Will the dollar continue to underperform?

27-06-2019

GFICC Investors

In Brief

- We expect the US dollar to underperform ahead of the first US interest rate cut of this cycle, which is expected in July. How the dollar trades following the cut in rates, however, depends to a large extent on whether the rate cuts are mid cycle or recessionary.

- Although we see few signs of the imbalances that typically signal a recession is imminent, macro data has clearly weakened recently, while significant uncertainties continue to cloud the economic outlook—not least ongoing global trade tensions.

- History suggests that if the expected rate cuts prove to be mid cycle rather than recessionary, July could mark the end of the dollar’s relative underperformance. However, if the rate cuts prove to be part of a recessionary cycle, the dollar could remain under pressure for longer.

Dovish central banks

June witnessed a significant dovish pivot from the world’s major central banks, as prospects for weaker global growth increased concerns over a prolonged period of below target inflation. Bond yields have declined substantially as markets have moved to discount significant monetary policy easing in the months ahead. It is now widely assumed that the Federal Reserve (the Fed) will cut rates in July, with the debate over whether the first cut of the cycle will be 25 basis points (bps) or 50bps.

Although the European Central Bank (ECB) underwhelmed markets at its June policy meeting, a subsequent speech by President Mario Draghi at the ECB’s Sintra research forum forcefully made the case for additional rate cuts, tiering and quantitative easing. Other central banks, including the Bank of Japan, Reserve Bank of Australia and Bank of England, have also sounded more dovish.

With bond yields declining in absolute terms, currency markets have been left to weigh the relative dovishness of policy announcements, the changing economic outlook and the implications for exchange rates.

US dollar to weaken into the first rate cut

Recent economic and monetary policy developments suggest a multi-quarter period of US exceptionalism is coming to an end as US growth slows back towards peers and the Fed starts to reduce the US dollar’s yield advantage.

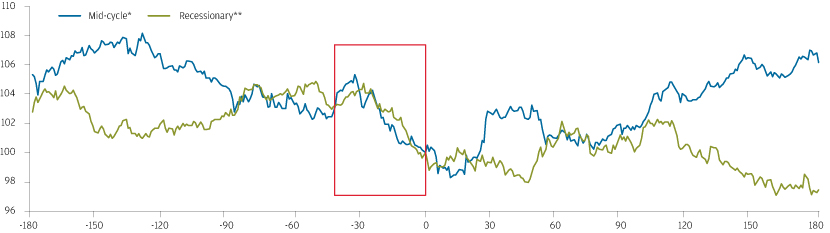

Historically, the dollar has tended to weaken in the weeks prior to the first rate cut in an easing cycle. We have seen a similar pattern in recent weeks, with the US dollar underperforming as the Fed validated market expectations for a July rate cut.

We believe it is reasonable to expect this US dollar underperformance to continue in the short term given the scale of the change in US yield levels and the still relatively elevated level of US dollar valuations.

US DOLLAR TENDS TO WEAKEN INTO FIRST CUT OF A FEDERAL RESERVE EASING CYCLE

DXY index (day of first cut = 100)

Source: Bloomberg, J.P. Morgan Asset Management. *95 & 98 cycle. ** 01 & 07 cycle.

Mid-cycle or recessionary easing?

How the US dollar trades in the weeks following the expected July rate cut is less clear. Again, history can be instructive. Following the first rate cut of the 1995 and 1998 easing cycles, the US dollar subsequently strengthened. Those mid-cycle rate cuts were subsequently shown to have refreshed US growth and buoyed US risk markets, with the subsequent positive asset flows into the US helping the US dollar to push on to the cyclehighs observed in 2000.

In contrast, the first rate cut of the 2001 and 2007 easing cycles—subsequently revealed to be recessionary cycles—did not result in a stronger US dollar as US risk markets declined, growth weakened and the Fed was forced to continue to cut interest rates more sharply than the rest of the world. The current growth outlook is clouded by significant uncertainties, particularly around global trade. However, the recent strong performance of risk assets and, in particular, the outperformance of US equity markets has parallels with the 1995 and 1998 mid-cycle rate cuts. Outside of trade tensions, household balance sheets remain strong and we see few of the imbalances that typically precede recessions.

Therefore, while we are comfortable with our view that the US dollar could weaken for the next few weeks, we remain open minded as to whether July might mark the end of US dollar underperformance.

RECENT US STOCK MARKET PERFORMANCE SUGGESTS A MID-CYCLE EASE IN THE FED FUNDS RATE

MSCI US vs MSCI ACWI ex USA local index price ratio

Source: Bloomberg, J.P. Morgan Asset Management; data as of 24 June 2019. Past performance is not a reliable indicator of current and future results.

Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

Currency Management

Since our first segregated currency overlay mandate funded in 1989, J.P Morgan Currency Group has grown to manage a total of USD 361 billion in bespoke currency strategies. Our clients include governments, pension funds, insurance clients and fund providers. Based in London, the team consists of 20 people dedicated exclusively to currency management with an average of over 15 years of investment experience.

We offer a range of hedging solutions for managing currency risk as well as a tailored optimal hedge ratio analysis:

- Passive currency hedging serves to reduce the currency volatility from the underlying international assets. It is a simple, low cost solution designed to achieve the correct balance between minimising tracking error, effectively controlling transaction costs and efficiently managing cash flows.

- Dynamic ‘intelligent’ currency hedging aims to reduce currency volatility from the underlying international assets and add long-term value over the strategic benchmark. A proprietary valuation framework is used to assess whether a currency looks cheap or expensive relative to the base currency and the hedging strategy is adjusted accordingly.

- Active ‘alpha’ currency overlay strategy offers clients’ passive currency hedging, if required, combined with an active investment process to deliver excess returns relative to the currency benchmark. Our approach is to build a global currency portfolio combining the output of fundamental models and incorporating the qualitative views of our strategy team.

0903c02a825f29b1