How to select from across different types of money market funds

Choosing a liquidity product can be challenging given the vast range of money market funds and other liquidity management options that are available.

When investing in a money market fund, it’s important to first consider the purpose of the cash investment and to ensure that the options for cash segmentation have been explored across cash portfolios. It’s also crucial to understand the differences in liquidity product structures and holdings.

Cash segmentation

With good cash forecasting, and depending on the need for liquidity, security and yield, an organisation can segment its short-term cash portfolio into three separate buckets: operating cash, reserve cash and strategic cash.

A cash investment policy statement promotes consistent, long-term discipline in decision-making by allowing an organisation to define its short-term investment objectives and the strategies it can use to achieve them. Policy statements should maintain a list of approved short-term investments and instruments, including suitable time deposits and approved liquidity fund vehicles. They should also specify minimum rating requirements, concentration limits and other criteria. In addition, policies should establish clear parameters for cash segmentation and investment diversification.

Explore the key characteristics of money market funds

Money market funds are highly regulated, actively managed pooled mutual funds that invest in diversified portfolios of short-term, high-quality debt instruments, with the aim of preserving capital, providing a high degree of liquidity and generating competitive returns relative to other cash equivalents.

They are structured as independent corporate entities, with boards of directors to safeguard the interests of individual shareholders, while assets are ring-fenced and held remotely from the asset manager’s own balance sheet.

