Economic & Market Update

Welcome to the 3Q 2023 J.P. Morgan Asset Management Economic and Market Update. This seminar, presented by Dr. David Kelly, highlights the major themes and concerns impacting investors and their clients, using just 10 Guide to the Markets slides.

There are 65 pages in the Guide to the Markets. However, we believe that the key themes for the third quarter can be highlighted by referencing just 10 slides.

ECONOMIC & MARKET UPDATE: USING THE GUIDE TO THE MARKETS

TO EXPLAIN THE INVESTMENT ENVIRONMENT

1. The economy is holding up better than expected, but recession risk remains.

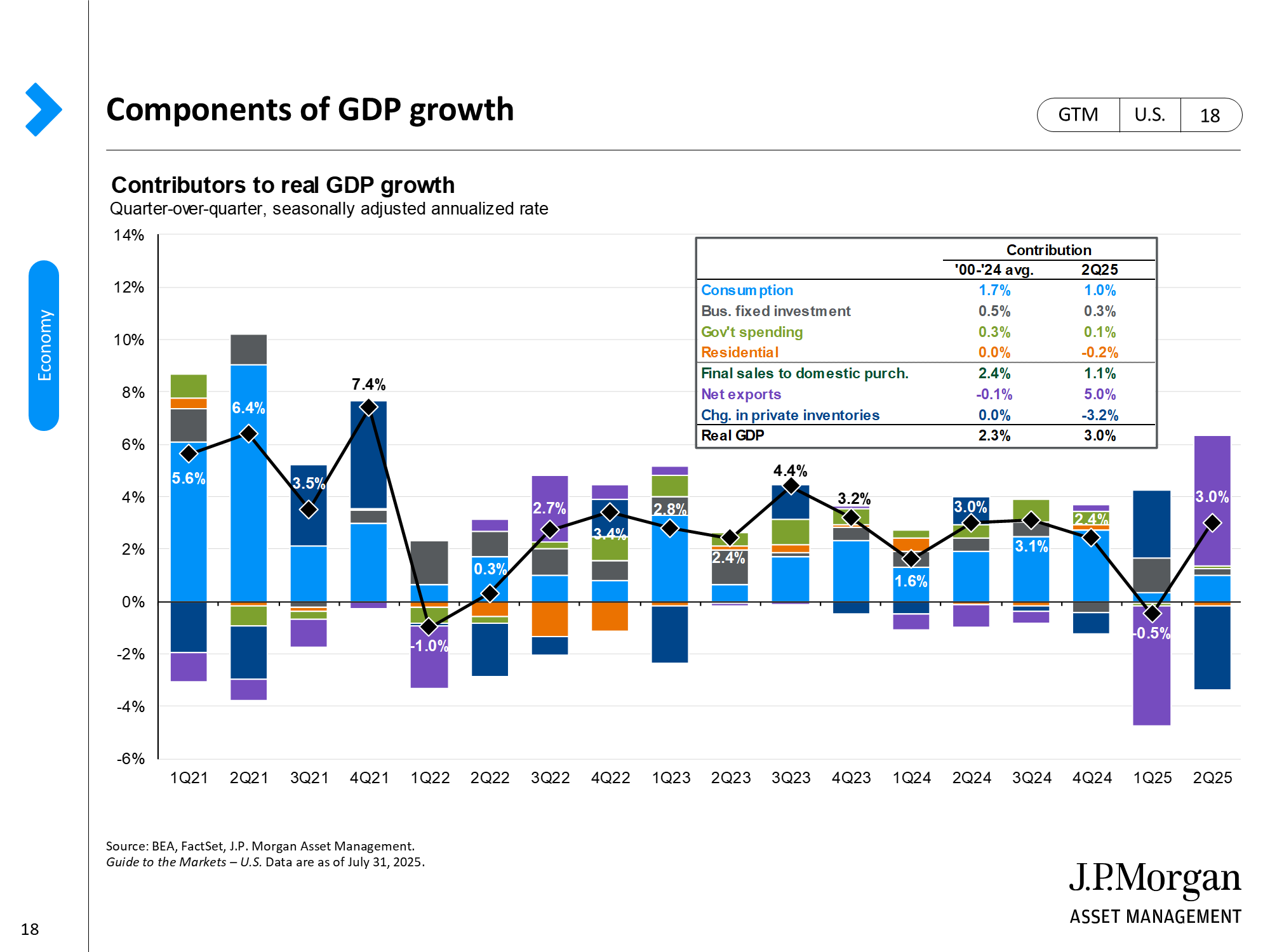

The U.S. economy remained resilient in the first half of 2023, widening the runway for a potential soft-landing. However, a quick look across each sector of the economy tells us that economic momentum is still slowing.

Business spending appears to be one of the most “at risk” areas of the economy. Recent layoffs in the tech sector could weigh on R&D spending while increased caution among lenders and slowing corporate profits could constrain capital expenditures. Consumers are still feeling the lagged effects of less fiscal stimulus and higher inflation, depleting their savings balances and taking on more debt to maintain their current lifestyles. The personal savings rate has fallen to 4.2% this year, well below its long-term average of 8.9%, suggesting that saving will need to increase over the next few years. This, along with the forthcoming resumption of student loan payments, should weigh on consumer spending in the coming months.

The housing market appears to be stabilizing, albeit at low levels, as tight housing supply and steadying mortgage rates are signaling that the worst is behind us. Trade should be a mild drag on the economy due to the lagged impact of a strong dollar. However, the global economy has been gaining steam and the trade-weighted dollar has now fallen by 10% from its peak, which should limit the damage of deteriorating trade moving forward.

Overall, the U.S. economy should continue to grow at a tempered pace from here, and while a recession is not guaranteed, a slower-moving economy will be increasingly sensitive to shocks. There remain risks on the horizon, most notably weakness in commercial real estate, that could push this slow-moving economy into a recession within the next year.

2. Cracks are beginning to emerge in the labor market.

The labor market has been a bright spot throughout this economic expansion, but cracks are beginning to emerge. Recent employment reports have shown the economy continues to add jobs at a robust pace, but the trend of job gains has been slowing over the past year. Improved labor force participation has so far supported job growth, with the participation rate for adults aged 25-54 having fully recovered to pre-pandemic levels. However, while the short-term impacts of the pandemic have now abated, aging demographics continue to place a structural limit on labor supply growth. The participation rate for adults aged 55+ has remained depressed, reflecting an aging baby-boomer population that has permanently left the workforce. Even with higher wages and low unemployment, the labor force participation rate may be at its peak.

