Slide Image

Chart Image

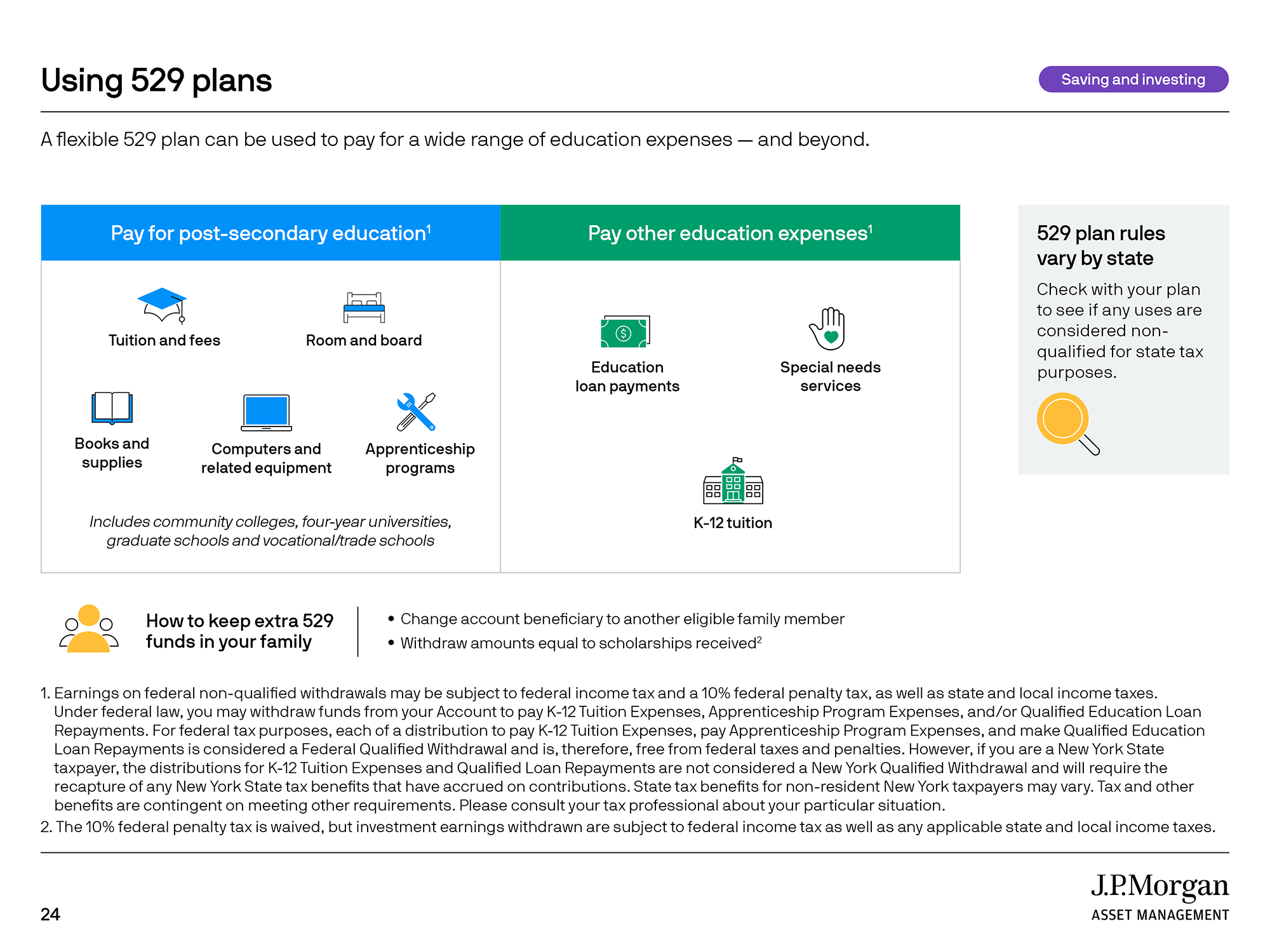

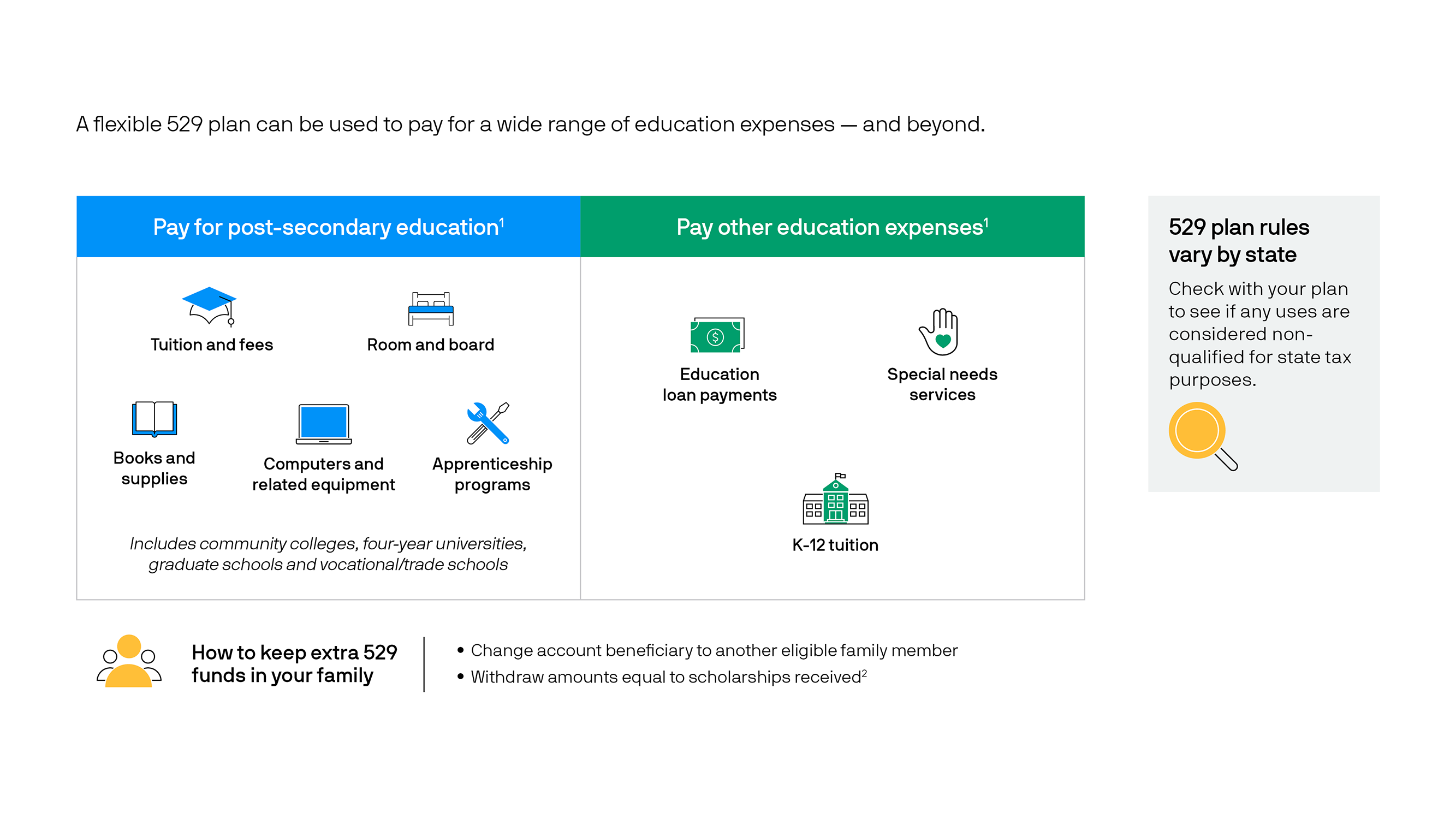

The 529 plan advantage

A 529 plan’s tax advantages include tax-free withdrawals for qualified education expenses* and the option to make large tax-free gifts that are removed from taxable estates. Account owners have the flexibility to change beneficiaries and use funds at any accredited school, with little or no impact on financial aid eligibility. There are no income or age limits to participate. Low investment minimums make it easy to get started, and high contribution maximums allow families to meet rising education costs. Key takeaway: 529 plans offer benefits not found in other types of accounts.

* Earnings on federal non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. New York State tax deductions may be subject to recapture in certain additional circumstances such as rollovers to another state’s 529 plan, withdrawals used to pay elementary or secondary school tuition, or qualified education loan repayments as described in the Disclosure Booklet and Tuition Savings Agreement. State tax benefits for non-resident New York taxpayers may vary. Tax and other benefits are contingent on meeting other requirements. Please consult your tax professional about your particular situation."