Equity assumptions

09-11-2020

Christopher Sediqzad

Patrik Schöwitz

Tim Lintern

Sylvia Sheng

Emily Overton

Mallika Saran

Stephen Macklow-Smith

Tougher starting point, lower returns

IN BRIEF

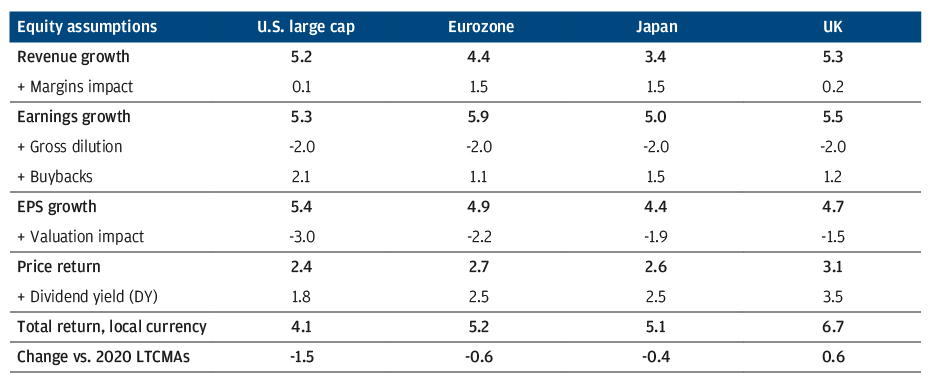

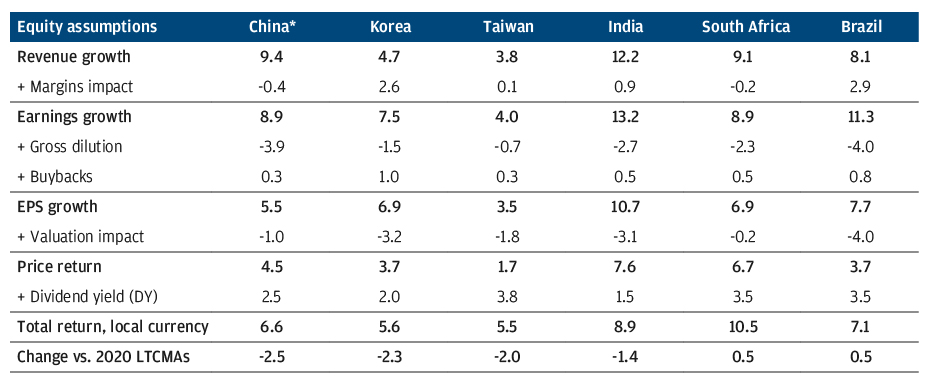

- We raise our long-term (10– to 15-year) equity return assumptions across most regions, with developed markets and emerging markets both up. The expected dispersion in returns between emerging and developed equities is roughly unchanged in local currency terms at 3.00%, while marginally expanding in U.S. dollar terms, from 2.75% to 2.90%.

- In the U.S., our expected return increases to 5.60% from 5.25%, primarily due to the reduction in the drag from valuation normalization; in the euro area, our equity return estimates are slightly lower due to a modest cut to euro area GDP expectations. We upgrade our expected UK equity returns, with attractive valuations offsetting lower margins and a stronger pound sterling vs. the U.S. dollar.

- Japanese equities posted the largest upgrade among developed markets, increasing from 5.00% to 5.50% in local terms. We continue to expect governance-led reforms to drive a sustainable increase in return on equity along with capital return to shareholders.

- We project modestly higher emerging market equity returns, with a diminished drag from margin normalization offsetting the negative impact from several GDP growth downgrades.

- We expect the USD to weaken over our forecast horizon, providing a tailwind to the attractiveness of international equity markets to U.S. dollar-based investors.

This year, our equity return assumptions rise across most regions

SELECTED DEVELOPED MARKET EQUITY LONG-TERM RETURN ASSUMPTIONS AND BUILDING BLOCKS

Source: J.P. Morgan Asset Management; estimates as of September 30, 2018, and September 30, 2019.

SELECTED EMERGING MARKET EQUITY LONG-TERM RETURN ASSUMPTIONS AND BUILDING BLOCKS

Source: J.P. Morgan Asset Management; estimates as of September 30, 2018, and September 30, 2019.

* China refers to MSCI China Index.

View Other Assumptions

Examine our return projections by major asset class, their building blocks and the thinking behind the numbers.