Capital preservation

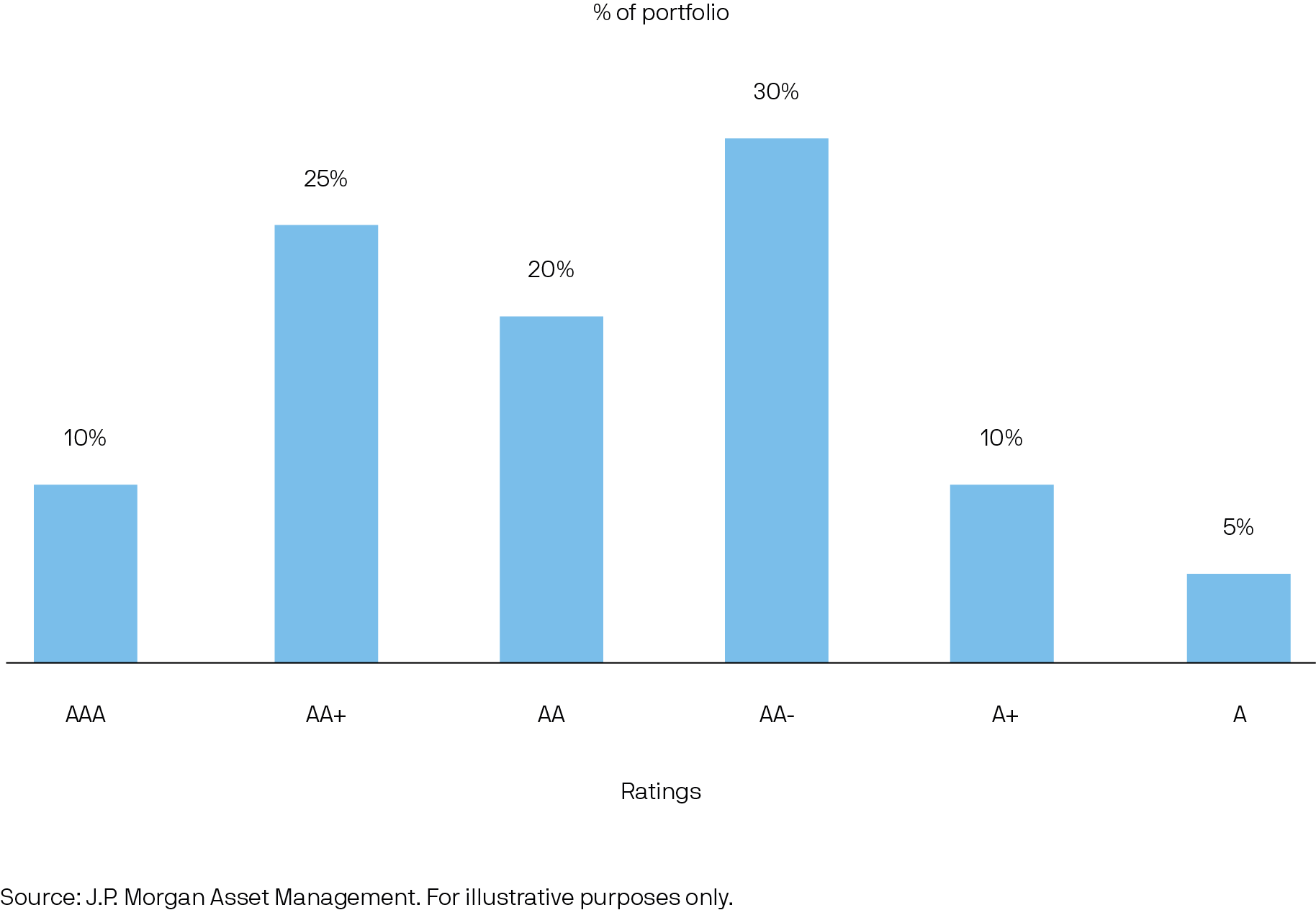

Money market funds primarily invest in a diversified range of short-tenor, high-quality securities to protect capital, which is of paramount importance to liquidity investors.

Leading money market fund managers will also conduct their own credit analysis in addition to considering ratings from independent credit rating agencies. A manager’s in-house credit analysis capability is an important point for investors to consider when choosing a money market fund.

Liquidity

Money market fund investors require a high level of liquidity and therefore money market funds typically offer same day (T+0) or next day (T+1) access.

This level of liquidity is particularly helpful for treasury teams when the ability to accurately predict cash flows is difficult.

Money market fund portfolio managers are able to offer this facility by maintaining high levels of daily and weekly liquid assets while investing in securities that are easily liquidated, if necessary.

In addition to daily liquidity, money market funds may also have later cut-off times than some alternative cash investment options, meaning that treasury departments have more time during the day to make decisions regarding the company’s liquidity needs.

Diversification

While it doesn’t guarantee positive returns or eliminate risk of capital loss, diversification is critical to preserving capital, generating returns and ensuring liquidity.

Money market funds hold a highly diversified range of securities from a wide range of issuers and maturities and focus on securities with the highest short-term credit ratings available, allowing investors to participate in a more diverse portfolio than they could achieve individually.

For example, a money market fund is generally permitted to hold no more than 5% in a single issuer (there are exceptions for repurchase agreements and overnight bank deposits, as well as for government securities).

Active fund management

Active fund management is essential to ensuring the key objectives of a money market fund — capital preservation, liquidity and return maximisation — can be achieved.

Money market fund portfolio managers will actively adjust the fund’s exposure to different issuers and sectors depending on their credit outlook. Active managers will also adjust the maturity of investments and the duration of the fund to reflect interest rate views and the expected cash inflows and outflows of the fund.

For example, in times of market volatility or uncertainty, the amount of liquidity held will typically be increased.

A money market fund can free treasury professionals from the business of evaluating counterparties and trading securities — while offering a high degree of transparency. As a result, money market fund providers have become even more transparent about their underlying investments and usually provide holding reports detailing the underlying securities on a monthly or more frequent basis.

The structure of money market funds

Money market funds use three main types of accounting methodology to calculate their net asset value (NAV), reflecting differences in risks and holdings across funds, and the types of investor who can buy them.

Key money market facts by region

All US money market funds are classified as either retail, government/treasury (invest at least 99.5% in cash, government securities or repurchase agreements that are fully collateralised by government securities) or institutional. Retail and government money market funds can use a CNAV structure, while institutional funds are FNAV only.

| CNAV MMF | FNAV MMF | |

|---|---|---|

| WAM (max) | 60 days | 60 days |

| WAL (max) | 120 days | 120 days |

| Maturity (max) | 397 days | 397 days |

| Daily liquid assets (min) | 25% | 25% |

| Weekly liquid assets (min) | 50% | 50% |

| Dealing NAV | Two decimals | Four decimals |

| Valuation | Amortized cost | Mark-to-market |

| Fees | Discretionary | Mandatory & Discretionary. Mandatory fees for Insti Prime and Insti Tax-Free if net outflows over 5% |

| Minimum credit quality | A-1, P-1, F1 | A-1, P-1, F1 |

Source: Security and Exchange Commission (SEC) Guidelines, Rule 2a-7, as of 31 July 2025.

