Arrested Development: the tightest labor markets in decades are pressuring the Fed; can “second chance” policies for those with criminal histories expand the labor force? Also: the Citrix canary and a COVID update

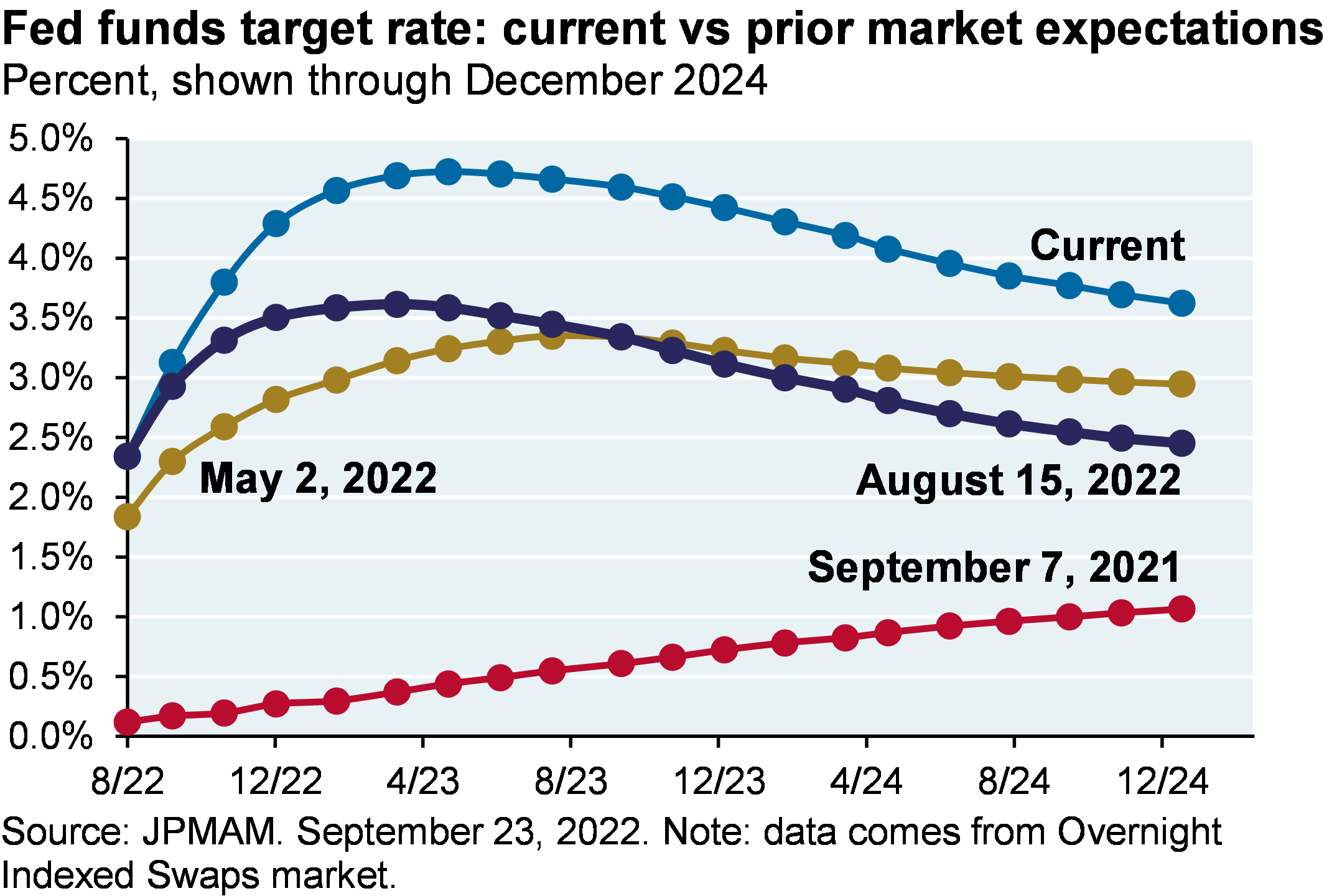

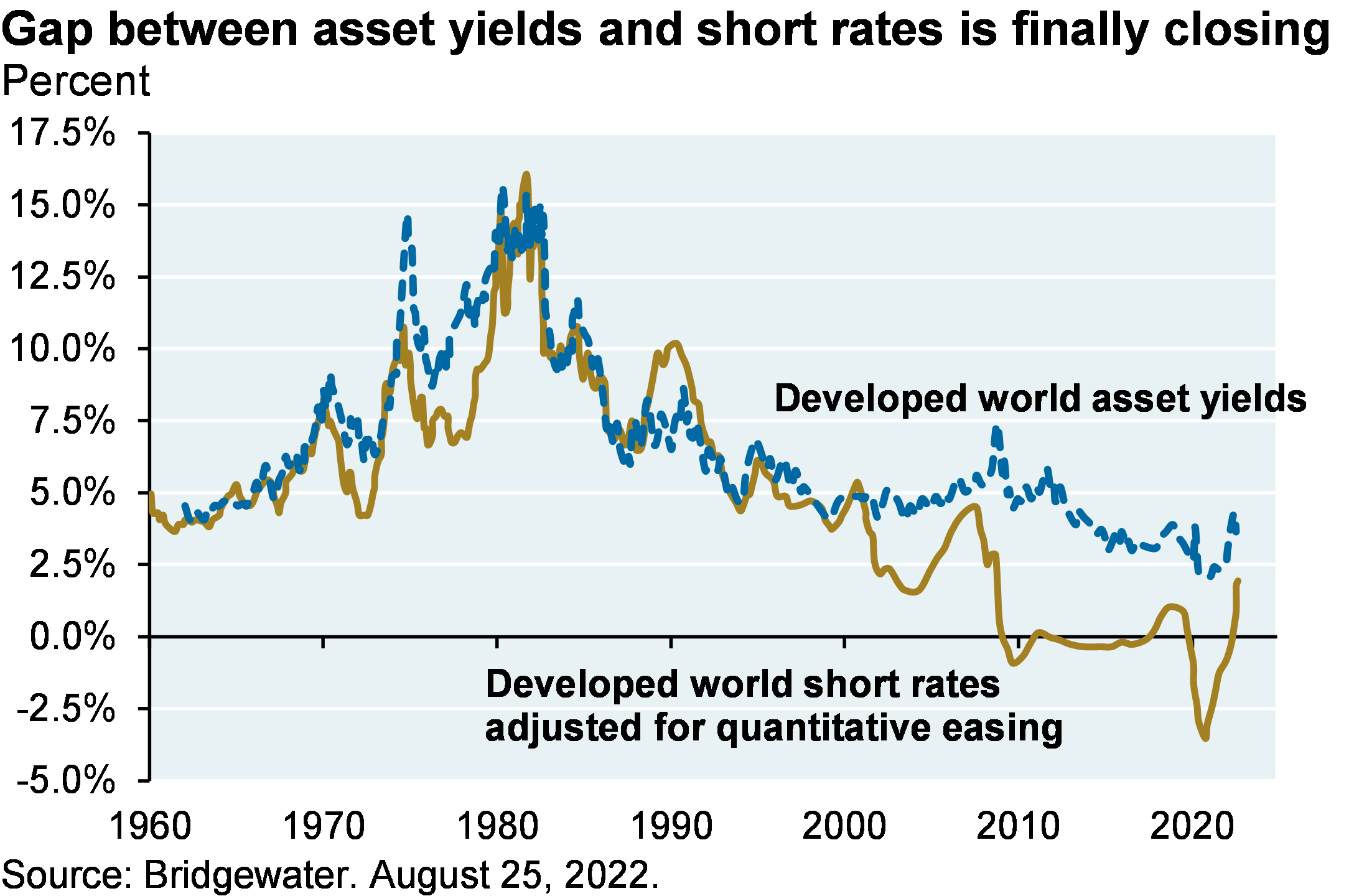

As I wrote in our Labor Day piece, we expected the S&P 500 to re-test June lows and now we’re there. Equity markets have been slow to digest the path of future policy rates shown in the first chart below. Additional headwinds come from Europe’s energy mess, and from China’s real estate collapse (bad debt ratio of 30% and rising) and its zero COVID tolerance policy. More broadly, as shown in the second chart, we’re emerging from a decade of abnormal pricing for risky assets relative to cash, which argues for lower valuations on just about everything as the gap closes and normalizes. As we wrote on Labor Day and earlier in the year, we do not envision a deep US recession based on the strength of consumer balance sheets, but we think better entry points on equities still lay ahead.