Other labor market data also suggest a trend of normalization. Weekly initial claims for unemployment have been trending higher to average 240K in the second quarter, compared to an annual average of 214K in 2022. While this modest increase is still indicative of a healthy labor market, claims may begin picking up more rapidly if layoff announcements become more widespread. Employees are also losing some confidence in their job prospects, as shown by recent declines in the Conference Board survey measure that asks individuals if jobs are plentiful vs. hard to get. Business surveys are showing similar trends, with the PMI measures of services and manufacturing employment and small business hiring plans moderating in recent months.

Overall, cooling demand for labor suggests that job growth should decelerate in the coming months. Indeed, it may even turn negative, which would signal the economy is likely entering into a recession.

3. Unemployment may rise further, but only slightly.

A tight labor market has allowed the unemployment rate to hover around its 50-year lows despite cooling demand, averaging at 3.5% this year after an uptick to 3.7% in May. Importantly, cooling labor market conditions have contributed to a moderation in wages, which only grew by 0.3% month-over-month in May for all private workers. Compared to a year ago, wage growth has now come down to 4.3% from a peak of 5.9% in March 2022.

However, there is also a limit to how much the unemployment rate could rise going forward, as U.S. businesses still face a structurally smaller labor force than prior decades. Diminished legal immigration, particularly over the course of the pandemic, and baby-boomers reaching retirement age have left the economy very short of workers.

As such, the unemployment rate may only nudge slightly higher in the year ahead despite businesses reeling back hiring efforts in the face of slower demand and higher costs. However, wage growth should continue to decelerate and help give the Federal Reserve (Fed) confidence that inflation is sustainably coming down.

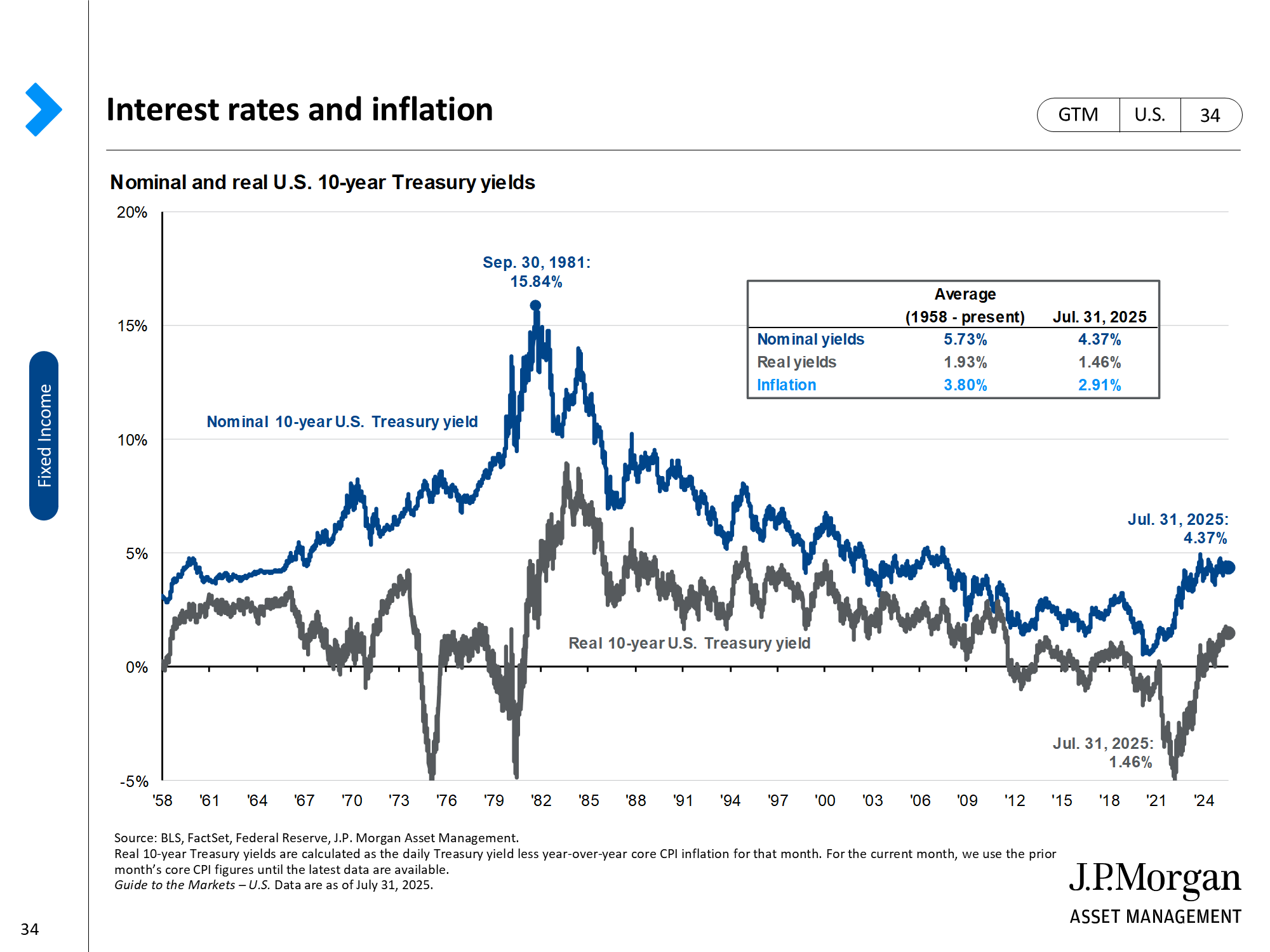

4. Inflation is gradually falling to more manageable levels.

After nearly two years of hot inflation squeezing consumer wallets and contributing to a swift rise in interest rates, a sustained inflation downtrend is now underway. Headline CPI inflation has come down from a peak of 8.9% y/y last June to 4.1% y/y in May. As we show on page 32, a modest pace of monthly core inflation has been mostly sustained for the last seven months.

