Global Asset Allocation Views 1Q 2023

Insights and implications from the Multi-Asset Solutions Strategy Summit

15/12/2022

Jeff Geller

Gary Herbert

Jed Laskowitz

Yaz Romahi

Katy Thorneycroft

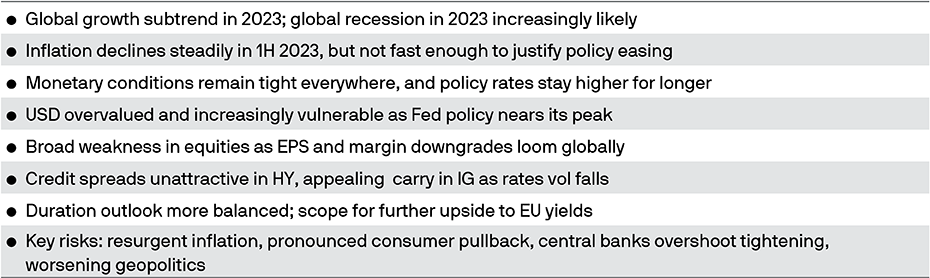

In Brief

- With U.S. inflation set to cool and policy rates set to peak around 5.00%-5.25% in early 2023, our focus shifts to the slowing growth and uninspiring earnings outlook. A mild contraction is increasingly likely in 2023, and a deeper recession can’t be ruled out.

- Although we anticipate subtrend global growth in 2023, the peak in the rates cycle and a decline in rates volatility present opportunities for investors, particularly in fixed income.

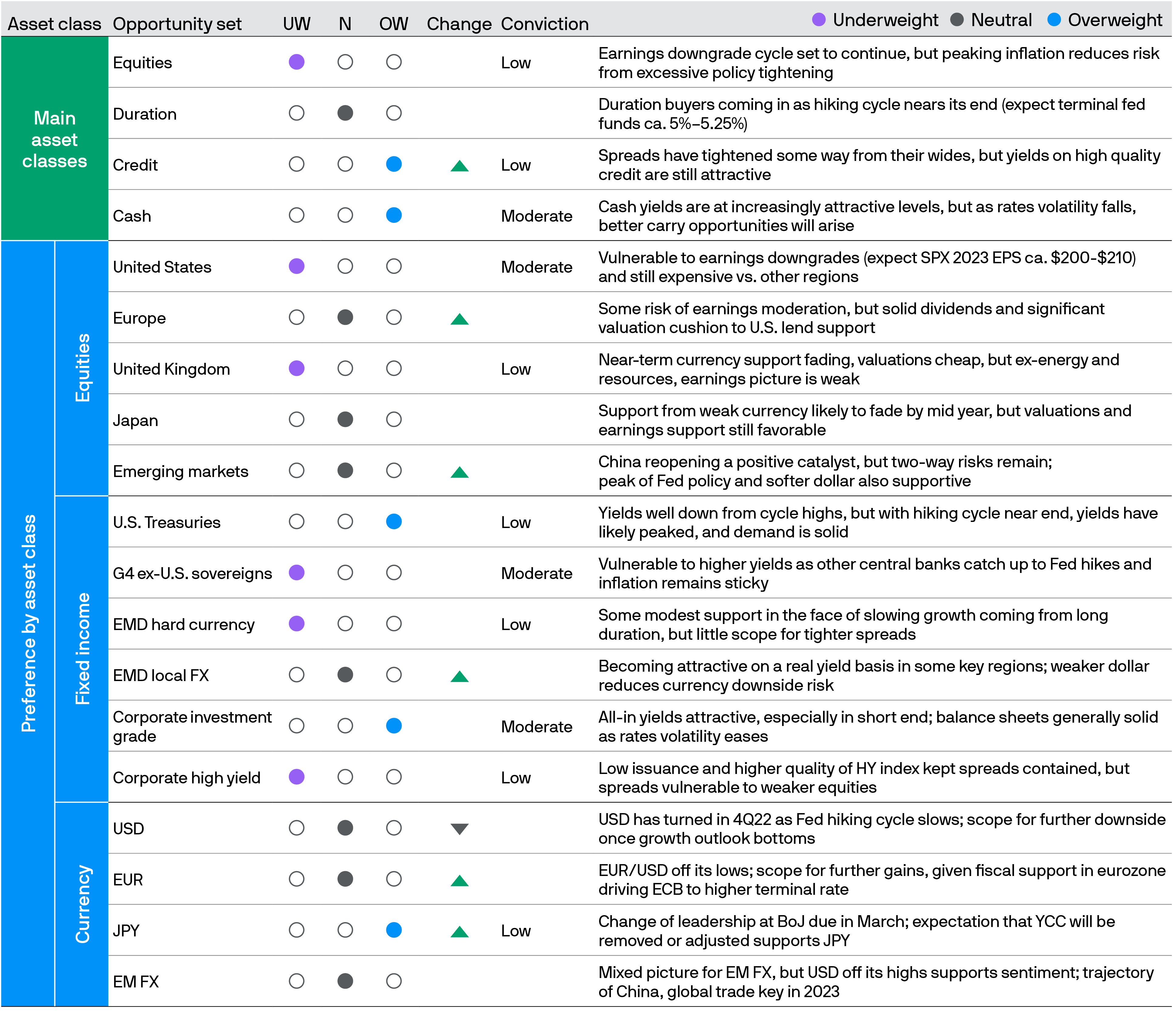

- We remain underweight equities and expect further cuts to earnings estimates. In duration, we are neutral, with a preference for U.S. Treasuries over other sovereign bonds; we upgrade credit to overweight but specifically for investment grade.

