The market drawdown in 2022 is creating an increasingly attractive entry point for long-term investors.

Executive Summary

Back to Basics

Lower valuations and higher yields mean that asset markets today offer the best long-term returns in more than a decade. It took a painful slump in stock and bond markets to get here, and the worst may not yet be over.

But after a year of turmoil, the core principles of investing still hold firm. Once again, 60/40 can form the bedrock of portfolios, while alternatives can offer alpha, inflation protection and diversification. Meanwhile, the end of free money, greater two-way risk in inflation and policy, and increased return dispersion across assets also give active managers more to swing for.

In the near term, investors face a challenging time as a recession, or at least several quarters of subtrend growth, lie immediately ahead. Still, our assessment of long-term trend growth is only marginally below last year’s. We expect today’s inflationary surge to eventually subside to a rate only slightly above our previous estimates.

Bonds normalize, stock forecasts soar

Our forecast annual return for a USD 60/40 stock-bond portfolio over the next 10–15 years leaps from 4.30% last year to 7.20%.

After policy rates normalized swiftly, bonds no longer look like serial losers. Once again, they offer a plausible source of income as well as diversification. Higher riskless rates also translate to improved credit return forecasts.

Projected equity returns rise sharply. In local currency terms, our developed market equity forecast rises 340 basis points (bps), to 7.80% , and in emerging markets jumps 230 bps, to 8.90%. Corporate profit margins will likely recede from today’s levels, but not revert completely to their long-term average.

Stock and bond valuations present an attractive entry point. Alternatives still offer benefits (diversification, risk reduction) not easily found elsewhere. With the U.S. dollar more overvalued than at any time since the 1980s, the FX translation will be a significant component of forecast returns.

Scarce capital, surging demand for capex

Many long-term themes affecting our outlook (demographics, shifts in globalization patterns) will demand higher capital investment – paradoxically just as the abundance of cheap capital of the last decade is reversing. As financial markets look to efficiently allocate scarce capital, the result may be more idiosyncratic returns, and lower correlations within indices.

Overall, the return outlook in this year’s Long-Term Capital Market Assumptions stands in stark contrast to last year’s. Headwinds from low yields and high valuations have dissipated or even reversed, and asset return forecasts might be considered “back at par.”

Asset reset, attractive entry point

It has taken a meaningful reset in asset markets to bring us to this place, and considerable pain for bondholders over a much shorter horizon than we had expected. Still, the underlying patterns of economic growth look stable, and the assumptions that underpin asset returns – cycle-neutral real cash rates, curve shape, default and recovery rates, and margin expectations – are little altered.

But the market drawdown in 2022 is now creating an increasingly attractive entry point for long-term investors. While 2022 was a painful ride as long-standing dislocations closed sharply, investors can now look forward to compounding future returns at much more attractive levels.

After a year of turmoil, the core principles of investing still hold firm. Once again, 60/40 can form the bedrock of portfolios, while alternatives can offer alpha, inflation protection and diversification.

These articles look into issues likely to have a profound and protracted impact on the global investment landscape.

Thematic Insights

Key points

Deglobalization is not inevitable. We expect a multi-polar world in which trading blocs become more politically aligned.

As globalization evolves, trade intensity in goods will likely decline. But services could flourish in a global economy that is more virtual.

In any disruptive environment, there will be winners and losers – new opportunities and risks – as investors adapt and respond to change.

Is globalization – an era of increasingly close economic integration- about to go into reverse? We don’t think so.

Globalization will not unravel but it will evolve, in our view. We see a wide spectrum of possible outcomes. The most likely scenario is a multi-polar world in which trading blocs become more politically aligned. Overall, the global economy could become less efficient.

Precisely how globalization evolves will likely depend on the role of innovation and automation, demand growth in new markets, as well as rising (or declining) nationalism and shifts in regulation on climate, taxes, and data.

There will be winners and losers by geography and industry. For example:

Low wage economies that have derived the greatest benefit of decades of globalization appear at greatest risk. Those yet to partake in export-led growth may see development curtailed.

