JPMorgan SmartRetirement® Passive Blend 2045

For individuals born between 1979 and 1983

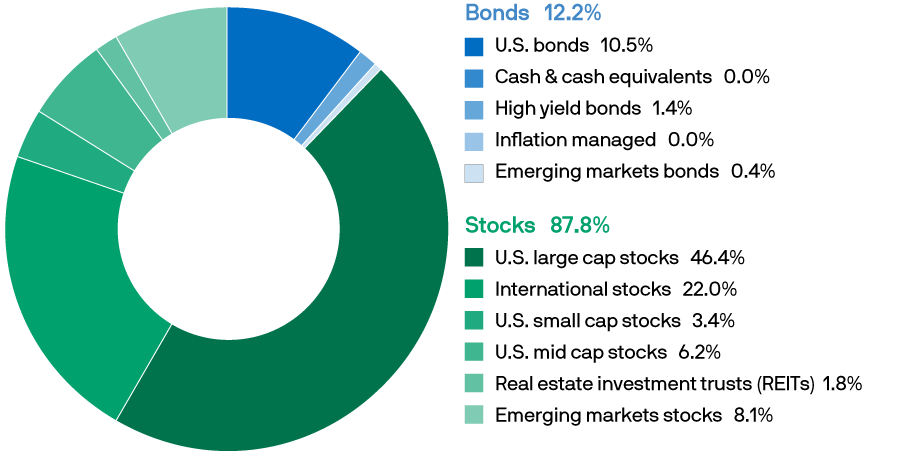

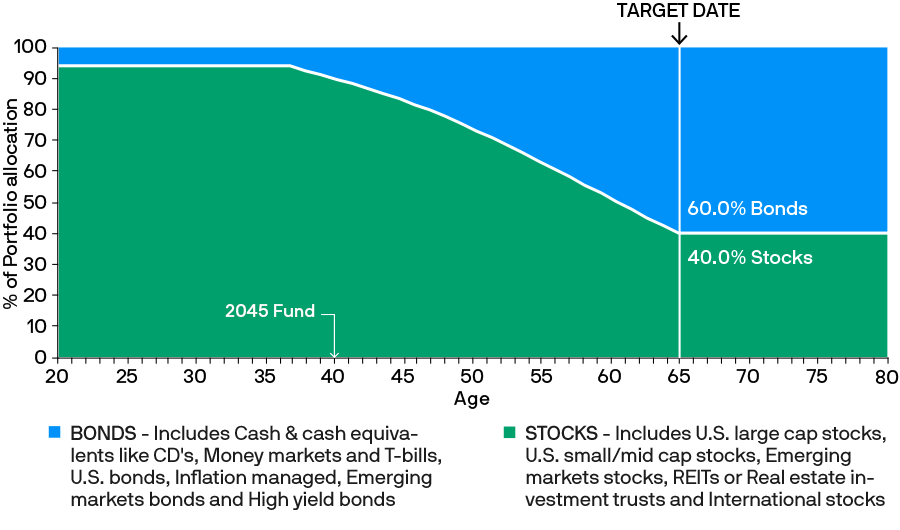

When you select a SmartRetirement Passive Blend Fund, you're automatically invested in more than 20 underlying funds across two asset classes - stocks and bonds. By investing in the fund, a team of more than 100 investment professionals at J.P. Morgan is responsible for shifting the allocation from stocks to bonds as the fund approaches its target date. This way your fund automatically changes to become more conservative as you approach your target retirement date.

Since each SmartRetirement Passive Blend Fund is dynamically managed for a specific date in the future, you'll want to consider selecting one named for the year closest to when you plan to retire and begin withdrawing from your account.

Select a different Fund

- JPMorgan SmartRetirement Passive Blend Income

- JPMorgan SmartRetirement Passive Blend 2025

- JPMorgan SmartRetirement Passive Blend 2030

- JPMorgan SmartRetirement Passive Blend 2035

- JPMorgan SmartRetirement Passive Blend 2040

- JPMorgan SmartRetirement Passive Blend 2045

- JPMorgan SmartRetirement Passive Blend 2050

- JPMorgan SmartRetirement Passive Blend 2055

- JPMorgan SmartRetirement Passive Blend 2060

- JPMorgan SmartRetirement Passive Blend 2065

Why SmartRetirement Passive Blend? Hear from investors like you.

[MUSIC PLAYING] Target date fund changes over time. It takes into account when I would retire, and starts phasing out of the more risky investments towards a more balanced or more conservative approach so that I have more stability at the time that I might retire. So before-- well, if I even bothered-- it was me going out trying to figure out which fund or mutual fund to invest in, and then having to go out online, make those choices, make those changes, watch everything that's going on, and trying to figure out for myself what I need to do.

And instead of that, a target date fund will allow me to let a professional do that for me. Investing in a target date fund is like what I've done for myself. I've lost 150 pounds, I gained 40 of it back, and realized I wasn't the one that was able to do this all on my own. I needed some experts to help me. So I've hired a nutritionist and a personal trainer to help me get back on track. And so that's what you do when you use a target date fund. It helps you stay on track without you having to do all of the work.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and company and its affiliates worldwide.

Sticking to a goal is very important to Karen, having her investments automatically adjust easily helps her prepare for retirement

[MUSIC PLAYING] So I think a target date fund is designed to provide opportunity for savings, and rather than have a do-it-yourself approach, it puts more knowledgeable people in charge of the decisions. And I always think that, when there is someone who is knowledgeable at something offering to help you, you should take advantage of that. You would be foolish not to. My target date fund invests more aggressively the further I am from retirement, and then, as I get closer to my retirement date, the assets shift into less aggressive investment options. I like the target date fund concept because it allows me to not have to add one more thing to do on my already too long list of things to do. And with something like retirement, which is so important, but also so far off at this point, it means that something is taken care of for me. This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

To Matthew, retirement is so far off in the future, he likes that his money is managed by our experts so he doesn’t have to worry

[MUSIC PLAYING] I think the benefits of investing in a target a fund are that you really don't have to do a lot of thinking around it. You what your target retirement date is, and you put yourself into that target date fund, and you have people do the management around what funds, you should really be invested in to maximize based on that retirement goal date.

Early on, if you're younger, they're going to put you in more aggressive funds, and as you get a little bit older or closer to retirement, they're going to put you into more stable funds. I guess, in my mind, it's their job. They do this every day. I am not an expert in target date funds or picking my own portfolio. Probably my expertise is changing diapers, and cleaning the house, and cooking dinner, and that kind of thing.

So of course, they're going to be more knowledgeable about, if my retirement date is 2050-- and they're looking at statistics, they're looking at market information, they're looking at all this on a day-to-day basis, and I just don't have the time to do that. I think the very best thing about target date funds are you put your money into it, and there is someone on the other side of the wall who's going to do all the work for you.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

Patty is confident that her investment is diversified and managed by a dedicated team of investment professionals.

What's in the 2045 Fund?*