All Europe-domiciled money market funds are classified as short-term money market funds or standard money market funds. Short-term funds can be CNAV (if at least 99.5% of holdings are in government assets), LVNAV or VNAV. Standard funds can only use the VNAV structure, as higher interest rate risks make it harder to maintain a constant NAV.

| Short-term MMF | Standard MMF | |||

|---|---|---|---|---|

| CNAV MMF | LVNAV MMF | VNAV MMF | VNAV MMF | |

| WAM (max) | 60 days | 60 days | 60 days | Six months |

| WAL (max) | 120 days | 120 days | 120 days | 12 months |

| Maturity (max) | 397 days | 397 days | 397 days | 397 days or less, or 2 years when the next interest reset is within 397 days |

| Daily liquid assets (min) | 10% | 10% | 7.5% | 7.5% |

| Weekly liquid assets (min) | 30% | 30% | 15% | 15% |

| Dealing NAV | Two decimals (provided NAV deviates < 50 bps) | Two decimals (provided NAV deviates < 20 bps) | Four decimals | Four decimals |

| Valuation | Amortized cost | Amortized cost for instruments ≤ 75 days; Mark-to-market for instruments > 75 days | Mark-to-market | Mark-to-market |

| Gates and fees | Optional and mandatory triggers | Optional and mandatory triggers | Optional | Optional |

| Minimum credit quality | A-1, P-1 | A-1, P-1 | A-1, P-1 | A-2, P-2 |

Source: European Security and Markets Authority (ESMA) Guidelines, as of 31 July 2025.

Historically, all money market funds in China used a CNAV structure; however, since April 2019, any new China-based money market fund must use a VNAV structure.

| CNAV | VNAV | |

|---|---|---|

| WAM (max) | 120 days | 120 days |

| WAL (max) | 240 days | 240 days |

| Maturity (max) | Bonds: 397 days TD and repo: one year FRN: Max 20% if tenor> 397 days |

Bonds: 397 days TD and repo: one year FRN: Max 20% if tenor >397 days |

| Daily liquid assets (min) | 5% | 5% |

| Weekly liquid assets (min) | 10% | 10% |

| Dealing NAV | T+1 | T+1 |

| Valuation | Stable NAV | Variable NAV |

| Gates and fees | Yes* | Yes* |

| Minimum credit quality | AAA (Domestic scale); Max 10% in AA+ rated | AAA (Domestic scale); Max 10% in AA+ rated |

Source: China Securities Regulatory Commission (CSRC) Guidelines, as of 31 July 2025. FRN: floating-rate note. TD: term deposits. *Fees: 1% fee charged on individual investor redemptions >1% if WLA is <5% and NAV deviation is negative. However, this can be waived if the fund manager and custodian agree an exception is in the best interest of the fund. Gates: If redemptions are more than 10% per investor per day, the asset manager can partially delay or postpone the redemption.