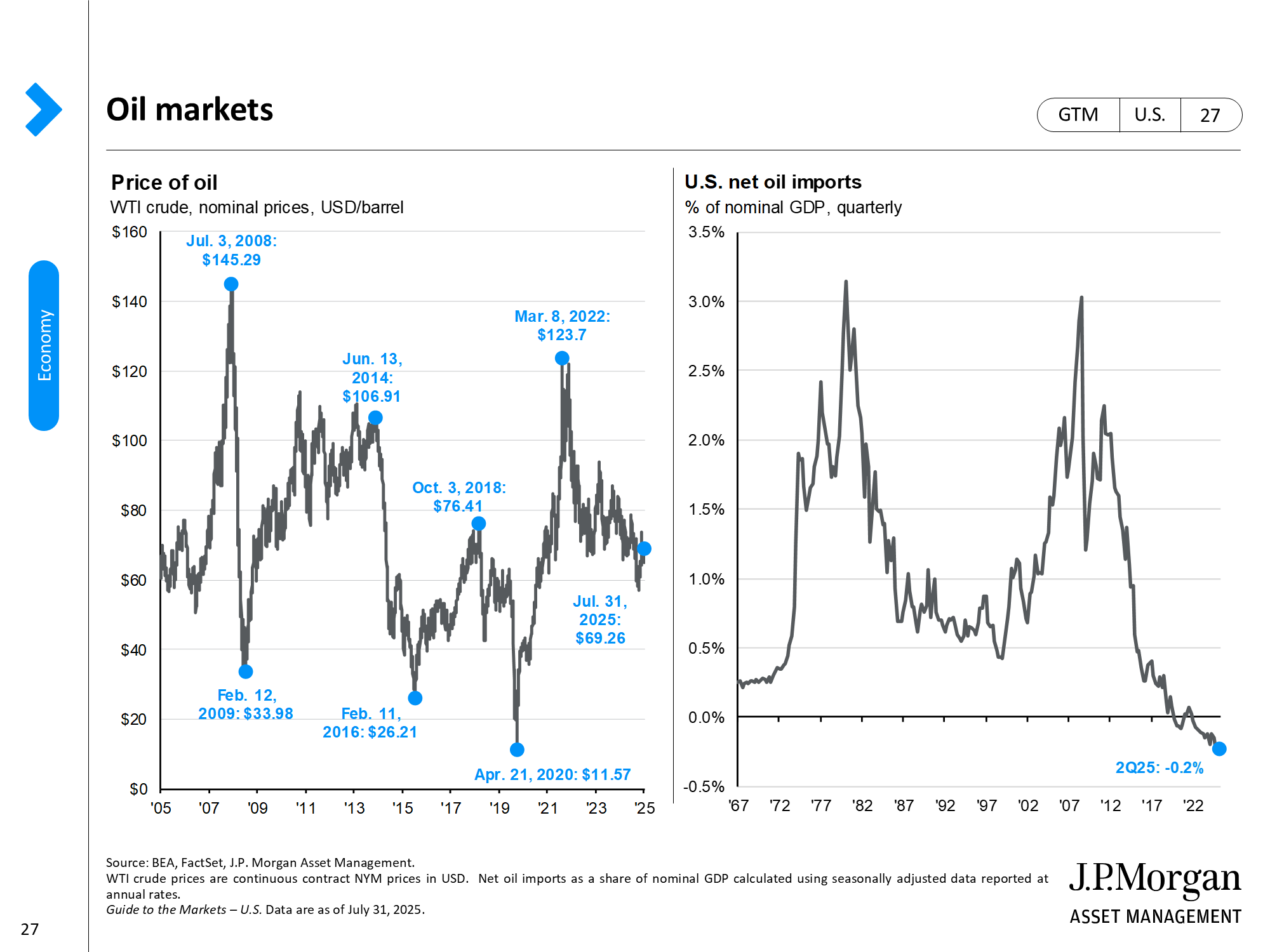

Importantly, the major hotspots of inflation from the last two years have now turned and are contributing to disinflation across the key components of inflation. Energy prices have been declining since the second half of 2022 while a combination of improved supply chains and lower consumer demand has allowed inflation to ease across core goods categories. Shelter inflation, which has been the stickiest part of core inflation, is also starting to ease. Since it reflects market conditions with a significant lag, it should continue to decline over the next year to reflect the stall in price increases for new transactions in the rental market.

The remaining problem for inflation, therefore, is core services prices outside of housing, a measure Chairman Powell has frequently quoted when referencing persistent inflation pressures. However, it seems to largely reflect the lagged effect of the same supply chain issues that impacted core goods prices, as transportation services account for the bulk of remaining inflation. Improved supply chains and easing labor market tightness should allow this measure of inflation to come down over the next year.

While inflation may not be falling as fast as the Fed would like, it is gradually falling to much more manageable levels. We expect CPI inflation will decline to 3.5% year-over-year by the end of this year and towards 2-3% by the end of 2024, even without a U.S. recession.

5. Risks to S&P 500 earnings remain to the downside.

Despite economic headwinds, equity markets have had a solid year so far, supported by a better-than-expected 1Q23 earnings season and expectations for a forthcoming end to Fed tightening. S&P 500 operating earnings-per-share rose 6.4% from a year earlier and 4.3% from the fourth quarter. Profit margins also rose to 11.7%, indicating that companies have had success in defending margins. However, with heightened risk of recession in the coming year, profit estimates should come under further pressure.

Current commentary also suggests that firms plan on reining in investment, although cuts will not be evenly distributed. Investment in equipment tends to see the largest pullback in investment as the economy slows, suggesting we may see cuts within the manufacturing and mining sectors. However, investment in technology, specifically artificial intelligence, should continue to rise as companies seek to optimize processes for long-term cost savings.

