Slide Image

Chart Image

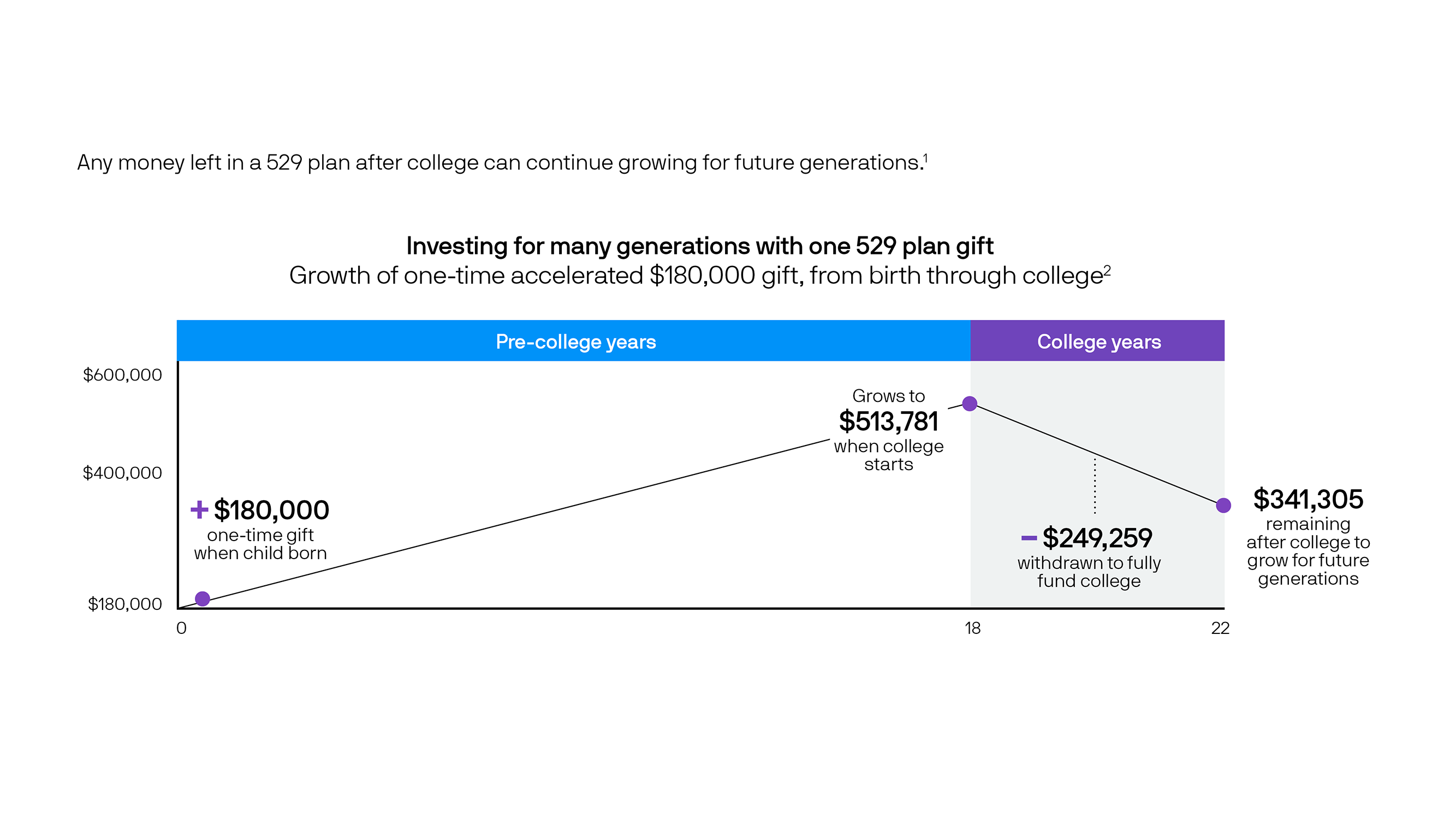

Creating family legacies with 529 plans

529 plans are effective legacy planning tools because any money left over after college can continue growing for future generations. This chart tracks one 529 plan gift from a child’s birth through post-college years. The account grows up until college and then declines in value as money is withdrawn to pay the bills. The remaining balance then keeps working for the next generation, and so on. Key takeaway: In this example, a one-time $170,000 gift fully pays for college, with $375,000 still left when the legacy begins.