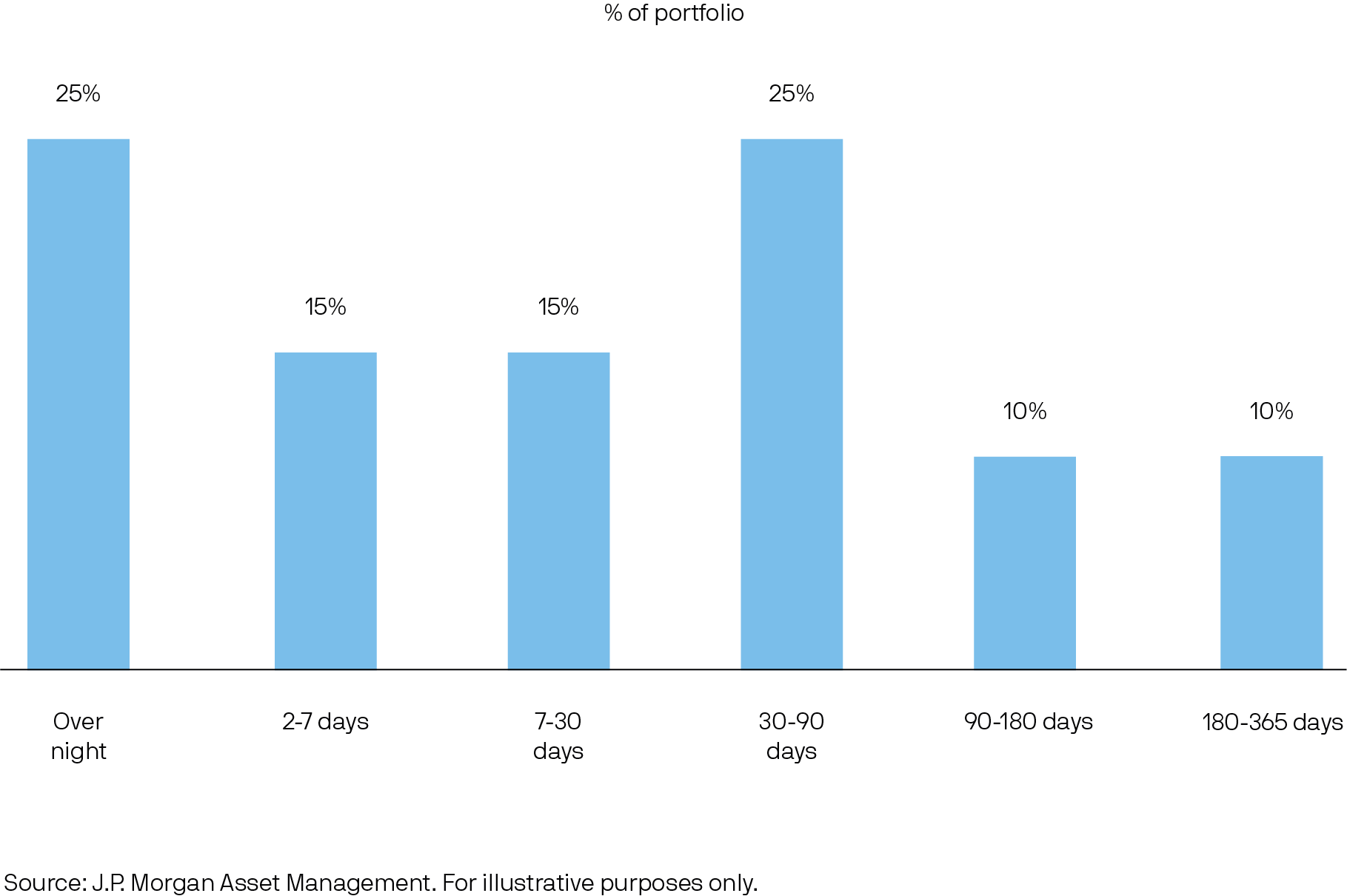

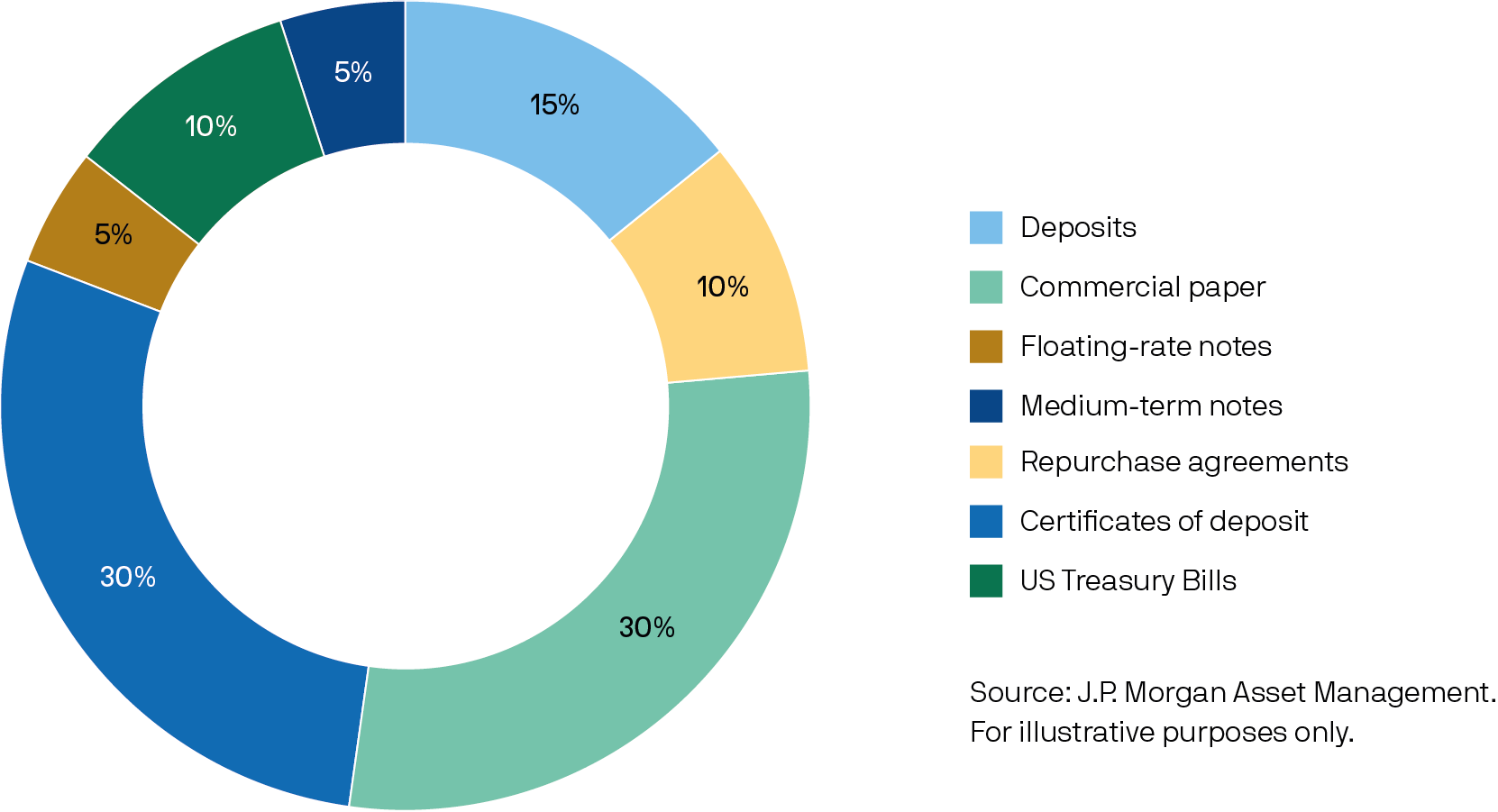

A typical money market fund portfolio

Money market funds aim to provide liquid homes for cash investments by holding highly diversified portfolios of short-term debt instruments from a broad range of highly-rated issuers, including governments, financial institutions and high quality corporations.

Typical money market fund securities

Money market funds may hold multiple types of short-term securities (usually with less than one-month maturity). Typically, these securities could include commercial paper, certificates of deposit, floating rate notes, medium-term notes, repurchase agreements (repos), agency securities, and government bonds or Treasury bills.

| Commercial Paper (CP) | Certificate of Deposit (CD) | Government bills | Floating-rate notes (FRNs) | Repurchase agreements (Repos) | Asset-backed commercial paper (ABCP) | Medium-term notes (MTNs) | |

|---|---|---|---|---|---|---|---|

| Summary | Tradable promissory notes | Similar to term bank deposits and can be traded on the secondary market | Short-term fixed interest securities often known as Treasury bills in the US | Securities that rest their rate of interest periodically | Agreement between two parties to sell and repurchase a security with interest. MMFs typically do reverse repos, lending cash and taking in collateral | A bankruptcy remote special purpose entity which issues commercial paper and uses the proceeds to acquire a portfolio of assets, such as receivables, securities and loans | Securities that are issued with fixed interest rates |

| Features | Highly liquid Allows diversification across different industries Wide range of maturities allows terms to be targeted precisely | Highly liquid – issuing bank often willing to repurchase before maturity | Liquid and highly active market Sovereign issuer Wide range of maturities Low risk reflected in low yield | Attractive when interest rate