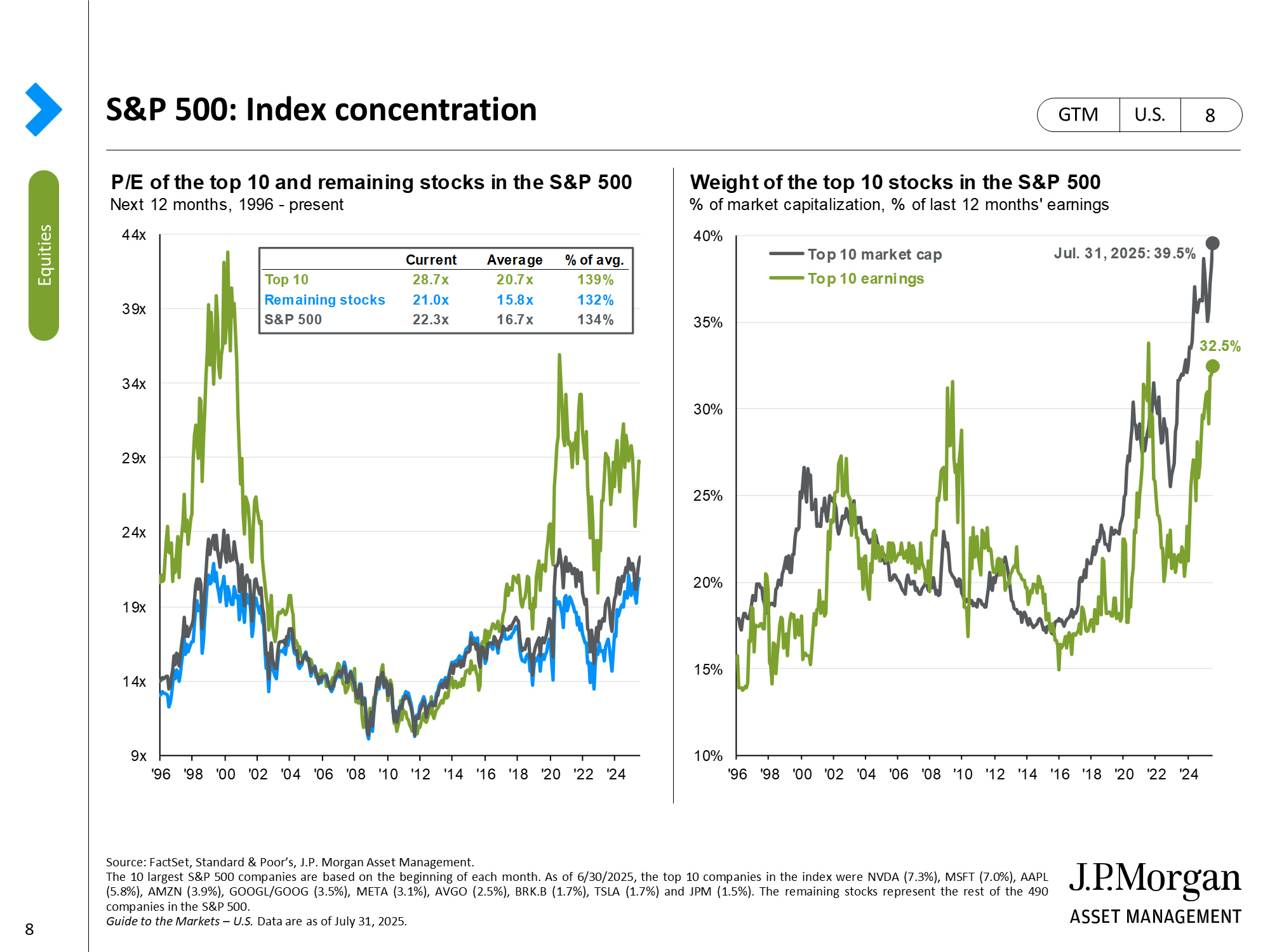

At the current juncture, it is difficult to be overly bullish in equities. While performance this year has been better, it has been entirely driven by valuation expansion on the back of lower interest rate expectations, with the top 10 companies in the S&P 500 accounting for 13.8 percentage points of the 14.9% price return year-to-date. Expectations for policy easing may also be too optimistic and as expectations adjust, multiples could come under further pressure. Along with slowing growth weighing on earnings expectations, this creates a challenging backdrop for equities ahead. As such, we prefer a defensive stance in equities with a focus on quality and cash flow generation.

6. The Federal Reserve is nearing the end of its tightening cycle.

Since the beginning of 2022, the Fed has hiked rates by a cumulative 5.00% in an attempt to combat persistent and high inflation. At their June meeting, the Fed voted to leave the federal funds rate unchanged at a target rate of 5.00-5.25% for the first time since tightening began. While this move was widely telegraphed, forward guidance was decidedly hawkish.

The Fed’s updated “dot plot” suggested that the “pause” in June may just be a “skip”. The median FOMC member now expects a year-end federal funds rate of 5.6%, implying two more rate hikes this year with no cuts until 2024. The committee also increased their forecast for rates in 2024 and 2025, reflecting the committee’s concern that elevated inflation may warrant highly restrictive monetary policy for longer.

This more hawkish outlook also stems from the Fed’s expectations of a more resilient U.S. economy. Compared to the March Summary of Economic Projections, the median expectation for real GDP and core PCE inflation increased materially, while the median forecast for the unemployment rate fell to 4.1% from 4.5%. The committee does acknowledge inflation is trending in the right direction but emphasized that they need further evidence that inflation is under control before calling an end to tightening.

In light of the Fed’s continued hawkishness, market expectations have become more in-line with Fed guidance. Following the May FOMC meeting, futures markets were pricing in three cuts and a year-end rate near 4.25%. Currently, there are no more cuts priced in for this year and year-end rate expectations have risen above 5%.

7. Global economic momentum outside of the U.S. remains strong.

At the end of last year, the global economy was losing steam with only 27% of the countries shown on page 52 registering a manufacturing PMI above 50, the level associated with accelerating economic momentum. At the time, energy troubles left Europe at heightened risk of recession and “zero-COVID” policies were dragging on activity in China.

In 2023, however, the global economy has gained speed. At the end of the second quarter, all countries shown on this page have a manufacturing PMI above 50 while the global services PMI is at an 18-month high. Fortunately, the two risks in Europe and China have turned in the other direction. In Europe, energy prices fell after a mild winter allowed natural gas inventories to improve and fiscal stimulus is further supporting Eurozone economies. In China, the lifting of COVID restrictions has allowed for a rebound in consumption after three years of sheltered activities. Travel and leisure spending have bounced back strongly, but a rebound in other services and goods spending remains dependent on a recovery in private business and consumer confidence, which has so far been tepid.

Still, China’s recovery will act as a strong tailwind for its trading partners and tourist destinations across Europe and Asia. As such, divergent paths of growth across the global economy are beginning to emerge with the U.S. slowing while Europe, China and broader Asia accelerate.

