PBoC cuts RRR – A renewed dovish signal

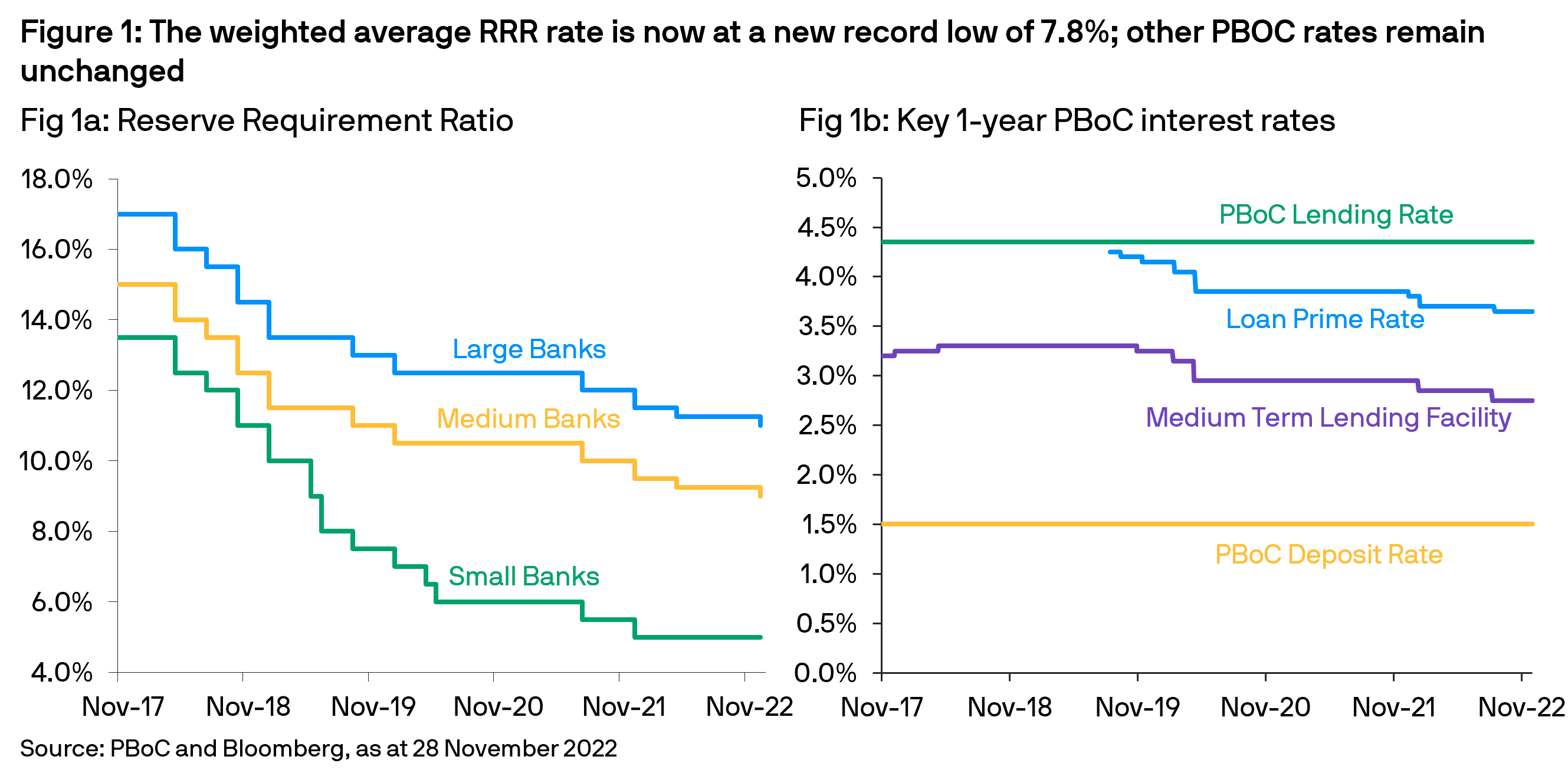

On Friday 25 November, the People’s Bank of China (PBoC) announced a 25bps Reserve Requirement Ratio (RRR) cut (Fig 1a). The cut will be effective on 5 December and apply to all banks, except those already at the lower RRR bound of 5%. It should release approximately CNY500bn of extra liquidity to the market while reducing commercial bank funding costs by approximately CNY5.6bn per annum. The RRR cut followed a surprise call by Premier Li at last week’s State Council meeting for a timely rate cut to keep ample liquidity and support the real economy.

Recent government announcements easing Covid rules and supporting the property sector had buoyed economic sentiment and suggested further monetary policy easing was unlikely. However, the rapid surge in Covid cases recently and subsequent negative impact on economic activity across multiple major cities were the likely trigger for the rate cut. In the accompanying statement, the PBoC confirmed the RRR cut was part of a package of measures to support economic growth, maintain liquidity at reasonable levels and keep broad credit growth largely in line with nominal GDP growth.