Greater regionalization as supply chains diversify and production moves closer to demand would benefit Asia and an increasingly wealthy consumer base.

Services sector takes the lead

As globalization evolves, trade intensity in goods will likely decline. But services could flourish in a global economy that is more virtual. Services industries should benefit from investment in skilled labor and labor-saving technologies. Economies such as India and the Philippines, with large populations of English speakers and established infrastructure, may also benefit and attract more foreign capital.

While regulations may tighten on the technology sector broadly, certain technology companies will benefit from new demands. The rise of “digital sovereignty” as a national security issue likely means increased spending on cybersecurity. Even before the Russian invasion of Ukraine, it was estimated that cybersecurity spending would surpass USD 200 billion by 2024, up 43% from 2021.

As the threat and costliness of security breaches worsen, companies and governments are highly incentivized to invest in protection. Similarly, defense sectors could benefit from a more tense and fragmented world.

Meanwhile, robotics and automation should become increasingly important and cheaper as replacements for workers, and as access to low-wage labor becomes more limited. We anticipate this trend continuing as aging demographics in developed countries further strains the labor supply and production shifts location to serve growth in new markets.

China’s shifting roles and relationships

What role will China play in the evolution of globalization?

China seems increasingly at risk of reduced trade with the rest of the world following a series of U.S. and European government actions aimed at regulating and curbing reliance on China. In such a scenario, other economies may see benefits. The rise in Chinese wages has already helped the wider Asian region as production has moved to relatively lower cost markets close to the source of final demand.

The shift to greater supply chain diversification could accelerate this trend, especially for manufacturers of consumer products such as textiles and technology hardware. It could also support infrastructure investment.

Investors adapt to change

The global economy has clearly benefited from 70 years of rising globalization. We expect a reconfiguration ahead, rather than a reversal. It will be a disruptive environment in many ways, with new opportunities and risks as investors adapt and respond to change.

Key points

Global population growth creates dramatic challenges and opportunities. Key for investors: demographics’ impact on economic growth, consumption patterns, infrastructure needs and the use of finite resources.

Countries are not guaranteed a demographic dividend. Policy, we believe, will be a differentiator. We created a set of scores to help screen for economies with solid national and corporate policies.

Timely investment is needed to cope with the stress growing populations put on the planet. Investment opportunities exist in green infrastructure, agriculture technologies, alternative sources of protein and reforestation.

By the end of this century, the global population is set to reach 10.6 billion, creating dramatic challenges and opportunities. “Younger” economies with a rising proportion of working-age people (15–64) stand to gain a demographic dividend – faster economic growth – than economies with a large proportion of older adults. In sub-Saharan Africa, the Middle East and parts of Asia, the working-age populations are growing the fastest.

Of primary importance for investors are these demographics’ impact on economic growth, consumption patterns, infrastructure needs and the harvest and use of finite resources.

Economic success based on demographics alone is far from guaranteed. Which young economies seem prepared to harness a demographic dividend?

We believe sound policy will be the differentiator. Countries with strong national and corporate governance frameworks, sustainable infrastructure and integration into global supply chains will be the likely winners.

Absent these, important risks arise. Economies that fail to properly invest in their fast-growing working-age labor forces, build out sufficient infrastructure (in time) and ensure the sustainable use of their natural resources could face disastrous consequences.

We have created sets of scores that aggregate indicators of key policy. Together, our four scores offer a multifaceted approach that can help investors decide where they might best take advantage of population growth.

To be sure, income inequality is a challenge. Still, investment opportunities to serve young consumers should be abundant in high-scoring younger economies. Rising numbers of young households in these economies are set to boost consumption growth for clothing, educational services and transportation.

But population growth also means more intensive use of energy, water, food, ecosystems and infrastructure. To alleviate the inevitable stress on the planet, adequate and timely investment is needed in sustainable solutions. Exciting investment opportunities can be found in solutions to the challenges – in rethinking infrastructure, energy and food consumption habits; in more sustainable land use, agriculture and forestry. The themes include green infrastructure, sustainable agriculture technologies, alternative sources of protein and reforestation.