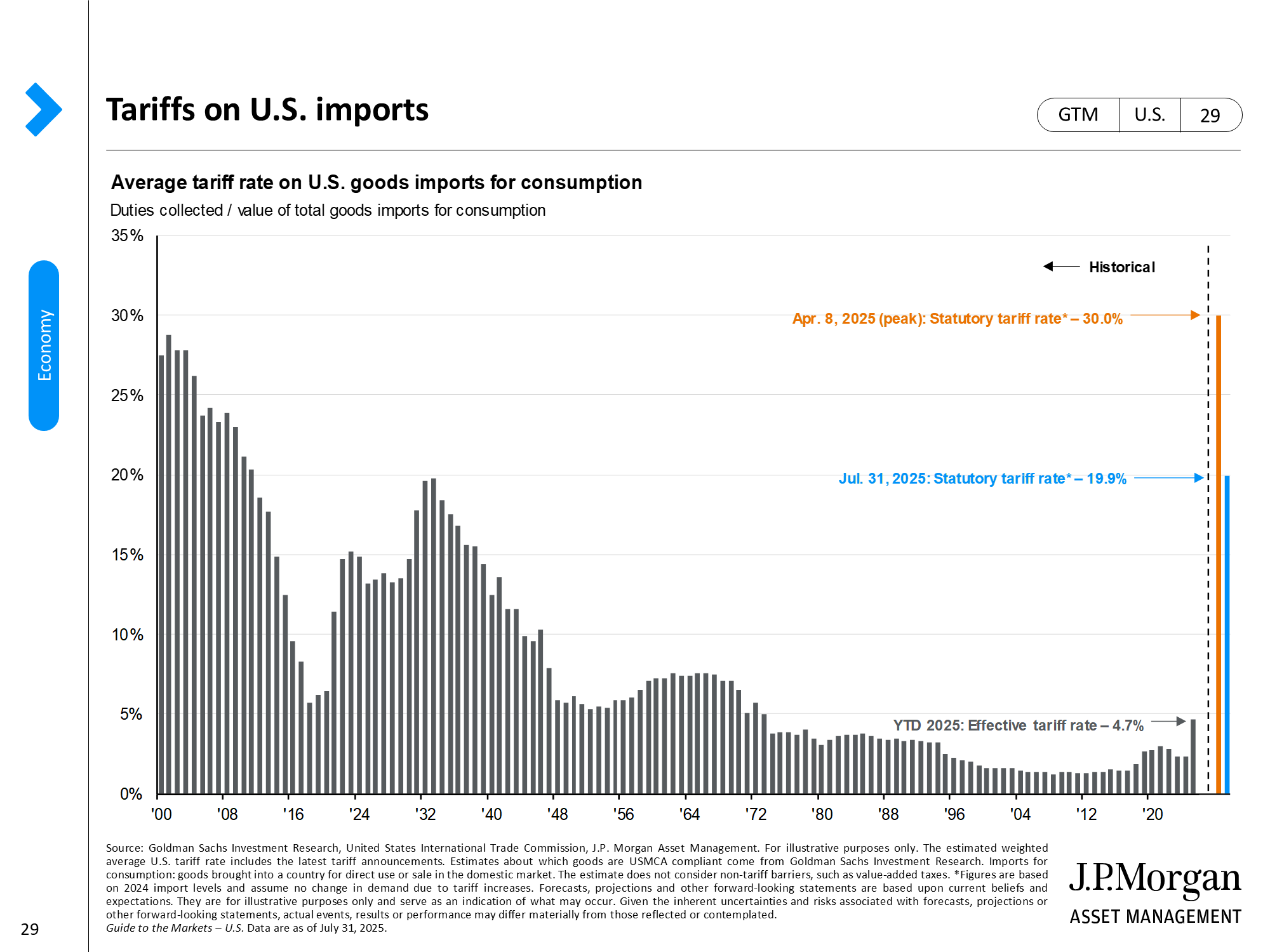

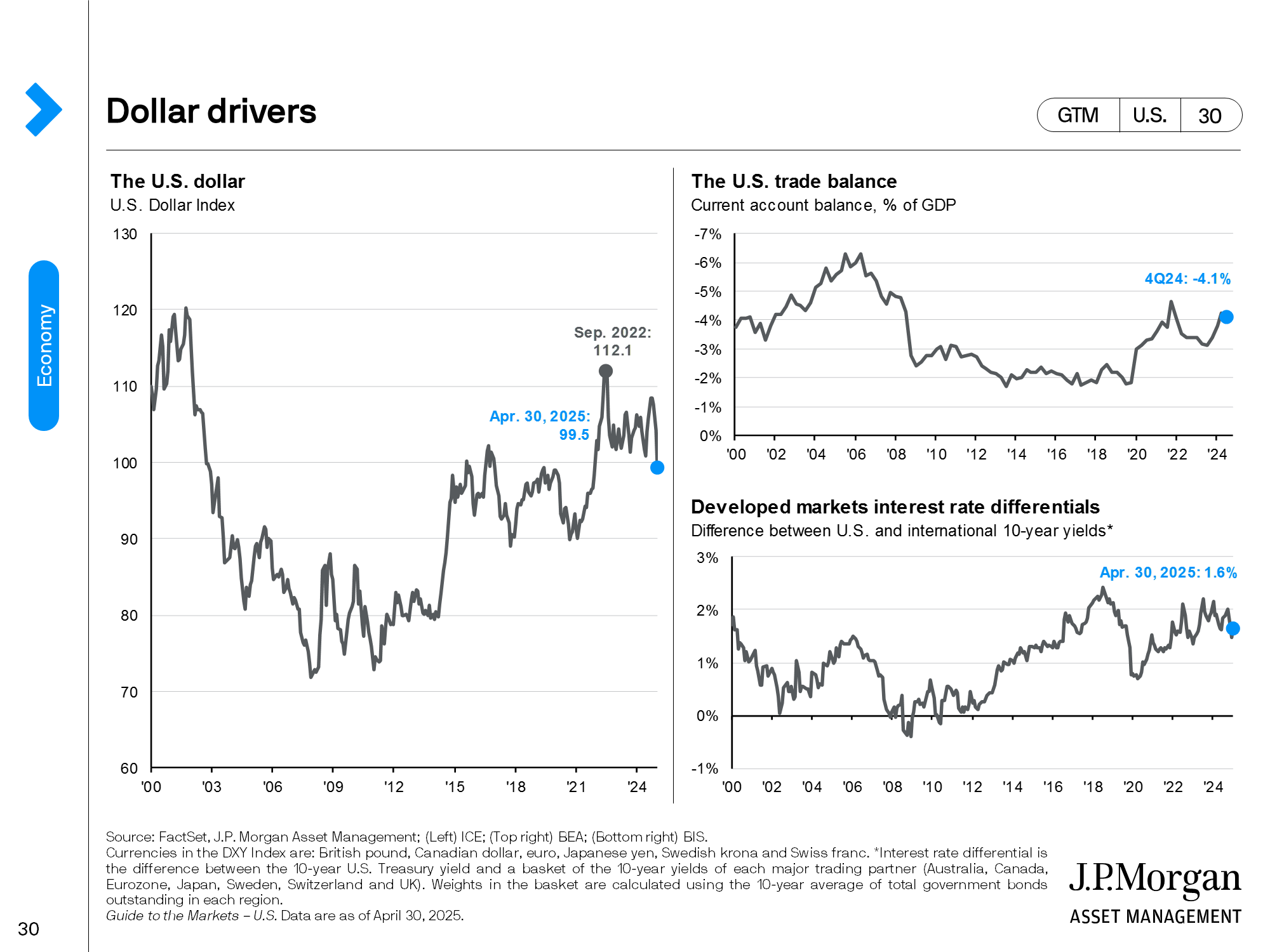

8. A new cycle of dollar weakness may be taking hold.

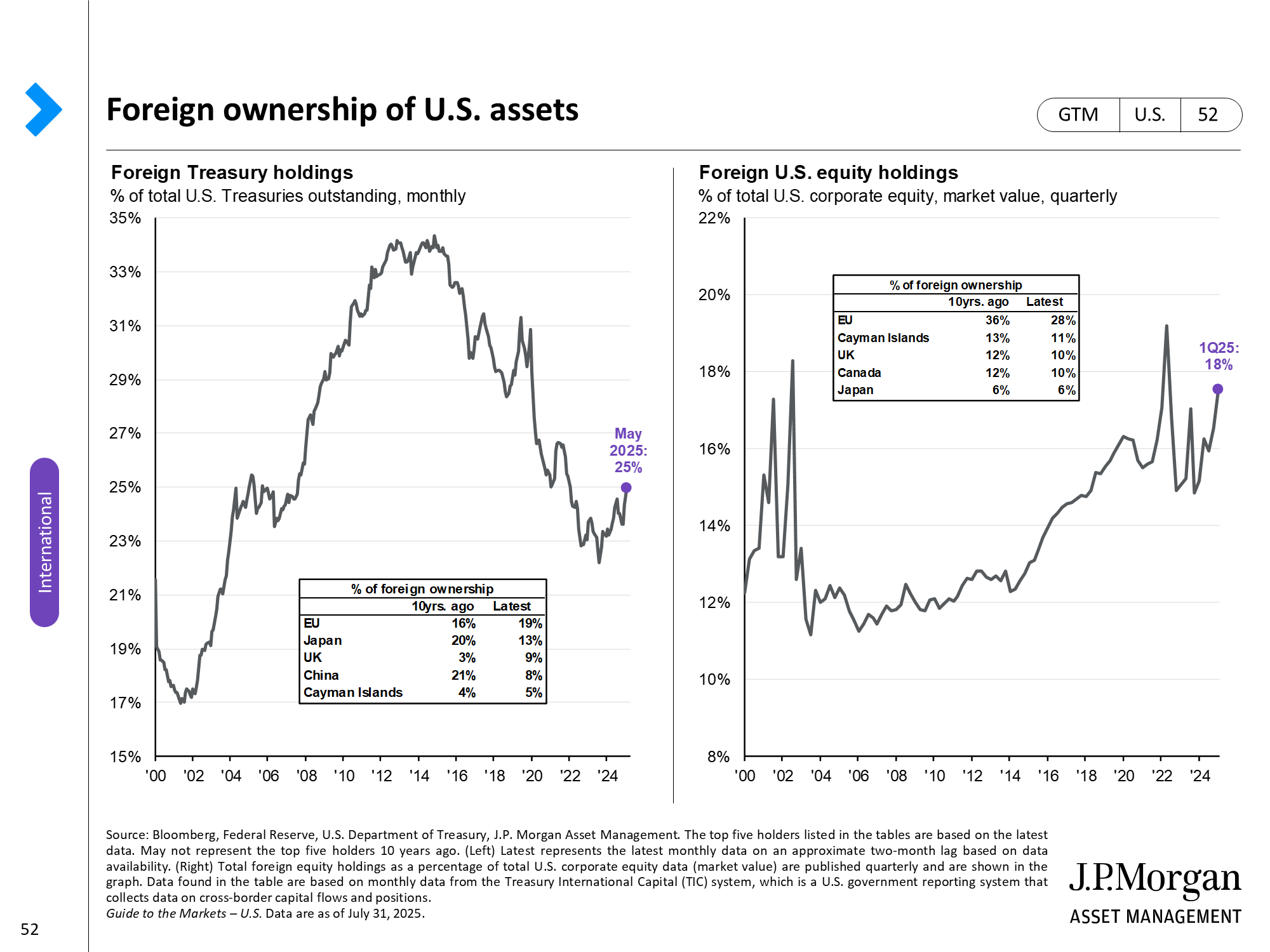

A long cycle of U.S. dollar strength is likely coming to an end. After reaching a 20-year high last September, the dollar had fallen by roughly 10% through late June. The forces that contributed to a rising dollar last year have now receded, potentially paving the way for a new cycle of dollar weakness.

Specifically, narrowing interest rate differentials and widening growth rate differentials should continue to weigh on the dollar. After the Fed’s aggressive tightening campaign caused interest rate differentials to widen in 2022, the Fed pause in June and continued global tightening efforts have led to a narrowing in differentials. Additionally, better-than-expected activity in China and Europe suggest further downward pressure on the dollar as global growth outpaces the U.S. Moreover, long-term fundamentals still pose headwinds. While the dollar has fallen from its peak, it is still trading near 20-year highs and remains expensive versus fair value. Moreover, the U.S. trade deficit now amounts to 3.2% of GDP. This partly reflects the negative impact of the dollar on the competitiveness of U.S. manufacturing and should help push the dollar down going forward, as U.S. demand for overseas goods, services and assets increases the demand for other currencies.

Over the long run, we expect economic forces to gradually drive the dollar down. In the near term, narrowing growth and interest rate differentials should prevent any sustained periods of appreciation. However, the dollar remains a safe-haven asset and could see bouts of strong performance during periods of uncertainty.

9. Despite this year’s rally, valuations still present long-run opportunities.

In the wake of last year’s broad market sell-off, lower valuations presented investors with a new slate of opportunities across asset classes. While markets have recovered from their lows, current valuations still look more attractive compared to lofty levels at the end of 2021.