- Within equities, we lean away from U.S. stocks, given the better valuations in developed markets ex-U.S., while a softer dollar plus China reopening renews our interest in emerging market equities.

The bear market rally that characterized the fourth quarter of 2022 is running out of steam. Hope of an early pivot in U.S. monetary policy, spurred by inflation peaking, has met the reality of a hot labor market that will keep policymakers hawkish. We see inflation falling in 2023 but not fast enough to justify policy easing. Our focus turns to the slower growth and uninspiring earnings outlook, the path of reopening in China and the risk of further tightness in energy.

Few investors will mourn the passing of 2022 into the history books. Yet while some of 2022’s challenges will linger into the early months of 2023, opportunities for investors – notably, across higher quality fixed income markets – are improving.

We believe that an extended period of subtrend global growth in 2023 is inevitable. Risk of a mild recession in the U.S. has increased. Europe may already be in recession, even if its severity turns out to be less than initially feared. Meanwhile, China is set to abandon its zero-COVID policy, and while this is a welcome development, we are wary of a chaotic reopening.

Inflation is cooling but remains uncomfortably high, in turn suggesting that policy rates are more likely to pause at a high level than to turn sharply lower. Still, investors continue to price a swift reversal in policy rates. The bond and money markets seem to have largely discounted the risk of recession – something the credit and equity markets have yet to fully acknowledge.

We see the Federal Reserve (Fed) pausing its hikes at around 5.00%–5.25% in 1Q 2023 – roughly in line with market pricing. But we expect the Fed to then remain on hold throughout 2023. In our view, the U.S. economy is sufficiently resilient to withstand this level of rates. As inflation declines from above 7% to nearer 3% by year-end 2023, we would judge a real fed funds rate of around 1.5% to be in line with the Fed’s interpretation of restrictive policy.

Under these conditions, the economy certainly slows to a subtrend pace, with a mild contraction increasingly likely and no guarantee of averting a more severe recession. But a strong labor market, decent corporate and banking sector health, and residual excess savings from the pandemic create economic buffers that clearly embolden the Fed to take this gamble. In Europe, data are holding up better than feared, suggesting that the bleak picture from mid-2022 has improved, but only at the margin and not enough to offset risks to growth and earnings.

Subtrend global growth, cooling inflation and restrictive but stable monetary policy will create a different investing environment in 2023. While a risk-off tilt and an underweight to stocks in the early months of the year would likely be well justified, opportunities to add duration and seek carry in high quality fixed income could also be appealing. Moreover, the peak in Fed policy rates also points toward potential dollar weakness later in 2023, which opens a range of relative value trades across equity markets.

We enter 2023 underweight equities, albeit with lower conviction. We are broadly neutral on duration but with an appetite to add duration on weakness and to increase our exposure to high grade credit, particularly at the short end of the yield curve. The prospect of a softer dollar as well as better valuation support leads us to marginally prefer non-U.S. equity markets. By contrast, in sovereign duration we continue to favor U.S. Treasuries over core European bonds.

Our upgrade of credit to overweight is specifically an up-in-quality view. High yield (HY) spreads are uncomfortably tight, and even though all-in yields are attractive, default rates are set to increase from current depressed levels. As rates volatility likely trends lower in the months to come, we expect better carry opportunities to emerge across U.S. investment grade (IG) credit, parts of the European credit complex and even in some segments of emerging market debt (EMD). We continue to keep an exposure to cash amid rising real yields but see a much wider set of opportunities to put this capital to work than we did six months ago.

Overall, our positioning reflects continued near-term caution and is unequivocally designed for a period of sluggish growth. Still, as our Long-Term Capital Market Assumptions flagged a few weeks ago, the reset in yields and valuations this year offers investors the best entry point in over a decade. In our view, we can sequence this entry first through fixed income, where carry opportunities are becoming compelling, and later in equities as the earnings downgrade cycle plays out further in the early months of 2023.

Multi-Asset Solutions Key Insights & “Big Ideas”

The Key Insights and “Big Ideas” are discussed in depth at our Strategy Summit and collectively reflect the core views of the portfolio managers and research teams within Multi-Asset Solutions. They represent the common perspectives we come back to and regularly retest in all our asset allocation discussions. We use these “Big Ideas” as a way of sense-checking our portfolio tilts and ensuring they are reflected in all of our portfolios.

Active allocation views

These asset class views apply to a 12- to 18-month horizon. Up/down arrows indicate a positive (▲) or negative (▼) change in view since the prior quarterly Strategy Summit. These views should not be construed as a recommended portfolio. This summary of our individual asset class views indicates strength of conviction and relative preferences across a broad-based range of assets but is independent of portfolio construction considerations.

Source: J.P. Morgan Asset Management Multi-Asset Solutions; assessments are made using data and information up to December 2022. For illustrative purposes only. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

Multi-Asset Solutions

J.P. Morgan Multi-Asset Solutions manages over USD 227 billion in assets and draws upon the unparalleled breadth and depth of expertise and investment capabilities of the organization. Our asset allocation research and insights are the foundation of our investment process, which is supported by a global research team of 20-plus dedicated research professionals with decades of combined experience in a diverse range of disciplines.

Multi-Asset Solutions’ asset allocation views are the product of a rigorous and disciplined process that integrates:

- Qualitative insights that encompass macro-thematic insights, business-cycle views and systematic and irregular market opportunities

- Quantitative analysis that considers market inefficiencies, intra- and cross-asset class models, relative value and market directional strategies

- Strategy Summits and ongoing dialogue in which research and investor teams debate, challenge and develop the firm’s asset allocation views

As of September 30, 2022.

0903c02a81cef736