Slide Image

Portfolio diversification

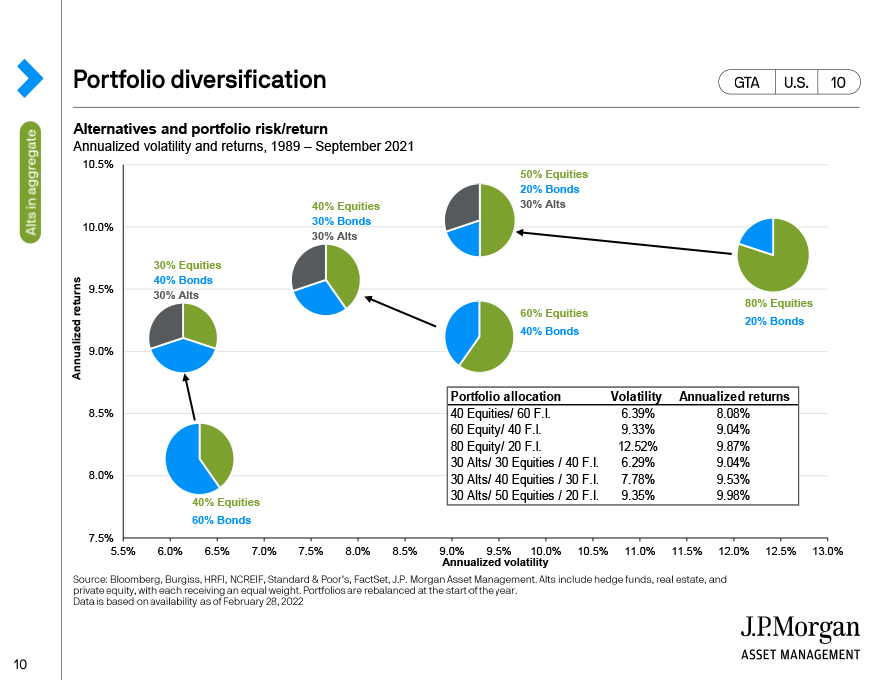

We receive lots of questions about how alternatives can be used in the context of traditional portfolios. In general, an allocation to alternatives should be outcome oriented – in other words, step one is identifying the challenge you are trying to address, and step two is allocating to the asset that will provide the desired solution. This chart shows that adding a diversified sleeve of alternatives (real estate, private equity and hedge funds) to traditional stock/bond portfolios can help manage risk and improve return.