The evolution of market structure

29-10-2018

John Bilton

Patrik Schowitz

Anthony Werley

Managing illiquidity risk across public and private markets

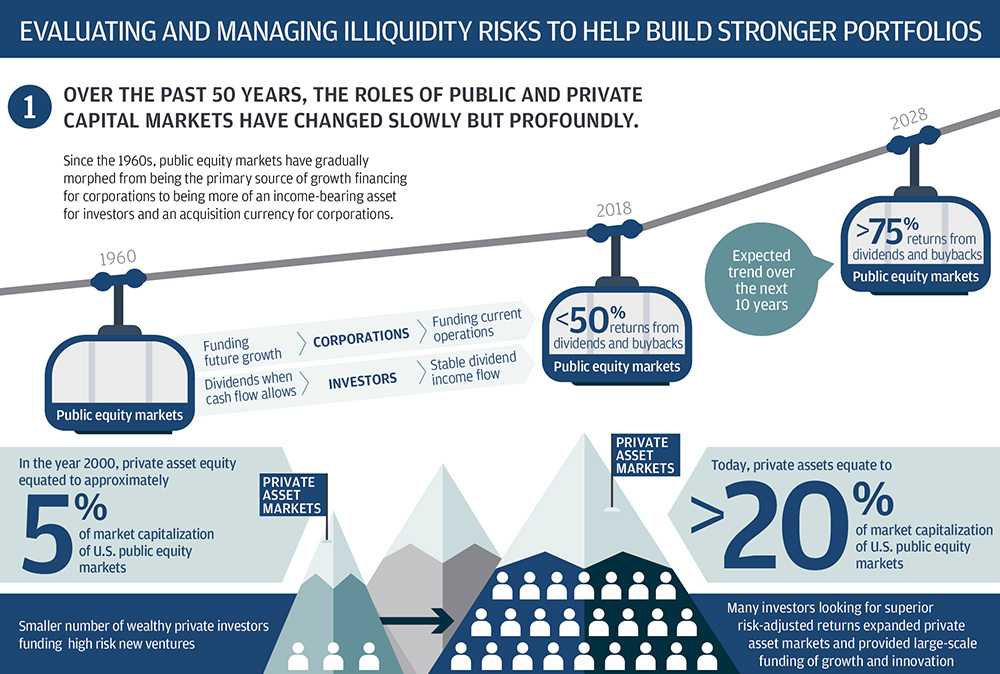

Over the past 50 years, the roles of public and private capital markets have changed slowly but profoundly. In both markets, managing illiquidity risk remains a critical element of portfolio construction.

Public equity markets have gradually evolved from being the primary source of growth financing for corporations to being an income-bearing asset for investors and an acquisition currency for corporations. Looking ahead, we expect over 80% of returns in developed public equity markets over the next 10 years to come from dividends and buybacks, compared with less than half over the last 25 years.

The infographic below uses illustrations to convey the main talking points and areas of interest covered in the article.