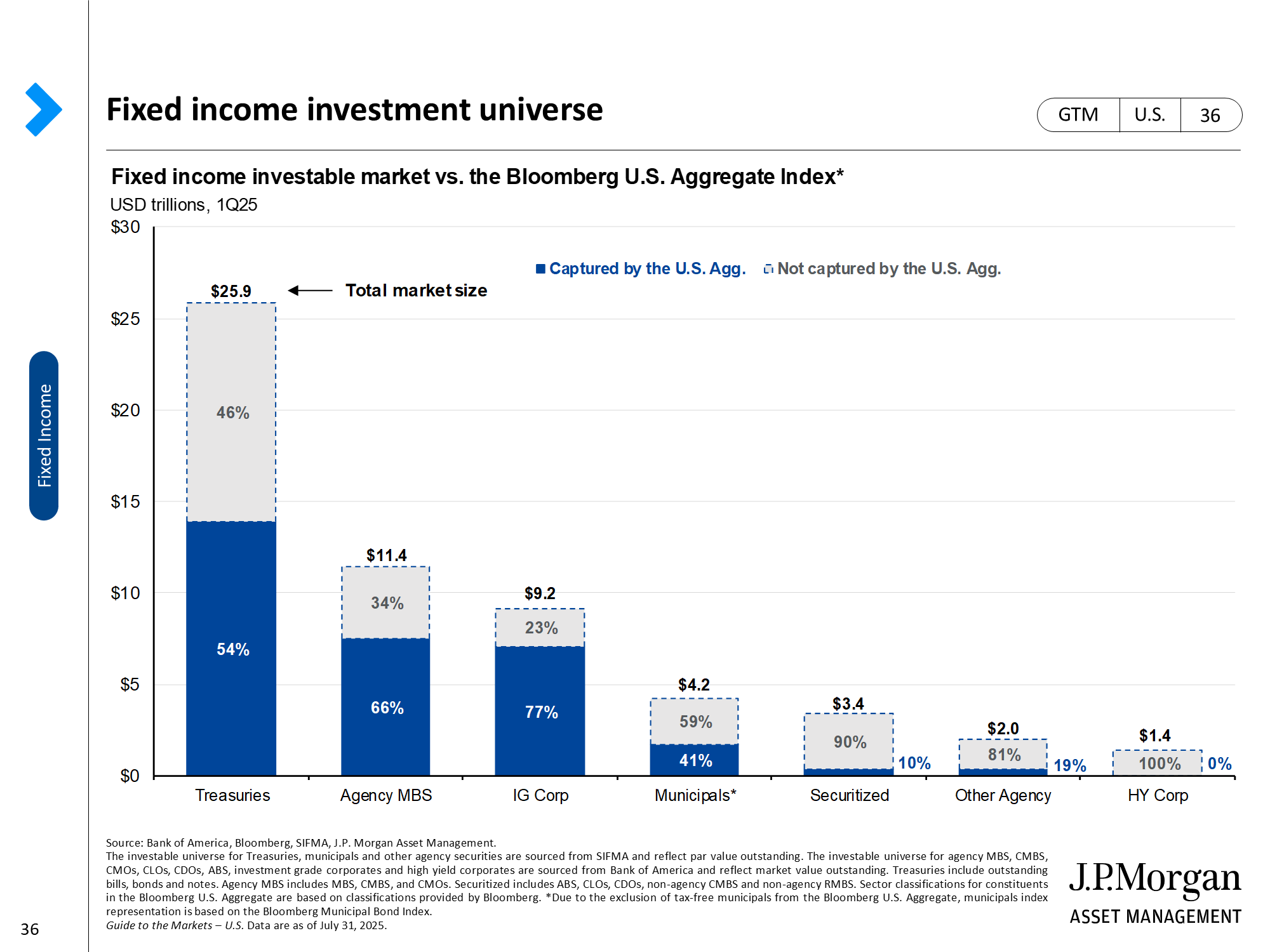

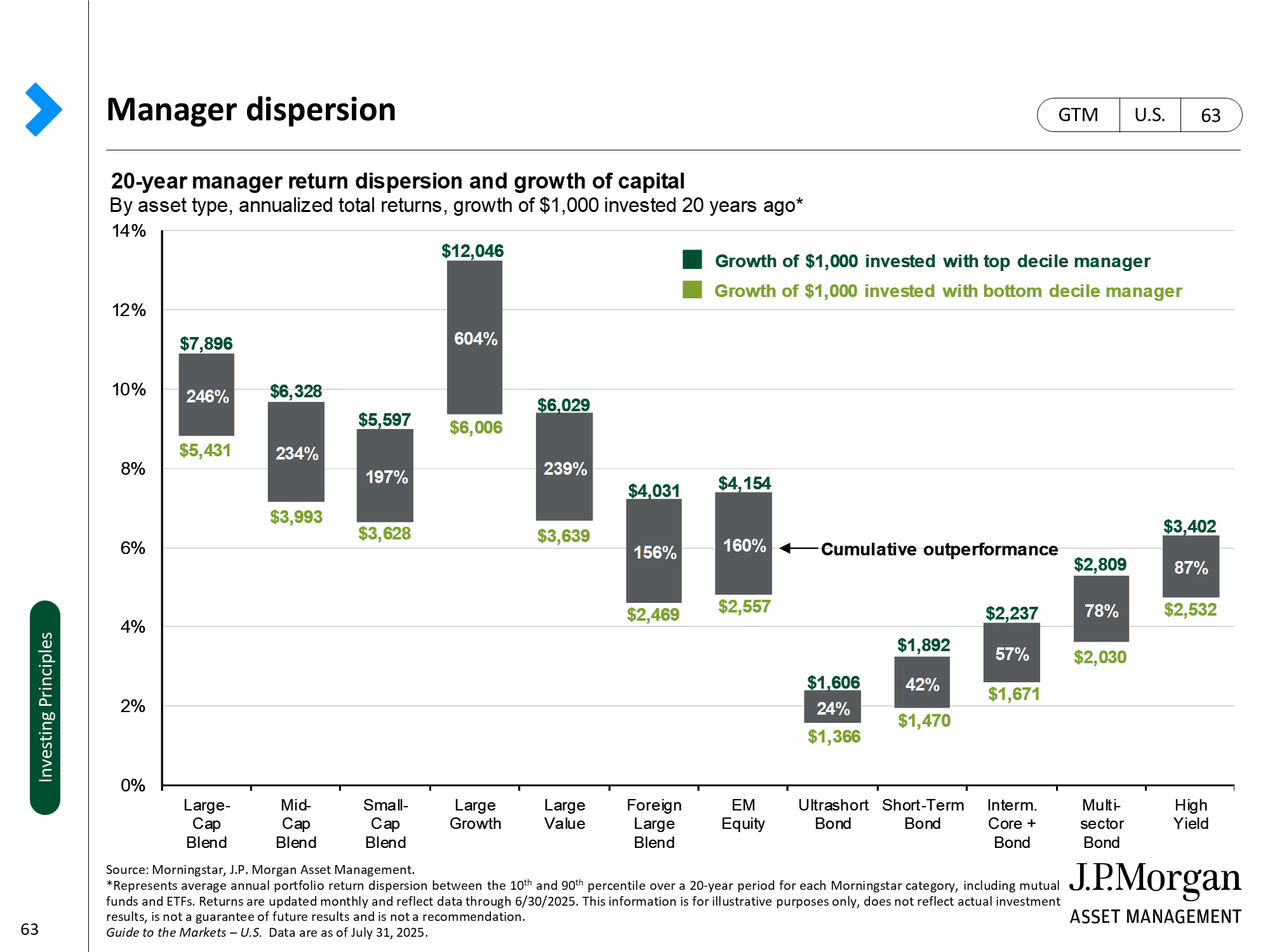

Page 63 shows 10 major asset classes and styles and their valuations, expressed as z-scores versus their respective 25-year history. Using z-scores allows us to illustrate how normal, or abnormal, current valuations are compared to history. Asset classes across the board are much cheaper today compared to the end of 2021, but by varying degrees. Fixed income continues to look attractive as U.S. Treasuries, core bonds and municipal bonds remain below their average valuation levels. International equities, in particular, are being offered at a historical discount while some areas of the U.S. market, specifically large cap and growth, look slightly expensive after strong performance in the second quarter.

As investors assess positioning in the remainder of the year, it’s important to assess both the remaining risks on the horizon as well as the menu of investment opportunities in the aftermath of last year’s market corrections. Within equities, investors may want to lean into international markets and focus on finding the attractively valued companies poised to drive long-run returns. Moreover, the current opportunity presented in fixed income could pass rather quickly once the Fed begins lowering rates, and investors would be well served to take advantage of current yields.

