For investors, it may be tempting to move to the sidelines while debt-ceiling uncertainty remains. However, it should be recognized that this situation will, eventually, be resolved.

In brief

- The “X Date”, where the U.S. government will be unable to fulfill its debt obligations, will likely come around June, but the precise date remains uncertain.

- The debt ceiling will almost certainly be raised, either through a swift consensus or a month-long political gridlock, possibly even leading to actual default.

- Volatility is expected in the short term, but at the time of resolution, stock market might rebound. Either way, the U.S. dollar will likely decline.

Why the debt ceiling is an issue

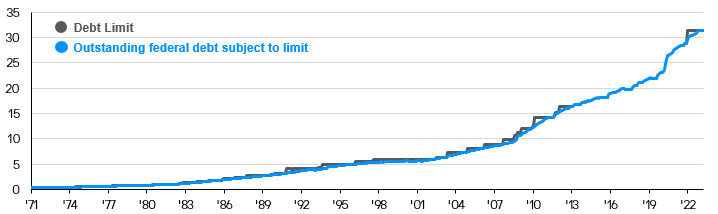

In 1917, the federal government instituted a debt ceiling as part of the Second Liberty Bond Act to help fund the U.S. contribution to World War I. Since then, the limit has been suspended or raised over 100 times, although this has often been accompanied by some political theatre. Most notably, the debt ceiling crisis of 2011 led Standard and Poor’s to downgrade federal debt for the first time in U.S. history and another tense negotiation over the debt ceiling brought the country to within days of default in 2013.

Since then, the debt ceiling has been raised or suspended five times without much controversy. Most recently, in December 2021, the debt ceiling was raised to $31.381 trillion, roughly $2.2 trillion higher than public debt subject to limit at that time. Deficits since then have, of course, added to the debt and in January, Treasury Secretary Janet Yellen announced that the federal government had reached the limit and was initiating extraordinary measures to pay the bills. She estimated the combination of the Treasury’s cash balances and these extraordinary measures would allow the Federal Government to pay the bills at least until early June.

Investors have been particularly concerned about the current debt-ceiling negotiations since Republicans achieved a narrow majority in the House of Representatives last November and have vowed to wring budget concessions from the Administration in return for a vote to increase or suspend the debt ceiling.

How close are we to the X Date?

In communications since January, Secretary Yellen has made it clear that considerable uncertainty surrounds the actual date on which the government will no longer be able to pay its bills, commonly referred to as the “X Date”. Part of that uncertainty is due to the difficulty in projecting annual tax payments and refunds which are processed around the mid-April tax filing deadline.

We are now getting some clarity on this issue. As of April 27th, with one business day left in the month, the Federal Government had $294 billion in its checking account at the Federal Reserve and we believe that the Treasury Department is already implementing all currently available extraordinary measures. We currently project budget deficits of $188 billion and $144 billion for May and June respectively, or a total of $332 billion, which would leave Treasury short by $38 billion. If Secretary Yellen could somehow find enough quarters in the couch to get to June 30th, there is a final one-time set of extraordinary measures available on that date, totaling $146 billion, that could just about fund the government through July, stretching the X Date out into early August.

However, more likely we are talking about June, and possibly early June, since the government typically makes substantial payments at the start of each month. However, because of the variability of daily cash flows, the Treasury Department is unlikely to know the precise X Date until a few days before.

Exhibit 1: U.S. statutory debt limit and outstanding debt

Source: U.S. Treasury, FactSet, J.P. Morgan Asset Management. From 2013 until 2019, Congress chose to suspend the statutory limit on the amount of federal debt outstanding for set periods of time. Data reflect most recently available as of 04/05/23.

The end game

Either way, the debt ceiling will have to be raised or suspended on a bi-partisan vote and so the only real question is how soon we get to this point?

If the Administration and Congressional leadership make it clear that this is where we are headed and immediately start negotiating in earnest, then it is possible to imagine an increase in the debt ceiling passing before the end of May. If this were to happen, markets would largely ignore the fiscal debate and resume their focus on the risk of recession, the pace of inflation and the hawkishness of the Federal Reserve.

If, however, political posturing prevails for some more weeks, then we could reach the end of May with a growing nervousness about whether such a bill would pass Congress in time to avoid default. Equity market volatility would rise. In theory, a threat to credit-worthiness of federal debt should boost Treasury interest rates and depress the dollar. However, the traditional safe-haven role of both Treasuries and the dollar make this effect less certain.

If, in an act of unprecedented recklessness, Congress fails to increase or suspend the debt ceiling in time, the Treasury will likely miss an interest or principal payment on the debt. This event would likely precipitate a major stock market meltdown, a spike in Treasury interest rates and a collapse in the dollar. A further downgrade to U.S. debt would probably occur. After a few days of chaos, Congress would likely suspend the debt ceiling for a period and get back to negotiating the budget. However, some default risk premium would likely permanently be added to U.S. Treasuries and the uncertainty caused by the crisis would increase the likelihood of a near-term recession.

Investment implications

For investors, it may be tempting to move to the sidelines while debt-ceiling uncertainty remains. However, it should be recognized that this situation will, eventually, be resolved. Partisanship in Washington could push the federal government to the brink of default or, in a worst case scenario, actual default. However, members of Congress won’t have the stomach to perpetuate a fiscal crisis and recession if, by the simple act of suspending the debt ceiling, they can provide relief to their constituents. The passage of such a bill should cause a rebound in the stock market, although some damage to the dollar and the Treasury bond market may be permanent.

Across all of these outcomes, the one potentially common thread is a decline in the dollar and investors may want to make sure they have good exposure to the bonds and stocks of other developed economies, denominated in foreign currency.

However, it is best not to think of the debt-ceiling crisis as a potential rerun of the Great Financial Crisis. Restoring confidence in the U.S. banking system in the wake of the subprime crisis was an immensely complicated and uncertain task. By contrast, recovery from a debt-default crisis would likely start the day Congress, belatedly, suspended the debt ceiling. Getting close to default or actually defaulting would undoubtedly reduce confidence in U.S. political leaders. However, given their willingness to dance on the cliffs of debt default, it is hard to imagine that much of this kind of confidence is priced into global markets today.