outlook is uncertain Variable rate makes them less exposed to interest rate risks | Negotiated individually so interest and term can be highly tailored MMFs usually only have government debt as collateral, which is typically priced at a discount for additional security Ultra-short duration funds can do non-traditional repos | Backed by collateral or financial assets, such as trade receivables (bills) Contains liquidity and credit support features designed to cover asset / liability mismatches between the underlying collateral cash flow and the ABCP, as well as the credit performance of the collateral | Highly liquid Allows diversification across different industries Wide range of maturities |

| Maturity | Overnight to one year (typically <95days) | One day to two years | Four weeks to one year | Typically one year or greater | Overnight to one year, typically overnight | One day to two years | Typically one year or greater |

| Issued by | Corporate and financial institutions, agencies and supranationals | Banks | Governments | Corporate and financial institutions, agencies and supranationals | Financial institutions | Special purpose vehicle established by a highly-rated financial institution | Corporates, financial institutions, agencies and supranationals |

| Interest rate | Fixed | Fixed* | Fixed | Variable | Fixed | Fixed | Fixed |

| Interest paid | At maturity** | At maturity | At maturity** | During term | At maturity** | At maturity** | During the term or at maturity** |

* Certificates of Deposit can be issued as fixed or floating and with coupon or at a discount. ** Via the security being issued at a discount to face value. Source: J.P. Morgan Asset Management. For illustrative purposes only. These investment examples are included solely to illustrate the investment process and strategies which may be utilized by the Fund. Please note that these investments are not necessarily representative of future investments that the Fund will make.

