J.P. Morgan Currency Management

J.P. Morgan Asset Management offers currency-hedged share classes in several of its exchange-traded funds (ETFs) to help investors mitigate the impact of foreign exchange (FX) movements on their investments.

Currency hedging is complex, requiring expert oversight to achieve consistently strong outcomes. At J.P. Morgan Asset Management, our currency-hedged share classes are managed by an in-house team of highly experienced and dedicated currency managers.

With USD 395 billion under management (as of January 2020), our currency management team is among the largest and most experienced currency overlay managers in the world.

Key points

- Currency hedging can reduce currency risk in regional or global portfolios, but achieving a perfect currency hedge is not possible.

- Different hedging models are available to mitigate currency risk. We have decided to use a tolerance-adjusted hedging approach for our ETF currency-hedged share classes*.

- Tolerance-adjusted hedging can provide a more effective hedge compared to static monthly hedging, particularly in volatile markets, while reducing costs compared to static daily hedging.

- Performance of share classes that use tolerance-adjusted hedging may diverge from monthly-hedged benchmarks.

Helping investors minimise currency risk

Currency hedging can help to reduce the impact of changes in exchange rates on an ETF’s performance when the currency or currencies of an ETF’s underlying assets are different to the investor’s own preferred currency.

However, achieving a perfect currency-hedged portfolio is not possible. Markets are constantly changing, making it unrealistic to align currency hedges to underlying asset values at all times, while transaction costs and the effect of interest rate differentials will also have an impact on the value of the hedged share class.

The task for ETF providers is to implement a hedging strategy that best mitigates currency risk in currency-hedged share classes, while minimising the transaction and operational costs associated with hedging.

Currency hedging for index funds and ETFs

Certain index fund managers and ETF providers may employ a static monthly hedging approach in their currency-hedged share classes.

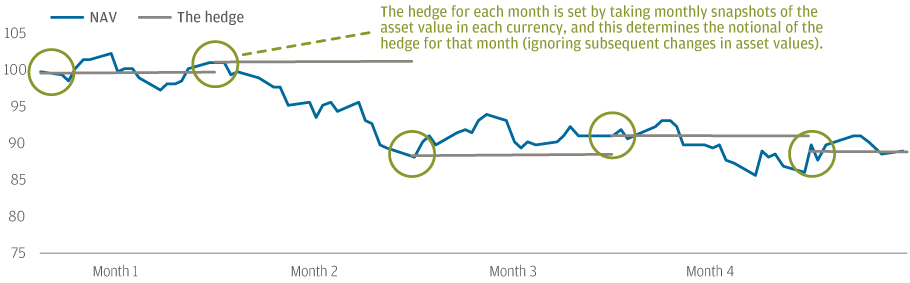

In the static monthly hedging model, a snapshot of the value of a portfolio’s assets in each currency is typically taken around the last business day of each month, which is used to determine the value of the hedges for the next month.

Source: J.P. Morgan Asset Management. For illustrative purposes only.

The static monthly hedge is a cost-effective and systematic model that is aligned to monthly-hedged benchmarks. However, because hedges are only reset each month, static monthly hedging ignores subsequent changes in the value of underlying assets. On the other side of the spectrum, static daily hedging removes more currency risk, however results in higher transaction costs.

J.P. Morgan Asset Management’s currency hedging approach for UCITS ETFs

We have adopted a tolerance-adjusted hedging model to mitigate currency risk in our ETF currency-hedged share classes.

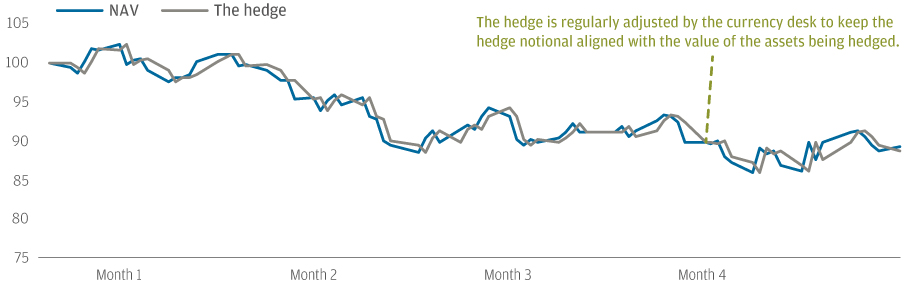

Currency hedges are regularly adjusted by our team whenever hedge ratios breach pre-set thresholds. This approach helps keep the value of the currency hedges notionally aligned with the value of the assets being hedged as market values change.

Source: J.P. Morgan Asset Management. For illustrative purposes only.

Tolerance-adjusted hedging provides an accurate currency hedge for ETF investors while reducing transaction costs associated with static daily hedging. Transaction costs, while still generally low, are typically higher than static monthly hedging, but lower than daily hedging. Tolerance-adjusted hedging reduces the risk that any large unadjusted over-hedged or under-hedged positions could affect the performance of the currency-hedged share classes.

Performance may, however, diverge from many ETF monthly-hedged benchmarks, where hedges are typically only reset once each month.

Spotlight on hedge ratios

To achieve a 100% hedge ratio, the value of the derivatives used to hedge a portfolio’s currency exposures should equal the notional value of the portfolio’s assets. If the value of the portfolio’s assets rises, the hedge ratio will fall and the portfolio will be under hedged. If the value of the portfolio’s assets falls, the hedge ratio will rise and the portfolio will be over hedged.

If hedge ratios become too stretched there is a risk that the impact on the performance of one hedged share class could impact another share class of the same fund. Regulatory measures require ETF providers keep hedge ratios within a 95%-105% tolerance, making a tolerance-adjusted hedging model appropriate for many ETFs.

Ring-fenced charges

All costs and expenses incurred in the hedging process will be borne on a pro-rata basis by all hedged share classes denominated in the same currency issued within the same ETF. The charges are therefore ring-fenced and only borne by investors in the currency-hedged share classes.

Balancing accuracy and costs

We believe our currency hedging approach is the most appropriate methodology for our range of UCITS ETF strategies.

Tolerance-adjusted hedging requires significantly fewer trades than a static daily hedging model, as hedges are only reset when hedge ratio thresholds are breached. Tolerance-adjusted hedging also provides increased accuracy of the currency hedge compared to a static monthly hedging approach, particularly in volatile markets.

ETF currency hedging strategies

Static monthly hedge

Monthly reset reduces transaction costs.

Consistent with many index methodologies, which may reduce tracking error.

Imperfect hedge may leave investors with unexpected currency risk.

Static daily hedge

Daily reset increases transaction costs.

Consistent with many index methodologies, which may reduce tracking error.

Daily reset minimises currency risk, however high transaction costs can outweigh benefits.

Tolerance-adjusted hedge

Hedges are reset whenever hedge ratio breaches pre-set threshold, resulting in lower transaction costs than daily hedging.

Difficult for index providers to reflect in index methodologies, which may increase tracking error.

Removes more currency risk than monthly hedging while reducing transaction costs compared to daily hedging.