Our scores:

Top-Down score: Measures key sovereign policies and institutions (rule of law, economic freedom, education and others). High scores may indicate appealing government bonds and currencies. India, Vietnam, Malaysia, South Africa, Saudi Arabia and the United Arab Emirates (UAE) show promise.

Bottom-Up score: Captures corporate governance. High scores may indicate appealing equity and credit investments. Malaysia and South Africa score well here.

Migration-Productivity score: Reflects how well an economy is capitalizing on migration trends. High-scoring Canada, UK, U.S., Germany and France can potentially deliver better growth results than their demographics alone suggest.

Energy Transition Momentum score: Captures the potential trajectory of green energy in different economies. Kenya, Vietnam and the UAE stand out.

Ultimately, private capital should complement public initiatives to unlock younger economies’ potential demographic dividend in the most sustainable way.. In a world of higher rates, sound policy will be the key to attract scarcer funding, creating winners and losers for investors along the way.

In a new macroeconomic regime, investors can stress-test their allocation process and make changes that will support risk-adjusted returns over multiple horizons.

Portfolio implications

Striking a balance: Strategic patience, tactical flexibility

The year 2022 marks a regime shift – from a world of low inflation and easy financial conditions to one of high inflation, tightening policy and higher interest rates. The emergence of this new regime presents an opportunity for investors to stress-test their allocation process and implement changes that will support risk-adjusted returns over multiple horizons.

A transformed investment environment requires a clear-eyed assessment of the longer-term assumptions that anchor the strategic allocation process. It also suggests a more flexible approach to short-term tactics, as recent market shifts offer opportunities to manage risk and capture returns in the near term. Investors need to strike a balance between strategic patience and tactical flexibility.

Adjusting allocation strategies

During the past year we observed a significant shift in the dynamics of asset allocation. Diversification within public markets disappeared as stocks and bonds declined in lockstep. The relative outperformance of private assets led to allocation imbalances. And finally the forceful policy response to rising inflation upended traditional yield curve and currency dynamics.

If these trends persist, strategies will need to adjust. Even if they are temporary, these trends may offer compelling tactical opportunities. We use an allocation model, adjusted for higher correlations and the latest return assumptions, to illustrate the directional tilts that could make sense.

Among our key conclusions: Given the improvement in forward return assumptions for public markets, a “baseline” 60/40 portfolio may deliver higher forward returns than at any time in more than a decade. In response to a stronger dollar, global investments may prove attractive to U.S.-based investors (and U.S. investments correspondingly less attractive to non-U.S. investors).

Caution is required, however, as the potential for a shift to a more positively correlated environment may limit an investor’s capacity to diversify equity risk and may increase volatility. As a result, increased exposure to lower volatility credit sectors and diversified alternatives may be needed to balance risk and return at the portfolio level.

The expanding role for diversified alternatives

Alternatives may be less critical to reaching forward return targets than they were at the end of 2021. But they are now even more important from a diversification standpoint. Diversified alternative allocations offer a compelling mix of lower absolute volatility as well as a reliable source of returns.

Our model allocates broadly across private equity, global core real estate, infrastructure, diversified hedge funds and direct lending. In our view, investors should consider allocating as much to these assets as their liquidity budgets prudently allow.

Examine our return projections by major asset class and the thinking behind the numbers.

Assumptions

Key Points

The pandemic and its aftershocks have not changed our long-term growth outlook by as much as seemed possible during the past two years.

Demographics continue to constrain growth prospects, especially in developed markets and many emerging Asian economies.

Our growth projections have not changed significantly from last year, although we have trimmed forecasts in several economies to take account of elevated starting positions.

We remain optimistic about long-term prospects for productivity growth, although our assumptions in this area have not changed from last year.

The major question hanging over the outlook is whether the world has moved into a high inflation regime.

While many economies are overheating today and inflation expectations have moved up, we think many secular forces that have depressed inflation in recent decades remain in place.

Additionally, we think most central banks will pursue their price stability goals assiduously over the medium term.

