Slide Image

Chart Image

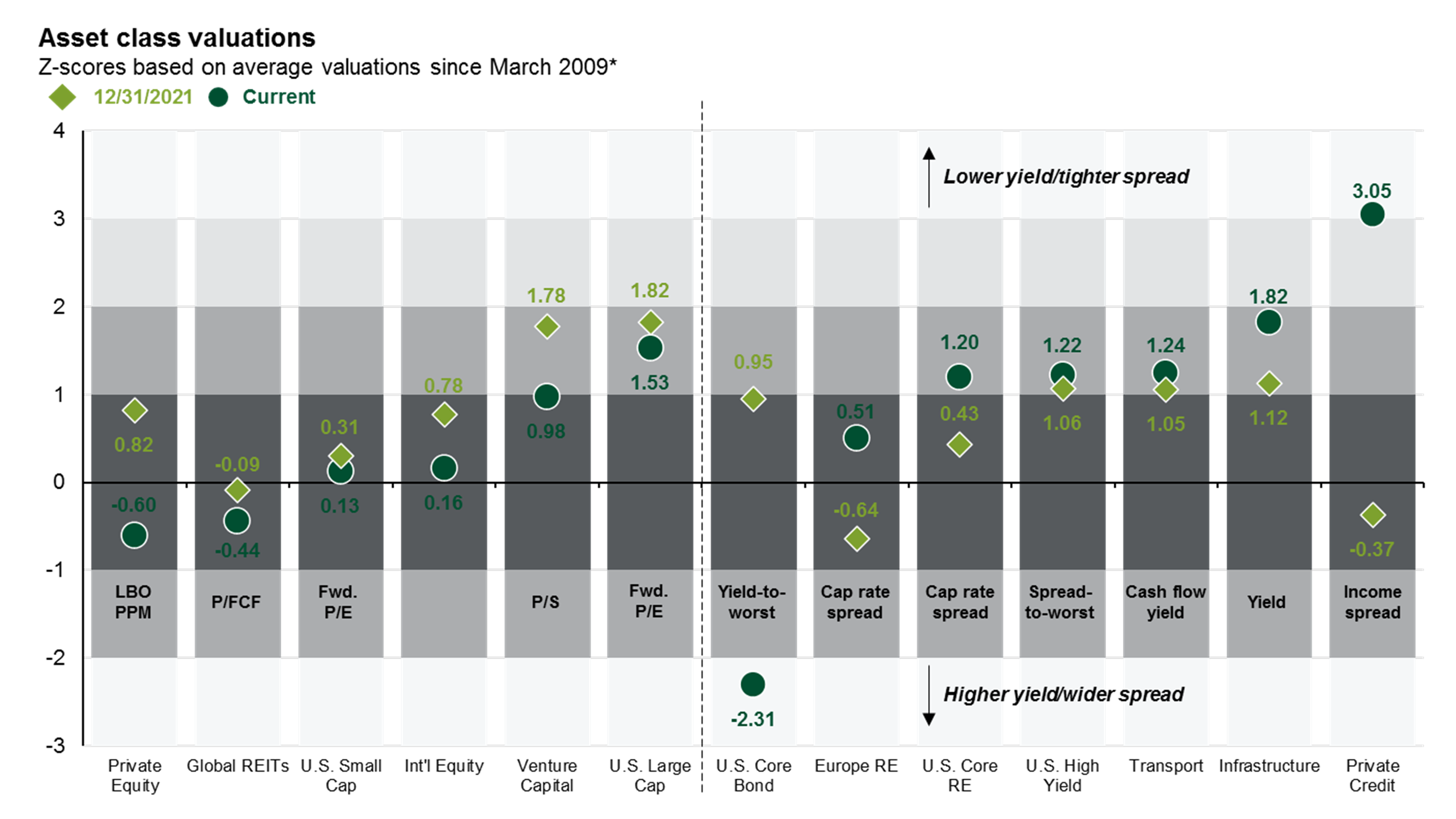

U.S. real estate dynamics

Although there continues to be a lot of concern around real estate, our work suggests that stress is relatively constrained, with risks varying across sectors. The chart on the left shows U.S. real estate cap rate spreads, essentially the rate of return on a real estate investment property less the U.S. 10-year Treasury, on average over four quarters. While spreads climbed at the onset of the pandemic, they have since come down below their long-run average due to the surge in interest rates. The chart on the right shows vacancy rates by property type. Industrial and retail vacancy rates continue to trend lower, while apartment vacancy rates improved relative to 4Q22 but remain above it lows from the global reopening. Office vacancy rates remain elevated, as firms struggle to fully exit remote working.