Slide Image

Chart Image

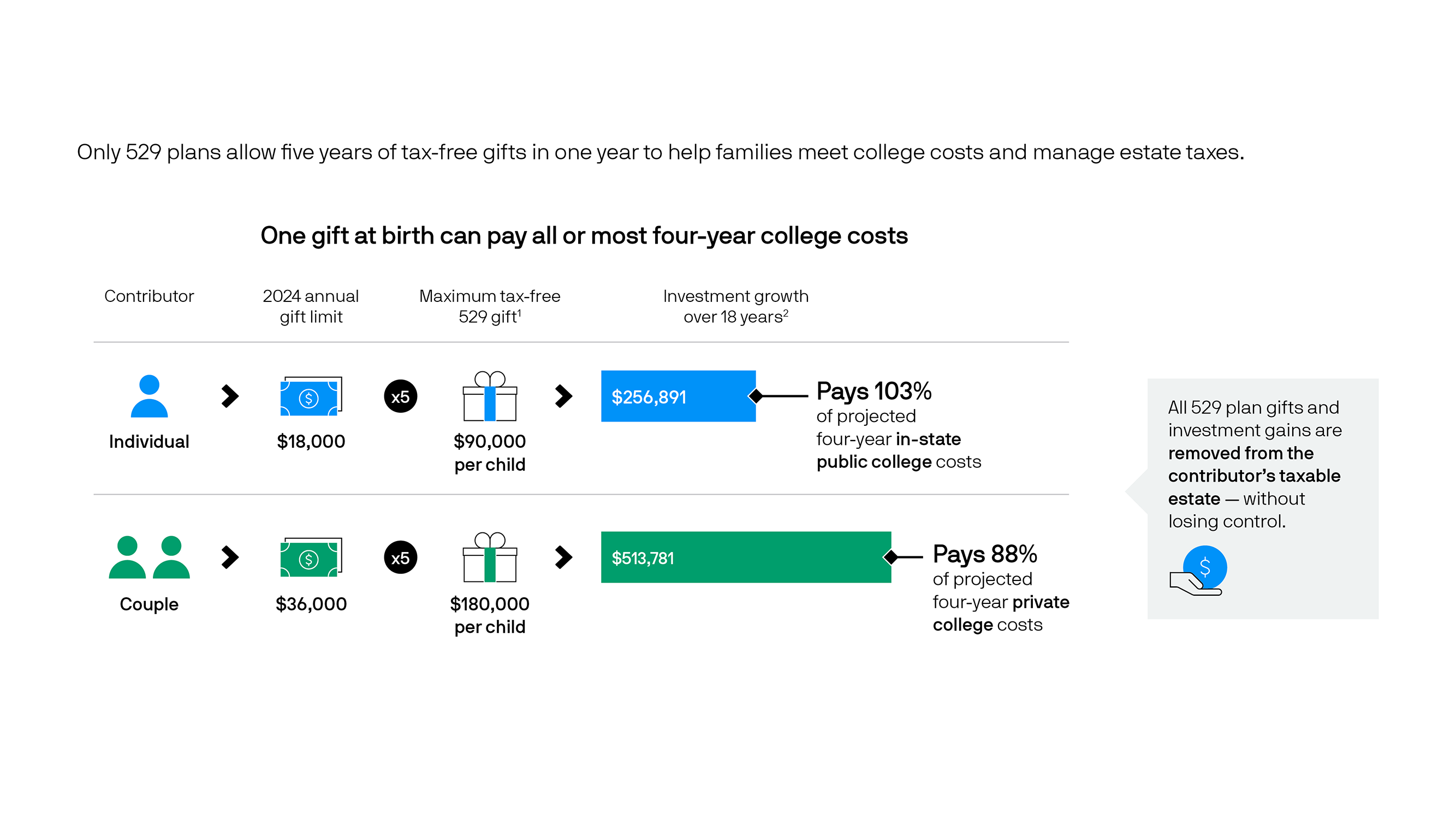

Making the most of college gifts

Only 529 plans allow five years of tax-free gifts in one year – up to $85,000 per child from individuals and $170,000 from married couples filing jointly. This chart shows that one large gift at a child’s birth may pay all or most of the expected total costs at four-year public and private colleges. As an added benefit, all 529 plan gifts and investment gains are removed from the contributor’s taxable estate – without losing control over the assets. Key takeaway: Gifts to 529 plans can help families meet college costs while also reducing estate taxes, increasing inheritances and creating lasting legacies.