As a result, our inflation forecasts have moved up modestly but not dramatically.

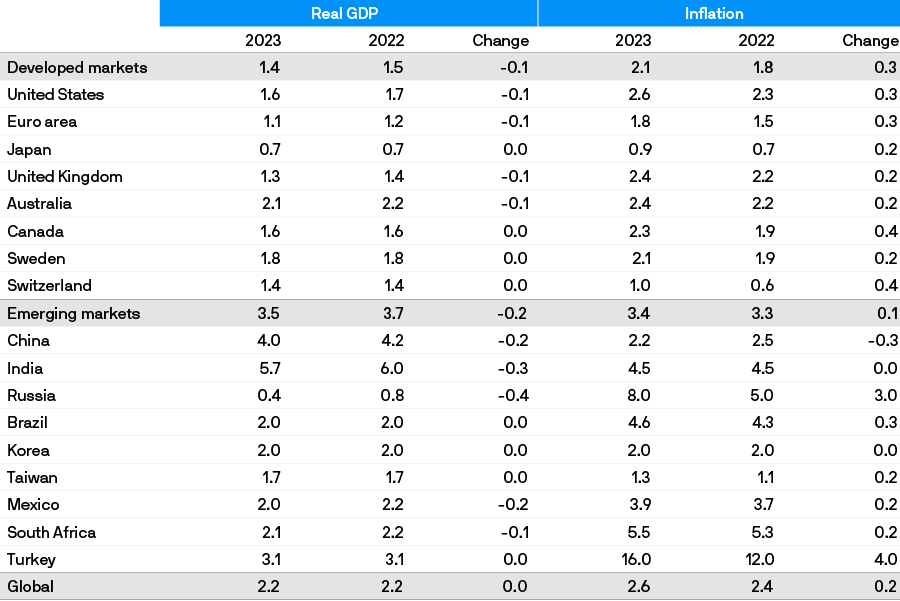

Our 2023 assumptions anticipate mostly stable real GDP growth and higher – but not dramatically higher – inflation

2023 Long-Term Capital Market Macroeconomic Assumptions (%, annual average)

Source: J.P. Morgan Asset Management; estimates as of September 30, 2022. Previous year’s real GDP forecasts shown include cyclical bonuses. Given depressed post-shock starting points, in last year’s edition we added cyclical bonuses to our 2021 trend growth projections. This year, our 2023 forecasting returns to trend rates alone. In comparing 2022 with 2023 trend rates here, we do not use last year’s rate-plus-cyclical-bonus figure but only the trend rate.

Key Points

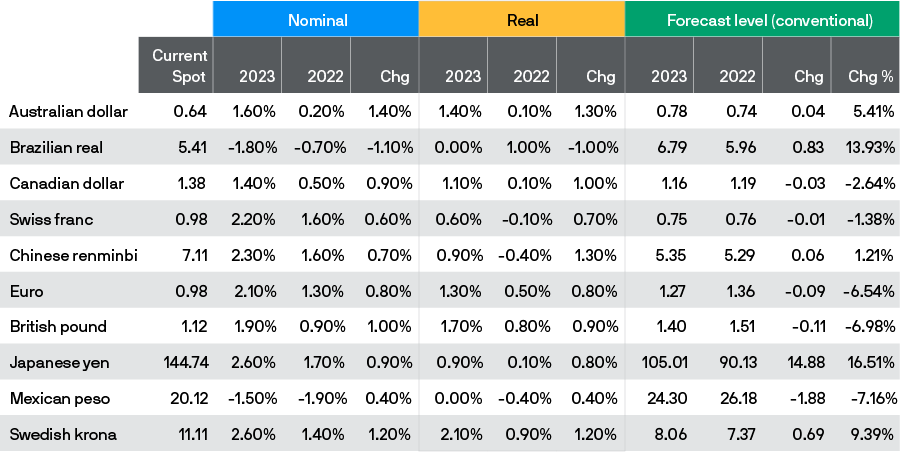

Our long-term fair value exchange rate assumptions change relatively little, as projected inflation differentials have remained stable despite rapidly rising inflation and aggressive monetary policy tightening over the past year.

