Who we are

Dedicated private credit professionals with extensive experience and specialized expertise.

Source: J.P. Morgan Asset Management; as of September 30, 2024.

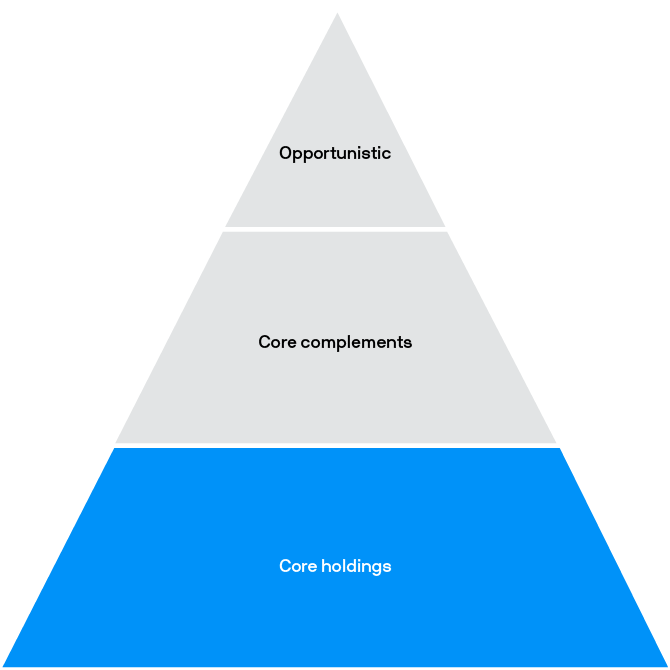

Our strategic framework

Diversifying portfolios and capturing opportunities across the credit spectrum

Seek to generate stable, consistent income from high-quality assets with low volatility

Characteristics:

- Low volatility

- Capital preservation

- High income

Examples:

- Senior direct lending

- Senior commercial real estate lending

- Senior real asset lending

- Senior residential real estate lending

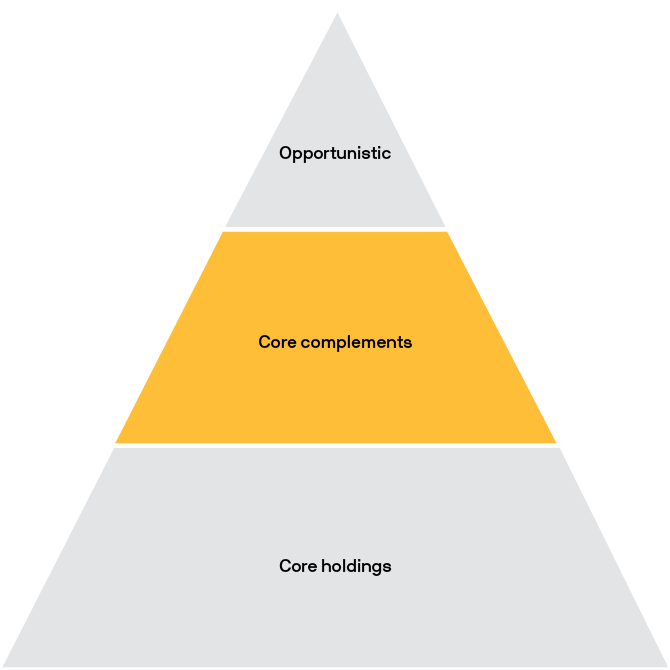

Seek to increase total returns and portfolio diversification

Characteristics:

- Asset class diversification

- Moderate return enhancement potential

- Downside protection

Examples:

- Direct lending mezzanine

- Commercial real estate mezzanine

- Private credit secondaries

- Multisector

- Real asset mezzanine

- Levered lending

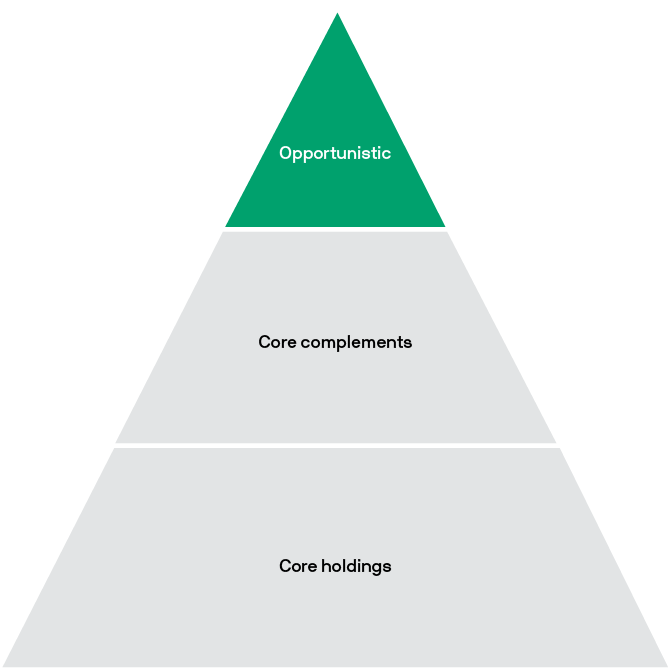

Seek to generate high total returns focusing on distressed, niche or opportunistic lending

Characteristics:

- Specialized markets

- High total return potential

- Risk mitigation

Examples:

- Specialty finance

- Esoteric credit

- Distressed lending

- Special situations

- Market inefficiencies

Our capabilities

Broad array of private credit solutions for clients seeking diversification, income, return and/or capital preservation.

Insights

Drawing on the experience of more than 380 dedicated alternatives professionals, access our latest insights in private credit and beyond.*

Gaining perspective on public and private equity

Read the latest publication from our Strategic Investment Advisory Group, exploring strategic asset allocation and active portfolio management in today’s credit markets.

*Source: J.P. Morgan Asset Management; as of December 31, 2024.

For more information, please email us or contact your J.P. Morgan client advisor.