JPMorgan SmartRetirement® Passive Blend 2020

For individuals born between 1954 and 1958

Your SmartRetirement® Passive Blend fund is ready for all the years ahead, including the years after you retire.

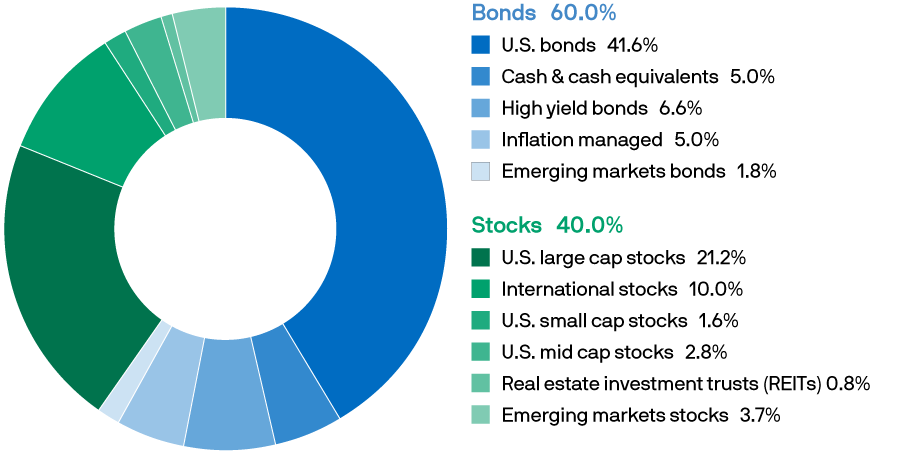

When you select a SmartRetirement Passive Blend Fund, you're automatically invested in more than 20 underlying funds across two asset classes - stocks and bonds. By investing in the fund, a team of more than 100 investment professionals at J.P. Morgan* is responsible for shifting the allocation from stocks to bonds as the fund approaches its target date. This way your fund automatically changes to become more conservative as you approach your target retirement date.

Keep in mind, SmartRetirement Passive Blend can meet your needs after you retire, too, with features that help you spend confidently so your money lasts.

Select a different Fund

- JPMorgan SmartRetirement Passive Blend Income

- JPMorgan SmartRetirement Passive Blend 2020

- JPMorgan SmartRetirement Passive Blend 2025

- JPMorgan SmartRetirement Passive Blend 2030

- JPMorgan SmartRetirement Passive Blend 2035

- JPMorgan SmartRetirement Passive Blend 2040

- JPMorgan SmartRetirement Passive Blend 2045

- JPMorgan SmartRetirement Passive Blend 2050

- JPMorgan SmartRetirement Passive Blend 2055

- JPMorgan SmartRetirement Passive Blend 2060

- JPMorgan SmartRetirement Passive Blend 2065

Why SmartRetirement Passive Blend? Hear from investors like you.

My family is very important to me. I'm married. I have one son who's 35 years old, and I also have a 5-year-old grandson. A grandchild's love is amazing. Every time I think about him, I just can't stop smiling. I want to be able to maintain a healthy life so that I can enjoy my grandson and any future grandchildren to come.

I've been preparing financially since I began my career. It's very important that my money lasts through retirement. It's going to be about laying on the beach, having a nice, little drink, relaxing, taking long walks, riding my bike.

So spending down my money in retirement is a bit of a fear factor for me. I do like that it provides an estimate as to how I would spend money in retirement and make it last. Not only is it conservative, it balances risks and reward, and it allows me to adjust my spending from year to year. Something like that gives me the ability to make my money last through retirement is the number one priority for me.

For Melia, there’s a fear factor to spending in retirement. So she likes the fund’s estimate of how much to spend.

I was flying back from the West Coast just the other day and I realized I haven't seen some of the parts of our country. And so I want to spend some time traveling around.

In New York, we're fortunate that we're a melting pot, so we can actually see a lot of different cultures in play. But I like actually going visiting and exploring the people in other cultures and the way they live day to day.

I've always wanted to get better at golf. I'm probably the worst golfer that I know. And I certainly wouldn't play with me if I had a choice.

So my biggest priority are two. One of them is to make sure that I have enough money to do the fun things that I want to do when I retire. And the second thing will be to support whatever charitable projects I think are important for future generations.

I really don't have an idea of what I should be spending when I retire. It's something that I worry about, but I don't have a clear idea. I am more risk averse as I've gotten older because I'm getting closer to retirement age. So I want a fund that's actually more conservative.

The thing that I want to get out of a tool like this is to spend my money intelligently to make sure that it lasts my entire retirement. And the great thing is that that is all built in. So I don't know if I'm going to live to 100, but it's really comforting to know that the fund will manage my money throughout my entire retirement.

I've been preparing for retirement my whole life. To have somebody that understands my stage of life I think is a really great idea and something that I would be very interested in.

Stuart’s priority in retirement is having enough money for the fun things in life. He thinks SmartRetirement Passive Blend can help him spend more intelligently so he can do what he loves.

Retired or retiring soon? Spend confidently in the future with SmartRetirement Passive Blend.

With exclusive features to manage your spending after you retire, SmartRetirement Passive Blend can help you enjoy life while feeling confident your money will last.

- See how much to spend each year with our sample withdrawal amount

- Spend more (or less) to meet your needs and easily adjust your future planning

- Gain additional spending power as your fund continues to focus on investment gains

You’ve been saving for retirement for a long time.

That was smart.

Now it’s time to be a smart spender, too, so you manage your money wisely in the years after you retire.

Your JPMorgan SmartRetirement fund has some important features to help.

For starters, SmartRetirement is designed to keep generating investment returns in retirement, just as it did during your working years.

That can give you more spending power, so you don’t deny yourself the things that make retirement fun.

Even better, your SmartRetirement fund gives you information to help you spend confidently in retirement… so you feel better about the decisions you make.

Let’s say you’re 65 and looking at your sources of retirement income.

The first thing you may want to do is keep your assets invested in JPMorgan SmartRetirement.

It’s designed to help you spend gradually, so your money can last through retirement, even to age 100.

Next, check in each year to see how much to spend to keep your retirement on track.

This amount is based on our research and market conditions.

And, finally, enjoy your retirement more knowing you can gradually spend your money over time with less worry.

Looking at this in more detail...if you have $100,000 invested in SmartRetirement, the fund will identify a sample amount to withdraw for each year of your retirement.

Starting with $5,000 at age 65, for example.

This amount will change yearly. So when you check in at age 75, it might be $7,000.

But what if you want to spend a little more (or a lot more) one year – say, for a special trip with the grandkids?

Our digital SmartRetirement calculator will help you evaluate the impact on your future ability to spend, so you can make the smartest decision for you.

All of your fund’s spending features turn on automatically as you near your target date.

So stay on track in the years ahead with JPMorgan SmartRetirement. It could be your smartest move yet.

What's in the 2020 Fund?*

Award-winning funds

SmartRetirement and SmartRetirement Blend rated bronze(1) by Morningstar

(1) Morningstar, US Fund Target Date categories. Medalist rating as of 10/03/22; applies to the SmartRetirement and SmartRetirement Blend R6 mutual funds.