The structural demand for consumer goods, financial services and the competitiveness in business process outsourcing (BPO) and information technology support are areas where strong growth can be expected.

In brief

- Investors’ interest in Indian equities has picked up in recent months.

- There are both cyclical and structural factors at play, some of which are well justified.

- In the near term, elevated valuation could be a challenge, but the long term prospects of the economy would imply India could play a more prominent role in Asian equity allocation in years to come.

An acceleration in manufacturing?

One possible structural growth bright spot for India is the potential rise in manufacturing. The recent visit by Prime Minister Modi to the US and France has shown the close tie between India and the western world, and this could appeal to multinational firms that are looking to diversify their manufacturing production away from China, especially in the technology sector.

India’s young population is often cited as an advantage in building its manufacturing. The United Nations projects that China’s median age would reach 48 years old by 2040, up from 2022’s 38.5. In contrast, India’s median age would only rise from 27.9 years old in 2022 to 34.6 by 2040. This is not only a source of cheap labour, high income could also create a new generation of consumers that could be a new source of business for multinational companies.

Yet, ample young workers are not enough to attract investment. The business environment and infrastructure are also critical in determining the success of establishing a manufacturing base. Historically, India’s infrastructure was a weak link, which explains why it prioritized the development of IT services instead of physical manufacturing. This has improved in recent years and is reflected in international surveys.

In the World Bank’s Logistics Performance Index, India ranked 38th, compared with China in 19, Vietnam at 43 and Indonesia at 61. While China is still leading in the scale of ports and domestic transportation systems, India is already comparable with a number of south and southeast Asian nations in terms of logistics, and this also represents an investment opportunity in more infrastructure.

As the overall investment climate in India improves, foreign businesses will still need to manage the possible divergence in policy priorities between the federal and state governments. Moreover, with the next general election expected to take place in 2Q 2024, businesses may also want to see whether Modi’s economic policies can continue in the coming years.

Cyclical tailwinds

Given India’s smaller share in manufacturing exports, the possible slowdown in the US and Europe should have a lesser impact on the broader economy. India’s manufacturing Purchasing Managers' Index has stayed well above 50 through 2022 and 2023, indicating expansion, while other export-oriented Asian economies have struggled.

India’s economic challenge often came from high inflation, especially from food prices driven by the monsoon season. While food prices have picked up in recent months, core inflation is well contained. This should allow the Reserve Bank of India to maintain its current policy rate for much of this year, especially with the Indian rupee enjoying a period of stability for much of 2023.

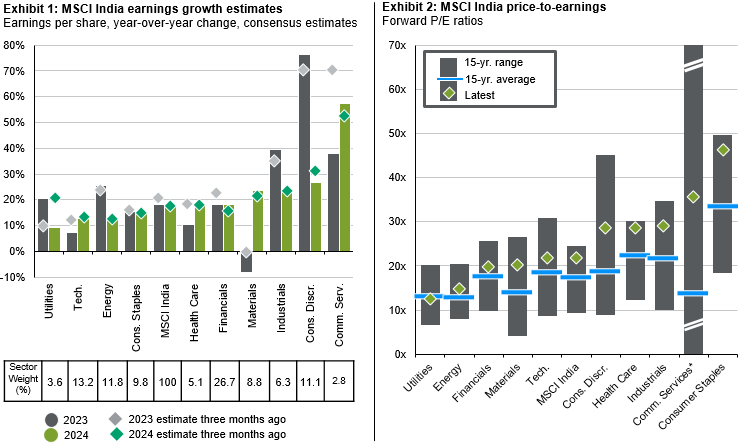

Source: FactSet, MSCI, J.P. Morgan Asset Management. Tech refers to Technology; Cons. Staples refers Consumer Staples; Comm. Services refers to Communication Services; Cons. Discr. refers to Consumer Discretionary. Consensus estimates used are calendar year estimates from FactSet. *The communication services sector reached a historic maximum of 2,099x and a historic minimum of -1,782x. Data for MSCI India real estate sector is unavailable. Guide to the Markets – Asia. Data reflect most recently available as of 30/06/23.

Investment implications

Both structural and cyclical factors are fuelling investor optimism in the Indian equity market. It is also becoming a sizeable share of the Asian equity market. As of the end of June 2023, India was the third largest market by weight in the MSCI Asia ex-Japan index, after China and Taiwan.

A short-term headwind is high valuation relative to its own history, especially in sectors such as consumer goods, communication services, and healthcare, as shown by Exhibit 2. While this could be justified by high earnings growth over the next 12-18 months, investors may want to see some near-term results to stay convinced.

Hence, it is important to deploy active management when investing in India. The structural demand for consumer goods, financial services and the competitiveness in business process outsourcing (BPO) and information technology support are areas where strong growth can be expected.