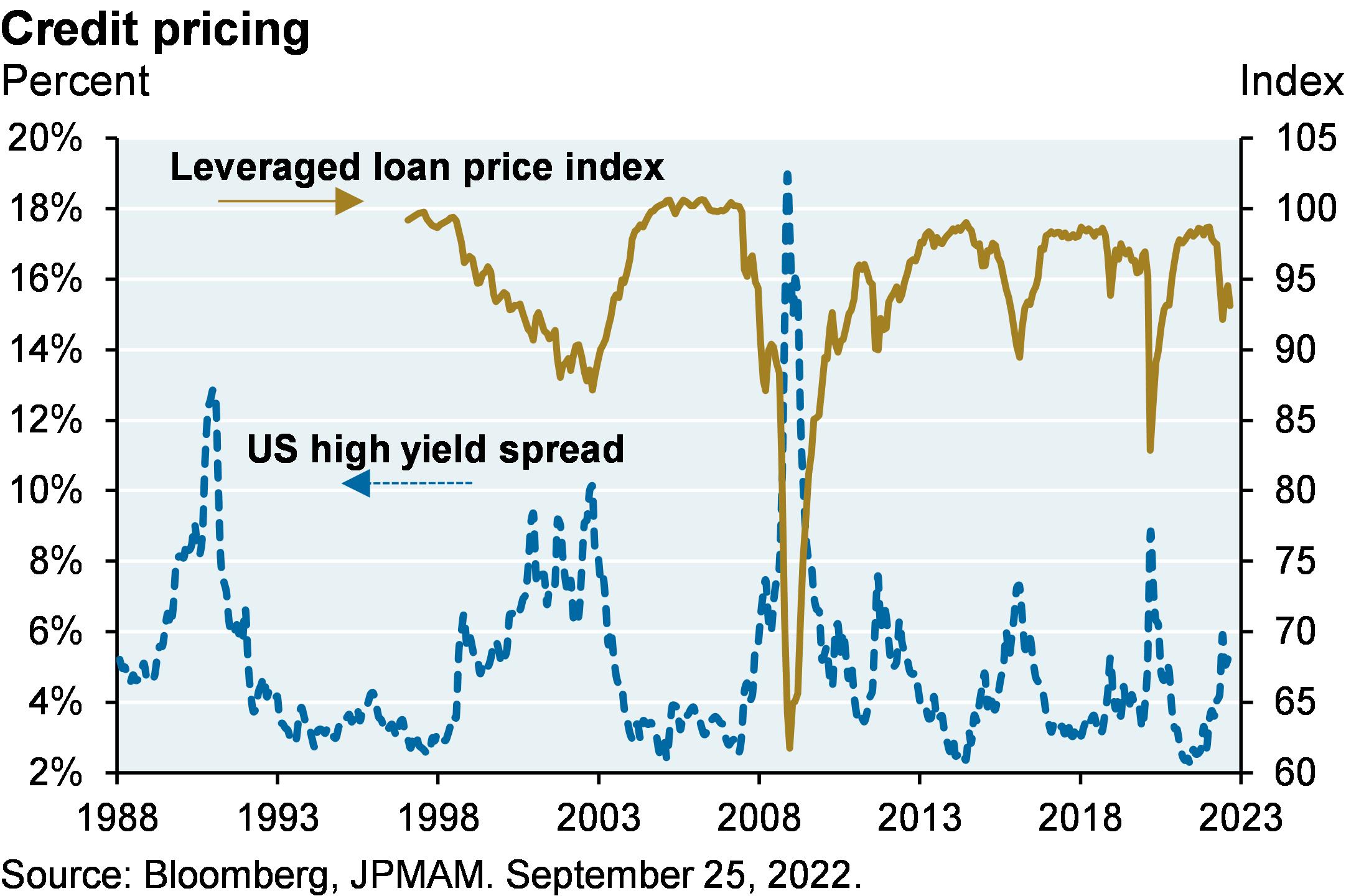

Consider the Citrix deal whose senior notes priced at 10% vs initial underwriting levels of 6.5%; underwriters still reportedly hold the all of the second lien Citrix notes which would require much larger discounts to place with investors. Pending large buyout financing deals include Twitter, Nielsen, Tegna and Tenneco, all of which are lower rated by Moody’s than Citrix. Citrix may be a canary in the coal mine given the limited selloff so far in high yield spreads and leveraged loan prices, which at 6% and $93 are still below recessionary levels.

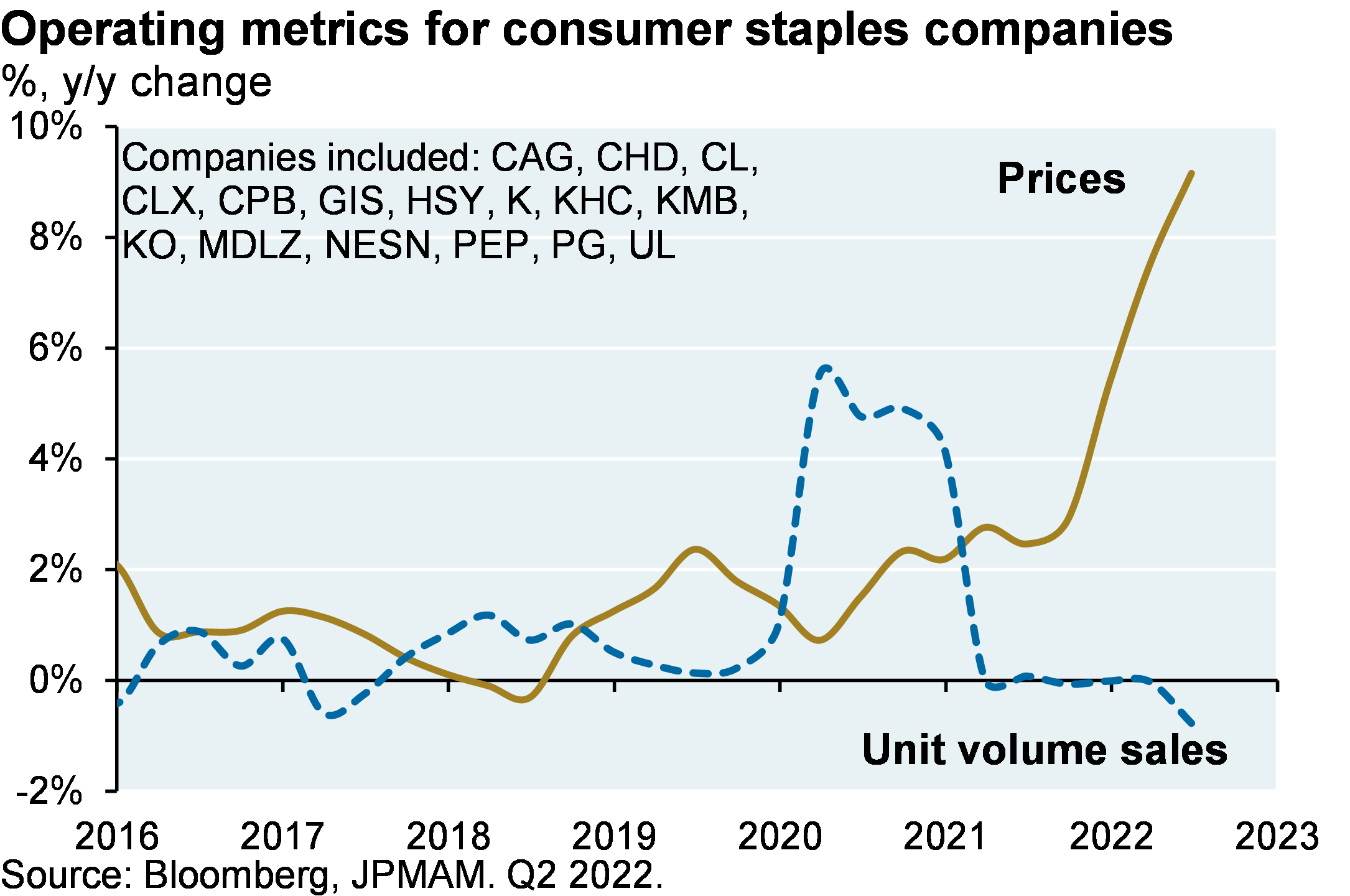

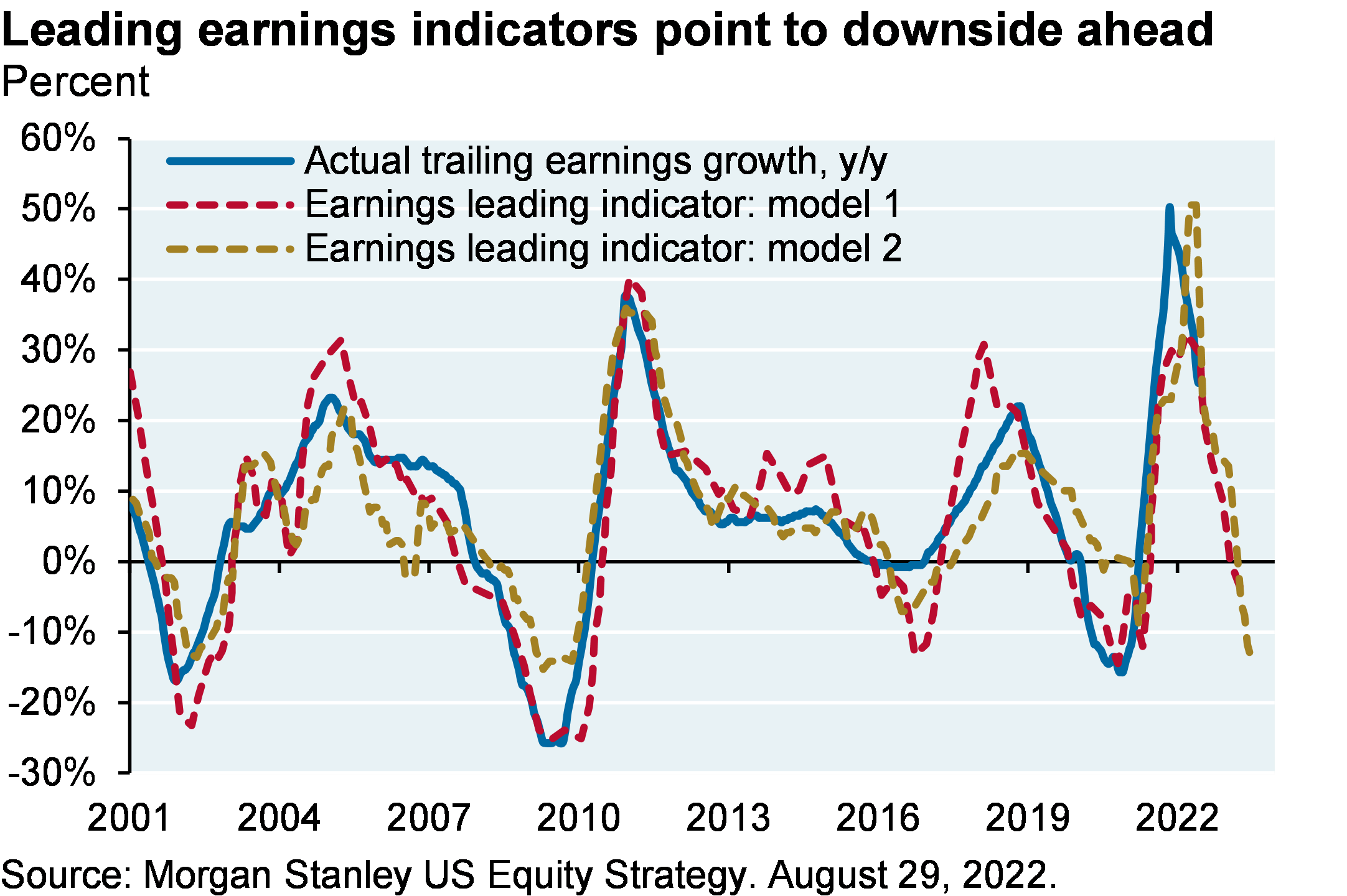

Early warning signs on earnings appear below. Consider US consumer staples: while Q2 revenues rose, all of the increase resulted from price hikes while unit volumes were down. As the economy weakens with rising Fed Funds rates, it will become harder to pass through rising costs. Other early warning signs on earnings include leading indicators with which they’re correlated (see chart below), and that’s before taking into account a projected ~2% EPS decline from the new 15% minimum book tax mostly affecting tech and healthcare companies, and the 1% buyback tax. Last point: as Gavekal Research highlighted in a recent note, the ratio of S&P to NIPA (economy-wide) profits has risen to 1.2x again, a level which historically has been a reliable indicator of pending profits recession.

