The BoJ will likely maintain an accommodative policy stance in the near term, and rate hikes are likely to be gradual.

In brief

- The Bank of Japan (BoJ) hiked its policy rate to 0.0%-0.1%, ending negative interest rate policy (NIRP).

- The BoJ also ended yield curve control (YCC) but will continue to purchase Japanese government bonds “broadly the same amount as before”. In case of a rapid rise in yields, they can adjust the amount purchased to stabilize yield levels.

- The BoJ will also end Japanese equity exchange traded fund (ETF) and Japan real estate investment trust (JREIT) purchases.

- Market reaction was muted as the move was well telegraphed. The markets interpreted this move as a dovish hike, with Japanese government bond yields largely unmoved, the Japanese yen (JPY) moving lower, and Japanese equities flat to mildly positive.

- There remains question marks over whether the BoJ will continue to hike over the remainder of 2024, what yield level the BoJ will tolerate for long-term rates, and how Japanese equity markets will do without the BoJ purchasing ETFs.

A symbolic March meeting for the Bank of Japan

What happened?

No surprises as the Bank of Japan (BoJ) raised its policy rate for the first time in 17 years (since 2007). There were four main policy changes announced:

- BoJ is the last of the major developed market central banks to abandon the NIRP that has been in place since 2016. Short-term rates will now be set in a range of 0.0%-0.1%.

- The NIRP tiering system has been removed, which saw deposits held at the BoJ assigned an interest rate from -0.1% to +0.1%. As of January 2024, only around 5% of total current account balances (equivalent to around JPY 25trillion) held at the BoJ was subject to a negative interest rate, meaning only a small fraction of deposits moved into positive rate territory.

- YCC policy, which was introduced in September 2016 was also removed. This will allow long-term Japanese government bond (JGB) yields to rise beyond the current 1% ceiling and fluctuate with market conditions. However, the BoJ will continue to purchase JGBs with the aim of minimizing drastic moves in long-term rates.

- The BoJ will end purchases of ETF and JREITs which began in 2010.

How did markets react?

The move was interpreted as dovish tightening by the markets.

Market reaction was fairly muted, given that the move was well telegraphed over the past week. JGB yields remained largely unchanged, with 2-year JGB yields unmoved, while 10-year JGB yields declined by 2bps. The JPY experienced a modest weakening, hovering around 149-150. Nikkei 225 was down initially but moved positive (up 0.2% at the time of writing), while TOPIX was up 0.6% (at the time of writing).

Why did the BoJ move?

Preliminary results from the Spring Wage Negotiations showed expected average wage increase to come in at 5.28%–higher than expectations and exceeding the 5% level for the first time in 33 years. In addition, wage increases for small and medium sized enterprises (with less than 300 union members) also reached 4.42%, the highest level in 32 years.

Over the past couple of months, BoJ messaging had become more confident around achieving 2% inflation target in a sustainable way, with higher wage growth being central to this view.

Source: FactSet, Morningstar, J.P. Morgan Asset Management. Data are of March 19, 2024.

In addition, the weakness of the JPY has also been unpopular amongst the general public given its role in exacerbating imported inflation. The Japanese government has also been critical of this issue, particularly as gas and electricity subsidies are expected to be lifted in the coming months.

What to look out for next?

Policy rate:

While removal of NIRP is symbolic, the move has virtually no impact on the economy. However, additional rate hikes are a different conversation entirely.

The question is whether the BoJ will hike again in 2024, and if so, what is the pace of additional hikes? Market pricing reflects a policy rate of around 0.25% (based on overnight index swap rates) by the end of 2024.

The BoJ will likely maintain an accommodative policy stance in the near term, and rate hikes are likely to be gradual. Despite the upward revision of 4Q23 gross domestic product, economic momentum has slowed, with private consumption marking three consecutive quarters of declines, and the recovery has been slow so far.

Although services inflation is still hovering above 2%, with domestic demand still lackluster, it is difficult for the BoJ to argue that firms will confidently pass on higher wage costs in the form of rising prices. There also needs to be further evidence that wages will be actually lifted as suggested by Spring wage negotiations, particularly for small and medium sized companies, which is contingent on corporate profitability. The bottom line is that further policy tightening requires evidence of the pass-through from wage growth to price growth in a sustainable fashion.

For more clarity around whether the BoJ will hike again, we look to the April economic report and the conclusion of Spring Wage Negotiations. The BoJ will also get two sets of inflation dates (March 22, April 19) before its April Monetary Policy Meeting, which takes place on April 26.

YCC:

With the removal of YCC, there are concerns that long-term rates could rise sharply. To avoid volatility in the bond market, the BoJ will continue to purchase JGBs at “broadly the same amount as before” to hold interest rates steady. The Bank also stated it would be nimble in purchasing JGBs and respond accordingly if long-term rate fluctuates significantly. There was no specific yield threshold mentioned, perhaps deliberately to deter markets from testing the BoJ’s tolerance for higher yields.

The removal of YCC was unsurprising, given 10-year JGB yields have been well below the 1.0% threshold since November last year and government bond purchases had slowed markedly. In January and February, JGB purchases were just under JPY 6trillion per month compared to the 2023 average monthly purchase JPY 9.5trillion.

