The People’s Bank of China’s (PBoC) recent and notable dovish pivot – after having been one of the most hawkish of the major central banks for months has significant implications for Chinese money market rates and investors.

What happened?

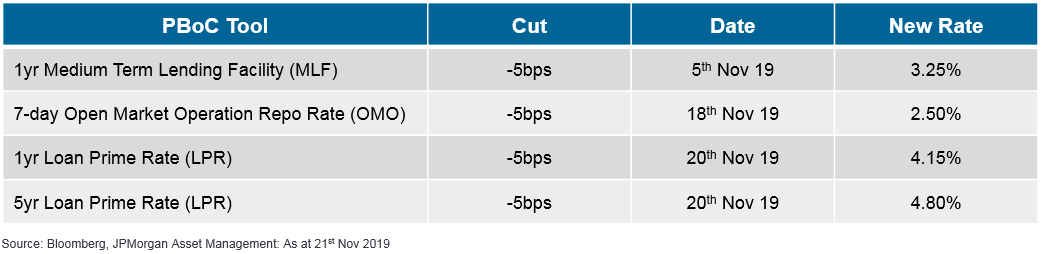

The surprise quasi-monetary policy (Fig 1) rate cuts – the PBoC’s de-facto policy tools since official deposit and lending rates were left unchanged since 2015 - will ease liquidity conditions for commercial banks and borrowers while sending a strong signal of PBoC monetary policy intentions.

Fig 1: Key quasi-monetary policy rate cuts:

Why now?

Chinese economic conditions remain challenging with economic growth slowing, trade tensions elevated, inflation spiking and shadow banking risks still a concern. Given this backdrop, the PBoC has pursued a two-pronged strategy of maintained a hawkish/neutral policy stance to reducing shadow banking, support the currency and prevent further asset price bubbles; while injecting additional liquidity to support smaller commercial banks and private enterprises.

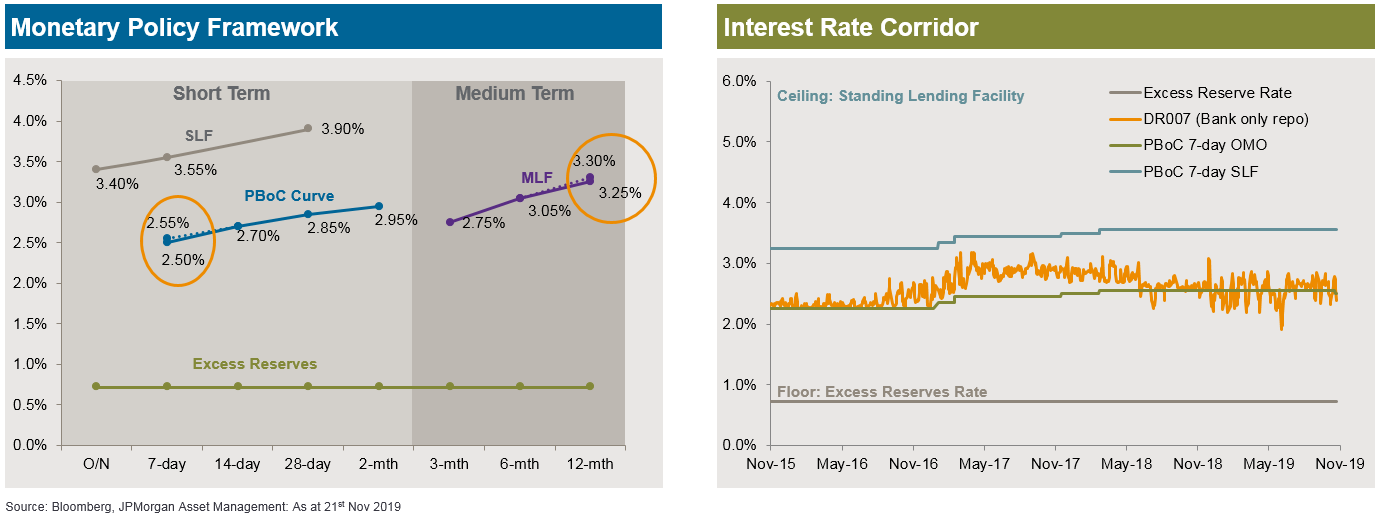

Recent economic data releases were much weaker than expected, forcing the central bank to assume a more dovish policy stance and cut rates. Fortunately, three Fed rate cuts and recent RMB stabilization offered the PBoC a window of opportunity with the central bank highlighting the need to “enhance counter-cyclical adjustment measures to improve liquidity supply” (Fig 2).