To be clear, institutional positioning and individual investor sentiment are quite bearish and some valuations already price in bad news: China banks at less than 0.5x book value, Europe 10.7x forward P/E converging on 2012 debt crisis lows and Metaverse-Fintech-Hydrogen-SPAC stocks down 50%-80% from their peaks. But all eyes are on the Fed and its vanishing hopes of a soft landing, which we discuss next (after a brief COVID update).

A brief COVID update: bivalent vaccines, inhalable vaccines and preventable deaths

While vaccine protection against infection and transmission have dropped sharply with efficacy below 50%, studies focused on people aged 60+ still show large declines in mortality and hospitalization risk from a 4th shot compared to two or three shots

Unvaccinated people (most of whom have already been infected) have 14x the risk of dying than vaccinated people, suggesting that infection-induced immunity is much weaker than immunity from vaccines

New bivalent mRNA vaccines are now available and have been engineered to work against the original strain and against Omicron BA4/5. There is not a lot of efficacy data yet; the decision to move forward was based on the results of a BA1 vaccine, a Beta variant vaccine and lab data from mice

A new report from the NEJM indicates that mucosal (nasal) antibodies are what may be needed to more effectively block infection and transmission, since that is where airborne pathogens are first introduced into the body

China approved its first inhalable COVID vaccine manufactured by CanSino, which uses the same adenovirus vector approach that it uses in its injectable vaccine. Early trials showed better immune responses than a regimen of three shots, and CanSino claims that its inhalable vaccine also needs much less viral material to be effective. India’s Bharat Biotech has also approved its own inhalable adenovirus vaccine which it developed in conjunction with researchers at the Washington University (St Louis) School of Medicine

Inhaled vaccines are best used in tandem within injected vaccines rather than replacing them, since injected vaccines produce antibodies in the bloodstream and internal organs which are needed if nasal defenses fail

As per Brown’s School of Public Health and Microsoft AI: from January 2021 to April 2022, the US experienced 320,000 deaths that could have been prevented if such individuals had been vaccinated. Excess death rates are still 10% above expected levels, and in 2021, the US experienced the largest decline in life expectancy in 100 years

Why would the Fed tighten into a weakening global economy? The risk of wage-price spirals apparently worries them even more. Can the US labor supply increase without a deep recession?

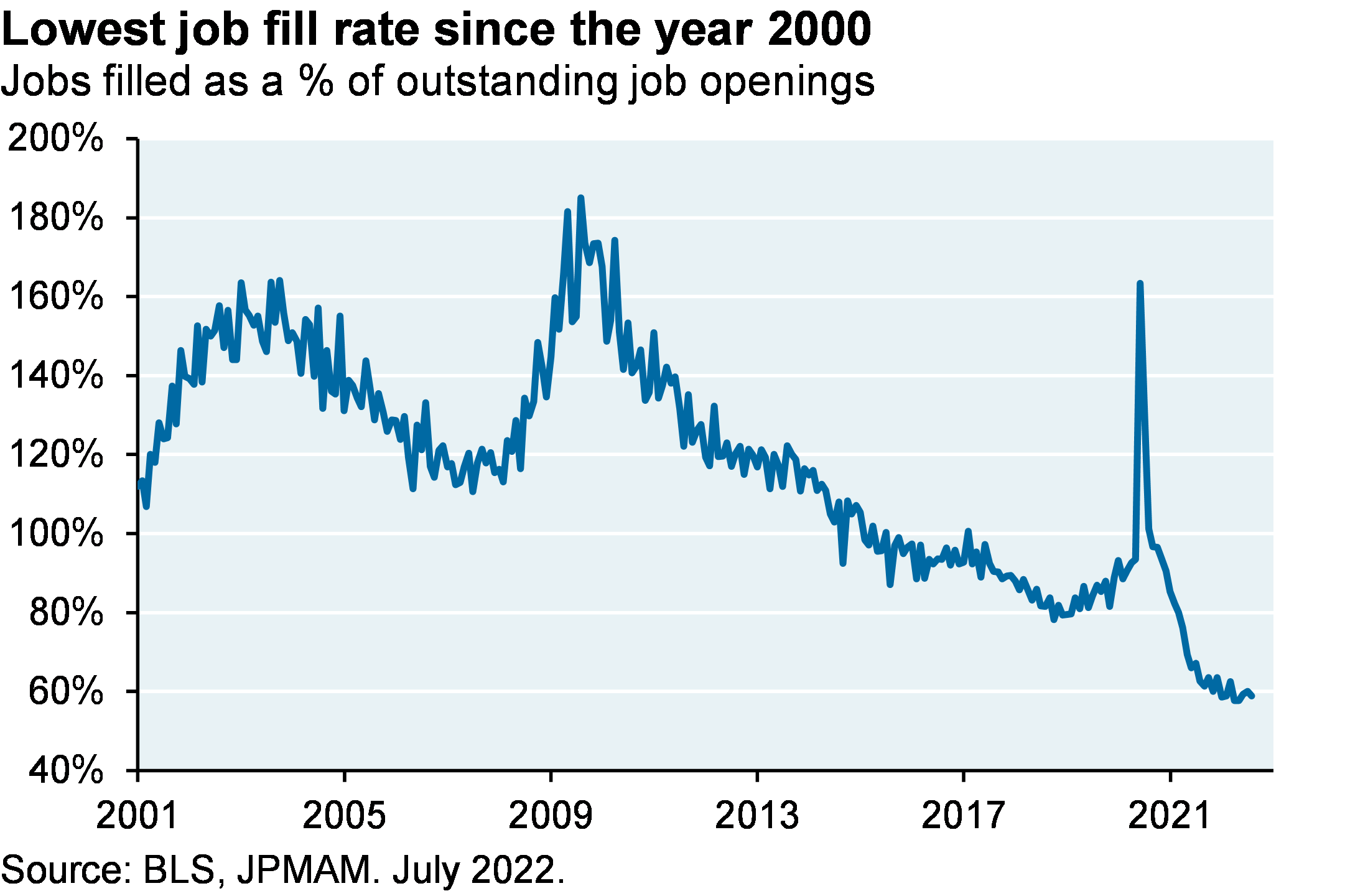

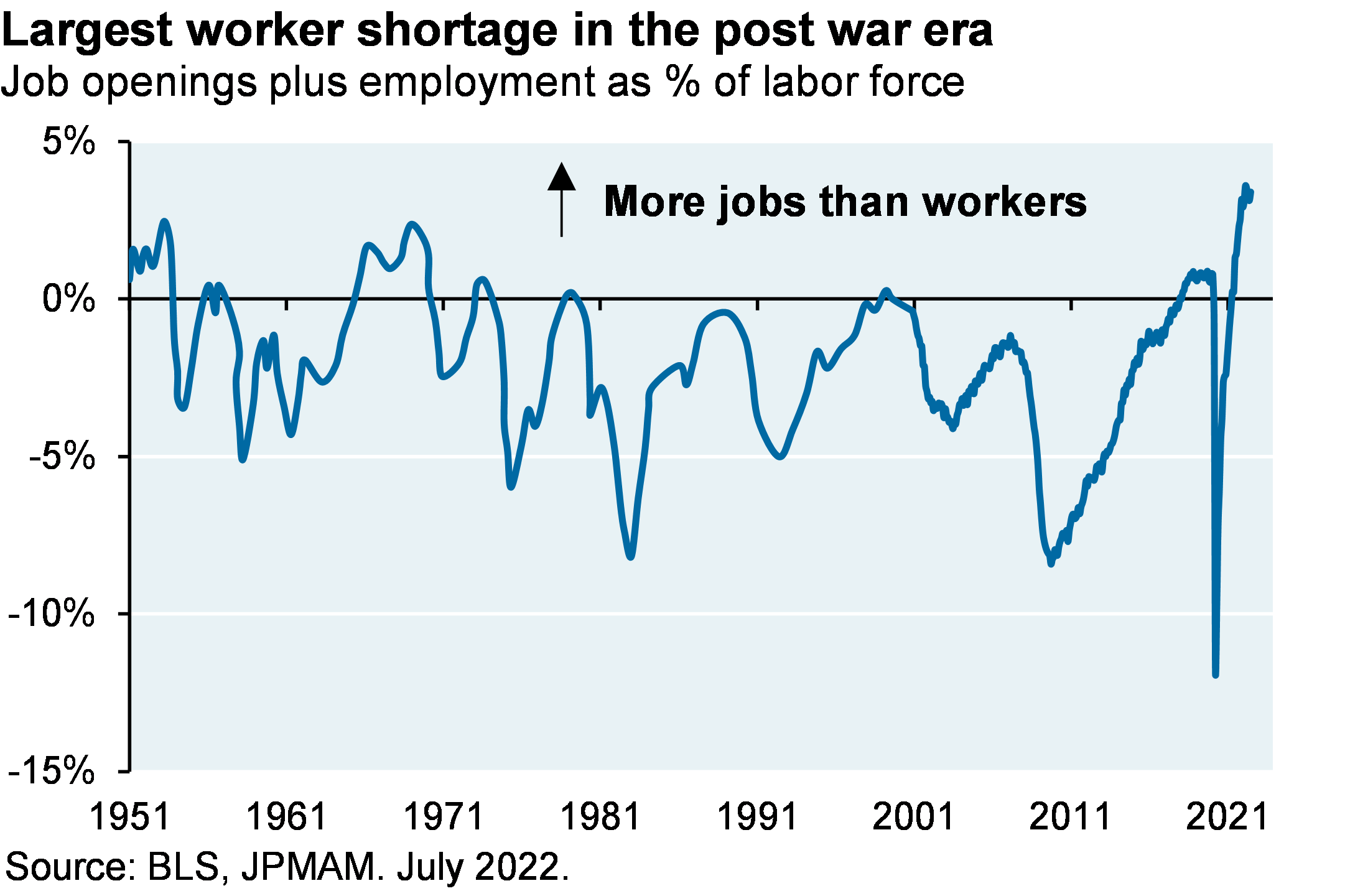

The Fed is under the gun: the monthly job fill rate as a % of openings has collapsed, and the ratio of employment plus job openings to the size of the labor force is close to its highest level on record. Other similar indicators:

