J.P. Morgan Asset Management Securities Lending Overview

- What is securities lending?

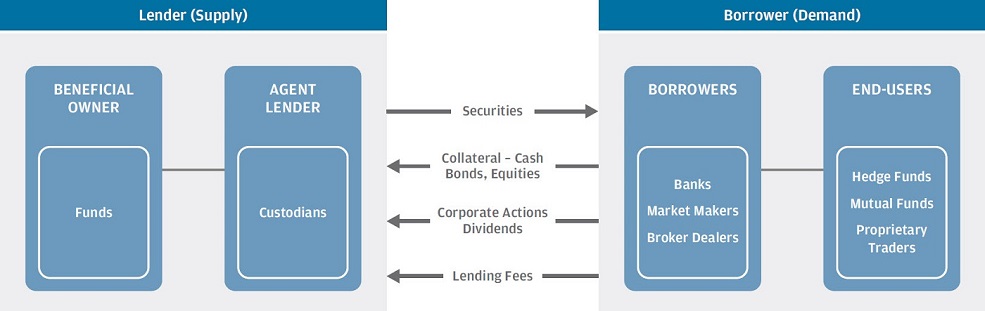

- How does the securities lending process work?

- The borrower is required to return the borrowed securities on demand, i.e. an “open loan”.

For illustrative purposes only. Source: J.P. Morgan Asset Management

When a security is loaned, the title of the security as well as the associated rights and privileges of ownership are transferred from the fund, as lender, to an approved borrower. However, the fund remains economically exposed to the securities that have been lent and retains the key benefits of ownership, except for voting rights.

Securities lending typically has a number of important features:

- Prior to lending, collateral must be received by the lender from the borrower. The value of the securities that have been loaned (as well as the value of any securities provided as collateral) is calculated daily by the lending agent based on current market prices, and the amount of collateral backing the loan is adjusted accordingly.

- While the borrower receives all dividends/interest and corporate action rights on loaned securities, the borrower is contractually required to make substitute payments to the lender.

- The borrower also holds any voting rights attached to the loaned securities while the loan is in place, unless the lender recalls the loan. While J.P. Morgan Asset Management’s aim is for clients to benefit from the revenues generated by securities lending, our internal teams actively look to protect client interests on key voting issues. There is a process in place to identify, recall and vote on stock to ensure appropriate levels of governance.

- At the end of a loan, the securities are required to be returned to the lender. The lender will receive a fee if the loan was collateralised by securities. If the loan was collateralised by cash, the lender may also earn a return or make a loss from the reinvestment of the cash collateral.

- Securities lending is typically conducted through an agent who receives a portion of the lending/cash reinvestment fees. For J.P. Morgan Asset Management funds domiciled in EMEA and participating in the program, JPMorgan Chase Bank N.A. and Brown Brothers Harriman & Co are the appointed agents.

- What are the benefits to investors?

- Securities lending aims to generate additional income for a fund, subject to the risks outlined in the following section and in the funds’ prospectus. The revenue from securities lending is returned to the funds, net of the fees paid to the lending agents. The lending agents for the funds, JPMorgan Chase Bank N.A. and Brown Brothers Harriman & Co., currently receive a fee of 10% of the gross revenue for their services. The revenue received by the funds from securities lending transactions is specified in the funds’ semi-annual and annual reports. The Management Company does not receive any revenue or compensation related to the funds participating in the J.P. Morgan Asset Management Securities Lending Programme.

- What are the main risks and how does J.P. Morgan Asset Management control these risks?

Securities lending is a long-established practice that can increase returns for shareholders in our investment funds that participate in the J.P. Morgan Asset Management Securities Lending Programme.

Securities lending works by allowing a fund to temporarily lend securities that it owns to an approved borrower in return for a fee. The borrower is required to provide sufficient collateral – in the form of either cash or securities – to compensate the fund if the borrower fails to return the loaned securities in the agreed timeframe, subject to certain counterparty and liquidity risks set out below.

The J.P. Morgan Asset Management Securities Lending Programme is designed to add value for clients by providing a potential additional source of incremental return while mitigating risks, and provides oversight of the lending agent appointed by the funds.

Some of the key guidelines and principles in place allowing for a low-risk programme are:

Agent obligations:

Our lending agents have obligations to compensate losses suffered by the funds where a borrower fails to return loaned securities.

Collateralisation:

To cover market fluctuations and exchange rates, borrowers are required to supply collateral with a higher market value than the securities on loan (typically, 102% to 105% for cash in USD or EUR and government securities). All loaned securities are valued every business day at their current market value, and collateral levels are maintained at pre-determined levels. Typically, the board of each fund decides what collateral is accepted by a particular fund. Broadly, collateral types accepted include select high-quality government securities and cash, currently these are the only types of collateral accepted by the programme.

Counterparty monitoring:

The J.P. Morgan Asset Management Counterparty Risk Team regularly monitors borrower exposures and reviews all approved borrowers on an annual basis.

Lending limits:

The funds currently have limits in place to control the amount that is lent and to monitor market exposure, ranging from 20% to 33 1/3% of assets under management (“AUM”). There are also certain European Securities and Markets Authority (“ESMA”) guidelines in force regarding collateral diversification and monitoring. More information can be found in the respective fund prospectuses.

The risks below are not fund-specific and so should be read in conjunction with any specific risks in the relevant fund prospectus.

Counterparty risk

There is a risk that a borrower could fail to return the borrowed securities. The default of a counterparty, together with any fall in value of the collateral (including the value of any reinvested cash collateral) below that of the value of the securities lent, may result in a loss to the fund. The above guidelines and principles are designed to mitigate this risk.

Cash collateral reinvestment risk

In instances where cash collateral is accepted and reinvested, there is a risk that losses could be incurred on the investment of the cash collateral if the investment drops in value since cash collateral investments are not indemnified by the lending agent. While the oversight and risk is monitored by J.P. Morgan Asset Management, the lending agent is not liable for any losses associated with the re-investment activity. Risk is mitigated through conservative reinvestment guidelines by investing cash collateral in overnight reverse repurchase agreements.

Note: Not all funds bear this risk as cash collateral may not be accepted or, if accepted, may not be reinvested.

A reverse repurchase agreement is the purchase of securities with the agreement to sell them at a higher price at a specific future date. (Investopedia definition)

Liquidity risk

There is a risk that settlement of a sold security may be delayed if a borrower is not able to return it in time to the lender because of poor market liquidity. By giving the lending agent sufficient notice of the sale, the fund still receives sale proceeds on settlement date regardless of whether the trade has settled. This ensures that there is little to no impact on the day-to-day trading activities within the fund.

Note: the profitability of any securities lending programme is not guaranteed, and while the mitigating factors described above aim to control losses incurred, the effectiveness of such measures can also not be guaranteed.