RBA: New Governor, similar policy stance

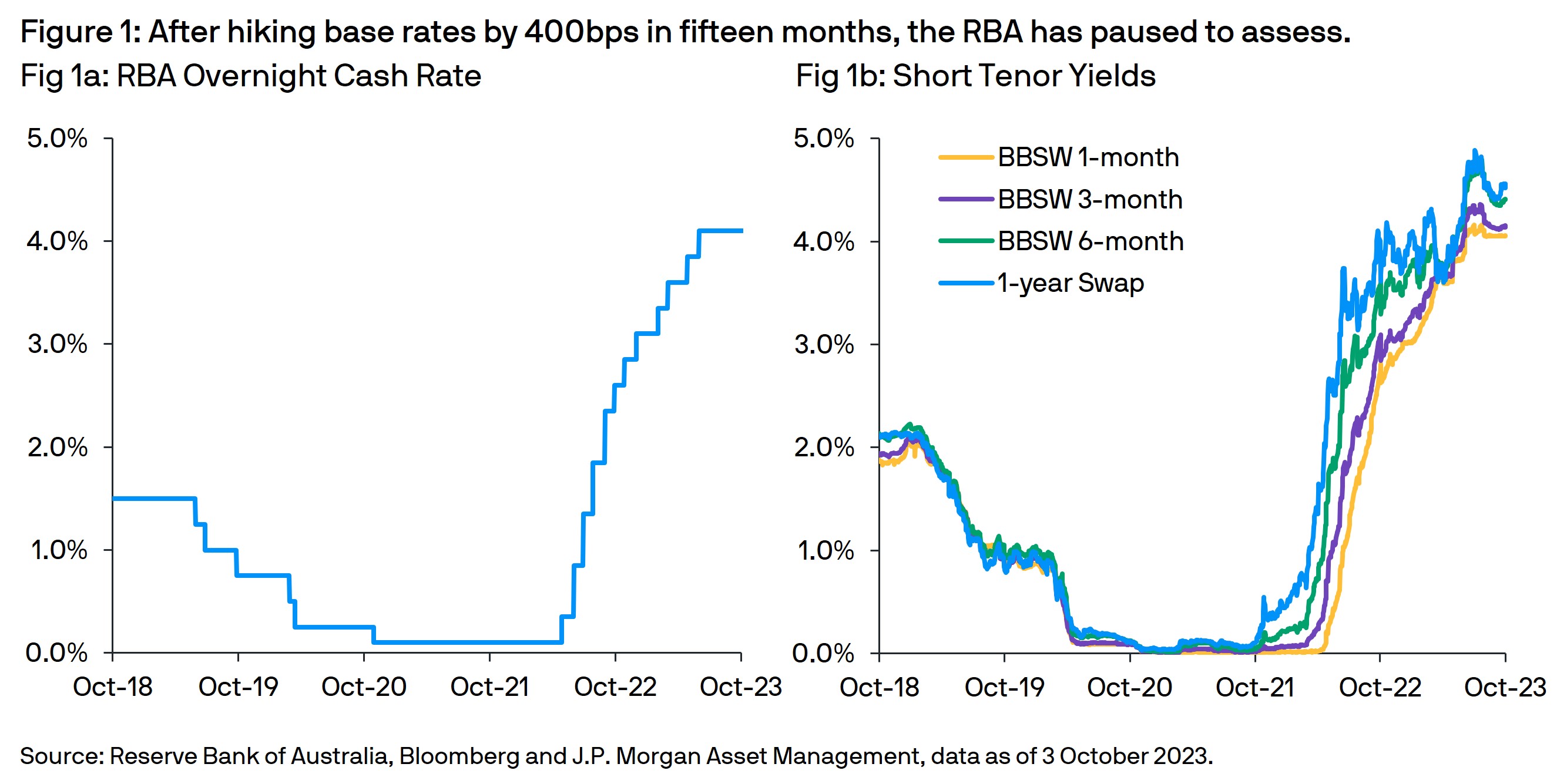

At Michele Bullock’s first monetary policy meeting as the Governor, the Reserve Bank of Australia (RBA) decided to leave the Overnight Cash Rate (OCR) unchanged at 4.10% (Fig 1). This was the fourth pause in the central bank’s rate hiking cycle as the Board noted that previous rate increases “are working” and given the current economic uncertainty, more “time to assess the impact of the increase in interest rates to date and the economic outlook” would be advisable.