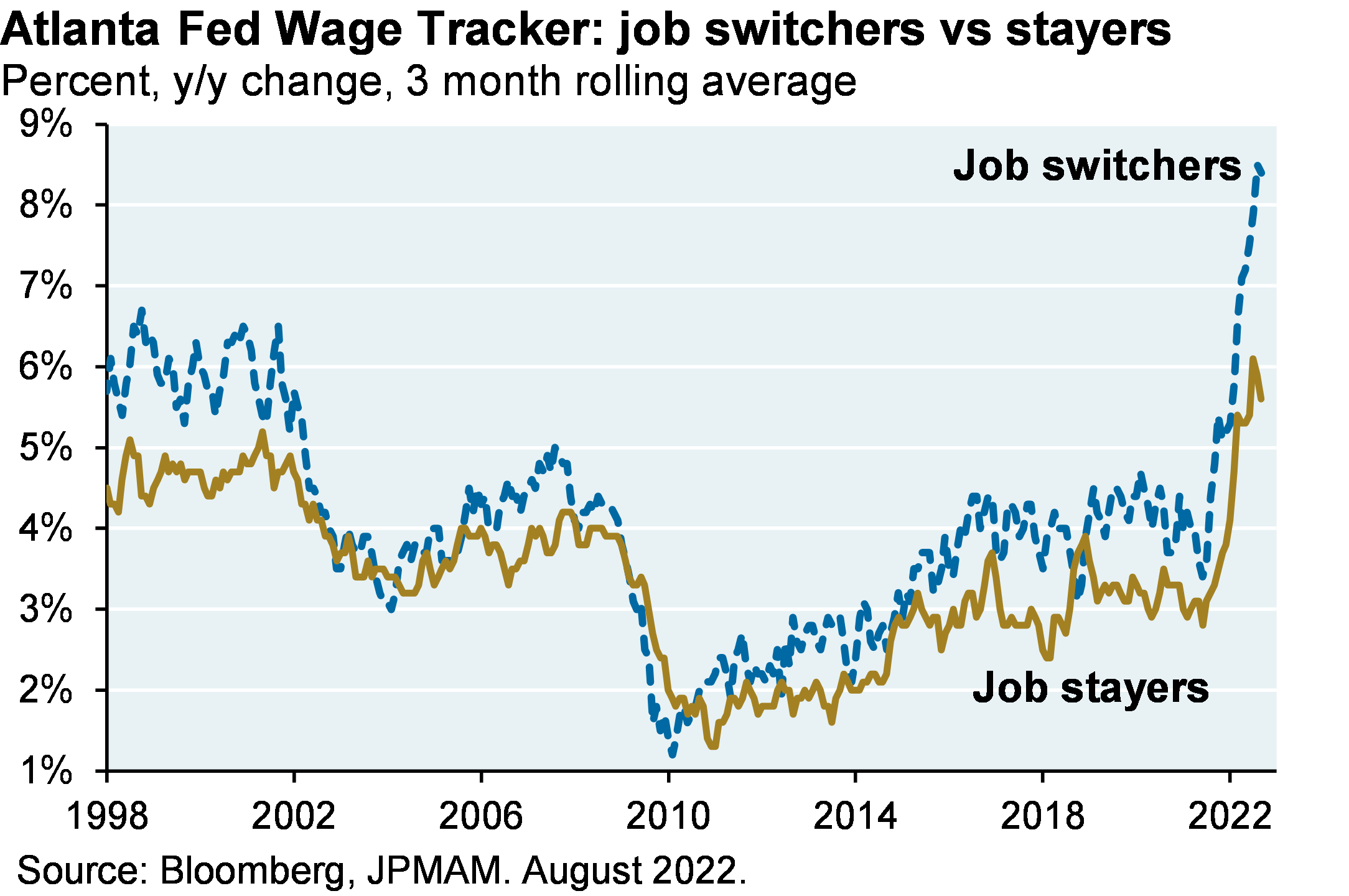

People switching jobs are earning a very high premium relative to those who stay put

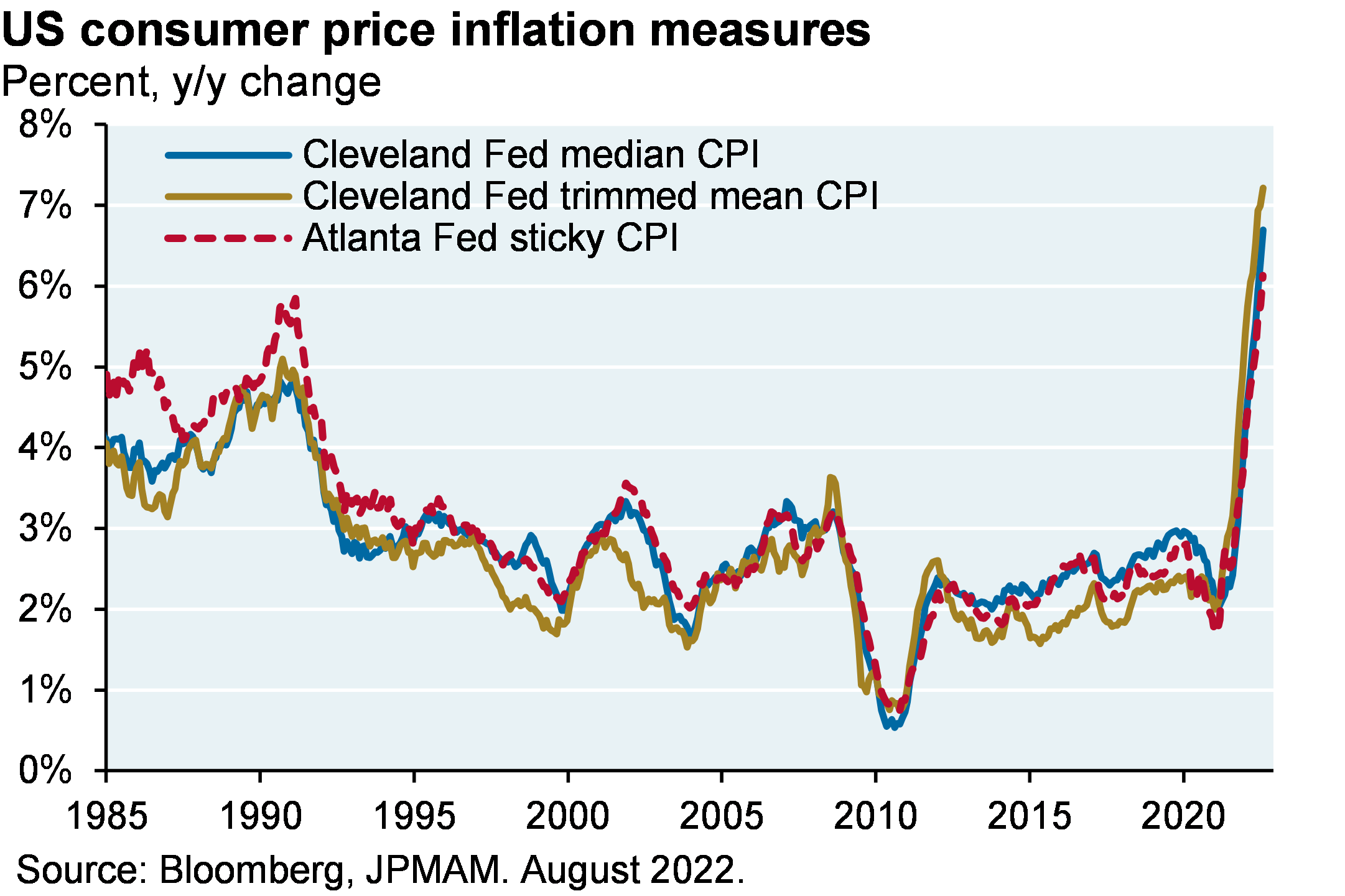

A Brookings paper cites labor market tightness as being responsible for 80% of the increase in consumer price inflation since 20201 [note: in our view, explosive monetary and fiscal stimulus, supply chain delays due to COVID and energy policy were the primary drivers of the initial rise in inflation]

A new NBER paper estimates NAIRU (the non-inflationary rate of unemployment) at 6%, one of the highest rates since the 1980’s2

