Slide Image

Chart Image

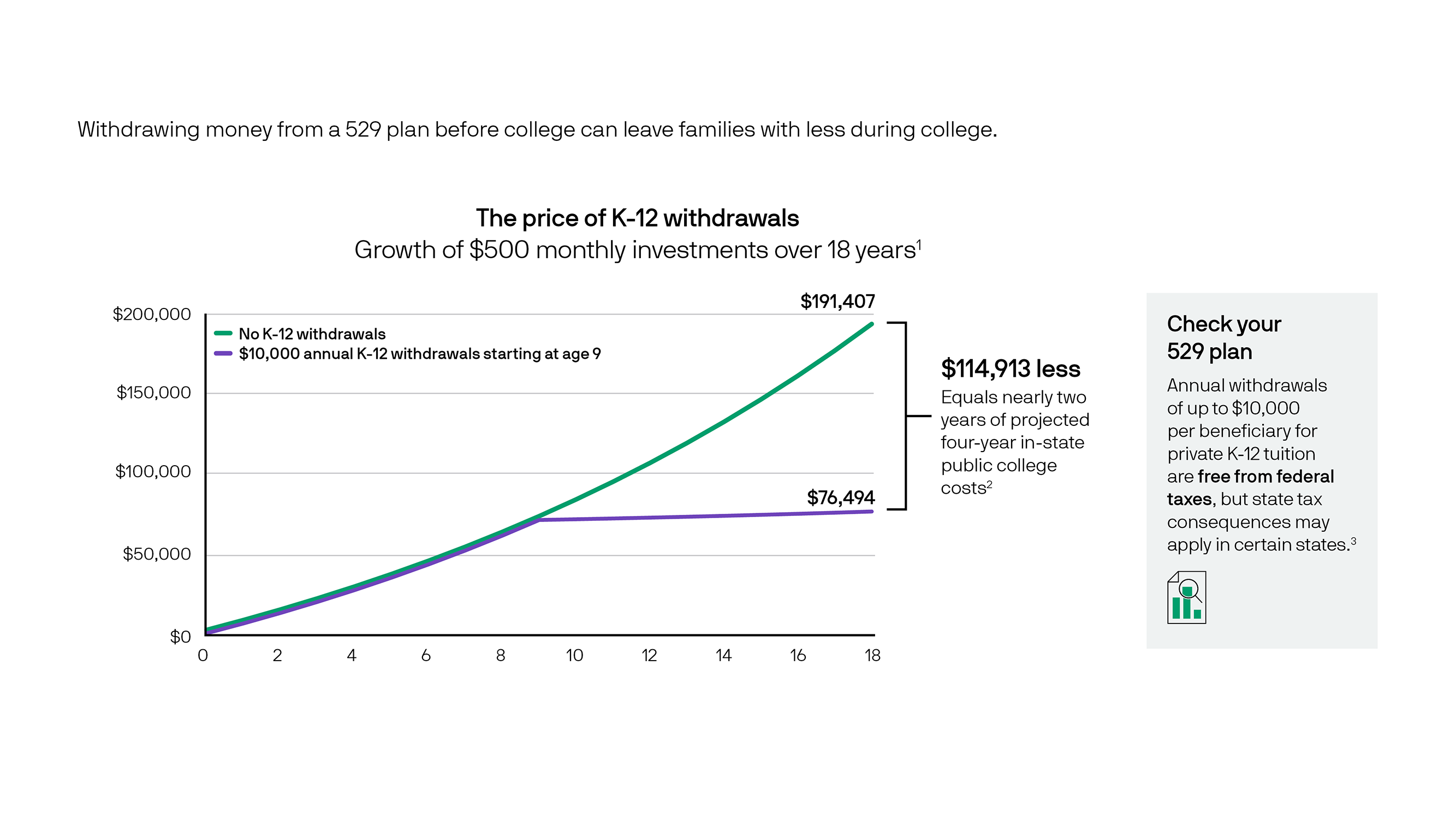

How K-12 withdrawals impact college funds

529 plans allow federal tax-free withdrawals of up to $10,000 per student each year for private K-12 tuition expenses.* However, those withdrawals can leave families with less for college. This chart shows that starting annual $10,000 withdrawals at age 9 results in nearly $115,000 less at age 18 – the equivalent of about two full years of projected in-state public college costs. Key takeaway: K-12 withdrawals can significantly impact college funds and may result in state tax consequences as well.

* Under New York State law, withdrawals used to pay elementary or secondary school tuition or qualified education loan repayments are considered non-qualified distributions and will require the recapture of any New York State tax benefits that had accrued on contributions.