MAS remains hawkish as it meets more frequently

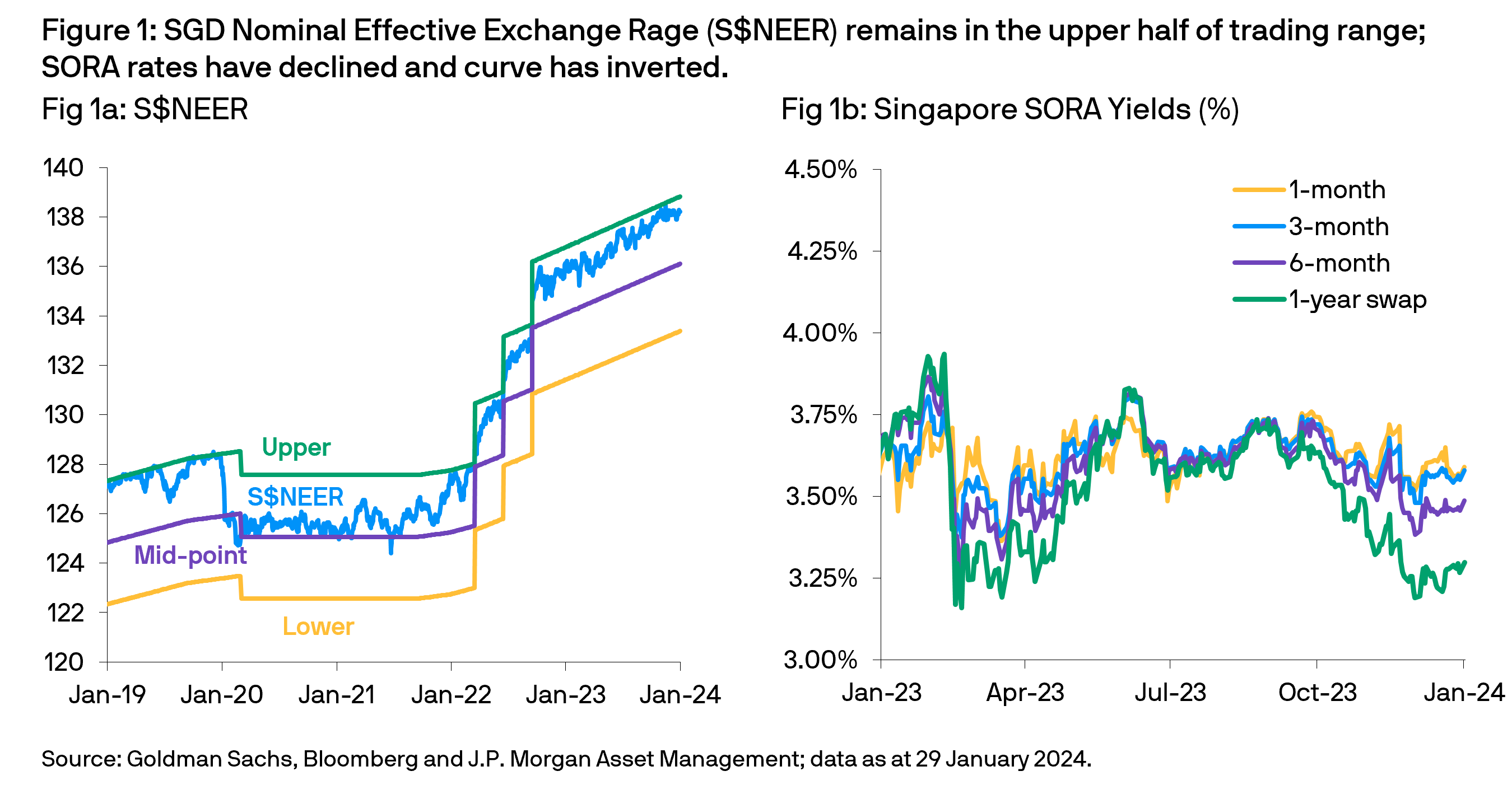

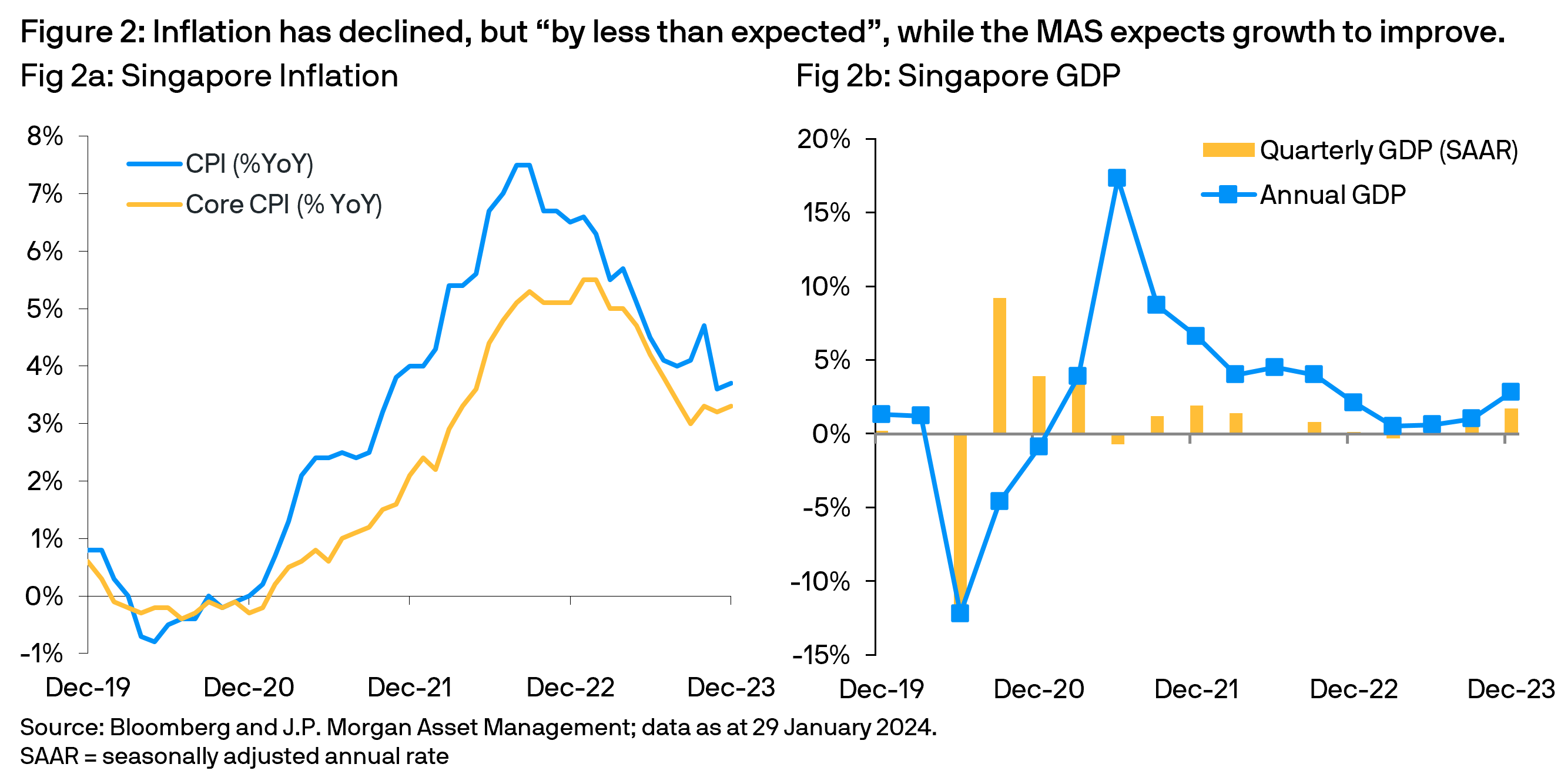

On Monday 29th January, at its first Monetary Policy Meeting of 2024, the Monetary Authority of Singapore (MAS) decided to “maintain the prevailing rate of appreciation of the S$NEER policy band”, with no change to its width nor centre point. While the MAS does not officially declare the pace of the Nominal Effective Exchange Rate (NEER), most economists estimate it is 1.5% per annum. Retaining its hawkish bias, as it moved from a bi-annual to quarterly meeting schedule, the central bank noted that growth was improving, but inflation was declining by less than expected. This implies a sustained appreciation of the policy band was necessary to “continue to dampen imported inflation and curb domestic price pressures”.

Revised forecasts

The MAS was the one of the earliest central banks to tighten monetary policy as inflation increased in 2021. However, following three slope increases and three upward re-centering, the MAS has left policy unchanged since April 2023. The central bank expects growth to recover further in 2024 and forecasts a range between 1-3%, helped by better external demand and a recovery in manufacturing. It also anticipates inflation to decline, aided by lower imported costs and a slower pace of domestic cost increases. Headline inflation forecast was revised down by 0.5% to 2.5-3.5%; although the core inflation forecast remains unchanged at 2.5-3.5%.

Outlook and investment Implications