10. Don’t let how you feel about the economy overrule how you feel about investing.

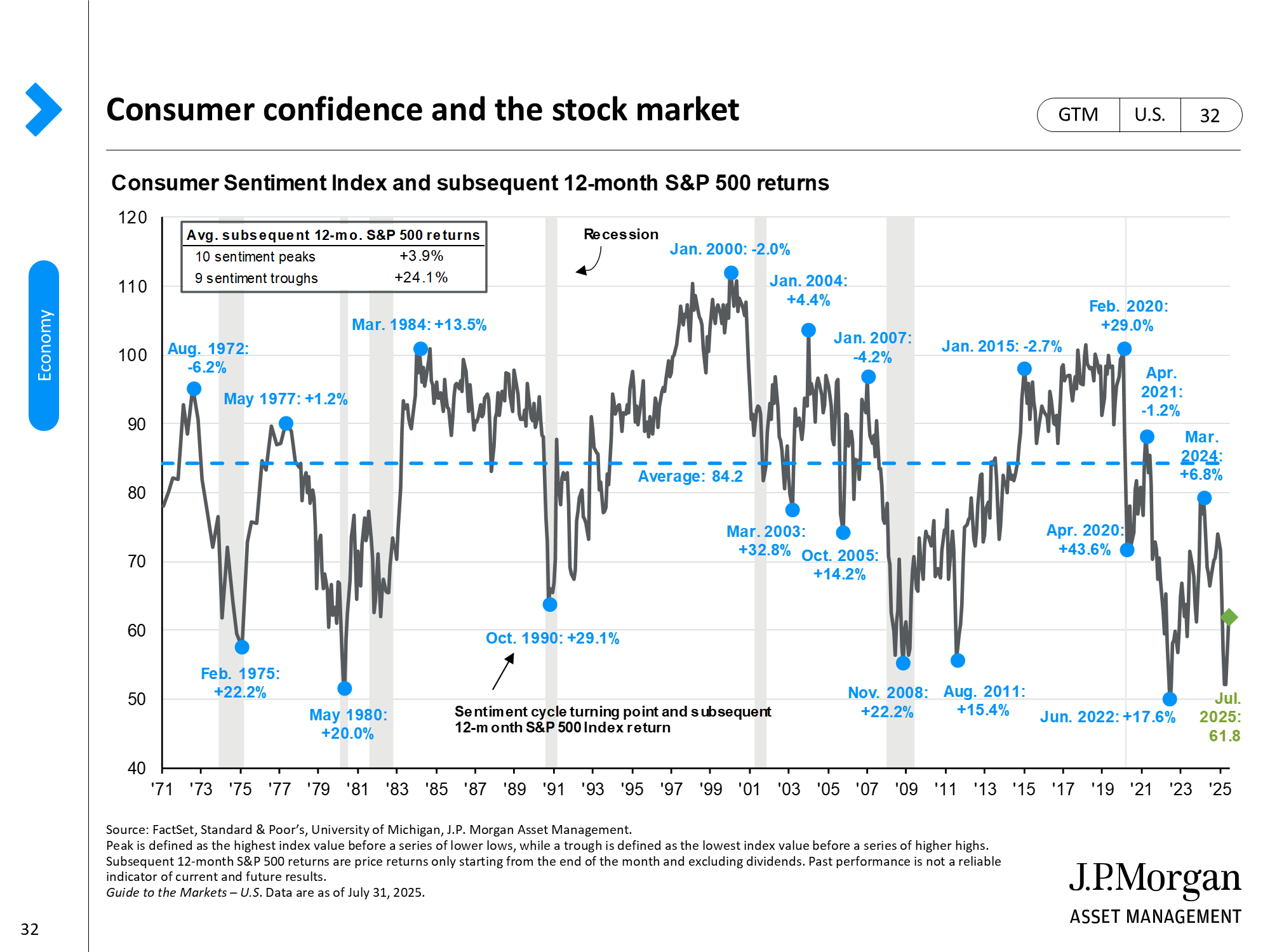

Consumer sentiment has since staged a modest recovery since hitting a new trough in June of last year. However, banking sector turmoil, fears of a U.S. default and the growing weight of the Fed’s aggressive tightening campaign kept consumer sentiment depressed in the second quarter. Looking ahead, increased risk of recession and softness in the labor market could keep consumer sentiment depressed this year.

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risk assets. However, history suggests that trying to time markets in this way is a mistake. This slide shows consumer sentiment over the past 50 years, with 9 distinct peaks and troughs, and how much the S&P 500 gained or lost in the 12 months following. On average, buying at a confidence peak returned 3.5% while buying at a trough returned 25%.

Importantly, this is not to suggest that U.S. stocks will return anything like 25.0% in the year ahead, as many other factors will determine that outcome. However, it does suggest that when planning for 2023 and beyond, investors should focus on fundamentals and valuations rather than how they feel about the world.