ETF purchases:

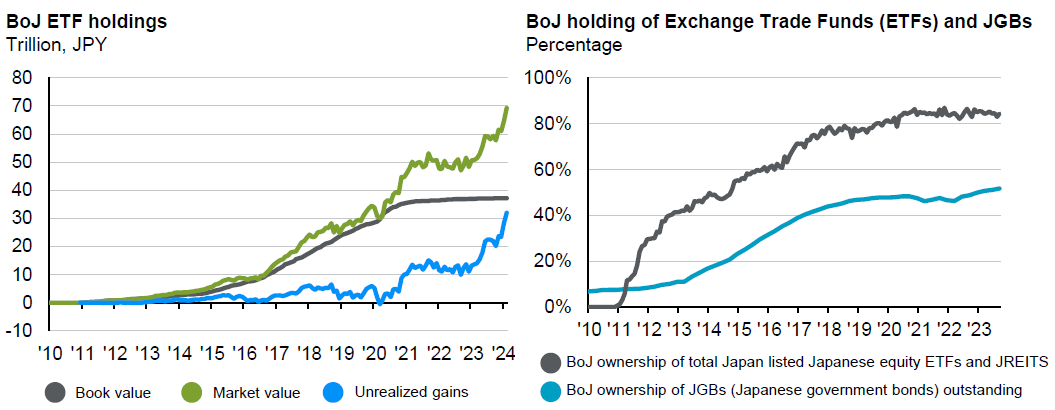

The halting of risk asset purchases shouldn't be too much of a concern for Japanese equity markets as the BoJ has not been purchasing ETFs or JREITS recently, so the real question is whether the BoJ will sell off its positions in the future.

Estimated market value of ETFs held by BoJ is over JPY 70trillion, with unrealized gains amounting to over JPY 30trillion, given the recent rally in Japanese equities. This means the BoJ holds over 80% of Japan listed Japanese equity ETFs and JREITs.

Given that the BoJ has not purchased ETFs as of late, Japanese equity markets are unlikely to be impacted by the BoJ halting ETF purchases. MSCI Japan 2024 and 2025 earnings expectations look healthy, relative valuations vs. the U.S. still look attractive (trading at >20% discount), international investor positioning is still light, and near-term softness in JPY should support the markets in the short run.

In addition, even if the JPY were to rally in the long run, Japanese equities could fare well. Traditionally, investors would associate a weaker JPY with positive Japanese equity performance and vice versa. However, as mentioned in our previous piece on Japanese equities, there is growing evidence that this relationship may not be as strong as before. Japan’s financial sector would benefit from higher rates, and more domestic oriented companies may benefit from the pick-up in wages and spending while also being less exposed to currency risks.

Source: FactSet, J.P. Morgan Asset Management. Data as of March 15, 2024.

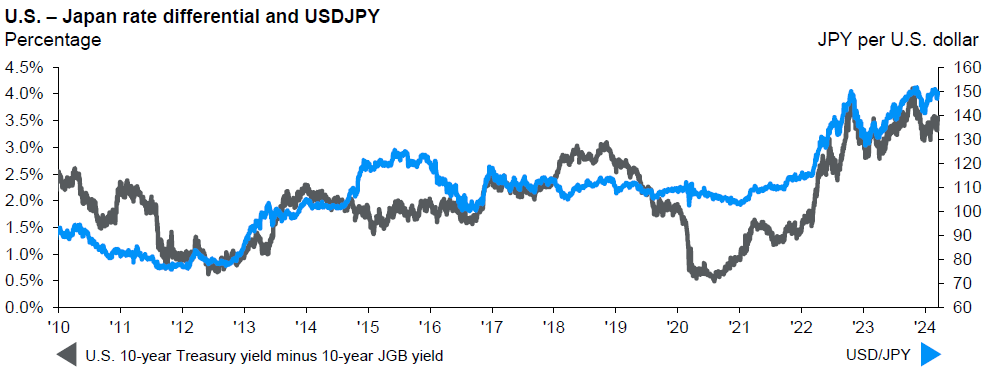

Direction of JPY in the hands of the Federal Reserve (Fed)

The JPY weakened moderately, with USD/JPY hovering at 149-150. The near-term trajectory of the JPY will depend more on the Fed than the BoJ, and the rate differential between Treasury and JGB yields. Weakness in the JPY could persist if the number of rate cuts by the Fed continues to be pared down. Market expectation for Fed cuts in 2024 has declined from 125bps to 75bps, which has prevented the expected appreciation in JPY. The dot plot from the Fed's meeting will be closely watched, given recent upside surprises to inflation prints as well as a still robust U.S. economy.

What does this mean for JPY carry trades?

Looking at the “Major Assets of Foreign Banks’ Branches in Japan”, which is believed to reflect the trends of JPY carry trades, the latest data as of January 2024 is at JPY 11.3trillion. While this level remains high, it is about half of the peak level of JPY 23trillion in February 2007, before the global financial crisis.

The attractiveness of JPY carry trade remains since Japan’s hiking path is likely to be gradual, and the BoJ will maintain easy monetary conditions in the near term. Only under the circumstance of a significant JPY appreciation—which would only occur if the Fed decides to undertake substantial rate cuts—would JPY carry trades become unattractive.

Conclusion

All in all, this move by the BoJ—while symbolic—should be interpreted as a nascent step in the BoJ’s long journey to policy normalization.