Slide Image

Chart Image

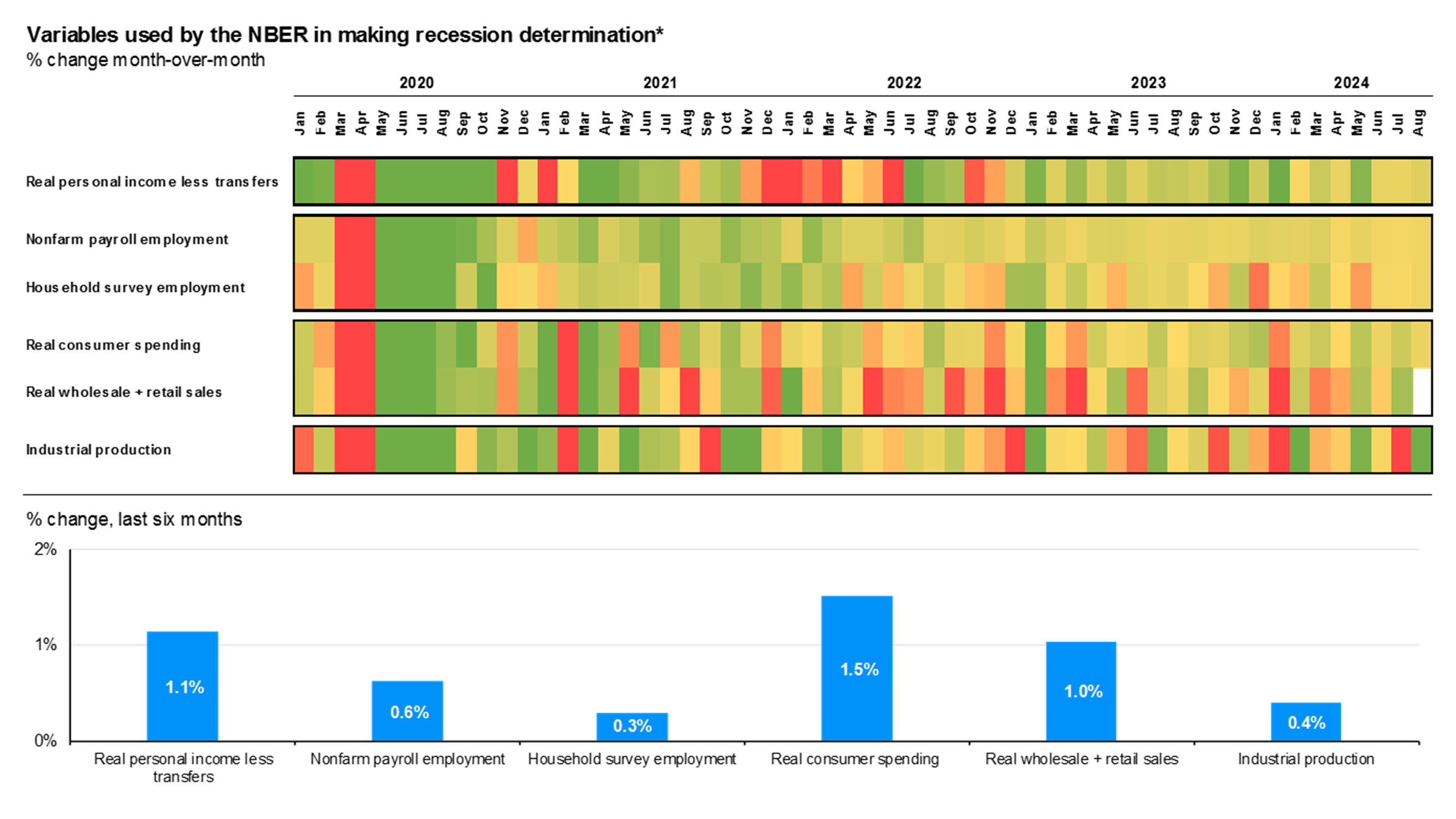

Recession determinants

Tighter monetary policy and persistent inflation have weighed on economic growth and increased the risk of a U.S. recession. A common, back-of-the-envelope definition of a recession is two consecutive quarters of GDP growth. However, the unofficial scorekeeper of when recessions start and end is the National Bureau of Economic Research (the NBER), and they look for a broad-based decline in a variety of economic indicators to make their determination. On this slide, we show a heatmap of the economic variables the NBER has listed in their methodology on a monthly basis going back to 2019. Green means that these variables grew month-over-month and red means that they fell. The shading or boldness of the color illustrates how strong the gain or loss was relative to history. On the bottom, we show the Citi Economic Surprise Index back to 2018. A reading above 0 indicates that economic performance has been better than expected while a reading below 0 indicates that economic performance has been worse than expected. Recently, economic data have been beating expectations, although only modestly. While it doesn’t look like the economy is currently in a recession, monitoring the indicators on this slide will provide a good gauge.