Different Governor, similar statement

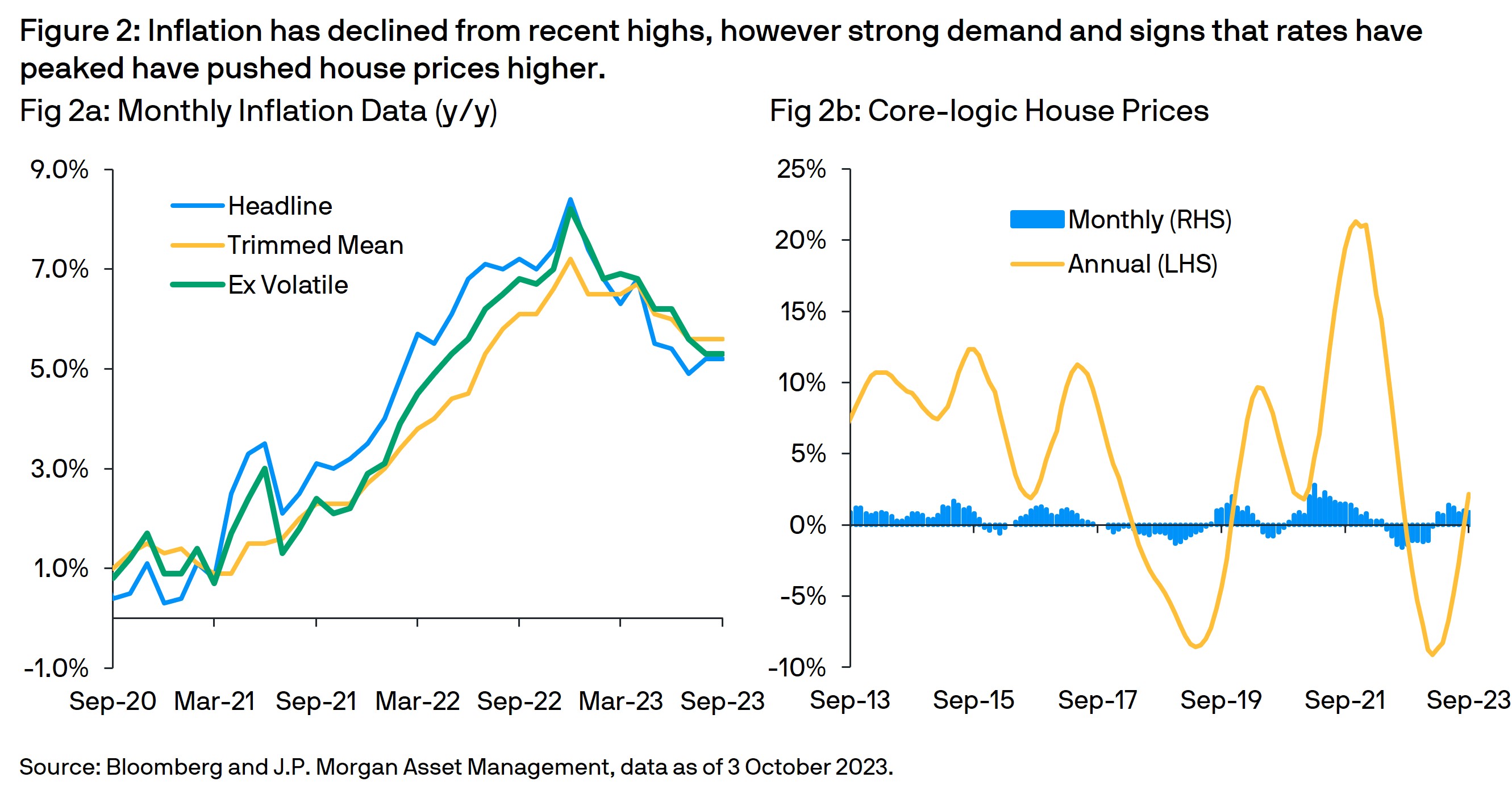

The accompanying statement was very similar to September’s missive – suggesting no significant difference between Governor’s Lowe and Bullock’s monetary policy stance. The RBA noted that inflation “has passed its peak” and with the economy operating below trend growth rate, the central bank still believes that Consumer Price Index (CPI) will return to their target range of 2-3% by late 2025. This was reflected in the latest monthly inflation readings, with core-CPI slipping to a fifteen-month low of 5.30%y/y, while consumer confidence remains muted and retail sales being moribund.

However, the Board also noted that “growth in the Australian economy was a little stronger than expected over the first half of the year” and “the prices of many services are continuing to rise briskly and fuel prices have risen noticeably of late”, while “rent inflation also remains elevated” (Fig 2a). In addition, the robust labor market (with unemployment hovering near a record low at 3.7%) and a rebound in house prices (up 7% from Jan-23 low, Fig 2b) suggest upward pressure on wages and costs are likely to remain a concern.

Market reaction

Since the RBA first paused in July, money market yields have declined and the curve has flattened. However, in recent weeks, global expectations that central banks would have to hold rates higher for longer and lingering concerns that the RBA may have to hike rates again have pushed yield curves steeper. Following the announcement, bond yields declined across the curve, while the currency weakened further to an eleven-month low versus the USD.

Outlook

Naturally, as the RBA approaches the perceived peak of its rate hiking cycle, caution is warranted to balance the needs of curbing inflation while avoiding unnecessarily triggering a recession. Nevertheless, the meeting statement confirmed that “returning inflation to target within a reasonable timeframe remains the Board’s priority” and retained the hawkish outlook, suggesting that “some further tightening of monetary policy may be required”.

For AUD cash investors, the current high cash yields and upward sloping yield curve continue to present relatively attractive investment opportunities for liquid, reserve and strategic cash balances. However, given the significant economic uncertainties and continued upside risks, we believe a diversified approach remains warranted.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

This information is generic in nature provided to illustrate macro trends based on current market conditions that are subject to change from time to time. This generic information does not take into account any investor’s specific circumstances or objectives and should not be construed as offer, research or investment advice.

09hp230310083518