JPMorgan SmartRetirement® Blend 2030

For individuals born between 1964 and 1968

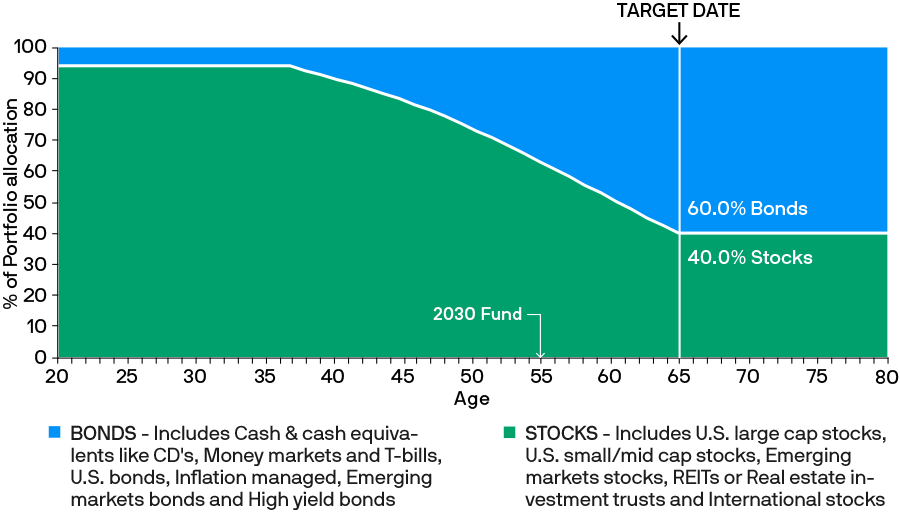

When you select a SmartRetirement Blend Fund, you're automatically invested in more than 20 underlying funds across two asset classes - stocks and bonds. By investing in the fund, a team of more than 100 investment professionals at J.P. Morgan is responsible for shifting the allocation from stocks to bonds as the fund approaches its target date. This way your fund automatically changes to become more conservative as you approach your target retirement date.

Since each SmartRetirement Blend Fund is dynamically managed for a specific date in the future, you'll want to consider selecting one named for the year closest to when you plan to retire and begin withdrawing from your account.

Why SmartRetirement Blend? Hear from investors like you.

[MUSIC PLAYING] I currently pick my own investments, but I'm considering moving my money into a target date fund. I originally chose my investments based on a friend's advice, but I haven't kept up you know on those investments, how they should be allocated appropriately, and so I'm considering moving to a target date fund, knowing that they'll be invested appropriately based on my age and be reallocated periodically as they should be, instead of me just sitting there letting them-- my current investments go with the flow of the market.

The very best thing about being allocated in a target date fund would be that I wouldn't have to worry about how much I should be allocated in this bond versus equities versus cash. They would be doing that for me and considering my age. I wouldn't be overweighted one way or the other in the investments.

I haven't done it yet just because I-- procrastination, and just, oh, I'll get to it, I'll get to. I think about it constantly about I need to reinvest into the target date funds.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

Ed currently does not reallocate his investments, so he likes the idea that his portfolio will be rigorously managed by experts.

[MUSIC PLAYING] It seemed easy to me to be invested in a target date fund, because I only had to choose the date that I hope to retire, and then everything was managed for me. I know you're supposed to reallocate every so often, and that happens automatically for me. I'm not overly knowledgeable, but you pick a date when you want to retire, and they put you in diversification-- so you have-- not all your eggs in one basket.

And then they make you less risky as you get closer to your retirement date is the best-- to my understanding. The portfolio managers, I would imagine, are the people who have the expertise and knowledge to help me be properly invested in the appropriate funds, and stocks, or whatever's in there so that I get the end result that I'm hoping for. I don't think anything's guaranteed. I'm sure it goes up and down with the stock markets, like any other investment. It's just that, when it's time to reallocate to a less risky position, I don't have to think about making sure that's getting done.

The best thing about investing in a target date fund for me is that, when I set it up, after that, it's basically effortless and runs itself. So hopefully I'll be getting the end result that will give me the retirement of my dreams. Everything is done automatically. I told them when I want to retire, and they make my adjustments as required without my input.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

Karen appreciates that as she gets closer to her retirement date the fund will adjust automatically for her.

[MUSIC PLAYING] The reason I invested in target date funds-- they were more appealing to me just because they made me feel a little more comfortable, I really don't have the expertise I need to know to track all these funds, and the fact that it takes care of the planning for me. And it just relieved some of my time and my tension about it.

Well, before target date funds, I would get together with my husband at night and go through the different funds and try and figure out what type of investment we wanted. Do we want aggressive? Do we want to be more conservative with our money? How much longer will we be in the market-- the job market? And trying to figure out the diversification-- how much stocks, how much bonds? And target date funds takes care of that for me now.

I think they analyze the funds, I'm hoping, on a daily basis. It's their job. Well, no, when I'm in a target date fund, there's nothing guaranteed. It's a decision you're making, but there's no promises or guarantees at the end of it. To me, the very best thing about having a target date fund is being relaxed enough and not feeling that I have to check on it every three weeks to see how everything's going. I'm just much more comfortable with that.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

For Rita, retirement planning can be stressful especially with the unknown, but knowing her investment is diversified to ride out market swings relives her tension

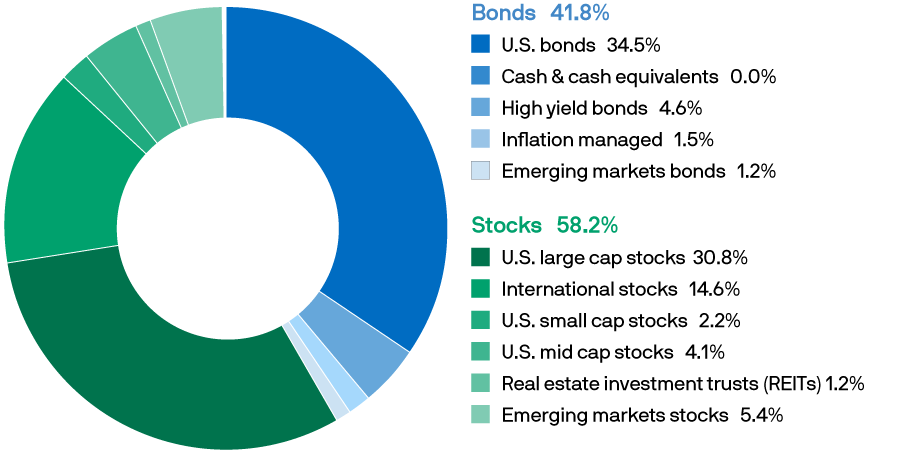

What's in the 2030 Fund?*