We maintain our conviction that the U.S. dollar – markedly richer since our last edition due to rapidly tightening monetary policy and increasing recession risks – unwinds much of its overvaluation over the Long-Term Capital Market Assumptions time horizon.

Since currency weakness through easy monetary policy adds to inflation, we believe central bankers will prioritize, to varying degrees, their inflation targets above currency competitiveness. This should enable some currencies to fully converge to fair value over our long-term horizon.

We expect the Australian and Canadian dollars, the Swiss franc, the Swedish krona and eventually even the euro to converge to fair value vs. the USD.

The Chinese renminbi appreciates less vs. the USD than fair value would imply, since a competitively valued currency remains an important support for the export sector. Consequently, other Asian currencies, such as the Japanese yen, the Korean won and the Taiwanese dollar, also likely appreciate less than their fair value would imply.

We maintain our conviction in broad based USD depreciation

Assumptions for changes in selected currency exchange rates vs. USD,* nominal and real

Source: J.P. Morgan Asset Management; data and forecasts as of September 2022. * All exchange rates are quoted in market conventional format.

Key Points

For the first time since the global financial crisis, the expected normalization of yields raises our long-term return forecasts across most markets: With bond yields now at or above expected cycle-neutral averages, our return forecasts rise significantly and the outlook is more stable.

High inflation and hawkish central banks sent bond yields much higher since our last edition; almost all the increase in our 2023 fixed income return forecasts derives from these higher starting points.

Our cycle-neutral bond and cash rate return assumptions rise across developed markets. In inflation-linked bonds, higher inflation forecasts should shift the breakeven curve higher. Our long-term credit and loan spread assumptions are little changed.

Emerging market (EM) debt assumptions are little changed, despite greater regional heterogeneity. Middle Eastern petroleum producer economies, for example, look healthier. Some Latin American economies are fighting inflation and many frontier economies face crises, helping to lift index starting yields and spreads – we view that as a reflection of near-term risk. We do not adjust our EM credit spread assumptions.

Increasingly, we believe bonds are again becoming a good risk hedge if we are correct in our expectation that inflation will eventually retrace back toward central bank targets.

Leverage does not seem stretched in credit markets; while defaults may drift higher over our Long-Term Capital Market Assumptions horizon, recovery rates should also increase towards historical average levels. We leave our overall loss rate forecast unchanged.

Normalization of rates is no longer a drag on average returns in most markets

Building-block fixed income return projections for G4 countries

Source: J.P. Morgan Asset Management; estimates as of September 30, 2022. Long-maturity government bond index: Citi EMU GBI 15+ yr EUR; Citi Japan GBI JPY; FTSE UK Gilts Under 15+ yr GBP and Bloomberg U.S. Treasury 20+ yr USD. High yield: Bloomberg US High Yield 2% Issuer Cap USD and Bloomberg Pan-European High Yield EUR. Emerging market debt: J.P. Morgan EMBI Global Diversified Composite. Cycle-neutral: the average yield we expect after normalization.* Emerging market local currency debt.

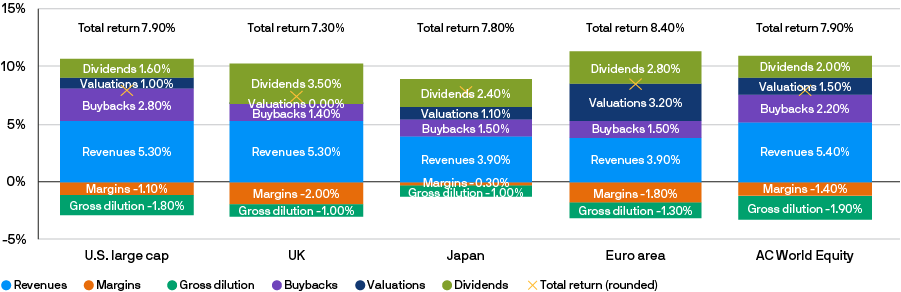

Key Points

We raise our long-term (10- to 15-year) equity return assumptions across regions. The biggest driver of increased return expectations is better starting valuations.

