Slide Image

Chart Image

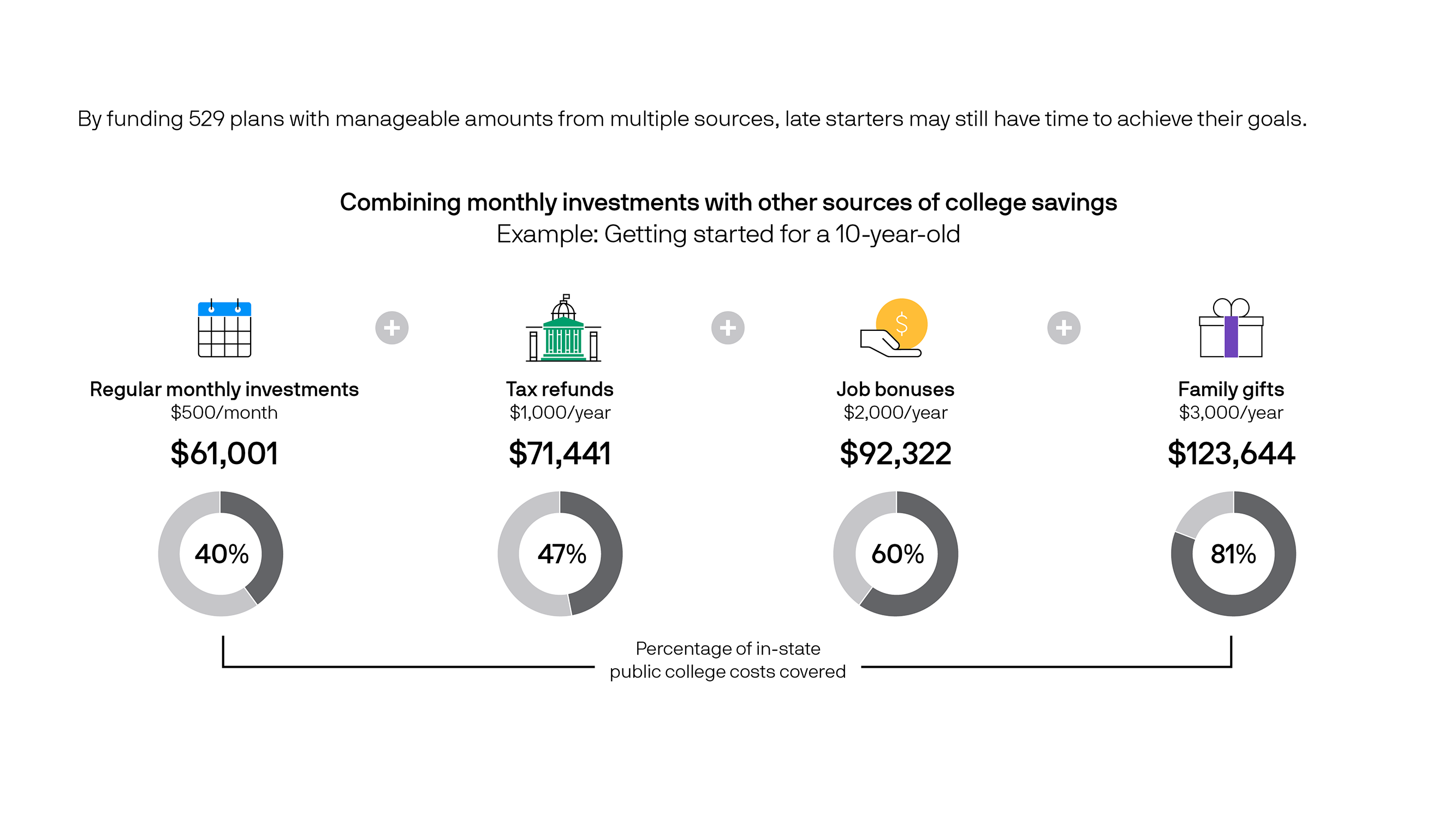

Catching up on college investing

To make up for lost time, this chart shows the impact of combining regular monthly contributions with additional annual investments from tax refunds, job bonuses and family gifts. For a family just starting to save for a 10-year-old child, a combination of all these investments covers 84% of projected in-state public college costs in just eight years. Key takeaway: It’s never too late to invest for college. By funding 529 plans with manageable amounts from multiple sources, late starters may still have time to achieve their goals.