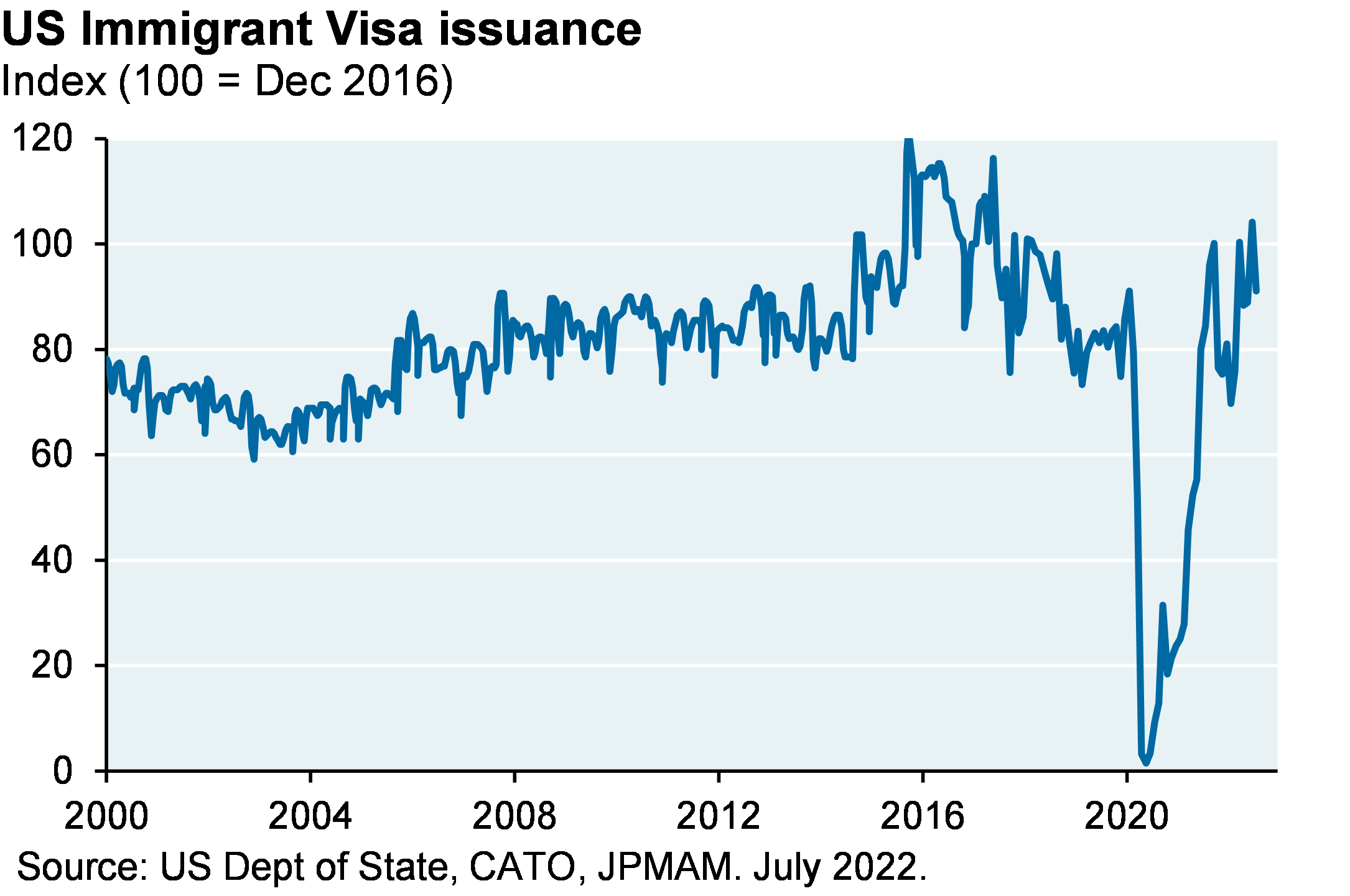

2.5% of the US workforce is estimated to have been lost to excess retirement during COVID, other COVID related issues (long COVID, terminations, child care shortages) and the decline in immigration3

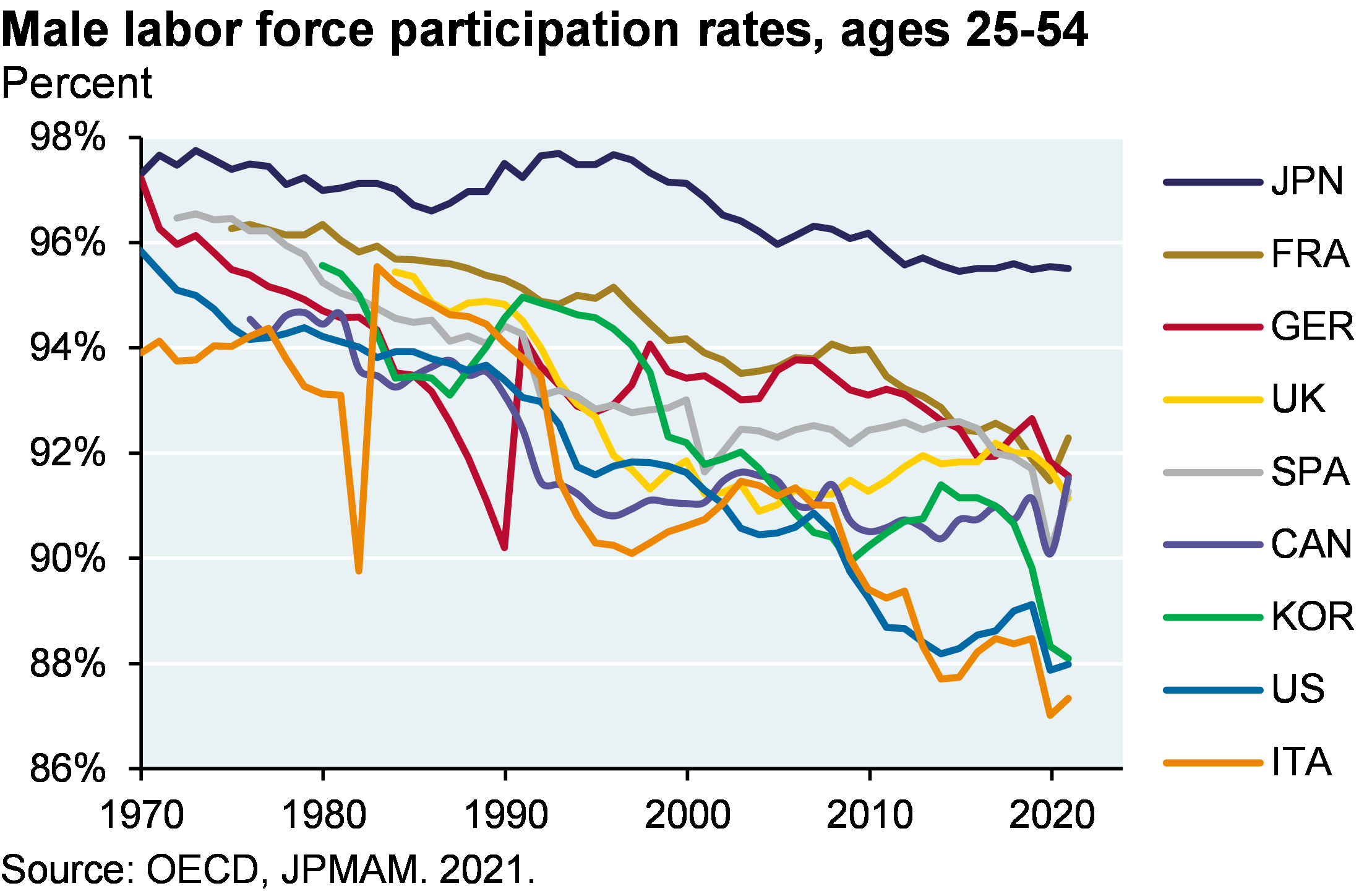

It’s hard to increase the labor supply. Birth rates are stagnant, immigration is just beginning to pick up (see Appendix) and it’s difficult to lure retired people back into the workforce. Unless the labor supply increases, wage-price spirals could become more commonplace; this is a risk that the Fed is clearly focused on. As we discussed last time, labor force participation is already back to normal for 25-54 year olds; it remains depressed for those over 54. One potential pool of underutilized labor: the population of people with a criminal arrest record, many of whom were never convicted for serious crimes and/or incarcerated. Let’s take a closer look.

Could “Second Chance” legislation help reduce the US labor supply shortage? It’s worth a closer look

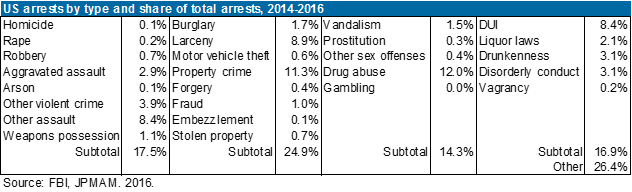

Second chance legislation refers to policies designed to ease the path to employment for people with a criminal record, some of whom have been incarcerated although many people with an arrest or conviction record haven’t been. Given the recent increase in violent crime rates, it might seem like an odd time for this; but if such policies can reduce recidivism, a wide range of social, economic and workforce issues could improve.

Main components of second chance legislation:

“Clean Slate” procedures under which criminal records are automatically expunged if individuals remain arrest-free for a specified period. Eight states have passed such legislation: PA, UT, MI, CT, DE, OK, CO, VA

“Ban the Box” legislation which would require most private employers to postpone asking about an applicant’s criminal record until after the applicant has had an opportunity to interview, or until after a conditional offer of employment has been made. More than 100 cities/counties and 19 states have already enacted ban the box policies, as has the Federal government4

The FDIC has recently narrowed the circumstances under which written consent is required in order for a bank to hire individuals with minor criminal offenses, but more can be done by Congress

Prevent unpaid court debts (fines, fees, costs and restitution) from being a barrier to record clearing. In almost every jurisdiction, outstanding court debt is a barrier to record clearing, either rendering a person ineligible for record relief or making it difficult for them to qualify for it5

Standardize record clearing timetables across states. These timetables refer to the time during which individuals must be crime-free in order to qualify for record clearing. Dispersion across states is very wide; for example, some states allow clearing of felony convictions after 1-3 years, others after 5, 7 or 10 years, and 16 states do not allow felony record clearing at all6

To understand why this legislation is worth thinking about, consider the following:

One third of the adult working age population has a “criminal record” that can impair their ability to get a job, even though most have not committed a “serious crime”, and even after the rest fulfill their justice system obligations. Criminal records are retained by the Department of Justice in its Interstate Identification Index even though many people who get arrested are never charged or convicted7. Around one third of employers consider an arrest without conviction as "somewhat influential” in their hiring decisions

In another study, 64% of all unemployed males between the ages of 30 and 38 had been arrested at least once, with negative implications for marriage, education, net worth, employment and earnings8

