How is Asia’s virus recovery so far?

The coronavirus pandemic still remains one of the key uncertainties facing Asia. The highly infectious Delta variant has resulted in new waves of cases across a number of countries, disrupting economic activity and setting back our recovery hopes. While we are still generally optimistic on a recovery continuing to take place across Asia, countries across the region have had varying responses in dealing with the situation, which will continue to cause a differing pace of recovery in the months ahead.

The journey out of the pandemic is likely to be a long path to return to some semblance of pre-COVID normality. There is unlikely to be one single event that will let us declare the pandemic officially over.

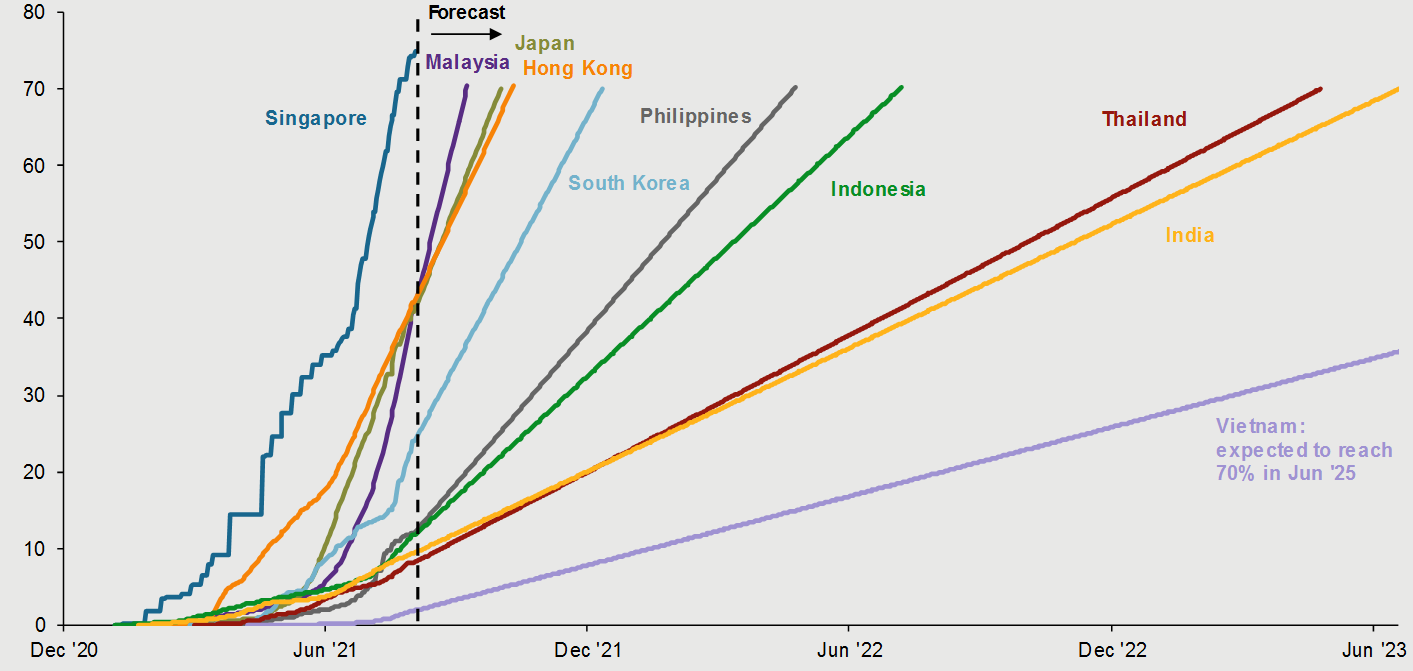

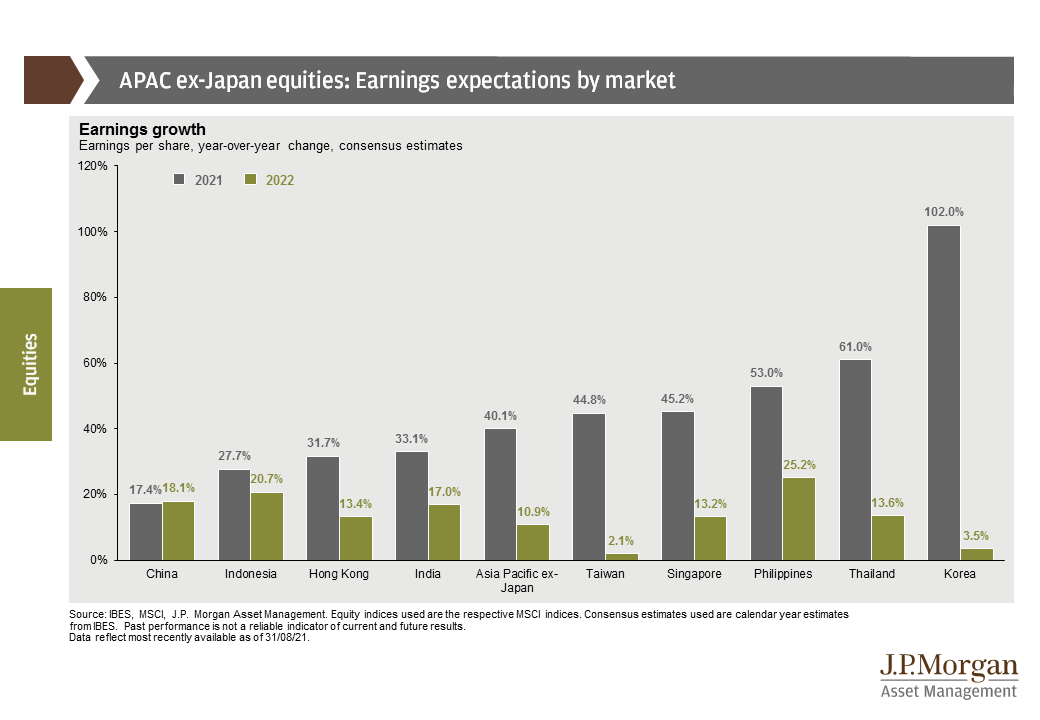

A key aspect that we see determining which countries are rolling along the smoothest on the path of recovery is the vaccination rate. Herd immunity, defined as around 70% of the population being fully vaccinated, should mean reducing both the pressure on hospitals and health care resources, while also meaning less need for governments to rely on lockdowns or restrictive measures on the public. Vaccination rates have varied—availability, public hesitancy and differing levels of government encouragement are amongst many factors affecting vaccination rates. New variants might mean the efficacy of vaccines is lower than hoped, but better vaccination progress will still mean less issues. Based on current data, the countries that will see the quickest timetable to herd immunity are Hong Kong, Japan, Malaysia, Singapore and South Korea. Singapore has already reached the 70% fully vaccinated benchmark, while the others are expected to reach it before the end of this year. At current rates, Indonesia and the Philippines are not expected to reach 70% until the middle of 2022, while Thailand and India are not expected to reach the threshold until well into 2023.

The recent spread of the Delta variant has resulted in different responses across the region. In general, countries in Asia have been far more cautious and more willing to enact lockdowns compared to the U.S. This has led to downward revisions and underperformance in growth compared to developed markets. Malaysia, Vietnam and the Philippines appear to be the hardest hit here, with still rising case numbers leading to stricter mobility conditions. In terms of the effect on growth forecasts, quarantine rules and the general uncertainty on the future of international travel means that Hong Kong and Thailand are seeing the lowest growth forecasts.