Today’s corporate margins are elevated and are set to decrease. But our forecasts still leave margins at high levels vs. history, mainly reflecting a shift in sector composition.

In the U.S., our expected return increases from 4.10% to 7.90%, primarily due to the reduction in the drag from valuation normalization. We see similar dynamics in other developed markets.

Emerging market (EM) returns are also better this year, but to a more moderate degree than in developed markets. We downgrade our revenue growth expectations for emerging markets, reflecting both lower nominal GDP forecasts in key regions and less optimism on EM corporates’ ability to earn revenues in high inflation environments.

We expect the USD to weaken over our forecast horizon. This is a tailwind to international equity returns for U.S. dollar-based investors.

Valuations are no longer a significant drag to our equity return forecasts

Selected developed market equity long-term return assumptions and building blocks, in local currency terms

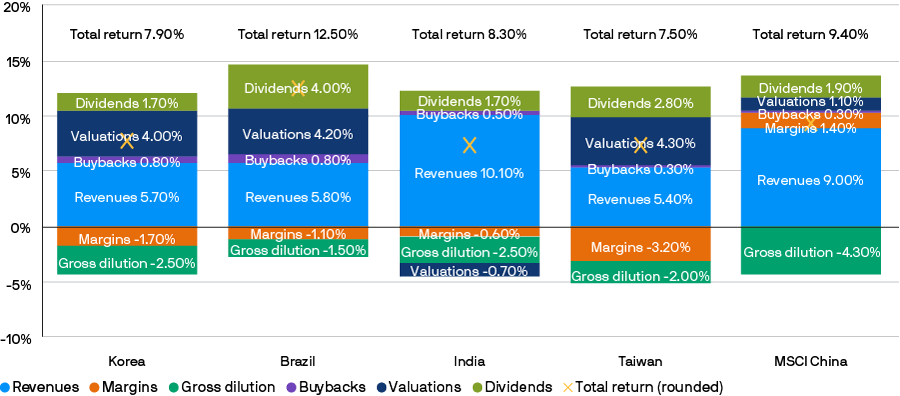

Selected emerging market equity long-term return assumptions and building blocks, in local currency terms

Source: J.P. Morgan Asset Management; data as of September 30, 2022. Please note that figures may not sum up due to rounding. MSCI China is treated as an asset whose local currency is CNY.

Key Points

Changes – both positive and negative – impact our alternative asset outlook, but these strategies and sectors continue to play an important role in portfolio diversification, return and cash flow in the context of volatile markets.

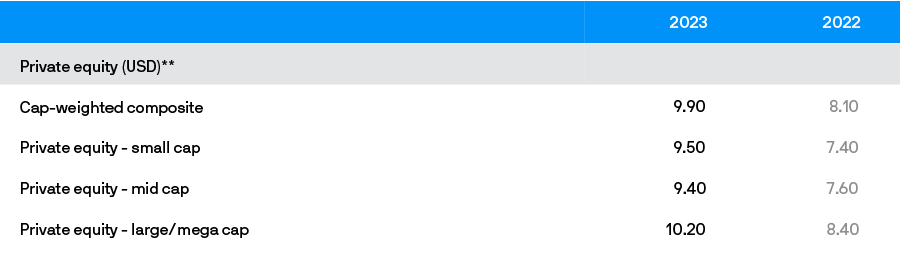

Private equity: Our return assumptions rise, driven by the public market component. Cyclical factors deflate returns in the near term while dry powder raises potential future returns. We see ample potential for alpha across a broadly changing economy.

Selected alternative strategies – return assumptions (levered,* net of fees, %)

Venture capital: We expect to see venture capital continue to marginally underperform private equity, as it has historically, with much higher return volatility.

Selected alternative strategies – return assumptions (levered,* net of fees, %)

Direct lending: Return estimates increase as base rates rise and available financial capital becomes increasingly scarce. Although fundamental headwinds are strengthening, the nature of direct lending transactions supports premium returns vs. public market equivalents.

