Slide Image

Chart Image

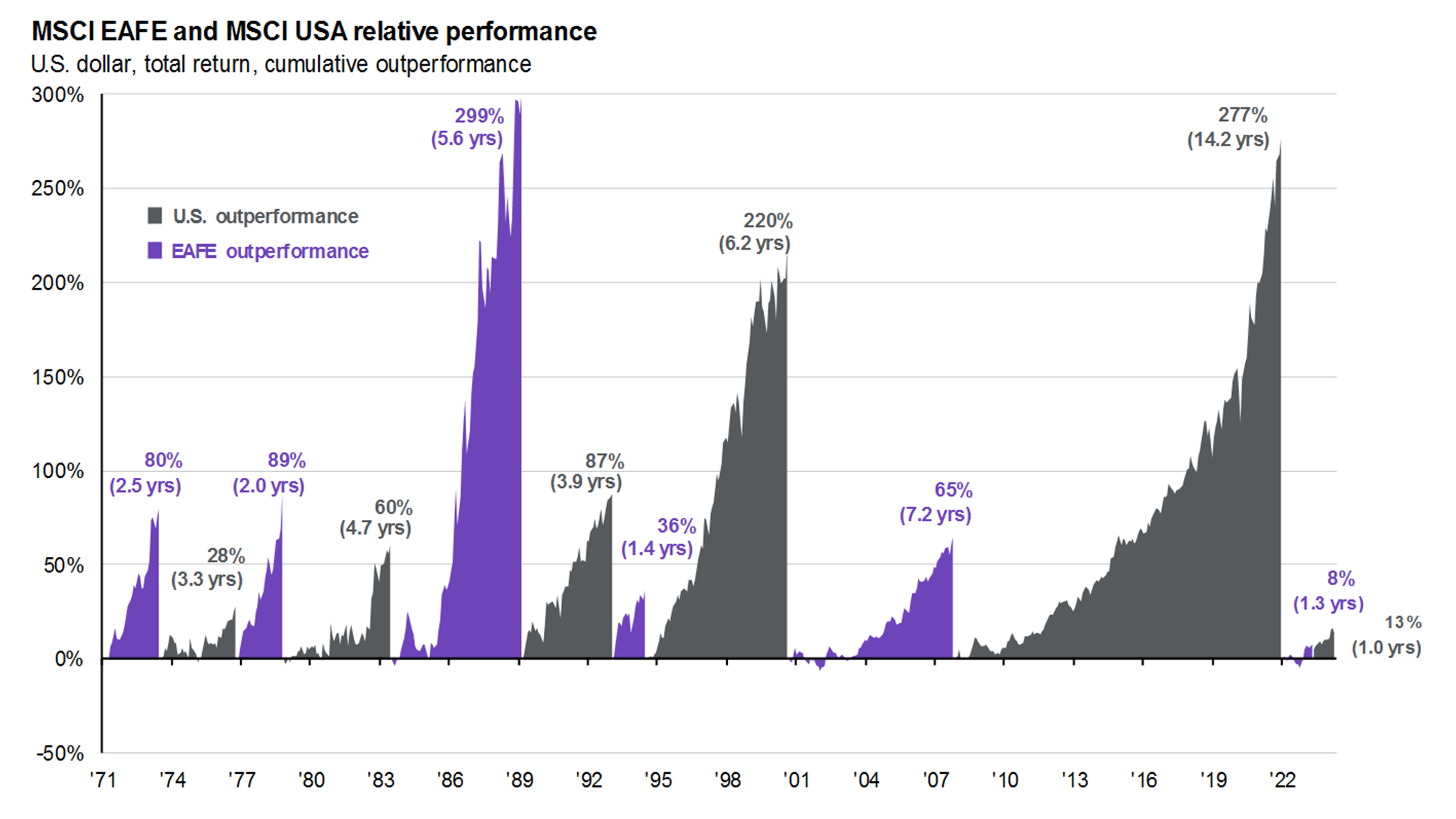

Global equity markets

This page looks at international equity markets and the opportunity set for global investing. The top-right chart underscores the reason why investors should look internationally, as almost half of the equity market opportunity set is found outside of the U.S. The bottom-right graph shows the percentage of revenue derived from the home country of listing. Where a company is listed can be very different from where its revenue is derived, and international indices such as MSCI Europe ex-UK and MSCI UK tend to be very internationally exposed. The table on the left shows USD and local currency returns for various international indices, highlighting the meaningful impact that currencies can have on returns. On the far right columns of the table, we show 15-year annualized returns and a 15-year beta, which is a measure of volatility.