Fixed income assumptions

09-11-2020

Thushka Maharaj

Michael Feser

Sean Daly

Jason Davis

A long road back to normal

IN BRIEF

- We expect double-barreled stimulus – fiscal and monetary – to continue well into the recovery. To enable the stimulus to be effective and help heal fragile economies, monetary policy will depress real rates. This new normal for policy increases the risk premium we attach to higher inflation outcomes before central banks hike rates.

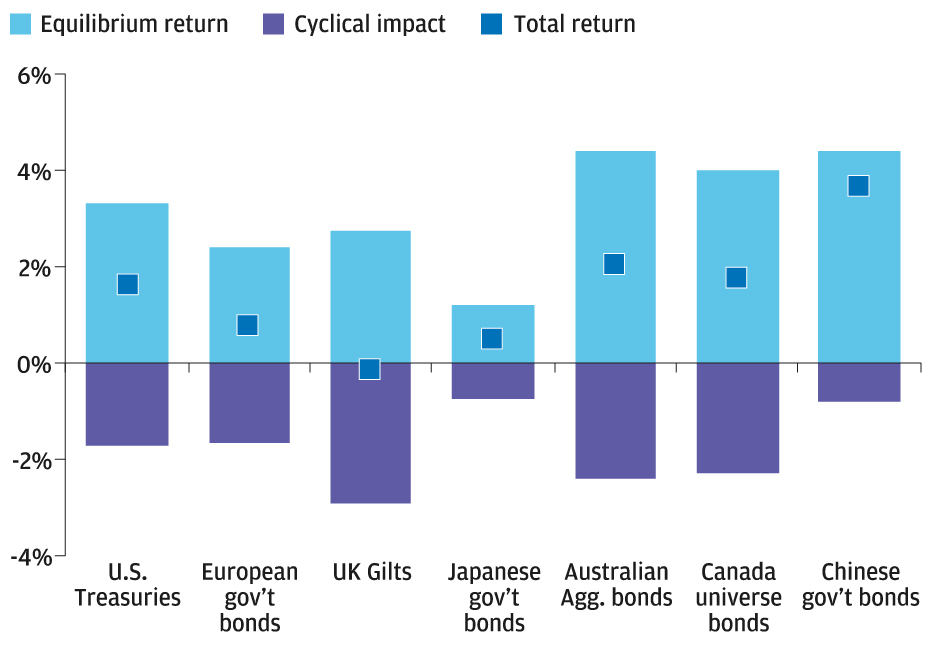

- We foresee three phases for major economy government bonds: In the first phase, we expect stable risk-adjusted returns for government bonds. In the second phase, we see capital depreciation as yields rise; in the third phase, as equilibrium yields are reached, we expect core fixed income returns to improve and return to a positive level.

- In credit, our U.S. investment grade total returns decline. High yield spread assumptions are unchanged, and returns are robust and comparable to equity. We expect corporate balance sheets to eventually delever as economies recover and policy rates normalize.

- We increase our equilibrium spread assumptions for both emerging market (EM) hard sovereign and corporate debt to reflect our view of higher indebtedness over the next 10 to 15 years. We expect more dispersion across EM country returns as fiscal policy stimulus creates distinct winners and losers.

The cyclical drag from today’s low yields diminishes over time

SUMMARY OF CORE GOVERNMENT BOND RETURNS

Source: J.P. Morgan Asset Management; data as of September 2020.

View Other Assumptions

Examine our return projections by major asset class, their building blocks and the thinking behind the numbers.