Monetary Authority of Singapore – Cautious optimism as recovery continues

04/20/2021

Aidan Shevlin

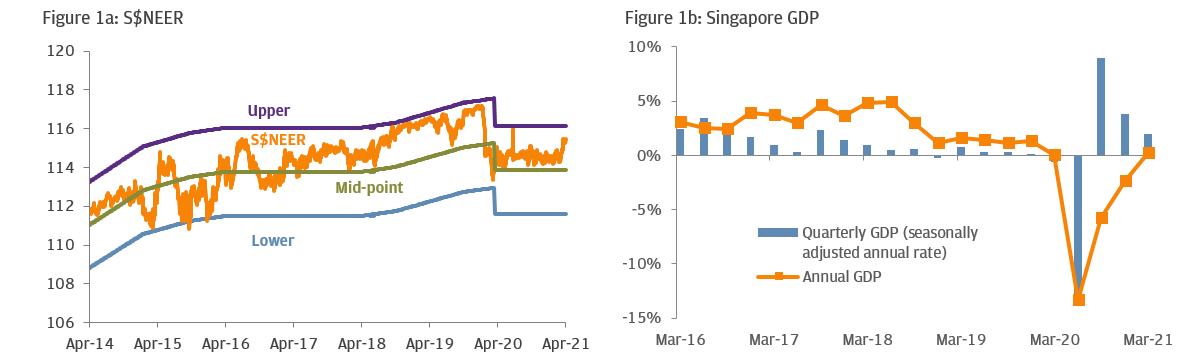

At their latest semi-annual policy meeting, the Monetary Authority of Singapore (MAS) left the slope, width and centre point of its S$NEER (Singapore Dollar Nominal Effective Exchange Rate) policy band unchanged for the second meeting. However, the accompanying comments were positive and the central bank revised up their headline inflation target – both of which could have implications for SGD cash investments.

MODERATELY UPBEAT OUTLOOK - MARGINALLY HIGHER INFLATION

Forced by weak economic data in late 2019 and the Covid outbreak in early 2020, the MAS rapidly pivoted to a dovish policy bias, cutting the previously appreciating S$NEER slope to 0% and re-centering the S$NEER band lower at their April-2020 meeting (Fig 1a). Although the central bank remained dovish for the remainder of 2020, it recognized the limitations of its policy tools and left monetary policy unchanged at subsequent meetings. Instead, responsibility for mitigating the negative economic impact of the Covid-19 pandemic fell on the government, who announced multiple fiscal stimulus packages to stabilize and support the economy.

The successful containment of Covid-19, a rebound in exports and improved consumer sentiment have allowed the MAS to rotate to a moderately upbeat outlook at their latest meeting. The central bank noted “the ongoing recovery in the Singapore economy”. This was reinforced by Q1-2021 Gross Domestic Product (GDP), which was printing higher than expected at 2.0% q/q (Fig. 1b) due to stronger manufacturing and services.

Source: Bloomberg and J.P. Morgan Asset Management; as at 14th April 2021

The MAS also observed that global growth prospects were improving, due to substantial additional fiscal stimulus and a steady pace of vaccine deployment in some markets. With Singapore leveraged to global growth, it believes that “the upturn in external demand will sustain an above-trend pace of growth in Singapore’s economy for the rest of 2021”. As a result, the central bank forecasted the 2021 GDP growth rate would likely exceed the upper end of the official 4–6% forecast range.

The MAS also expects core inflation to pick up in the months ahead, as the disinflationary impact of government subsidies fades and oil price base effects become visible. Given these modest price pressures, the central bank marginally increased its 2021 headline inflation target to 0.5% to 1.5% (up by 1%), while keeping its 2021 core inflation target unchanged at 0.0% to 1.0%.

Despite the broadly upbeat economic outlook, downside risks remain. A rebound in domestic consumption and construction have been hampered by social distancing rules. While the continued closure of international borders and slow rollout of vaccines across the Asia-Pacific region have thwarted a recovery in the important travel and tourism sectors. Inflation will also likely remain below its long term average as the international negative output gap will keep imported inflation contained, while domestic wage growth will remain subdued due to higher than average unemployment.

MARKET IMPLICATIONS

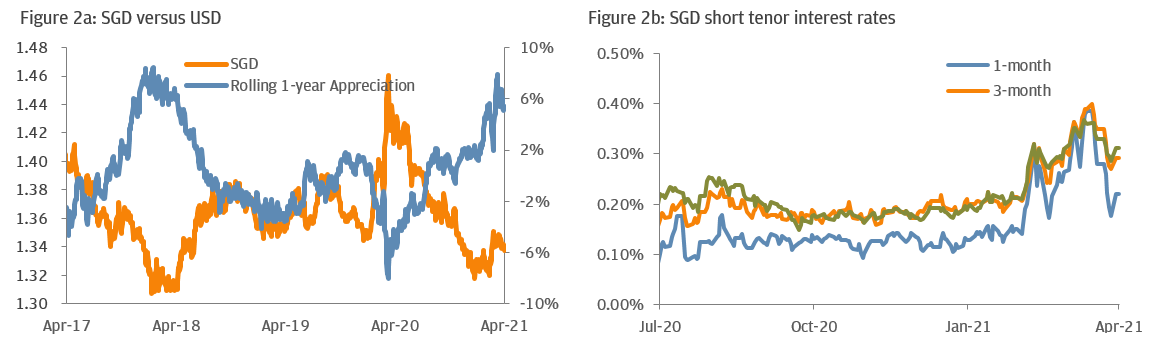

Year to date, positive international and local economic data has strengthened the SGD versus the USD (Fig 2a) - although the MAS focused on maintaining the S$NEER just above the mid-point of its trading range by increasing the issuance of treasury bills to absorb excess imported liquidity. Combined with global reflation expectations, this pushed Singapore interest rates sharply higher, while the yield curve steepened (Fig 2b).

Source: Bloomberg, Citibank and J.P. Morgan Asset Management; as at 14th April 2021

It was widely noted that MAS had removed references to weak “underlying growth momentum” and the need to keep policy accommodative “for some time” from its latest monetary policy statement. Nevertheless, the central bank highlighted that output would linger below potential, inflation would remain muted and significant uncertainties still exist.

This dichotomy has generated a divergence among economists: A minority, expecting a more rapid recovery and swift re-emergence of the MAS’ hawkish bias, are predicting monetary policy tightening as early as October 2021. While the majority believe the central bank has adequate time to observe the direction of economic data and policy tightening in April 2022 would be more likely. Regardless, with risks to the upside, the S$NEER is likely to continue grinding higher towards the top end of its current trading range, encouraging additional liquidity inflows which could cause Singapore interest rates to lag any further international bond sell-off.

IMPLICATIONS TO CASH INVESTMENT

We believe Singapore’s short term interest rate may have peaked and could decline, especially if major global central banks continue to forestall any expectations of base rates moving higher. Corporate treasurers should rethink their SGD cash investment strategies. Extending duration slightly to lock in current attractive interest rates or investing in longer duration money market or ultra-short duration strategies rather than continue placing cash in overnight deposits would appear a reasonable precaution.