1. Over the past 50 years, the roles of public and private capital markets have changed slowly but profoundly.

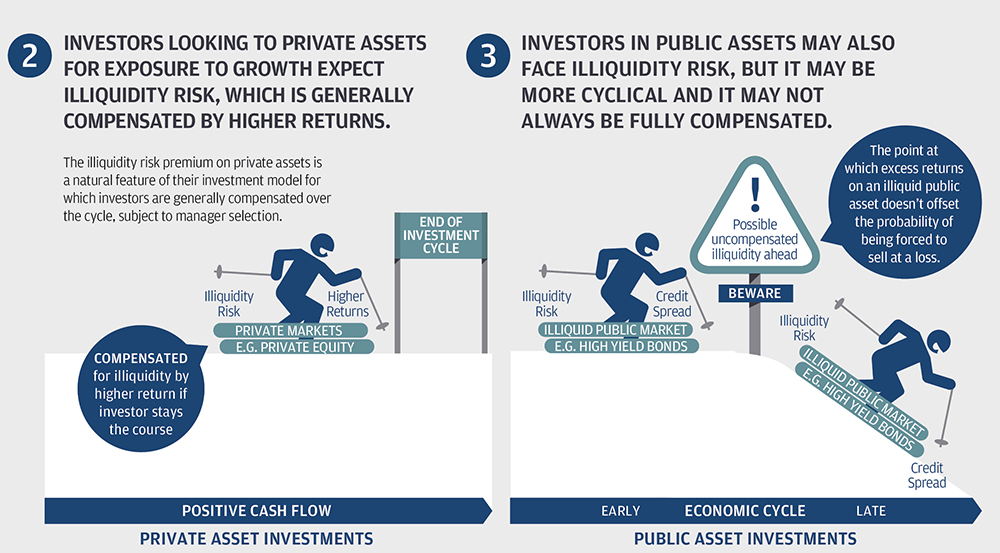

2. and 3. Private and public asset investments

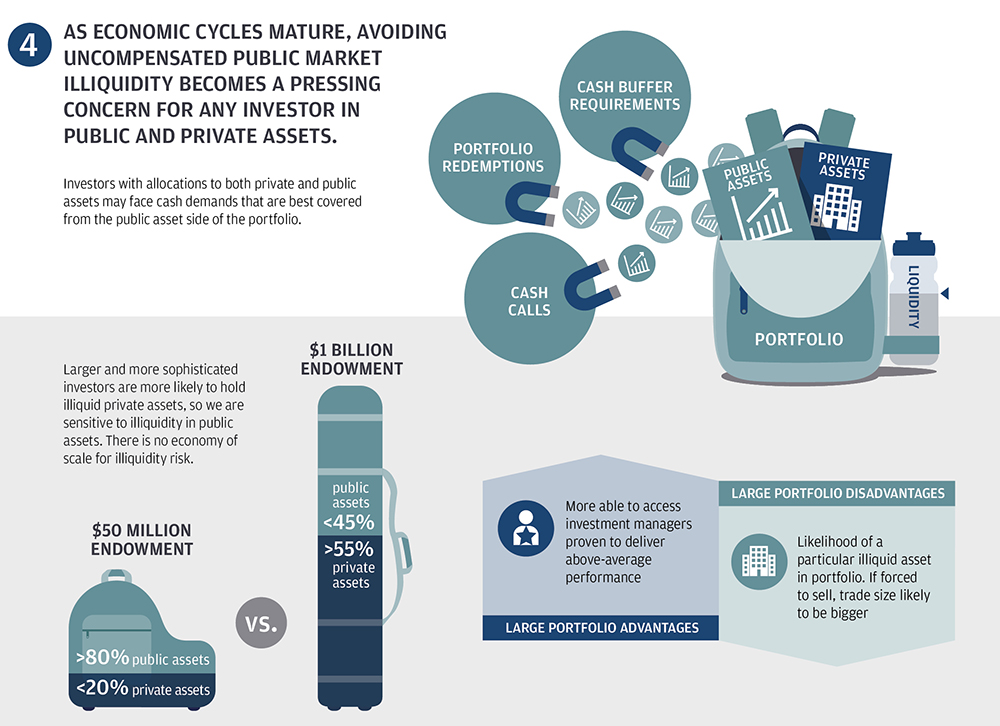

4. As economic cycles mature, avoiding uncompensated public market illiquidity becomes a pressing concern for any investor in public and private assets.

5. Actively planning for illiquidity risk in both public and private assets will help multi-asset investors build stronger portfolios through the cycle.

You should also read

Full report and executive summary

Choose between a comprehensive analysis of our forecasts and critical investment themes, or a simpler overview of our macro and asset class assumptions.

Download the latest full report >

Download the latest executive summary >

Surviving the short term to thrive in the long term

We can’t predict how the next recession will unfold, but we can provide a framework to help investors prepare for late-cycle risks.

LTCMA

J.P. Morgan Asset Management's Long-Term Capital Market Assumptions draws on the best thinking of our experienced investment professionals worldwide.

0903c02a823f8052