This was the first OMO cut in over four years and will reduce commercial banks short term funding costs, while the MLF cut will reduce longer term funding costs. With the 1-year LPR rates directly linked to the MLF, the reduction in the former was expected after the PBoC actions, but the reduction in the 5-year LPR rate – which will impact retail mortgage rates – was a surprise.

Notably, the small scale of rate cuts highlights the central banks residual concerns about high inflation and a reluctance to re-stimulate property and shadow banking markets.

Fig 2: Quasi-monetary policy tools are seen as the de-facto policy rates in China

What happens next?

Even if a trade deal is agreed, structural issues suggest the Chinese economy will remain weak. With the PBoC apparently willing to temporarily ignore the current inflation spike - additional, gradual, monetary policy easing is likely; especially as the benefits of earlier government fiscal stimulus fades.

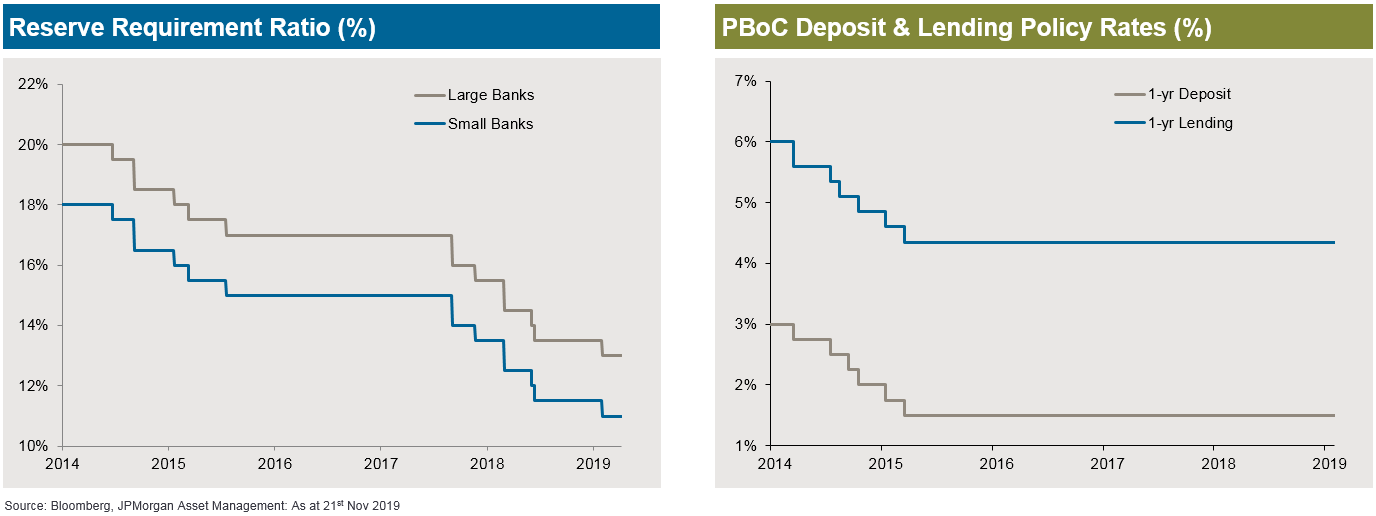

Future potential monetary policy steps include; further reductions in MLF and OMO plus additional cuts to the Standing Lending Facility (SLF) and Reserve Requirement Ratio (RRR) - all targeted at supporting the real economy and increase credit growth (Fig 3).

Nevertheless, there is a limit to how much further quasi-monetary policy rates can be cut before adversely impacting commercial banks willingness and ability to lend; the blocked monetary transmission mechanism has already muted the impact of the recent monetary easing. Reducing the benchmark deposit and lending rates would be significantly more beneficial, but remains unlikely.

Fig 3: The PBoC’s key deposit and lending rates have remained unchanged since 2015

What does it mean for money market rates and investors?

The PBoC’s dovish pivot will push interest rates lower and further flatten the yield curve. While short maturity yields have already declined, maintaining a long duration position provides insurance against further flattening and the opportunity for capital gains. An additional economic slowdown, will adversely impact weaker commercial banks asset quality and weaker corporate’s profitability. With little sign of an economic turnaround, China credit fundamentals are not expected to improve and detailed, independent credit analysis remains important prior to investment.