Comparing different liquidity investment options

When devising a liquidity strategy, the benefits and risks of money market funds should be evaluated alongside other liquidity investment options, such as cash deposits or ultra-short duration bond funds.

Two important benefits of investing in money market funds rather than in bank deposits are investment efficiency and cost. Using money market funds relieves treasury professionals from some of the day-to-day operational activities associated with overseeing numerous individual cash investments. In addition, most money market funds offer a T+0 or T+1 settlement cycle for withdrawing assets. By contrast, cash managers using a ladder of various bank deposits with different maturities may be forced to break a bank deposit agreement should they suddenly need a larger amount of cash than expected.

Money market funds also prioritise capital preservation by investing in a diversified portfolio, spreading counterparty risk and reducing volatility. In contrast, deposits may be concentrated with a limited number of counterparties. However, this diversification benefit of money market funds may be balanced by the fact that in some countries, bank deposits up to a specified value are protected by government guarantees, although these guarantees do not always apply to institutional investors.

The return on money market funds may also be higher than for bank deposits. Money market funds can seek to enhance yield through investing in a broader range of short-tenor instruments. In standard market conditions, when the yield curve is upward sloping, money market fund portfolio managers can invest in underlying securities with longer durations to increase yields.

An ultra-short duration bond fund is one of the first strategies investors might consider as they step out from money market funds using a cash segmentation strategy.

Ultra-short duration bond funds typically blend money market securities, such as commercial paper and certificates of deposit, with short-dated bonds. The funds tend to hold securities with final maturities out to either three years or five years, depending on client preference. The longer securities in the blend include government, agency, covered and corporate bonds with some securitized credit, such as AAA-rated asset-backed securities (ABS). Derivatives are generally only used for hedging purposes.

An ultra-short duration strategy typically allows a weighted average duration out to a maximum of one year, compared to a weighted average maturity cap of 60 days for short-term money market funds and 180 days for standard money market funds. This additional duration risk is one lever to help generate additional returns. Credit risk is the other lever. Whereas money market funds have a minimum credit-rating floor of single A, ultra-short duration strategies typically include down to BBB-rated securities.

The widening of the bond universe not only allows an ultra-short duration strategy to generate additional returns, but also offers greater diversification of underlying issuers, which is important because an increasing number of corporate issuers are rated BBB. Furthermore, whereas money market funds offer exposure mainly to issuers from the financials sector, the one- to three-year and one- to five-year corporate bond markets also include issuers from the industrials and utilities sectors.

When it comes to producing consistent incremental returns across the credit and interest rate cycle, it is crucial for investors to seek out strategies that are backed by a strong investment process.

| MMFs | Cash deposits | Ultra-short duration strategies | |

|---|---|---|---|

| Operational requirements | Actively managed on investors’ behalf with no need for reinvestment | Requires daily management and reinvestment by the investor | Actively managed on investors’ behalf with no need for reinvestment |

| Objective | Actively managed for capital preservation, liquidity and yield | Achieve return, capital preservation and liquidity by locking up cash at a pre-set interest rate and for a preset tenor | Actively managed for return, capital preservation and liquidity |

| Costs | All portfolio management, custody, administration, accounting and transfer agency fees accounted for in the total expense ratio (TER) | Custody expenses, rolling and breakage fees and the cost of treasury resources can all apply | All portfolio management, custody, administration, accounting and transfer agency fees accounted for in the total expense ratio; ETFs also have a bid-ask spread on the shares |

| Security risk | Risk is diversified among multiple securities | Moderate risk from investing in one deposit vehicle | Risk is diversified among multiple securities |

| Counterparty risk | Risk is diversified among multiple counterparties and assets are held off balance sheet with a third-party depository | High, due to investing with one counterparty on their balance sheet | Risk is diversified among multiple counterparties and assets are held off balance sheet with a third-party depository |

| Liquidity | T+1 | T+1 | 5% |

| Dealing NAV | Aim for daily access at all times | Daily access only with overnight deposits | T+1 or T+3 liquidity depending on fund |

| Credit rating | Many MMFs carry a AAA rating | Few AAA-rated banks available to depositors | Fund ratings are less typical, but for many ultra-short portolios, the weighted average credit quality is in the single-A category |

| Credit research | Manager provides ongoing credit analysis for all securities and issuers | Onuson investor to access and monitor bank’s credit rating | Manager provides ongoing credit analysis for all securities and issuers |

| Interest | Option to pay out or reinvest income | Usually paid out daily | Option to pay out or reinvest income |

The importance of correct benchmark selection

The vast majority of asset managers invest portfolios vs. a benchmark, which helps managers understand how they will be judged and organisations understand how managers are performing. Therefore, selecting the correct benchmark is a critical decision. Fixed income investors have a large range of indices available, but the choices for liquidity and ultra-short duration investors are significantly more limited, amplifying the challenge of assessing the risk and return of these strategies. Nevertheless, correctly identifying key investment goals and carefully selecting an appropriate benchmark can help minimise these limitations.

