The taming of the business cycle

Fewer recessions but weaker recoveries

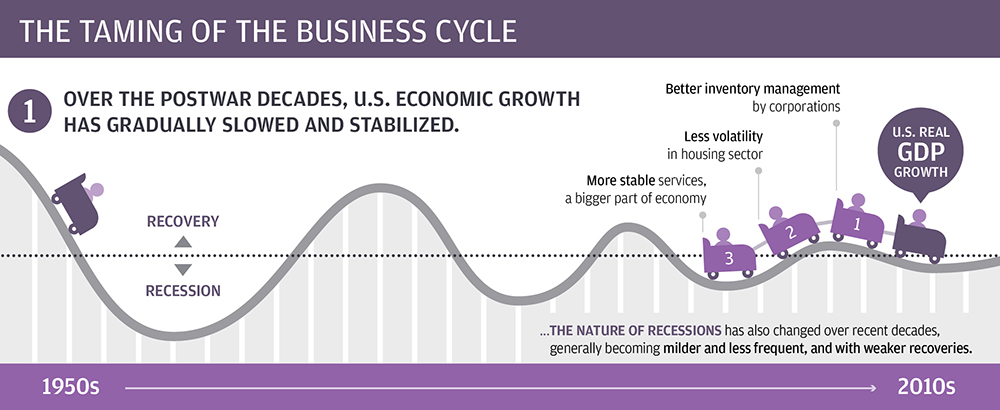

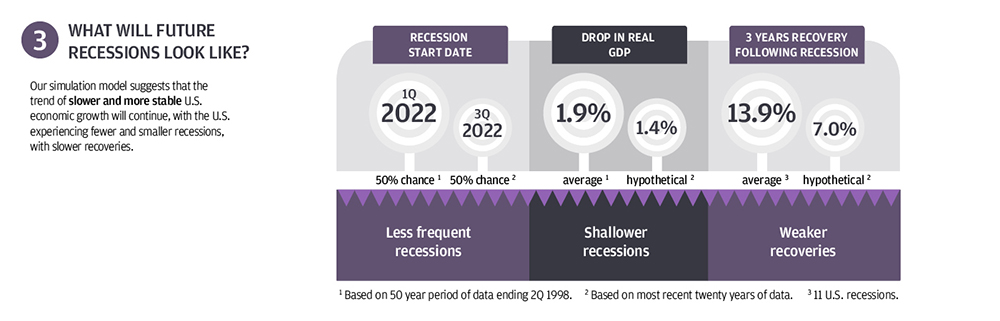

In recent decades, the U.S. economy has become more stable. Notwithstanding the global financial crisis, recessions are milder and less frequent, while recoveries are weaker. The business cycle has certainly not been eliminated, but perhaps it has been tamed.

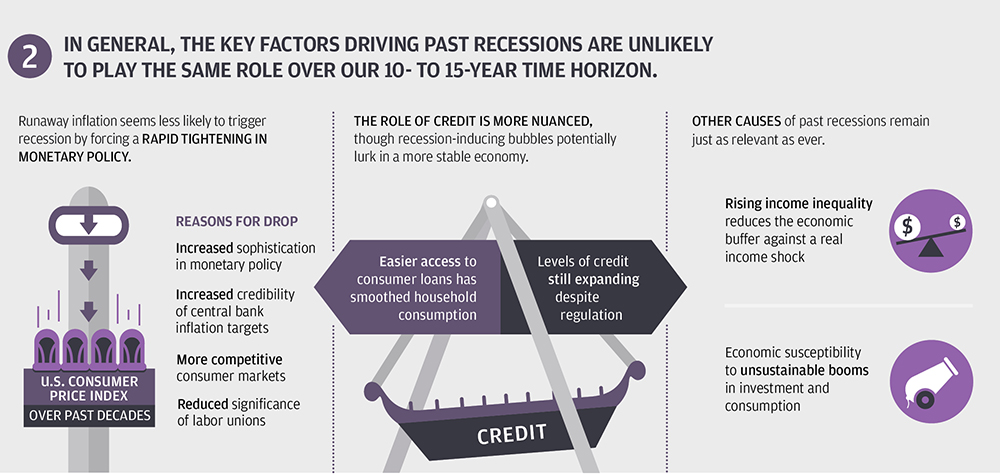

Several factors explain this increased economic stability, including better inventory management and diminished volatility in the housing sector, government spending and the services sector. In addition, some of the ultimate causes of recessions – the deeper imbalances that build up over time – have faded in their relevance.

The infographic below uses illustrations to convey the main talking points and areas of interest covered in the article.

1. Over the postwar decades, U.S. economic growth has gradually slowed and stabilized.

2. In general, the key factors driving past recessions are unlikely to play the same role over our 10- to 15-year time horizon.

3. What will future recessions look like?

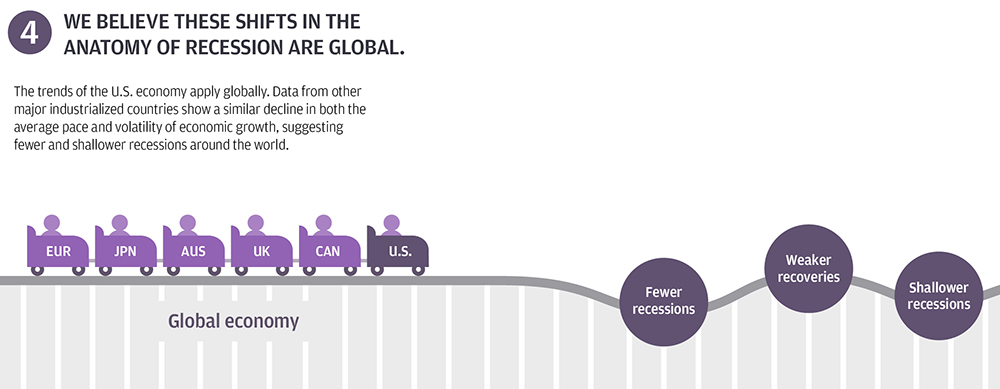

4. We believe these shifts in the anatomy of recession are global.

0903c02a823f8052

You should also read

Full report and executive summary

Choose between a comprehensive analysis of our forecasts and critical investment themes, or a simpler overview of our macro and asset class assumptions.

Download the executive summary >

Will debt be a drag?

What would a successful DM public debt consolidation look like, based on successful past consolidations, and what are the obstacles today?

LTCMA

J.P. Morgan Asset Management's Long-Term Capital Market Assumptions draws on the best thinking of our experienced investment professionals worldwide.