Slide Image

Hedge funds and volatility

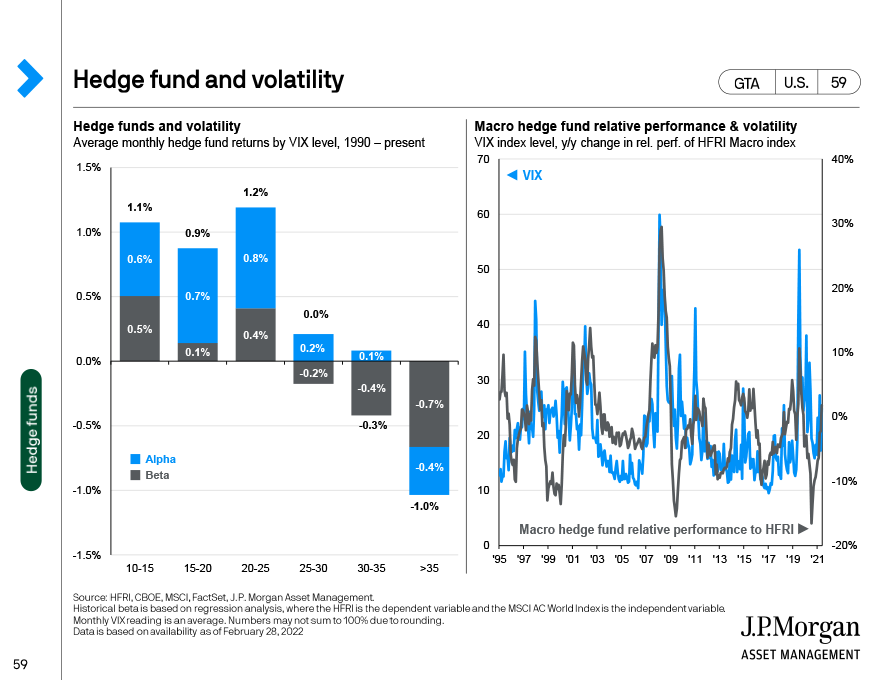

In a low interest rate world, hedge funds are another way to hedge against volatility. The chart on the left shows hedge fund returns decomposed into alpha (return-generating above the market) and beta (market sensitivity) components at different VIX ranges. During calmer markets, hedge funds generate alpha and benefit from positive overall markets through beta. However, during times of market stress, shown in the VIX 25-35 range, although hedge funds do not benefit from beta, they do still generate modest alpha. Only during times of extreme stress do both components suffer, although alpha suffers less than beta due to manager skill.

In the left-hand chart, macro strategies tend to benefit most during periods of volatility, as illustrated by the close directional relationship between the VIX and the outperformance of macro hedge fund strategies relative to the rest of the hedge fund universe.