-

Matching the benchmark to the investment strategy

-

What makes a good benchmark?

-

Challenges for liquidity and ultra-short duration investors

-

Using a Treasury Bill-based index as a liquidity benchmark

-

Conclusion

Matching the benchmark to the investment strategy

Once an organisation has chosen an appropriate portfolio strategy that fits its investment objective and investment policy, the next step is considering a benchmark in line with the strategy’s long-term goals (Exhibit 1).

Exhibit 1: An appropriate benchmark helps investors work towards long-term goals

Source: J.P. Morgan Asset Management. Data as of 31 July 2025. For illustrative purposes only.

Selecting an appropriate benchmark is critical for several reasons. First, a benchmark helps investors separate risks and returns into manageable objectives (Exhibit 2). Second, a benchmark also allows fund managers to understand how their performance and risk allocations will be assessed; thirdly it provides investors with a method for measuring performance. Finally, having a benchmark also establishes a neutral position for the portfolio manager, which is still in-line with an investor’s long-term goals.

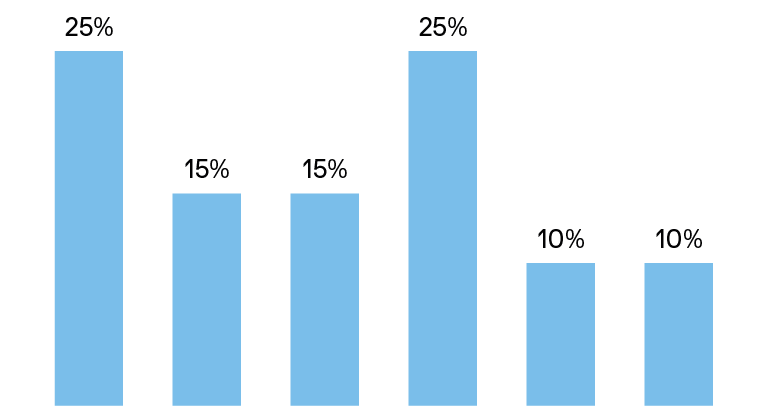

Exhibit 2: Benchmarks help separate returns and risks into manageable objectives

Source: J.P. Morgan Asset Management. For illustrative purposes only.

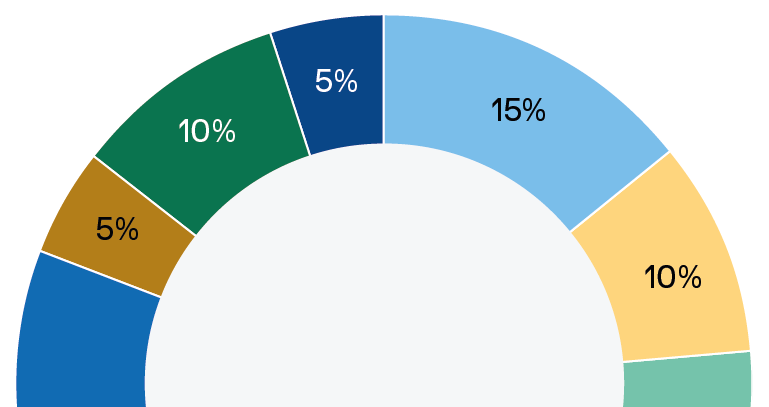

Key factors when selecting an appropriate benchmark include the investor’s risk tolerance and return objective. The characteristics of the benchmark, including duration, maximum and minimum maturities, credit quality and range of issuers, should be aligned with the investor’s guidelines (Exhibit 3).

Exhibit 3: Properly aligning the benchmark and guidelines is important to ensure effective investment:

Source: J.P. Morgan Asset Management. Data as of 31 July 2025. For illustrative purposes only.

What makes a good benchmark?

