JPMorgan SmartRetirement® Blend 2035

For individuals born between 1969 and 1973

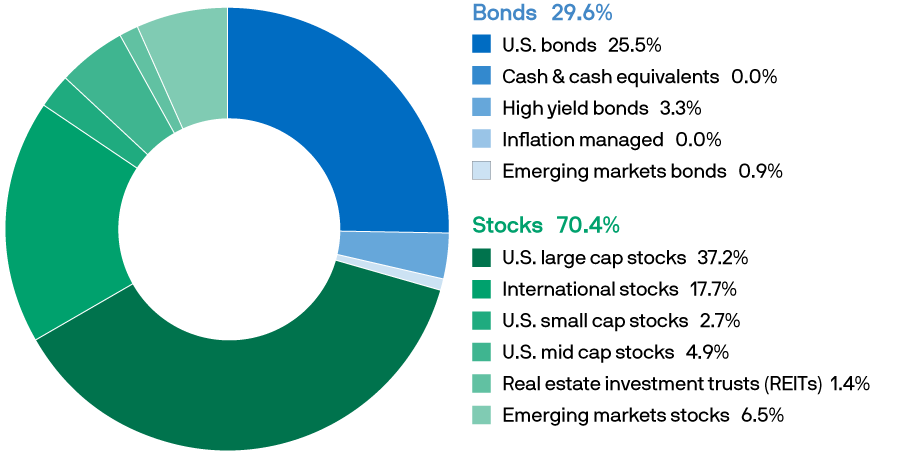

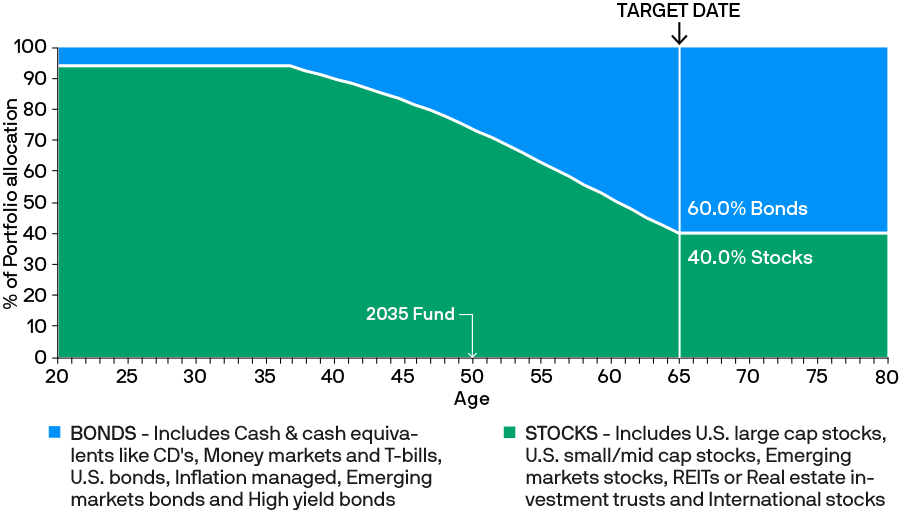

When you select a SmartRetirement Blend Fund, you're automatically invested in more than 20 underlying funds across two asset classes - stocks and bonds. By investing in the fund, a team of more than 100 investment professionals at J.P. Morgan is responsible for shifting the allocation from stocks to bonds as the fund approaches its target date. This way your fund automatically changes to become more conservative as you approach your target retirement date.

Since each SmartRetirement Blend Fund is dynamically managed for a specific date in the future, you'll want to consider selecting one named for the year closest to when you plan to retire and begin withdrawing from your account.

Why SmartRetirement Blend? Hear from investors like you.

[MUSIC PLAYING] I'm currently not invested in target date funds, but based on my research and looking at what other investors are doing with their money, I realize I'm a prime candidate for target date funds. Well, target date fund has what's called a glide path. It's basically looking at the allocation between stocks and bonds that is appropriate for how long it is before an individual investor has until they retire.

And so as that individual investor gets closer to that retirement date, that allocation between stocks, bonds, and cash will shift to a more conservative allocation, meaning less stock. And so without that investor having to continue to babysit that allocation, that glide path makes those changes for them. I think their expertise is looking at what's going on in the economy, what's going on in the market, and making good decisions about what underlying investments make up those funds.

Well, with a target date fund, I just need to choose what I think I'm going to retire. It's that simple. I think a targeted fund speaks to what people want to spend their time on. They don't want to spend the time on retirement. For them, retirement's scary. It's way off in the future. They don't want to think about it. But if they can get an investment like a target date fund that takes a lot of the guesswork out of it for them, I think it's a great option for them.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

Bruce appreciates the simplicity of choosing a target date for his retirement and letting the fund gradually shift as he approaches that date

[MUSIC PLAYING] Investing in a target date fund is kind of like the school box that I can buy for my children when they enroll for their classes at the beginning of the year. Instead of going out to the stores and getting all the separate supplies that I need for each child for each different class, I buy one school box for each child and it includes everything they need for that grade.

I think probably the people who manage my money have a really complex system that they use to pick the right funds, which is why I let them do it. I think life before target date funds was kind of a random choosing of funds for me. I could read the documentation on what the different funds provided, how much risk there was, but the education that it took to get myself comfortable with what I was choosing was hard.

Now that I have the target date funds, the choice is fairly simple. I know that the allocation mix is right for my age, and I can set up my deferrals for my money to go into my retirement plan, and be happy with my choice.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

For Maria, she likes the idea of having to make one decision and letting our experts manage the rest.

[MUSIC PLAYING] Our fund options continue to grow and grow, and so I think the process became more difficult and time-consuming. And so with the implementation of target date funds in our plan, it really made it a lot easier for me to spend a lot less time, and haven't had to maybe stress out as much as I did in the past.

Before the plan offered target date funds, I would take a look at the list of funds really on an annual basis, and oftentimes, take my best guess as to what I thought was adequate diversification. I think, once you make a decision as to here's how you want to invest and here's what you're comfortable with, I think it's very easy just to stick with that and just really not make any changes.

I was just comfortable where I was at, didn't really get proactive to look at the new options that had been offered. And then finally, when I did take a look and talk to some people, I thought it was time for me to make a change at last. These managers are familiar with funds, they're familiar with the different types of asset classes, and they understand how these combinations can work together towards a certain end date to make sure that you do have an appropriate mix.

I don't expect that I will continue to work at this job until I'm 85 years old, so I know that I'm going to be needing some extra money. And I know that the earlier I save, my investments will grow, and I'll be able to have more of that income that I need in retirement. Target date funds are not guaranteed. Just like any investment that you have in a retirement plan, they're not going to be guaranteed, but I do believe that they provide a level of sanity and competence that you might not find if you're just willy nilly picking your own funds.

This material has been prepared for informational and educational purposes only. It is not intended to provide and should not be relied upon for investment, accounting, legal, or tax advice. JP Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase and Company and its affiliates worldwide.

Mike appreciates that even from the start he’s well-diversified with just one fund.

What's in the 2035 Fund?*