Selected alternative strategies – return assumptions (levered,* net of fees, %)

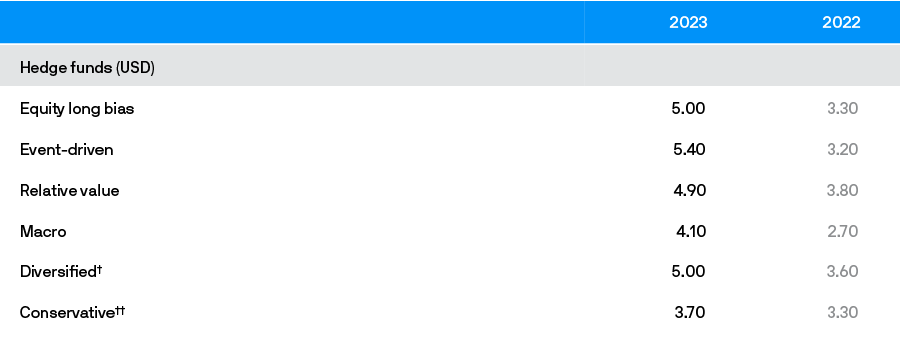

Hedge funds: Assumptions rise moderately across all strategies, with particular emphasis on macro. The overall environment for alpha improves, based on rising risk asset volatility, interest rate projections and strong positive momentum for commodities.

Selected alternative strategies – return assumptions (levered,* net of fees, %)

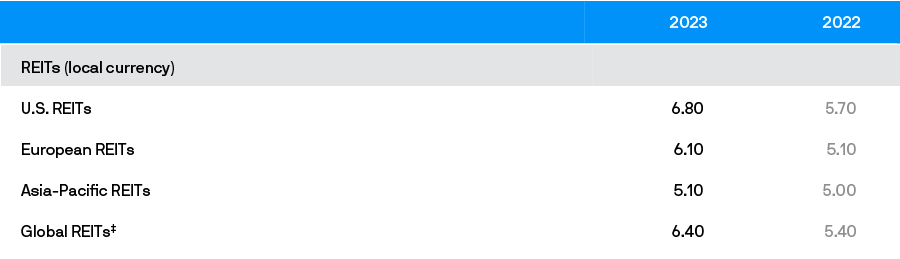

Real estate: Return estimates for private real estate decline across all regions due to exit capitalization expansion and the rising cost of capital, although sector dispersion may offset some challenges. The outlook for REITs, however, has improved, based on attractive starting valuations.

Selected alternative strategies – return assumptions (levered,* net of fees, %)

Infrastructure: Return projections remain robust. We expect infrastructure to continue to provide meaningful inflation protection and portfolio diversification in a rising rate environment.

Selected alternative strategies – return assumptions (levered,* net of fees, %)

Transport: Operating yield for global core transport continues its upward trajectory, supported by strong demand and dynamic seaborne trade flows; key return drivers include COVID-19 disruptions, inflation, geopolitical tensions and high asset utilization.

Selected alternative strategies – return assumptions (levered,* net of fees, %)

Timber: Timberland’s operating yield has increased given the constrained supply of the asset globally. Driven by timberland’s environmental, social and governance attributes and inflationhedging qualities, strong growth in investor interest and limited timber supply support our return projections.

Selected alternative strategies – return assumptions (levered,* net of fees, %)

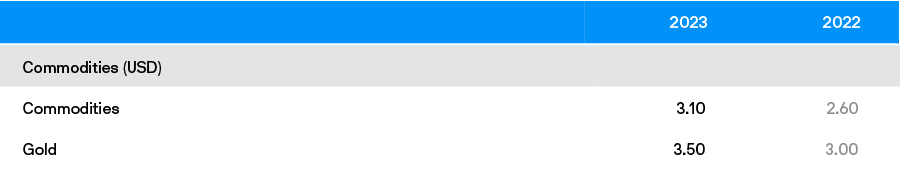

Commodities: Our return assumptions for long-term broad-basket commodities improve on the margin despite the aging of the cycle.