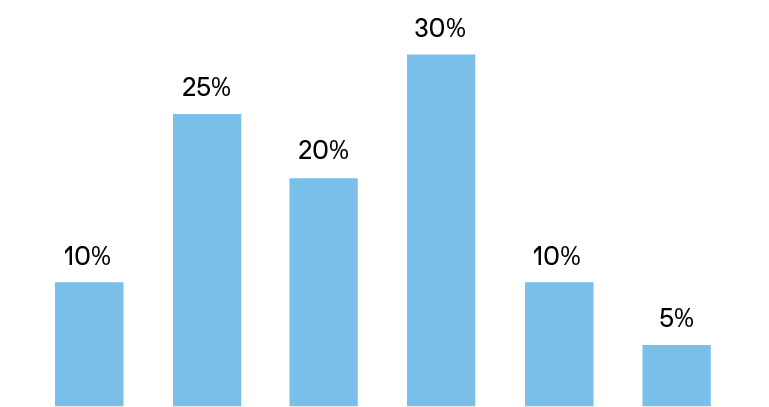

The most useful indices are consistent, comprehensive, relevant, replicable and measurable. Bond indices achieve these characteristics with clear rules that determine which securities can be included – typically based on the debt outstanding, credit rating, time to maturity and issuer type. A well-constructed benchmark can help to closely align market movements and key drivers of a portfolio’s performance (Exhibit 4).

Exhibit 4: A well-constructed bond benchmark can help align portfolio returns with market movements

Source: J.P. Morgan Asset Management. Data as of 31 July 2023.

Bond indices are typically provided by brokers or securities pricing providers, both of which can efficiently monitor and accurately price the securities in the index. An active portfolio manager can then underweight or overweight duration, sectors and issuers vs. the benchmark in an effort to manage risk and/or improve returns.

The number of bond market indices has increased dramatically over the past decade as bond markets increase in size and the desire for customised benchmarks has grown. Investors have a wide range of appropriate indices to choose from – either pre-existing or customised – to closely match their risk and return goals.

Challenges for liquidity and ultra-short duration investors

For money market investors, the potential range of benchmarks is significantly smaller due to several factors. First, many brokers are reluctant to price and trade shorter-term securities which are likely to be held to maturity by investors and have much shorter tenors – necessitating more frequent benchmark rebalancing. Second, short-term security issuance is dominated by money market instruments like commercial paper (CP) and certificates of deposit (CD), where data on issuance, pricing and liquidity may be scarcer.

These factors imply that fixed income indices with average maturities of less than one year are dominated by deposit rate indices, interest rate indices and Treasury Bill indices. Moreover, the majority of these indices may not exist outside of the US due to a lack of liquidity, limited number of suitable data points and lack of broker engagement.

While simple to use and readily available, indices based on deposit rates and interest rates are limited by their inability to capture credit, duration and other fixed income risks, making them unsuitable benchmarks, especially during periods of volatile interest rates (Exhibit 5) and credit spread. Deposit rates are also dependent on specific bank funding costs which may not be representative of broader market conditions. These costs can also be impacted by seasonal, regulatory and local market factors. By combining multiple bank fund rates or using actual trade data, interest rate indices (e.g., SOFR, LIBOR, etc.) seek to mitigate the idiosyncratic characteristics of deposit rates. However, both these benchmarks suffer similar disadvantages – they are unable to capture capital gains and losses, which can magnify tracking error during periods of interest rate and credit spread volatility.

Exhibit 5: Indices based on deposit rates and interest rates only capture return due to yield, while failing to capture capital gains and losses

Source: J.P. Morgan Asset Management. Data as of 31 July 2023.

Using a Treasury Bill-based index as a liquidity benchmark

Treasury Bill-based indices are a better alternative. Treasury Bills are available in most local currency markets and are typically regarded as the most liquid and highest-quality debt, which also contributes to accurate and fair pricing. Meanwhile, in contrast to deposit and interest rate indices, Treasury Bill indices – which are based on actual securities – more accurately replicate the impact of both yield and changes in yield.

While Treasury Bill indices do not capture credit risk, fortunately, the impact of credit spread movements is relatively limited for money market investments given their focus on very short tenor and high credit quality issuers.

Exhibit 6: Treasury Bill indices capture key drivers of return including yield and duration, with longer-maturity returns exhibiting more volatility during periods of interest rates instability

Source: J.P. Morgan Asset Management. Data as of 31 July 2023.

Conclusion:

Selecting a suitable benchmark is critical step towards achieving long-term strategic investing goals. Although, the choice of benchmarks is more limited for liquidity and ultra-short duration investors, choosing a benchmark that accurately captures key drivers of return is important to fairly analyse risks, returns and the performance of investment managers.