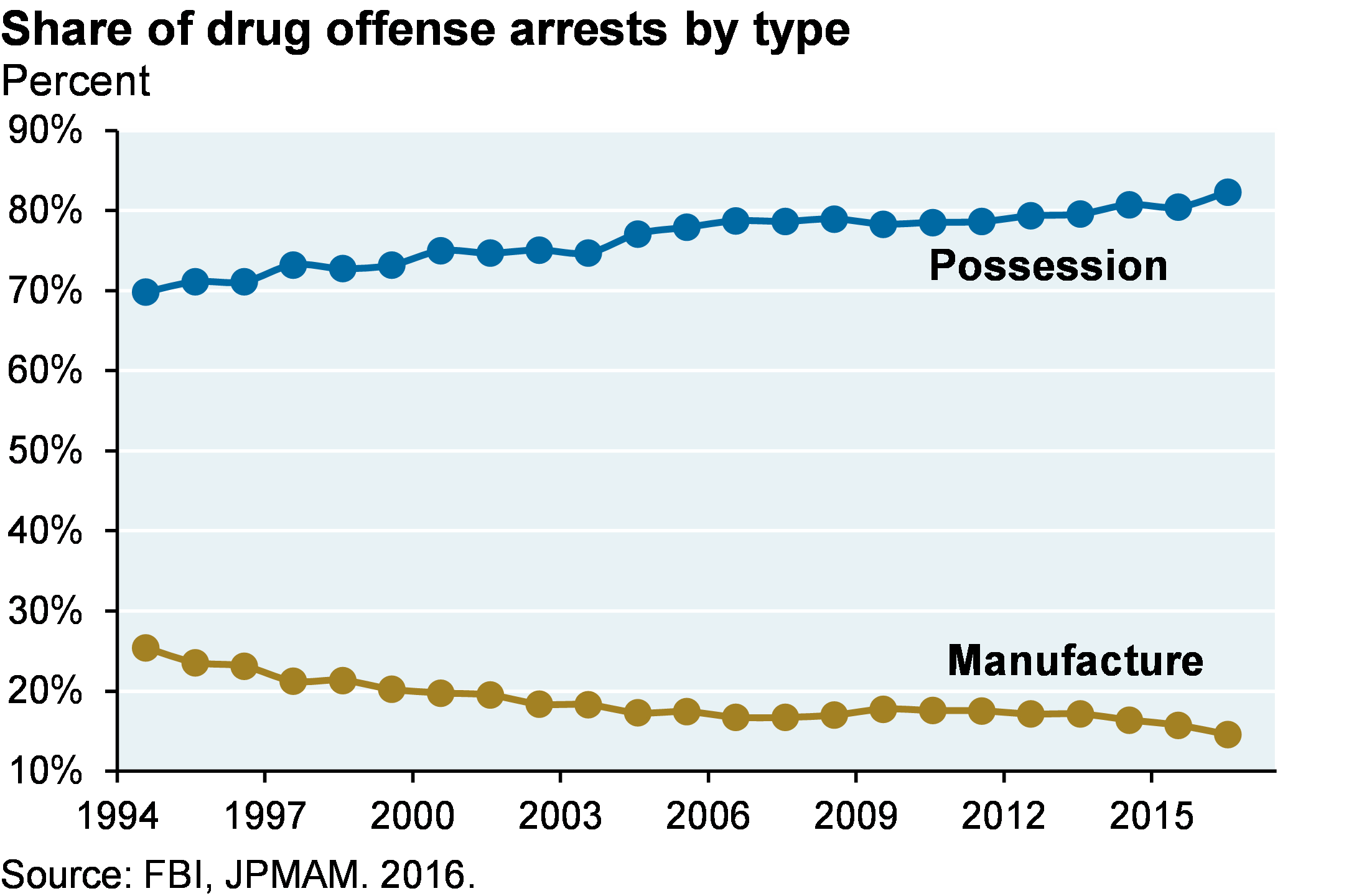

With respect to drug arrests, 70%-80% have been for possession rather than manufacture (see Appendix)

The current system of having records expunged is costly, complex and very time-consuming; as a result, few people pursue it even though having an arrest record reduces the chances of being contacted by an employer by 50%-65%9. Example: among those eligible for expungement in Michigan, just 6.5% obtain it within five years of eligibility due to a limited understanding of expungement laws and procedures, application fees and possible loss of wages for time taken off work10

The US has the highest rate of incarceration in the world, just above Rwanda, Turkmenistan and El Salvador. Formerly incarcerated people are routinely and systematically shut out of the work force

In one study11, 33% of parolees found no employment over four years post-release, and at any given time no more than 40% was employed (i.e., a roughly 60% consistent unemployment rate). Those who were employed had an average of 3.4 jobs throughout the four-year study and earned 50%-80% of median wages, suggesting they were landing jobs that didn’t offer security or mobility

Someone imprisoned as a young adult suffers a lifetime earnings loss of $480k, regardless of the offense12

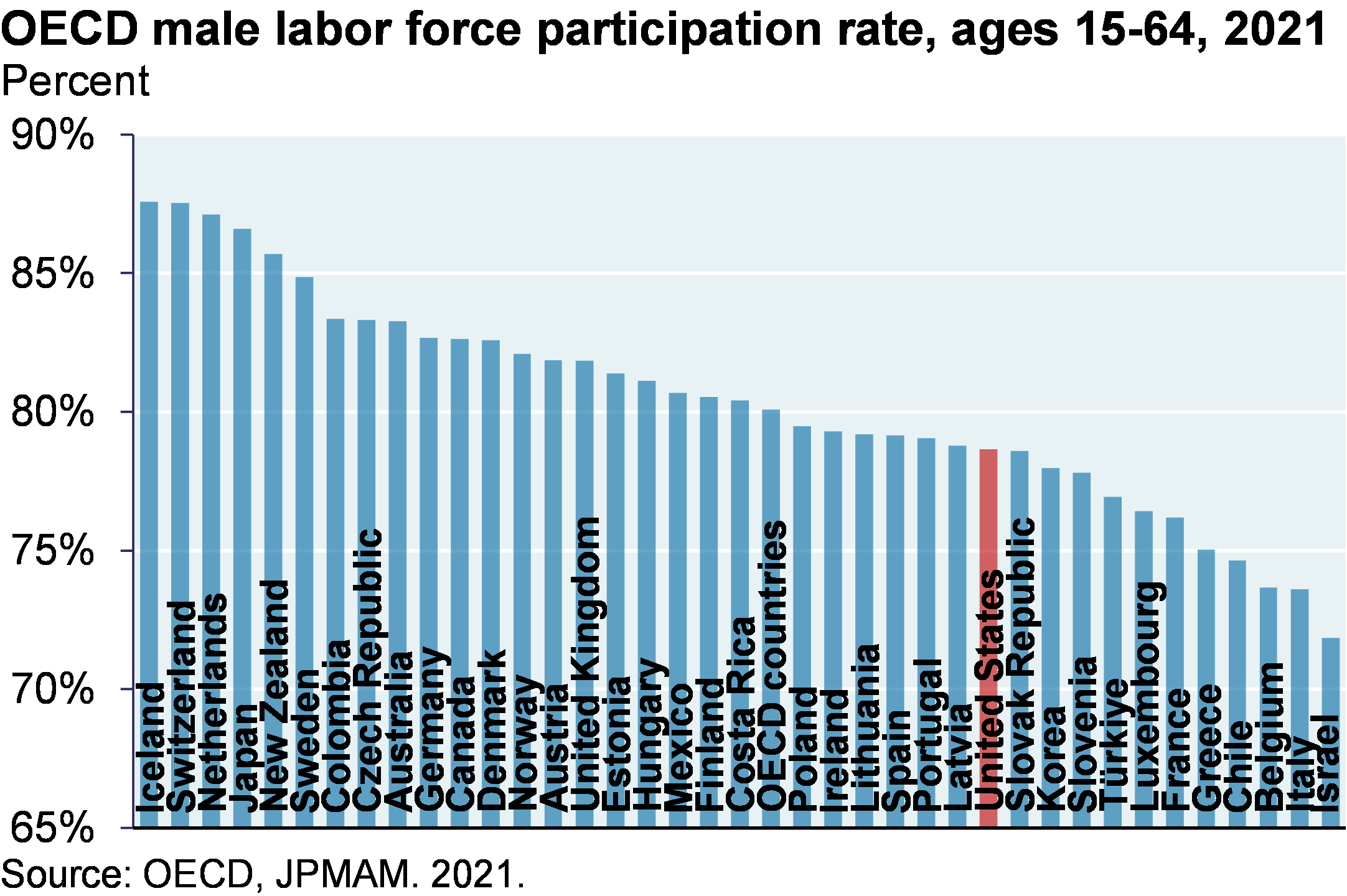

All of the above contribute to the US having one of the lowest male labor force participation rates in the OECD (see Appendix)

Will such second chance programs “work”? In other words, when Ban the Box and record clearing legislation exists, do such policies sustainably increase the work force? They just might. Studies differ, of course; here are some noteworthy analyses.

Employment has been estimated to be the most significant factor in decreasing recidivism13

In Chicago, formerly incarcerated people who had found employment for one year had a recidivism rate of only 16% over three years compared to a 52% for all other releases14

However, it appears that “any job of any kind” doesn’t help as much. In several studies, recidivism rates only declined when parolees got higher paying jobs leading to sustainable career pathways15, such as construction and manufacturing jobs rather than retail or food service jobs16

Reducing employer liability could increase hiring rates of people with criminal records. According to the Society of Human Resource Management, 52% of employers said their primary reason for checking candidate backgrounds was to reduce legal liability rather than to ensure a safe work environment (49%) or assess trustworthiness (17%)17

In a criminal background check, how far back should employers look? In other words, how long does it take for someone who has been convicted or arrested to demonstrate that it won’t happen again? By shrinking the time horizon of background checks, pathways to employment increase

One answer comes from a 2009 paper which looked at 88,000 first-time arrestees in New York and followed them for the next 25 years to see whether they committed other crimes. After a sufficient amount of time following a prior offense passes without new charges, ex-offenders are no more likely to be arrested than the average citizen. For those who commit their first crime at a young age or whose first crime is a serious offense, it takes about eight years without another offense. For others, such as those who commit non-serious crimes, it can take as little as three years18

Policy experts in this field believe that viable employees are being passed over unnecessarily. Emerging research suggests that some combination of age, number of prior convictions and time since last conviction (and not the nature of the crime itself) are the best indicators of future criminal activity risk. In other words, the older someone is and the more time that elapsed since the crime occurred, the lower the risk to the employer of recurrence. Algorithms have their problems and biases, but policies driven by empirical data are probably better than the ad-hoc and zero-risk tolerance approaches used today by many hiring managers.

