Stocks and bonds took the news in stride, likely pleased the Fed remains biased to ease.

As widely anticipated, the Federal Open Market Committee (FOMC) voted to maintain the Federal funds rate at a target range of 4.25%-4.50%. The statement language was sanguine on current conditions, noting the economy continues to expand at a solid pace and labor conditions remain solid.

Interestingly, it also stated that “uncertainty about the economic outlook has diminished” while just six weeks ago it remarked economic uncertainty had increased. Given not much has changed since their last meeting this could either be viewed as comforting given both sides of their mandate are near target, or somewhat dismissive given the uncertainty tied to trade negotiations, pending fiscal stimulus and increased risks in the Middle East

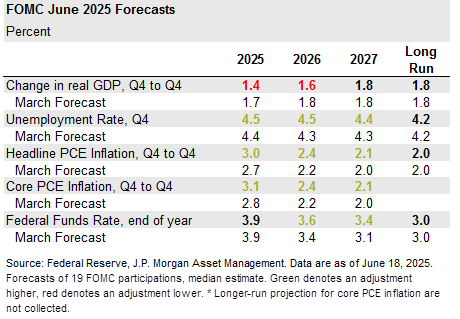

The updated Summary of Economic Projections, however, suggests caution:

- Growth was downgraded from 1.7% to 1.4% this year and by 0.2% to 1.6% in 2026.

- The unemployment rate was nudged higher to 4.5% in 2025 and 2026.

- Both headline and core PCE were raised by 0.3% to 3.0% and 3.1%, respectively, for 2025. Further out saw modest increases suggesting a longer runway for tariff related policy implications to feed through to inflation.

- The median interest rate maintained the outlook for two rate cuts this year, however shifted to one rate cut in 2026 and 2027.

It’s worth mentioning that the number of members envisioning no easing this year increased to seven, from four in March. The median would have picked up to one cut if only one of the eight participants expecting two reductions switched to one 25bp reduction.

Moreover, since the committee’s December 2024 meeting, the committee has only increased this year’s unemployment rate estimate by a meager 0.2%, while raising its inflation forecast by 0.6%, suggesting the committee views inflation may remain further away from target relative to labor market risks supporting its patient stance.

During the press conference, Chairman Powell emphasized the committees current wait-and-see approach. He mentioned that while uncertainty has come down relative to early April it remains elevated, and interest rate forecasts are highly uncertain across committee members. The committee fully expects higher tariffs will begin to impact inflation, it’s just a matter of when and how significant those impacts are. That said, given growth and labor remain intact, they can afford to be patient.

Stocks and bonds took the news in stride, likely pleased the Fed remains biased to ease. It seems reasonable to expect September and December rate cuts as a base case, though if tariff related impacts take more time to be visible in the data, they are likely to remain on hold until December.

For investors, the outlook for growth, inflation and policy rates remains highly uncertain. Therefore, investors should remain well diversified across high quality bonds, reasonably priced stocks, international assets and alternative assets.