While the MAS forecasts Singapore’s economic growth will be stronger in 2024, they also believe inflation could be sticker than expected, noting that core CPI is “likely to remain elevated in the earlier part of the year”. This suggests the central bank is likely to retain its hawkish bias. We believe the MAS will keep policy unchanged this year, allowing the gradual appreciation of the S$NEER to curb upward price pressures while not unduly impacting growth prospects.

Anticipating that US inflation has peaked and the Federal Reserve is likely to cut its target rate this year – markets have priced in multiple rate cuts and US yields have fallen sharply while the curve has flattened. This has also impacted Singapore yields, which have likewise declined and the curve has flattened. However, lingering inflation concerns and a hawkish MAS implies S$NEER is likely to remain close to the upper end of its trading band while Singapore interest rates are unlikely to fall as fast as that of US rates.

For SGD cash investors, short-maturity SORA yields have likely already peaked, although they continue to present relatively attractive opportunities. Balancing the need to lock in longer tenor yields relative to the loss of carry, given the inverted yield curve, remains one of the investment consideration. Given the current economic environment, we believe a laddered and diversified approach to investing cash across different maturities and instruments is warranted.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

This information is generic in nature provided to illustrate macro trends based on current market conditions that are subject to change from time to time. This generic information does not take into account any investor’s specific circumstances or objectives and should not be construed as offer, research or investment advice.

09e3243101101856