Employers are increasingly turning to second chance hiring

The Second Chance Business Coalition, co-chaired by JPMorgan Chase, represents more than 40 large companies across industries that are committed to developing best practices and tools for employers to deploy second hiring and advancement strategies at companies like Accenture, CVS, Eaton, General Motors, McDonald’s, Microsoft, Verizon and Walmart

Last year, JPMorgan Chase hired more than 4,300 people with criminal backgrounds (~10% of new hires in the US) whose history fit within industry regulatory guidelines and had no bearing on the requirements of the job they were seeking

Many were involved in low-level crimes such as disorderly conduct, personal drug possession and DUI (driving under the influence), and are employed in jobs such as transaction processing, and lending and account servicing

The firm “banned the box” that asked about a candidate’s criminal or arrest records on initial job applications, and established a community hiring strategy that provides legal services, job search support and mentorship in collaboration with local nonprofit organizations

In addition to our own hiring practices, the firm is supporting Second Chance legislation at the state and Federal levels through the JP Morgan Chase Policy Center

Second Chance Bills in front of Congress

Fair Hiring in Banking Act, H.R. 5911, would expand employment opportunities for those with a previous minor criminal offense without posing safety and soundness risks to the financial system. This measure passed the U.S. House of Representatives in May with significant bipartisan support and is expected to be introduced in the U.S. Senate this month

Clean Slate Act, H.R. 2864, would create a process for clearing low-level nonviolent federal records and streamlining the process through automation

Fresh Start Act, H.R. 5651, would allow states that have expungement or sealing laws in place to apply for a Federal grant to help automate the process

Appendix charts

2 “Estimating Natural Rates of Unemployment”, Bok and Petrosky-Nadeau (FRBSF), May 31, 2022

3 “The Big Stuff: Earnings, Inflation and the Labor Market”, Empirical Research, September 14, 2022

4 As per the Federal Fair Chance Act of 2019, the Federal government and its paid contractors may not require that job applicants disclose criminal history information prior to extending a conditional offer of employment

5 “The high cost of a fresh start”, National Consumer Law Center, February 2022

6 “Waiting for relief: a national survey of waiting periods for record clearing”, CCRC, February 2022

7 Brennan Center for Justice, Matthew Friedman, November 2015

8 “Barred from employment: More than half of unemployed men in their 30s had a criminal history of arrest”, Bushway et al, Science Advances, 2022

9 Colorado Law & Policy Center, “Ban the box legislation boosts employment and reduces recidivism”, Nov 2015

10 “Expungement of Criminal Convictions: An Empirical Study”, Prescott and Starr, Univ. of Michigan, 2020

11 “New data on formerly incarcerated people’s employment reveal labor market injustices”, Wang and Bertram, Prison Policy Initiative, February 2022

12 “Conviction, Imprisonment, and Lost Earnings: How Involvement with the Criminal Justice System Deepens Inequality”, Brennan Center, September 2020

13 “Reentry and the Ties that Bind: An Examination of Social Ties, Employment, and Recidivism”, Justice Quarterly, 2011

14 “Safer Foundation Three-Year Recidivism Study”, Georgia Justice Project, 2008

15 “Local labor markets and criminal recidivism”, Yang (Harvard Law), 2017; “The Impact of Post-release employment on Recidivism in North Carolina”, Berger-Cross (NC LEAD), 2022; and “Not Just Any Job Will Do”, Ramakers et al. (IJOTCC), 2017

16 “Good Jobs and Recidivism”, Schnepel (Univ. of Sydney), 2016

17 Society of Human Resources Management survey, SHRM Research Institute

18 “Redemption in an Era of Widespread Criminal Background Checks”, Blumstein & Nakamura (NIJ), 2009

IMPORTANT INFORMATION

This report uses rigorous security protocols for selected data sourced from Chase credit and debit card transactions to ensure all information is kept confidential and secure. All selected data is highly aggregated and all unique identifiable information, including names, account numbers, addresses, dates of birth, and Social Security Numbers, is removed from the data before the report’s author receives it. The data in this report is not representative of Chase’s overall credit and debit cardholder population.

The views, opinions and estimates expressed herein constitute Michael Cembalest’s judgment based on current market conditions and are subject to change without notice. Information herein may differ from those expressed by other areas of J.P. Morgan. This information in no way constitutes J.P. Morgan Research and should not be treated as such.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from J.P. Morgan or any of its subsidiaries to participate in any of the transactions mentioned herein. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Non-affiliated entities mentioned are for informational purposes only and should not be construed as an endorsement or sponsorship of J.P. Morgan Chase & Co. or its affiliates.

For J.P. Morgan Asset Management Clients:

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy.

ACCESSIBILITY

For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

This communication is issued by the following entities:

In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), which this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only.

For J.P. Morgan Private Bank Clients:

ACCESSIBILITY

J.P. Morgan is committed to making our products and services accessible to meet the financial services needs of all our clients. Please direct any accessibility issues to the Private Bank Client Service Center at 1-866-265-1727.

LEGAL ENTITY, BRAND & REGULATORY INFORMATION

In the United States, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A. and its affiliates (collectively “JPMCB”) offer investment products, which may include bank-managed investment accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (“JPMS”), a member of FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPM. Products not available in all states.

In Germany, this material is issued by J.P. Morgan SE, with its registered office at Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). In Luxembourg, this material is issued by J.P. Morgan SE – Luxembourg Branch, with registered office at European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Luxembourg Branch is also supervised by the Commission de Surveillance du Secteur Financier (CSSF); registered under R.C.S Luxembourg B255938. In the United Kingdom, this material is issued by J.P. Morgan SE – London Branch, registered office at 25 Bank Street, Canary Wharf, London E14 5JP, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – London Branch is also supervised by the Financial Conduct Authority and Prudential Regulation Authority. In Spain, this material is distributed by J.P. Morgan SE, Sucursal en España, with registered office at Paseo de la Castellana, 31, 28046 Madrid, Spain, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE, Sucursal en España is also supervised by the Spanish Securities Market Commission (CNMV); registered with Bank of Spain as a branch of J.P. Morgan SE under code 1567. In Italy, this material is distributed by J.P. Morgan SE – Milan Branch, with its registered office at Via Cordusio, n.3, Milan 20123, Italy, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Milan Branch is also supervised by Bank of Italy and the Commissione Nazionale per le Società e la Borsa (CONSOB); registered with Bank of Italy as a branch of J.P. Morgan SE under code 8076; Milan Chamber of Commerce Registered Number: REA MI 2536325. In the Netherlands, this material is distributed by J.P. Morgan SE – Amsterdam Branch, with registered office at World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Amsterdam Branch is also supervised by De Nederlandsche Bank (DNB) and the Autoriteit Financiële Markten (AFM) in the Netherlands. Registered with the Kamer van Koophandel as a branch of J.P. Morgan SE under registration number 72610220. In Denmark, this material is distributed by J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland, with registered office at Kalvebod Brygge 39-41, 1560 København V, Denmark, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland is also supervised by Finanstilsynet (Danish FSA) and is registered with Finanstilsynet as a branch of J.P. Morgan SE under code 29010. In Sweden, this material is distributed by J.P. Morgan SE – Stockholm Bankfilial, with registered office at Hamngatan 15, Stockholm, 11147, Sweden, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Stockholm Bankfilial is also supervised by Finansinspektionen (Swedish FSA); registered with Finansinspektionen as a branch of J.P. Morgan SE. In France, this material is distributed by JPMCB, Paris branch, which is regulated by the French banking authorities Autorité de Contrôle Prudentiel et de Résolution and Autorité des Marchés Financiers. In Switzerland, this material is distributed by J.P. Morgan (Suisse) SA, with registered address at rue de la Confédération, 8, 1211, Geneva, Switzerland, which is authorised and supervised by the Swiss Financial Market Supervisory Authority (FINMA), as a bank and a securities dealer in Switzerland. Please consult the following link to obtain information regarding J.P. Morgan’s EMEA data protection policy: https://www.jpmorgan.com/privacy.

In Hong Kong, this material is distributed by JPMCB, Hong Kong branch. JPMCB, Hong Kong branch is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission of Hong Kong. In Hong Kong, we will cease to use your personal data for our marketing purposes without charge if you so request. In Singapore, this material is distributed by JPMCB, Singapore branch. JPMCB, Singapore branch is regulated by the Monetary Authority of Singapore. Dealing and advisory services and discretionary investment management services are provided to you by JPMCB, Hong Kong/Singapore branch (as notified to you). Banking and custody services are provided to you by JPMCB Singapore Branch. The contents of this document have not been reviewed by any regulatory authority in Hong Kong, Singapore or any other jurisdictions. You are advised to exercise caution in relation to this document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. For materials which constitute product advertisement under the Securities and Futures Act and the Financial Advisers Act, this advertisement has not been reviewed by the Monetary Authority of Singapore. JPMorgan Chase Bank, N.A. is a national banking association chartered under the laws of the United States, and as a body corporate, its shareholder’s liability is limited.

With respect to countries in Latin America, the distribution of this material may be restricted in certain jurisdictions. We may offer and/or sell to you securities or other financial instruments which may not be registered under, and are not the subject of a public offering under, the securities or other financial regulatory laws of your home country. Such securities or instruments are offered and/or sold to you on a private basis only. Any communication by us to you regarding such securities or instruments, including without limitation the delivery of a prospectus, term sheet or other offering document, is not intended by us as an offer to sell or a solicitation of an offer to buy any securities or instruments in any jurisdiction in which such an offer or a solicitation is unlawful. Furthermore, such securities or instruments may be subject to certain regulatory and/or contractual restrictions on subsequent transfer by you, and you are solely responsible for ascertaining and complying with such restrictions. To the extent this content makes reference to a fund, the Fund may not be publicly offered in any Latin American country, without previous registration of such fund’s securities in compliance with the laws of the corresponding jurisdiction. Public offering of any security, including the shares of the Fund, without previous registration at Brazilian Securities and Exchange Commission— CVM is completely prohibited. Some products or services contained in the materials might not be currently provided by the Brazilian and Mexican platforms.

JPMorgan Chase Bank, N.A. (JPMCBNA) (ABN 43 074 112 011/AFS Licence No: 238367) is regulated by the Australian Securities and Investment Commission and the Australian Prudential Regulation Authority. Material provided by JPMCBNA in Australia is to “wholesale clients” only. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Corporations Act 2001 (Cth). Please inform us if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

JPMS is a registered foreign company (overseas) (ARBN 109293610) incorporated in Delaware, U.S.A. Under Australian financial services licensing requirements, carrying on a financial services business in Australia requires a financial service provider, such as J.P. Morgan Securities LLC (JPMS), to hold an Australian Financial Services Licence (AFSL), unless an exemption applies. JPMS is exempt from the requirement to hold an AFSL under the Corporations Act 2001 (Cth) (Act) in respect of financial services it provides to you, and is regulated by the SEC, FINRA and CFTC under U.S. laws, which differ from Australian laws. Material provided by JPMS in Australia is to “wholesale clients” only. The information provided in this material is not intended to be, and must not be, distributed or passed on, directly or indirectly, to any other class of persons in Australia. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Act. Please inform us immediately if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

This material has not been prepared specifically for Australian investors. It:

May contain references to dollar amounts which are not Australian dollars;

May contain financial information which is not prepared in accordance with Australian law or practices;

May not address risks associated with investment in foreign currency denominated investments; and

Does not address Australian tax issues.

