflation surge of 2022 was driven by supply bottlenecks combined with pent-up consumer demand, whereas the consumer today is much more quiescent. Spending levels are overall quite healthy (at least in nominal terms), but there is heightened price sensitivity amongst consumers leading to trade-downs and weakness in discretionary spending. The consumer remains resilient, but it is not exuberant.

- Inflation expectations are well anchored. Long-term inflation expectations from consumers, professional forecasters and bond markets are averaging 2.4%, just slightly higher than the 10-year average of 2.3%.

- The pace of shelter inflation is unsustainable. There are two main reasons why CPI lags and dilutes swings in market rent inflation: (1) CPI rents reflect average rent growth for all tenants, in contrast to market measures like Zillow and Apartment List that capture new leases signed on rental units (2) the Bureau of Labor Statistics only examines rents every six months and attributes one-sixth of the total observed increase to the month, smoothing out large swings. This, combined with the fact that new tenant leases only make up 9% of the market, suggest that while market rents fell dramatically over the course of 2022-2023, the passthrough to the CPI has been limited and it is lagging more than expected. Still, in absolute terms, shelter accounts for more than double its typical contribution to CPI, and the New Tenant Rent Index1, Zillow and Corelogic all suggest CPI rent inflation should decline over 2024 and 2025.

Overall, it seems unlikely inflation can sustain a reacceleration, and much more probable that disinflation will resume in the coming months. In the meantime, PCE inflation of 2.7% year-over-year is not a cause for alarm. The economy remains strong, workers are fully employed and experiencing real wage gains, and markets have shown resilience in handling higher-for-longer rates. While the Fed’s cutting cycle may be delayed, the risk of “stagflation”, where rising inflation is paired with weak growth, does not seem significant at this time.

