4Q 2023 Global Fixed Income Insurance Quarterly

This paper is a product of the Global Fixed Income Currency & Commodities (GFICC) Insurance Team.

02-11-2023

A team of our senior investors completed the GFICC Investment Quarterly (IQ) meeting and released our views on global fixed income markets for the next three to six months. We invite investors to read the IQ letter from Bob Michele, our Global CIO, which summarizes our thoughts on the current macroeconomic outlook.

Highlights from this quarter’s IQ:

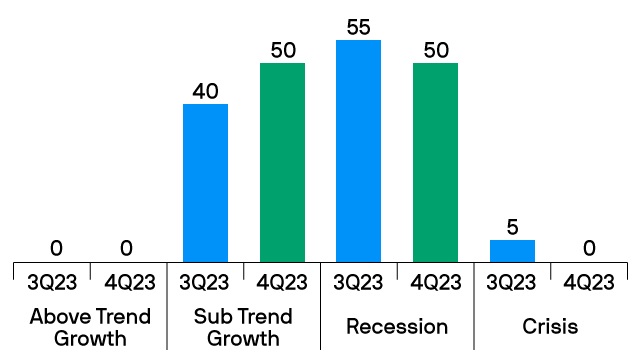

- Recession and Sub Trend Growth are now our equal-weighted base cases at 50% each. Above Trend Growth remains at 0%, and we reduced the probability of Crisis to 0%.

- Growth and inflationary pressures have moderated to the point that the U.S. economy appears to be in a soft landing. But could the economy merely be mirroring a soft landing on the way to recession?

- The primary risk to our forecast is that inflation flares up and the central banks resume a prolonged hiking cycle.

- We believe high yielding front-end cash flows are the best place to wait out the next few uncertain months.

Scenario Probabilities (%)

In this bulletin, we examine the platform’s views through our insurance lens and provide insight on how we are positioning insurance portfolios.

U.S. Life companies

The U.S. economy has shown a great degree of resilience. Despite an incredibly aggressive hiking cycle, the labor market has proven to be robust, the consumer has held steady, and we are seeing continued pockets of strong economic data. However, when we take a step back and consider the broader picture, we see enough evidence that the economy is slowing down and that we are at the end of the hiking cycle. There are clear signs of weakness from more negative business surveys, slowed growth and tighter credit and monetary conditions. If we look at the health of the overall economy, it feels very similar to the beginning of other recessions. With that in mind, we have pushed out the timing of a potential recession and updated our scenario probabilities to reflect equal-weighted base cases of recession and sub-trend growth.

We believe that U.S. life companies should continue to maintain their focus on sticking to high-quality names. With the market’s current yields, particularly in investment grade, there are opportunities that offer attractive yield without sacrificing quality. We are positioning portfolios to stay up-in-quality within the investment grade corporate landscape, focusing on companies that are better positioned at the sector and issuer level to withstand an economic downturn, limiting downward ratings migration risk. With the resilience of consumers and corporations, and the strength of the labor market, a soft landing feels much more plausible. Yet, the risk of a recession is still very real and the prospect of going into riskier sectors, particularly high yield, does not yet seem appealing. Following the banking crisis in 1Q2023, we analyzed credits in portfolios with a particular focus on regional banks and commercial real estate, and we are continuing to monitor these credits to ensure any potential changes of direction with regards to the sector’s outlook is being captured. We’re focusing on adding US money centers and stronger Yankee banks. Other opportunities are presented in short-dated securitized and agency mortgage-backed securities (MBS), where yields have been and continue to look attractive.

With our revised probability of a recession, U.S. life insurers may benefit from moving into more neutral-duration positions where opportunities are attractive. Our expectations have not shifted drastically. We continue to expect a recession in 2024 and believe U.S. life insurers will continue to benefit from remaining in high-quality core fixed income.

U.S. P&C (Property & Casualty) companies

As the third quarter played out, intermediate investment-grade (IG) corporate bonds have continued to post positive excess returns on a YTD basis. Second quarter earnings in the U.S. remained resilient and this seems to be the case for the third quarter for which earnings season has recently started. In Europe, revenue and EBITDA growth have joined the U.S. in single-digit territory; leverage has ticked up but remains below pre-COVID levels in both regions. As discussed in prior quarters, IG corporate issuers are generally well positioned for a downturn. In our base case (through 2Q 2024), we believe EBITDA drawdown will be manageable.

