Slide Image

Chart Image

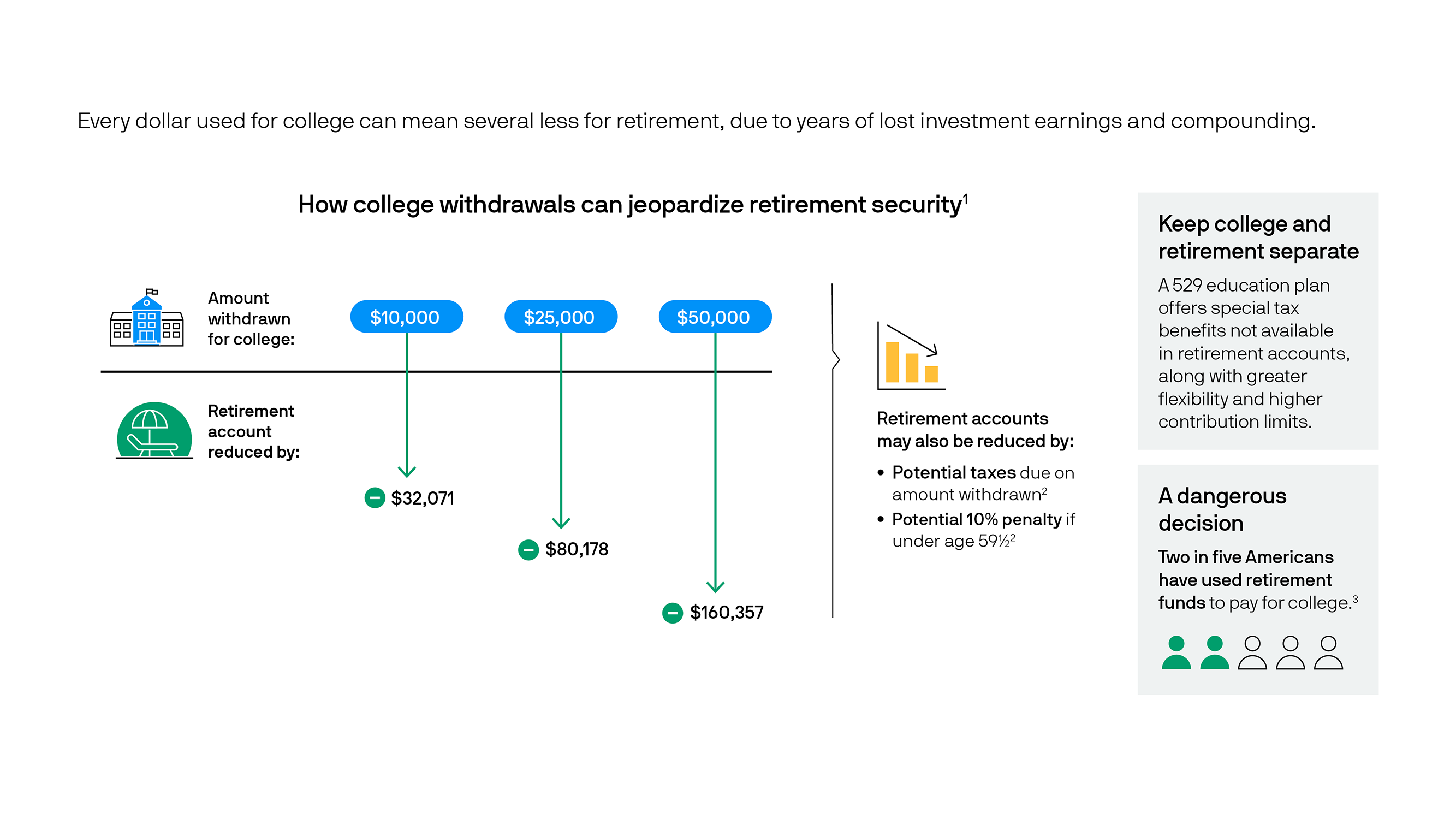

Don't pay for college with retirement funds

Every dollar taken from 401(k)s and IRAs to pay for college can mean several dollars less for retirement, due to years of lost investment earnings and compounding. For example, withdrawing $25,000 for college now could result in $80,000 less for retirement in 20 years. Using retirement money for college may also result in taxes, penalties and reduced financial aid in certain situations. Key takeaway: Setting up and contributing to separate accounts for college and retirement can help investors pursue both goals at the same time.