Volatility and correlation assumptions

09-11-2020

Grace Koo

Xiao Xiao

John C. Manley

After near-term choppiness, long-run forecast remains stable

IN BRIEF

- Despite a roller-coaster ride for markets and economies in 2020, our volatility and correlation forecasts are stable year-over-year because previous years’ assumptions already factored in short-term disruptions.

- Unprecedented Federal Reserve actions and enormous fiscal support will likely depress U.S. fixed income and credit market volatility in the next few years before rising to our long-run forecasts.

- In equities, we expect volatilities to return toward long-run historical levels after the uncertainties around the new U.S. administration and the pandemic recovery have receded over the coming months and quarters.

- In ex ante Sharpe ratio terms, U.S. government bonds and equities deteriorate again this year over our forecast horizon. Bonds’ near-term Sharpe ratio, however, is likely better as they benefit from dampened volatility over the next few years. Our preference, in risk-adjusted terms, for extended credit and alternatives – especially real assets – continues to strengthen.

- Our case study explores a framework for adding liquidity considerations to portfolio construction. We find that it helps create a more balanced and diversified portfolio with improved liquidity profiles while minimally affecting the expected risk and return.

- A structured way of incorporating liquidity metrics offers investors an additional lens when allocating to less liquid assets such as extended credit and alternative assets – a likely direction of travel, given the need to expand investment opportunity sets to achieve an acceptable return.

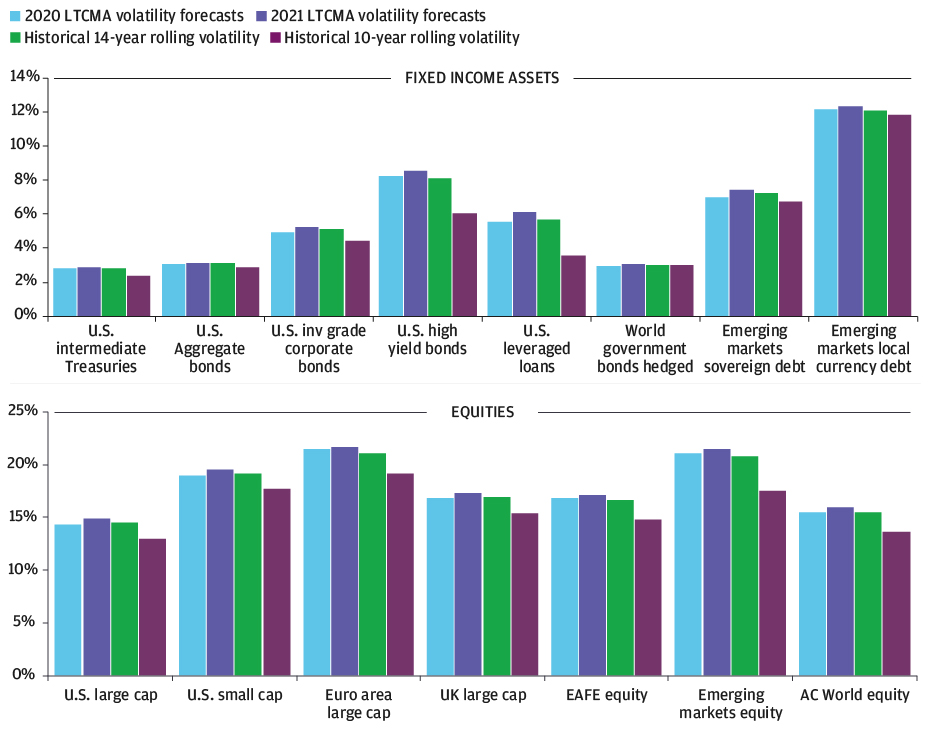

Forecasts demonstrate stability, as prior years incorporated recession expectations

YEAR-OVER-YEAR COMPARISON, LTCMA VOLATILITY FORECASTS

Source: Bloomberg, J.P. Morgan Asset Management; data as of September 30, 2020. For illustrative purposes only.

View Other Assumptions

Examine our return projections by major asset class, their building blocks and the thinking behind the numbers.