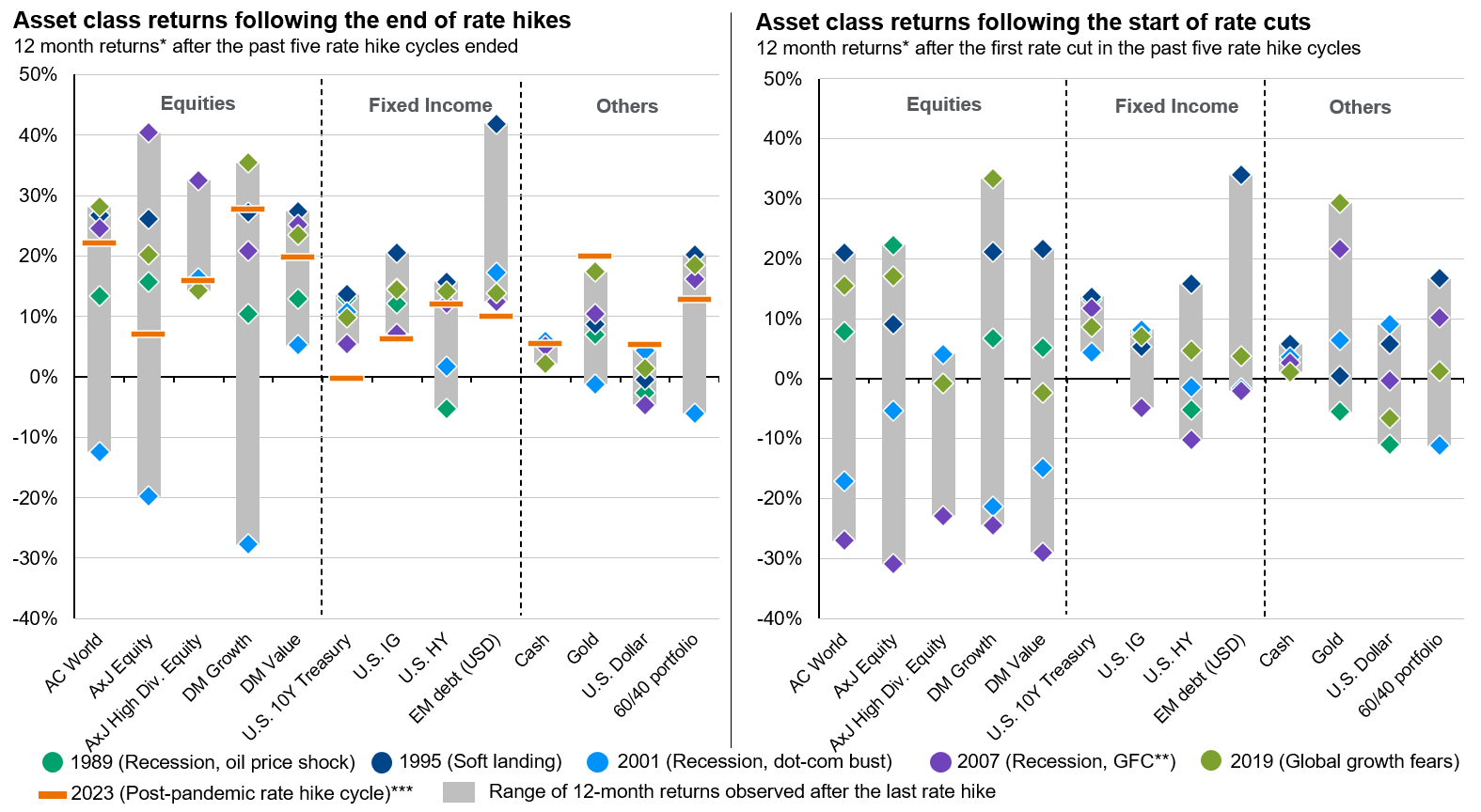

Source: FactSet, U.S. Federal Reserve, J.P. Morgan Asset Management. Based on MSCI AC World Index (AC World), MSCI Asia Pacific ex-Japan Index (AxJ Equity), MSCI Asia Pacific ex-Japan High Dividend Yield Index (AxJ Equity High Div. Equity), MSCI World Growth Index (DM Growth), MSCI World Value Index (DM Value), Bloomberg U.S. Treasury Bellwethers 10Y (U.S. 10Y Treasury), Bloomberg U.S. Corporate Investment Grade Index (U.S. IG), Bloomberg U.S. Credit Corporate High Yield (U.S. HY), J.P. Morgan EMBI Global (EM Debt USD), Bloomberg U.S. Treasury Bills 1-3M (Cash), Gold New Spot price (Gold), U.S. dollar index (U.S. dollar), 60% AC World and 40% Global Bonds (60/40 portfolio). The last rate hikes referred to in the charts occurred in Feb ‘89, Feb ’95, May ‘00, Jun ‘06 and Dec ‘18. The first rate cuts occurred in Jun ’89, Jul ’95, Jan ’01, Sep ’07, Aug ’19. *Total returns in local currency are used, unless otherwise specified. **GFC stands for global financial crisis. ***Returns are annualized and calculated from the assumed last rate hike date (26/07/23) to date. Past performance is not indicative of current or future results.

Guide to the Markets – Asia. Data reflect most recently available as of 31/03/24.

Some healthy cooling in the job market

The softer-than-expected April jobs report provided welcome reassurance that the labor market is not adding to inflationary pressures. The economy added 175K jobs in April, below expectations of about 220K, with a net downward revision of 22K applied to February and March. The best news from this report was likely the slowdown in wage growth, after a rather hot Employment Cost Index (ECI) print spooked investors earlier in the week.

- The economy continues to add jobs where most needed. Employment gains were particularly strong in healthcare and social assistance occupations (+87K), a sector that accounts for one-fifth of the remaining job openings in the economy and the overall largest growth in labor demand since the pandemic.

- Part of the weakness came from a drop-off in government hiring (+8K), which has been a strong source of hiring in the past year. Private sector job creation stepped down to a still-healthy +167K.

- The labor force was mostly unchanged but a softer increase in household employment (+25K) led to a tick higher in unemployment to 3.9%.

- Labor market churn has stabilized further. The JOLTS quits rate fell to 2.1% in March, coinciding with further declines in job openings. Notably, layoffs also fell in March and continue to run well below the 10-year average preceding the pandemic.

- Private sector wages grew a modest 0.2% month-over-month, bringing the year-over-year rate to 3.9% from 4.35% at the start of the year. While the ECI indicated stronger wage growth in the 1st quarter, the 2nd quarter is so far looking much softer.

While this report continues to show healthy job growth, more moderate payroll and wage gains, in combination with this week’s JOLTS report, suggest disinflationary pressures remain in place. At its April Federal Open Market Committee meeting, the Fed reiterated their unwillingness to reduce the federal funds rate until they have greater confidence that inflation is moving sustainably towards 2%. While the latest report probably won’t be enough to trigger a June rate cut, it should bolster the confidence which had been shaken by hotter numbers in the first quarter. Following the jobs report, markets modestly increased rate cut expectations for the year to 46 basis points (bps) (from 34bps the week prior), as indicated by the futures market.

Investment implications

We have argued in recent weeks that the Fed rate cut cycle is only delayed. Once the conditions for the Fed to ease monetary policy is in place, we should see a resumption in the decline of government bond yields, which should be positive for both stocks and bonds. Meanwhile, the recent drop in U.S. Treasury yields has coincided with a softer U.S. dollar, which could persist once the Fed is more engaged with monetary easing. Since the start of the year, our view has been that the start of the Fed rate cut cycle should allow fixed income to outperform cash. Assuming the central bank is cutting rates on the back of an orderly economic slowdown (i.e. soft landing), equities should benefit too. A weaker U.S. dollar should also encourage more capital flows into emerging markets and Asia, both in terms of equities and fixed income.