Slide Image

Loan issuance and by purpose and quality

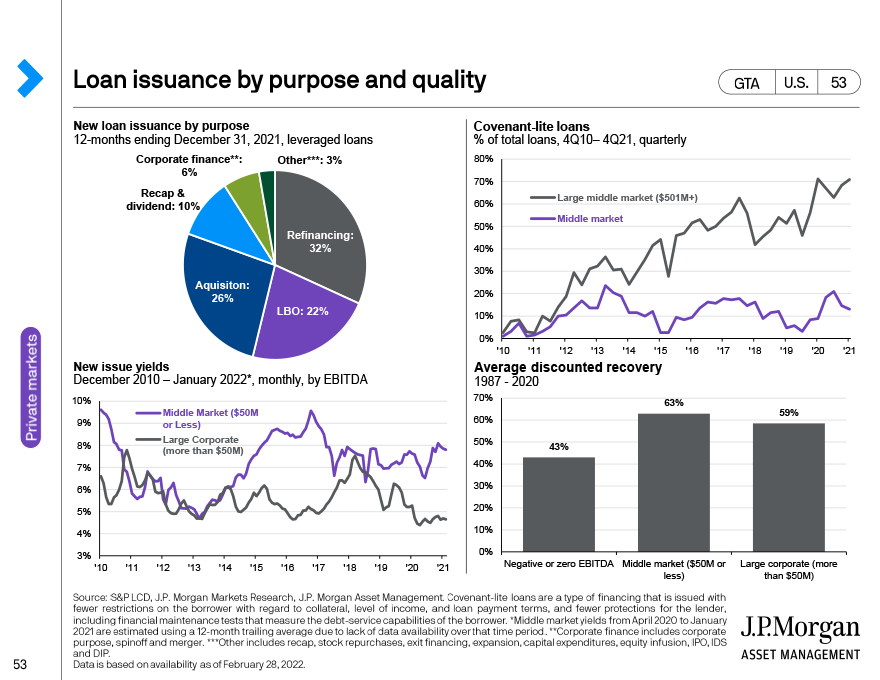

The top left chart shows new-issuance leverage loans by purpose as of the 12-months ending December 31, 2021. The economic environment of the last year and half has driven an increase in refinancing, LBOs and acquisitions.

The top right chart shows the % of middle market and large middle market loans that are covenant-lite. More than 70% of large loans are covenant free, while less than 15% of middle market loans are cov-lite.

The bottom left shows the new-issue yields of middle market and large corporate (broken out by EBITDA) loans.

The bottom right shows the averaged discounted recovery, again broken out by EBITDA, for unprofitable, middle market and large corporate companies. The key takeaway is while middle market loans tend to have more covenants due to higher risk.