Year-to-date intermediate IG spreads have traded in a 60 basis points (bps) range, currently hovering around unchanged from where we started the year (126 OAS as of October 5). On a 10-year lookback, spreads are near historical averages, indicating markets are currently pricing corporate bonds for a soft landing scenario. Given our expected outcome of soft landing and recession, it is prudent to maintain exposure to intermediate corporate credit given that yields are currently ~1.8x their 10-year average, but not be too overexposed to higher beta issuers. We see value in banks, air lessors, REITs (not exposed to office) and front-end BBB corporate credits. We remain comfortable with the senior bonds in larger U.S. regional banks and have selectively added in the new issue market but remain cautious about overweighting at this time. We continue to like utilities operating in stable regulatory environments given their stable cash-flow profile and tailwind from incentives launched as part of the Inflation Reduction Act. Lastly, we will continue to be active in the primary market across sectors where new issues have been pricing with attractive concessions. That said, on a cross-sector basis, we maintain our preference for short securitized and agency MBS assets, where appropriate, as they provide higher-quality cash flows at attractive spreads, which are an ideal fit for P&C accounts.

Agency mortgages were the lone underperformer within securitized assets during the third quarter. Continued interest rate volatility and supply coming from non-traditional sources have cheapened agency mortgage valuations to near their widest levels since the Great Financial Crisis, giving marginal buyers such as insurance companies the opportunity to take advantage of the widening. Current coupon mortgage Z-spreads are hovering in the 125-150bps range and look historically cheap to us across the broader fixed income platform. We suggest P&C insurers add to better convexity in 4.5%–5.5% coupons and agency multifamily securities, securing high-quality income in the 5- to 10-year part of the curve at yield levels we haven’t seen in 15 years.

Commercial real estate (CRE) risk remains topical for insurers, specifically around office exposure. Transaction volume is down significantly across property types, and distressed sales aren’t being reflected in broad price indices. We think rising cap rates and funding costs will continue to challenge the Commercial Mortgage-Backed securities (CMBS) market, and we remain cautious on office collateral. P&C insurers should be thinking about idiosyncratic risks in the single-asset single-borrower (SASB) space and broader cash-flow extension risk in the CMBS market. Additionally, we think there is a downward NAIC and NRSRO ratings migration risk as we head into 2024. We are, however, still constructive on adding to the single-family-rental (SFR) sector for P&C accounts with needs in the intermediate part of the curve at valuations compelling to competing asset classes near 150bps over Treasuries. Consumer health has normalized back to pre-pandemic levels (excess savings, etc.), but aggregate delinquencies and financial obligations are still low; the consumer balance sheet is still intact. We are seeing marginal pockets of stress in the deepest part of the subprime market, as well as marketplace consumer lending, but nothing broad based. The Federal Reserve (Fed) staying restrictive for longer, as well as student loan payments restarting, will put further stress on the consumer. As such, we are staying up in quality and further up in the capital structure in originators and sponsors we feel comfortable with to weather a weakening macro environment. Collateralized Loan Obligation (CLOs) also provide for an attractive carry in this environment, but we caution insurers to think before adding further to their floating rate exposure into the latter innings of a Fed hiking cycle.

UK & European insurers

The enduring rise in yields is proving to be a mixed blessing for insurance company clients. The days of ultra-low and even negative yields are a distant memory, with investors achieving upward of 6% yields on corporate debt both in the UK and European markets. However, harvesting this yield is problematic given the large unrealized losses tied to existing holdings. Investors who lack any real budget to crystalize those losses are dependent on maturities for reinvestment. Given the relatively sanguine economic backdrop and robust corporate fundamentals, investors remain comfortable redeploying risk into the corporate market, which we have recognized as a favorable asset class during our IQ discussions.

Insurers concerned about rising solvency capital requirements should have limited concerns around credit quality and rating downgrades in the near term. In fact, the rating upgrades trend continues in 3Q2023 and the BBB- share of the index is at a seven-year low. The global IG upgrade/downgrade ratio is ~2.1x, with upgrade momentum evident across all sectors while downgrades have been contained to the real estate sector.

In order to help protect the quality of our portfolios when the forecasted recession takes hold, we have developed a proprietary forward-looking Predictive Ratings Model. This helps identify 12-month-ahead rating transition probabilities to forecast changes in the solvency capital requirement (SCR) of European IG corporate bonds. It allows us to act ahead of potential downgrades being reflected in bond prices. An insurance portfolio manager who is sensitive to the capital charges being levied on their bond holdings would likely want to know how the charges might evolve in the future. Bonds that get upgraded would result in a lower capital charge, as would bonds that rolled down from a high duration bucket to a lower one. The opposite is true of bonds that get downgraded— their SCR would increase rather exponentially.

09jl232510185902

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan Asset Management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation.

Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://www.jpmorgan.com/privacy.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

READ IMPORTANT LEGAL INFORMATION. CLICK HERE >

The value of investments may go down as well as up and investors may not get back the full amount invested.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.