Selected alternative strategies – return assumptions (levered,* net of fees, %)

Source: J.P. Morgan Asset Management; estimates as of September 30, 2021, and September 30, 2022.

* All return assumptions incorporate leverage, except for commodities, where it does not apply.

** The private equity composite is AUM-weighted: 65% large cap and mega cap, 25% mid cap and 10% small cap. Capitalization size categories refer to the size of the asset pool, which has a direct correlation to the size of companies acquired, except in the case of mega cap.

† The Diversified assumption represents the projected return for multi-strategy hedge funds.

† † The Conservative assumption represents the projected return for multi-strategy hedge funds that seek to achieve consistent returns and low overall portfolio volatility by primarily investing in lower volatility strategies such as equity market neutral and fixed income arbitrage. The 2023 Conservative assumption uses a 0.70 beta to Diversified.

‡ The global composite is built assuming the following weights: roughly 65% U.S., 15% Europe and 20% Asia-Pacific.

Key Points

We forecast higher volatility for most asset classes, most meaningfully in fixed income as rates revert to higher yield levels and returns likely rise back to levels last seen before the global financial crisis.

Over our long-term forecast horizon, U.S. stock-bond correlations remain negative, although slightly less negative because of the effect of positive short-term correlation.

Correlation between U.S. equities and Treasuries should remain volatile, lessening the efficacy of core fixed income in smoothing equity volatility, but while the benefits of diversification may have weakened at the margin, they endure.

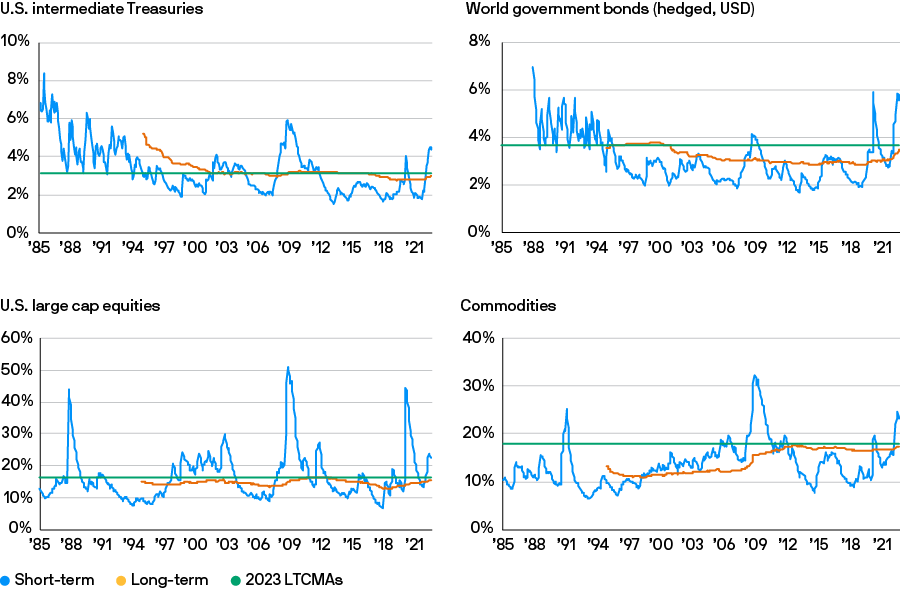

Risk dynamics proved challenging in 2022 as short-term volatility deviated significantly from our long-term assumptions. Despite this dislocation, our analysis reaffirms that even as long-term volatility forecasts trend upward, short-term risks don’t become long-term forecasts unless today’s macro and market environment becomes a multi-year phenomenon.

Our Sharpe ratio forecast for equities improves, reverting to historical averages, and rises for government bonds and corporate credit. Real assets’ Sharpe ratios are stable to declining, yet despite this relative downgrade, alternatives retain their stable and highly diversifying return and risk profiles.

While short-term volatility is trending higher across global markets, projected long-term levels remain stable

Short- vs. long-term volatility (%), selected assets (USD)

Source: Bloomberg, J.P. Morgan Asset Management; data as of September 30, 2022.