Arrested Development

Three topics this week: the repricing of risky credit, labor markets and a COVID recap.

[START RECORDING]

FEMALE VOICE: This podcast has been prepared exclusively for institutional, wholesale professional clients and qualified investors, only as defined by local laws and regulations. Please read other important information, which can be found on the link at the end of the podcast episode.

MR. MICHAEL CEMBALEST: Good morning, this is late September Eye on the Market. This one’s called Arrested Development for reasons we will discuss. There are three topics I want to go through this time. One is on markets and the Citrix canary. The second topic is labor markets, the Fed, and if second chance policies for those people with criminal histories can expand the labor force. And then lastly, a brief COVID update.

So, on markets and Citrix and high yield and everything, I wrote in our Labor Day piece that we had expected the S&P to retest the June lows; now we’re there. Equity markets have been very slow to digest the path of policy rates, which continue to rise. It’s almost like people didn’t take Powell at his word, and Powell was extremely slow to recognize what was unfolding in front of him. Amazing that the Fed barely had forecast any rate increases a year ago, even though we had very tight labor markets and commodity prices were skyrocketing.

So you have the additional headwinds from Europe’s energy mess, China’s real estate collapse, its zero-COVID policy, et cetera. So more broadly, as we show in here, we’re emerging from this weird decade where the pricing on risky assets was very high relative to the pricing of cash and cash equivalents. And now that that gap is closing and renormalizing, that argues for lower valuations on a lot of different things. So we don’t think there’s a deep US recession coming, particularly given the strength of consumer balance sheets. But we think that better entry points on equities probably still lay head sometime between now and next spring, when the fund rate peaks.

Now on the Citrix deal, which a lot of you probably read about, the senior notes were originally underwritten a few months ago at 6.5. They got placed at 10, and the underwriters still reportedly held all of the second-lien Citrix notes, which had initial underwriting levels of 8.5, and nobody really knows where those would’ve been placed because they weren’t placed. And Citrix was reportedly one of the better deals in the pipeline. What comes next is Twitter and Nielsen, Tegna, Tenneco, all of which are lower rated and/or more cyclical than Citrix. So given while there’s been a lot of repricing in the equity market so far, the selloff in high yield and leveraged loan has been pretty modest. And Citrix, this Citrix deal and the next couple may be telling us something more about how much assets will reprice here.

We’ve got some charts in here on leading indicators for earnings, which are falling. They’re not dropping off a cliff, but obviously they’re declining as the economy gets weaker. And there is some evidence that positioning and sentiment are very bearish, and some valuations already price in a lot of bad news. And China banks are trading at less than half of book value. The P/E ratio on European equities is getting pretty close to the 2012 debt crisis lows and then all that kind of Metaverse, Fintech, hydrogen, SPAC nonsense stuff is down 50 to 80% from its peak. But right now, all eyes are on the Fed and a rapidly vanishing window for a soft landing. And that’s what we’re going to discuss next, as it relates to the Fed and the labor markets.

So a lot of clients are asking why in the world, with the Fed tightened into a weakening global economy. That’s a good question. But the risk of wage price spirals apparently worries them even more. The Fed’s under the gun here. The monthly job-fill rate has collapsed, right. That’s the percentage of open jobs that get filled each month. There’s a measure you can look at that looks at the ratio of employment plus job openings to the size of the labor force. So there’s a lot more jobs than there are workers right now. And that that number is close to the highest level we’ve seen in decades. People that switch jobs are earning a big premium relative to those who stay put. And then there’s a whole bunch of academic research coming out, citing labor markets as being responsible for the bulk of the increase in CPI. The latest NARO [phonetic] estimate from one of the other papers is 6%, which is one of the highest estimates we’ve seen in a long time.

And so it’s hard to increase the labor supply. Birth rates are stagnant, immigration is just beginning to pick up, and it’s difficult to lower all those retired people back into the workforce. I think two-and-a-half times the number of people retired over the last couple of years compared to prior pre-COVID trends. And so unless the labor supply picks up, the wage price spirals could become a risk for the Fed. And that’s why they may see themselves as being forced to crush the economy to get that labor supply number and labor inflation back to normal. And as we discussed last time, the labor force participation rate is already back to normal for 25 to 54-year-olds. It’s very depressed for those over 54.

So there’s a section in this piece, and I’m not going to go into too much detail ‘cause you kind of have to read it to see what we’re getting at, but there is a potential pool of underutilized labor in the form of people with criminal arrest records, a lot of whom are never convicted for serious crimes or incarcerated. And this is something that J.P. Morgan has done a lot of work on as a firm and with other members of the Business Coalition.

And in general, clean slate procedures refer to things that ease the paths to employment. It can be things like having your arrest records automatically expunged if you remain arrest-free for a certain period, something called ban the box approaches, which would require private employers to not ask about criminal records until after they’ve had the chance to interview or after they’ve been made a conditional offer of employment. The FDIC can do more to allow our banks to hire individuals with minor criminal offenses until recently that required written waivers.

I think more can be done in terms of preventing unpaid court debts from being able to clear your arrest record. In almost every jurisdiction, any outstanding fines and fees and things like that can be a barrier to having your record clear. And then in some states, they don’t allow for clearing of felony convictions at all, despite the number of years that you might be crime-free.

And to think about why this is important, and when I started looking at this, I didn’t think this was going to be this important and I found these numbers kind of shocking, one-third of all working-age adults in the US have a criminal record, which is again kind of shocking to me. And obviously that’s going to impair their ability to get a job, even though most of these people have not committed what you and I would consider to be a serious crime, and even after the rest of them who did commit serious crimes fulfill their justice system obligations.

And another study, and I spoke to someone from the Rand Institute who worked on this, almost two-thirds of all unemployed males who are currently unemployed today between the ages of 30 and 38 had been arrested at least once. And so again, it points to the fact that there could be, amongst this population of people that had been arrested, barriers to employment that are worth thinking about. And with respect to drug arrests, 70 to 80% of them historically have been for possession rather than manufacturing.

And then as you all probably know, the US has a higher, the highest rate of incarceration in the world, above places like Rwanda and Turkmenistan. So there’s a large pool of people here who could potentially benefit. And the US also has one of the lowest male labor force participation rates in the entire OECD. And again, that’s another sign that we’ve got people missing from the workforce, and some of these second chance policies have the potential to really help on this front.

The last topic for this week’s piece is a brief COVID update. I haven’t talked to you or written to you about COVID in a little while, and I wanted to just give an update on the bivalent vaccines, the inhalable vaccines, and preventable deaths. So as we all know, based on how transmissible omicron is, the vaccines are no longer very effective in terms of preventing infection and transmission. Those efficacy rates have dropped below 50%, and that’s in particular, after four to six months.

However, studies focused on people aged 50 and 60 and above, a cohort that I care a lot about, still show very large declines in mortality and hospitalization risk from a fourth shot compared to either two or three shots. So there’s a lot of research here showing the benefits in terms of mortality and hospitalization risk, even if it’s hard to prevent infection transmission.

The other thing that’s interesting is that a lot of the studies showing the risk of unvaccinated people versus vaccinated people ending up in the hospital or dying, is that a lot of the unvaccinated people have already been infected. So to the extent that those rates for unvaccinated people look bad, it now tells us that infection-induced immunity is not nearly as strong as immunity that’s acquired from vaccines.

So there are these new bivalent mRNA vaccines available. Bivalent simply means they’ve been engineered to work against two different strains, the original strain and omicron BA 4 and 5. There’s not a lot of hard data on efficacy yet for these new vaccines. The decision to move forward with them was based on the results of some prior vaccines and some lab data on this new vaccine from mice. So efficacy data should be rolling out in the weeks ahead.

But looking forward, what the world really needs, and we’ve all obviously been reading about this a lot, is something that does a better job on infection and transmission. And there is a new report from the New England Journal of Medicine indicating that that nasal mucosal antibodies are what may be needed to really block infection and transmission, ‘cause that’s where pathogens, airborne pathogens, are first introduced into the body.

A bunch of companies are working on this. Take for what it’s worth, China improved its first inhalable COVID vaccine, and I can understand why people would have concerns about the data there. But according to what they’ve reported, their trial show a better immune response from two injectable vaccines plus an inhalable booster, than from a regimen of three shots. They also claim the inhalable vaccine needs a lot less viral material to be affected.

And what I think is interesting and important is that India’s biotech approved its own inhalable vaccine, which it developed in very close conjunction with researchers at the Washington University of St Louis. So that has an imprimatur that I feel much better about. And I think in the future, the inhaled vaccines are going to be used in tandem with the injected ones. You still need the injected vaccines to produce antibodies in your bloodstream and internal organs in case the nasal vaccine defenses fail.

So that’s a brief COVID update. Thank you very much for listening. I’m very proud of Jamie’s testimony last week, particularly as it relates to energy topics. And for those of you that read the Eye on the Market annual energy paper, you will understand why. Thank you for listening, and I’ll talk to you next time, bye.

FEMALE VOICE: Michael Cembalest’s Eye on the Market offers a unique perspective on the economy, current events, markets and investment portfolios, and is a production of J.P. Morgan Asset and Wealth Management. Michael Cembalest is the Chairman of Market and Investment Strategy for J.P. Morgan Asset Management and is one of our most renowned and provocative speakers. For more information, please subscribe to the Eye on the Market by contacting your J.P. Morgan representative. If you’d like to hear more, please explore episodes on iTunes or on our website.

This podcast is intended for informational purposes only and is a communication on behalf of J.P. Morgan Institutional Investments Incorporated. Views may not be suitable for all investors and are not intended as personal investment advice or a solicitation or recommendation. Outlooks and past performance are never guarantees of future results. This is not investment research. Please read other important information, which can be found at www.JPMorgan.com/disclaimer-EOTM.

[END RECORDING]