Vaccination rates are key in determining which countries will recover faster. The pace across Asia will be heavily divergent

EXHIBIT 1: PATH TO FULLY VACCINATING 70% OF THE POPULATION IN ASIAN COUNTRIES

PER 100 PEOPLE

Source: Our World in Data, J.P. Morgan Asset Management. Forecast assumes that the daily vaccination pace of the last 30 days will continue forward.

Data reflect most recently available as of 25/08/21.

Investment Implication

Asia’s path out of the pandemic will likely not be a short one, with very divergent paths for all countries based on vaccination rates and their economic exposure to various factors. It is not until mid-2022 at the earliest where we expect most major countries in Asia to have reached herd immunity and fully open up.

Keep in mind that no country is travelling the way out by itself, unaffected by what happens to its neighbors. It is highly unlikely we will have a specific mark where we would announce that the finish line has been reached and everything pandemic-related is over. The recovery is ongoing, but the effects of the Delta variant will still weigh on growth due to its disruption on trade, supply chains and consumer activity.

Recent improving infection situations in Thailand have given the equity market there a temporary boost, but for now it appears opportunities will be tactical. Based on what we see so far, the countries that we expect to do better in terms of performance and growth in the coming months are Malaysia and Singapore. South Korea is another country that has a positive mix of factors relating to vaccination rates and economic performance. It has already begun to raise rates in a shift toward policy normalization, one of the first in Asia to do so. Central bank officials in South Korea appear to consider the current virus impact on activity to be more benign than previous waves, but this still could prove to be a risky move if the virus situation develops unfavorably with the rise of new variants and infection waves.

It will still be some time before there is a sustained recovery that leads to a prolonged valuation re-rating.

0903c02a829b6918