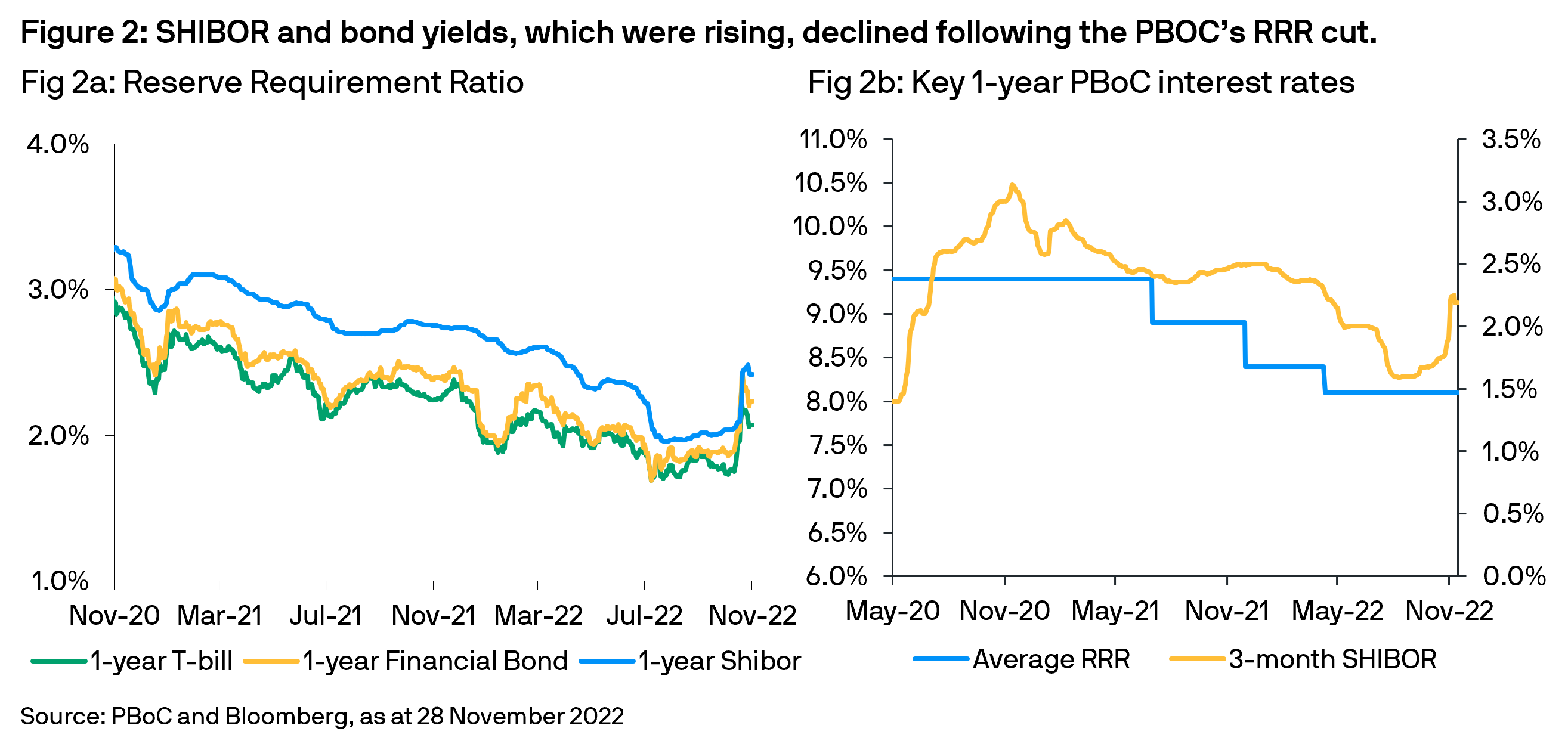

Given the RRR for smaller banks is already at the lower bound of 5% since December 2021, the latest cut mainly benefits large (11.25% to 11.00%) and medium banks (9.25% to 9.00%) via a permanent funding boost and lower liquidity costs. Other key PBoC interest rates, including the Medium Term Lending Facility (MLF) and Loan Prime Rate (LPR), remain unchanged (Fig 1b) after cuts in January and August. Following the PBoC RRR cut, market driven interest rates, which had jumped sharply higher since the start of November on expectation of economic reopening, declined (Fig 2a) and the currency weakened.

Conclusion

The dovish signal sent by the PBoC’s surprise RRR cut will likely be more impactful than the liquidity boost achieved. It suggests the government remains focused on economic growth as local authorities attempt to balance the need to achieve current Covid policy while also implementing the government’s latest Covid easing measure. However, downside risks to economic growth rises as sporadic Covid lockdowns increases. In our opinion, further monetary policy easing – potentially via additional RRR, MLF and LPR rate cuts – cannot be ruled out; this implies market driven interest rates are likely to remain under pressure in the near term.