Slide Image

Chart Image

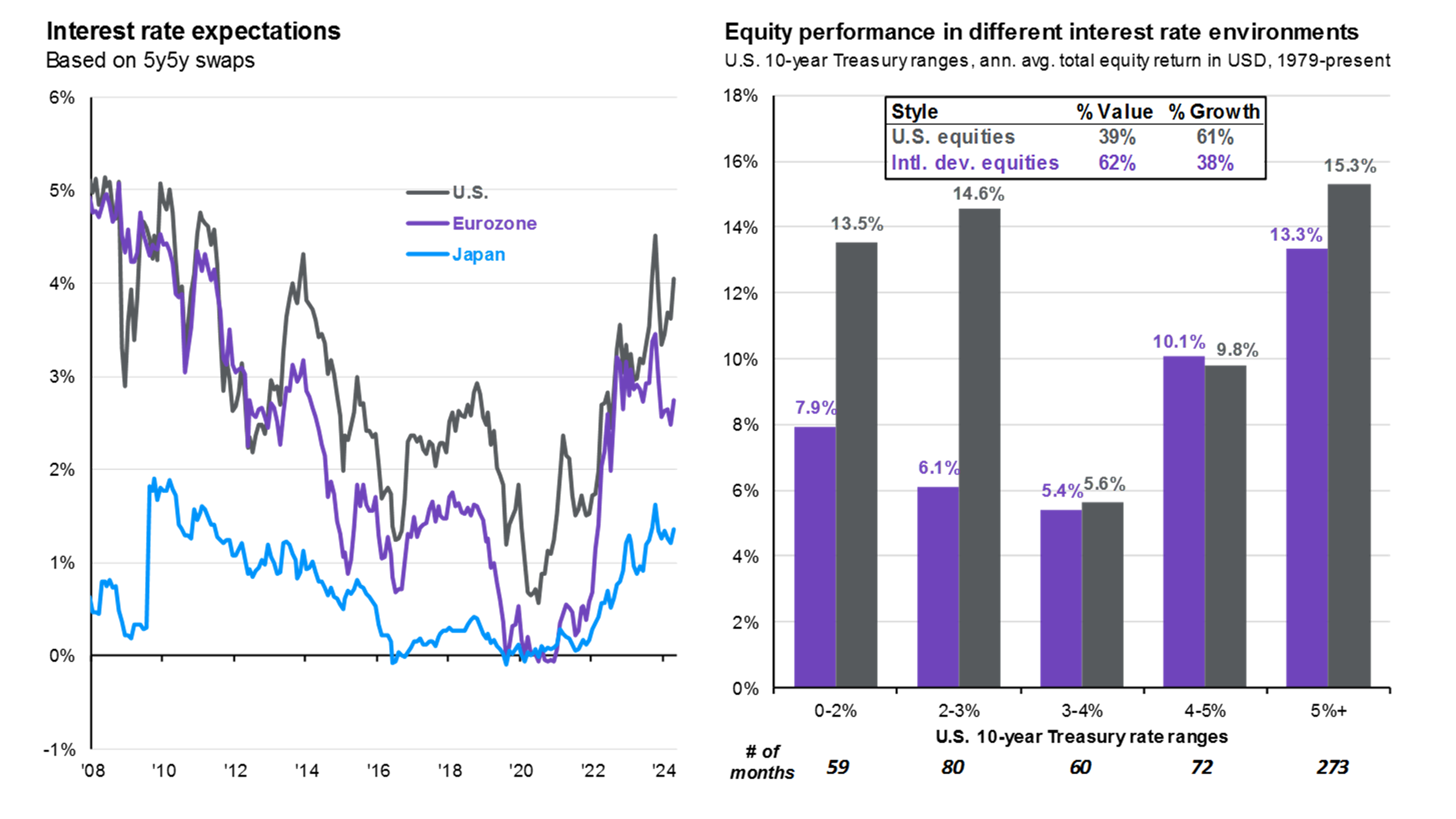

International equity earnings and valuations

This page looks at different measures of equity earnings and valuations across five areas of the world: The U.S., China, EM, Japan and Europe. The left side provides a snapshot of global equity market fundamentals, with earnings expectations over the next twelve months. It helps explain why international outperformed the U.S. from 2000-2007 (when earnings outside the U.S. grew much faster than those in the U.S.) and underperformed the U.S. from 2007-2022 (when U.S. earnings grew much faster than other regions). Recently, U.S. earnings expectations have been coming down, while they have been more resilient (and even positive) in other areas of the world. The right side of the page compares each region’s current valuation to its 25‐year history and its valuation at the end of 2021. Overall, this slide emphasizes the potential for a turning point in earnings growth in international regions vs. the U.S., which combined with discounted valuations, help make the case for investing in international equities.