Slide Image

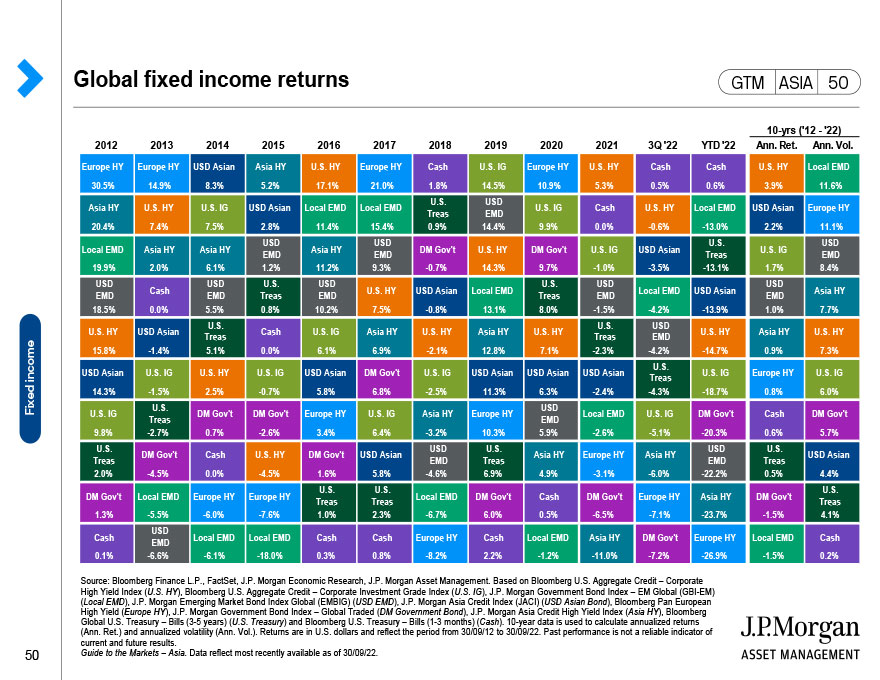

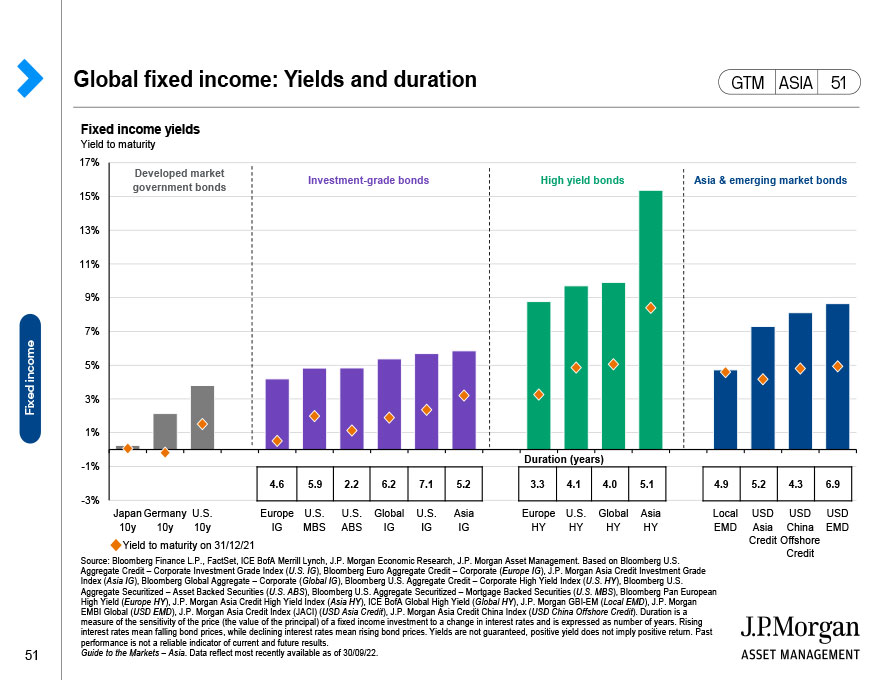

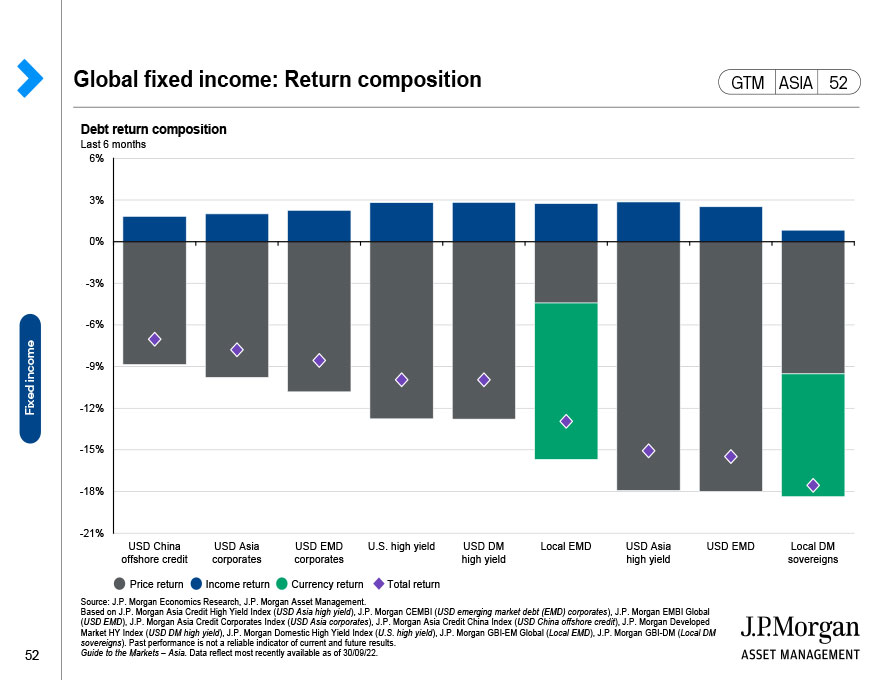

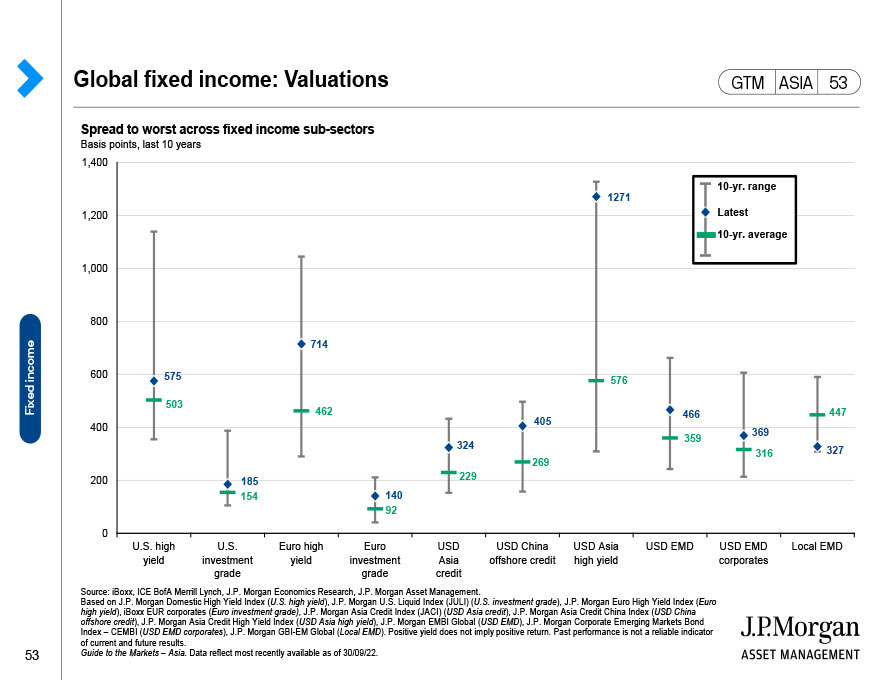

Global fixed income: Yields and returns

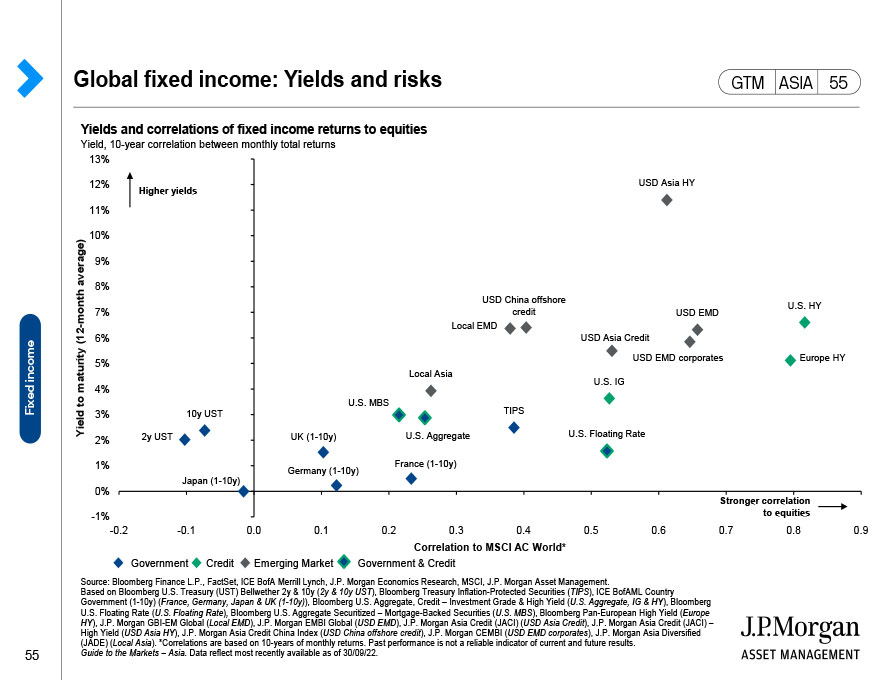

This is a snapshot of the important factors for various fixed income asset classes. At a glance, we can see and compare their returns, the yield to maturity, their duration or sensitivity to interest rate movements, as well as their correlation with global equities and benchmark U.S. Treasuries.