Invest in America’s sustainable leaders

As US companies adapt their businesses to take greater account of environmental, social and governance (ESG) factors, the US stock market is providing access to a wealth of opportunities for investors seeking sustainable long-term returns.

However, identifying America’s sustainable leaders can be a challenge. The inconsistent quality of third-party ESG data and the international nature of US large-cap revenues means that only managers with specialist, locally-based investment resources, and genuine global investment coverage, can fully engage with the companies leading America towards a more sustainable future.

Access a sustainable US equity portfolio

The JPM US Sustainable Equity Fund capitalises on the fundamental research capabilities of one of the industry’s most experienced US equity analyst teams, and the insights provided by our dedicated Sustainable Investing Team, to provide investors with a best-in-class sustainable US large-cap equity portfolio.

Our approach to investing in sustainable companies

Our portfolio managers look to invest only in companies that lead their peer groups in respect of their sustainability performance across broad financial and ESG criteria. These sustainable leaders are identified using a clear four-step fundamental research approach:

We exclude industries that are unsustainable on values that matter to our clients, including fossil fuels, gambling, tobacco, weapons and adult entertainment.

We make norms-based exclusions for companies in breach of the United Nations Global Compact, while we exclude stocks in the worst quintile of companies based on our proprietary sustainability score.

We invest in companies identified by our analysts as sustainable leaders within their sectors, or companies that demonstrate improving sustainability characteristics, based on our near-70 question sustainability survey.

We use active engagement to understand how companies approach ESG issues, to influence behaviour and to encourage best practice.

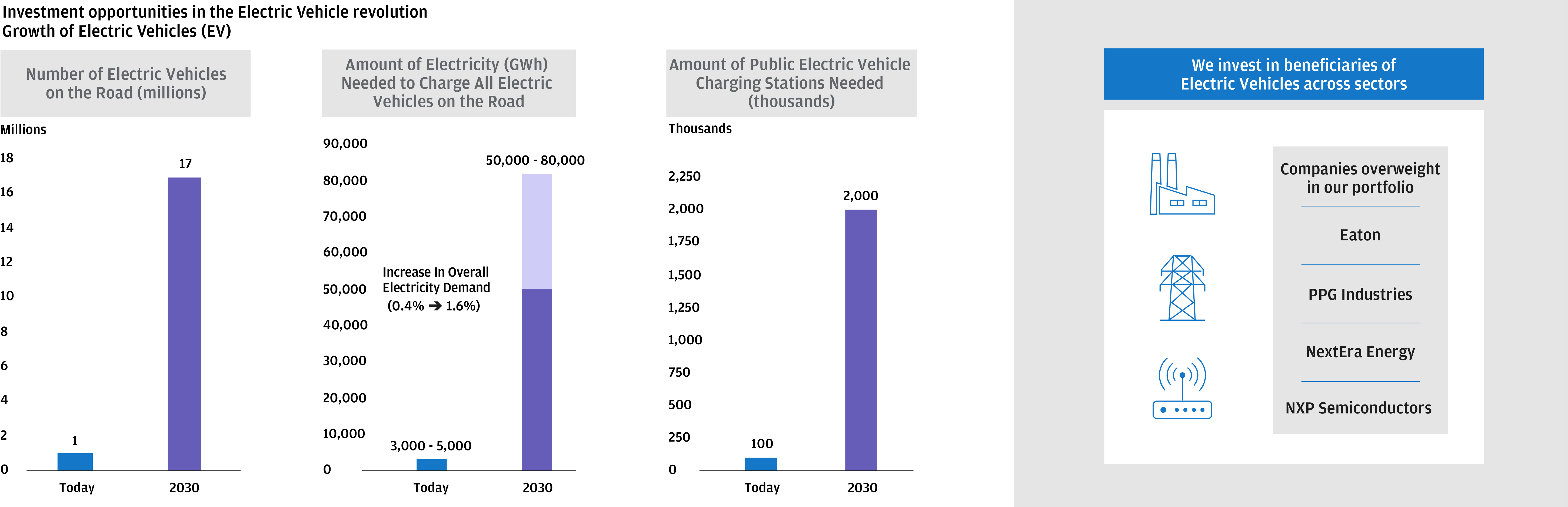

Capitalising on global sustainability trends

The fund looks to invest in US companies that are driving secular global sustainability trends, including decarbonisation of the economy, innovative medicine, sustainable housing, and precision agriculture. Across the board, innovative US companies are at the forefront of the drive towards sustainability.

For example, when it comes to efforts to decarbonise the economy, the development of electric vehicle technology will be crucial to cut fossil fuel emissions. The fund is able to capitalise on this theme by investing in US stocks across several sectors:

- Automotive – US carmakers are creating the products to meet the growth in demand for electric vehicles

- Utilities – Alternative electricity producers are striving to generate the electricity needed to run electric vehicles

- Information technology – Semiconductor makers are providing innovative autonomy, connectivity and electrification solutions specifically designed for electric vehicles

- Electrical/industrials – Specialist US energy companies are developing the charging, battery and energy storage technology required to power and run electric vehicles more efficiently

Source: J.P. Morgan Asset Management. The securities above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met